India’s energy needs are rising every year. Power demand grows with cities, factories, data centres, and electric mobility. Fossil fuels cannot carry this load forever. They are expensive, polluting, and increasingly volatile. Renewable energy is no longer just an environmental choice. It has become an economic and strategic necessity for the country.

You can already see this change taking shape. Around 50 GW of renewable capacity was added during 2025. Nearly Rs 2 lakh crore went into building this out. The government wants to maintain this momentum through 2026 and beyond. Large targets around solar, wind, and hybrid power are now tied to execution timelines, not just policy intent.

When investors look at this transition, attention usually goes to the obvious names. Solar panel makers, battery companies, and transmission players dominate most discussions. These are important pieces of the puzzle.

The ‘pick-and-shovel’ play

But large energy build-outs also depend on quieter businesses that supply equipment, systems, and industrial support. This article follows a pick-and-shovel approach by focusing on those enablers that benefit as renewable capacity scales up across the country.

The four stocks selected here meet a clear set of filters. They are directly linked to renewable expansion, but not dependent on one single technology. Their products and services are used across multiple projects and customers. Most importantly, they participate in execution, not just announcements. That makes them relevant as India’s renewable push moves from ambition to sustained on-ground build-out.

#1 Polycab India: Riding the cable cycle behind India’s power build-out

Polycab India is India’s leading manufacturer of cables and wires and allied products such as uPVC conduits and lugs and glands. We have a range of cables and wires for practically every application. More recently Polycab has also launched a wide range of consumer electrical products like fans, switches, switchgear, LED lights and luminaries, solar inverters, and pumps.

Record profits & volume growth

Polycab India reported a good set of numbers in the September quarter of FY26, helped by steady demand across segments. Consolidated revenue for the quarter rose 18% year-on-year (YoY) to Rs 6,477 crore, while net profit increased 56% to Rs 693 crore, marking the company’s highest-ever second-quarter profit.

The wires and cables segment grew 21% YoY, led by high-teen volume growth. Demand stayed healthy across power, infrastructure, real estate and industrial projects.

Renewable linkages & capex

This also ties Polycab, in a roundabout way, to the renewable energy build-out. Large solar and wind projects need a lot of cabling and grid work, and that flows through to companies like this. Growth was spread across regions. Overseas revenue also moved up during the quarter and now makes up a small but rising share of sales.

On the investment side, the company continued to spend under its Project Spring plan. Capex in the first half was about Rs 7,500 crore, broadly in line with what it had outlined for the year. Work on the EHV cable plant is progressing and the facility is still expected to be ready by the end of calendar 2026. Management did not sound aggressive but appeared comfortable with visibility, supported by a strong order book and a net cash position.

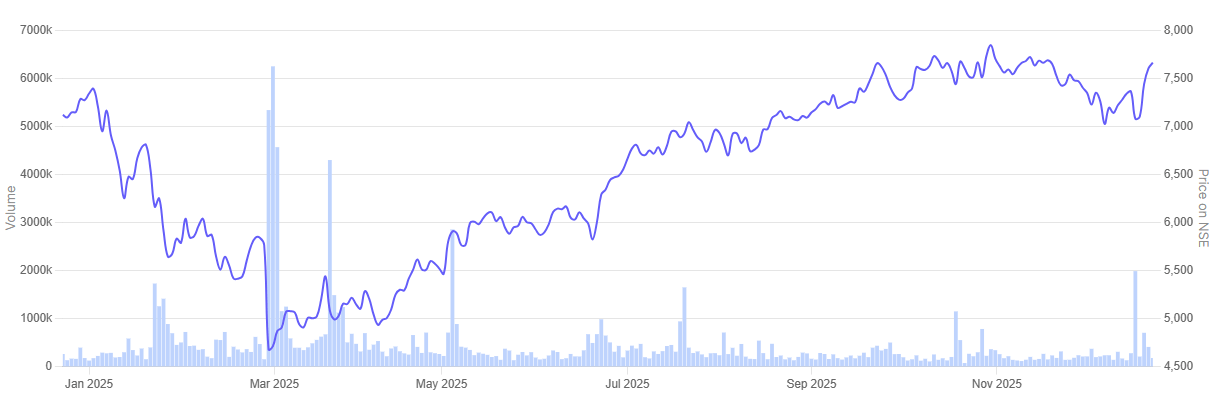

In the past one-year Polycab India share price is up 7.4%.

Polycab India 1-Year Share Price Chart

#2 Apar industries: Export-led conductor growth anchored in grid expansion

Apar Industries is a market leader in India with a global presence. Starting as a power transmission cable manufacturer, Apar has evolved into a diversified player with three core segments: conductors, transformer oils, and cables.

Strong quarterly performance

APAR Industries had a good quarter in September FY26, helped by steady demand at home and a sharp rise in exports. Consolidated revenue grew 23% from a year ago to Rs 5,715 crore. Net profit increased 30% to Rs 252 crore.

The conductor and cable businesses did most of the work. Volumes improved in the conductor segment, and higher-value products saw better traction, especially in the US.

Export powerhouse

Exports rose 43% during the quarter and now contribute close to 35% of total revenue. The cable business also reported better numbers, supported by overseas orders and firmer pricing.

Critical role in grid expansion

APAR is not a renewable energy company by itself, but it sits close to the sector. Its conductors and cables are used to move power from solar, wind and hydro projects to the grid. Spending on transmission lines and reconductoring continues to support demand.

The company is also adding capacity across both conductors and cables. These expansions are moving ahead as planned. Most additions are expected to be operational by March 2026, with cable capacity coming on stream by mid-2026. Management acknowledged near-term risks from metal prices and tariffs but remained confident about medium-term demand, driven by grid upgrades and global energy transition needs.

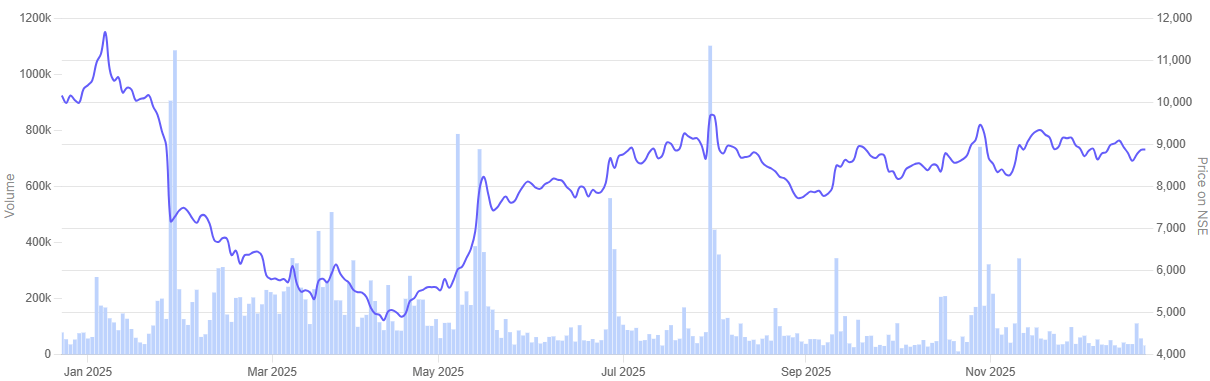

In the past one-year Apar Industries share price is down 12.5%.

Apar Industries 1-Year Share Price Chart

#3 Havells India: Steady electrical demand beyond consumer cycles

Havells India is a leading fast moving electrical goods (FMEG) company and a major power distribution equipment manufacturer with a strong global presence.

Cables offset summer weakness

Revenue for the quarter came in at around Rs 4,779 crore, up 5.3% from last year. Net profit rose 18.7% to Rs 318 crore. Margins held steady, mainly because cables, wires and switchgear continued to perform well. This partly made up for the slowdown in summer products. That segment was hit by a shorter season and too much stock sitting with dealers.

Cables were steadier through the quarter, helped by ongoing power and infrastructure work. The company is continuing with its cable expansion plans and has bought 39 acres of land near its Alwar plant to support future capacity. Switchgear and lighting numbers were largely stable. Appliances and cooling products, however, saw some impact from inventory correction during the quarter.

Betting on solar & manufacturing

Havells also has a link to the renewable energy space through its cables, switchgear and solar-related products, which are used in grid connectivity and rooftop installations. Management expects solar-related demand to improve in the second half, helped by its investment in Goldi Solar.

Management sounded cautious on the near term but did not flag any major concerns. Channel inventories are expected to come back to normal levels by the end of the third quarter. Capital spending for FY26 is estimated at around Rs 1,450 crore and will largely go towards expanding capacity, improving efficiency and building capabilities in newer, energy-related segments.

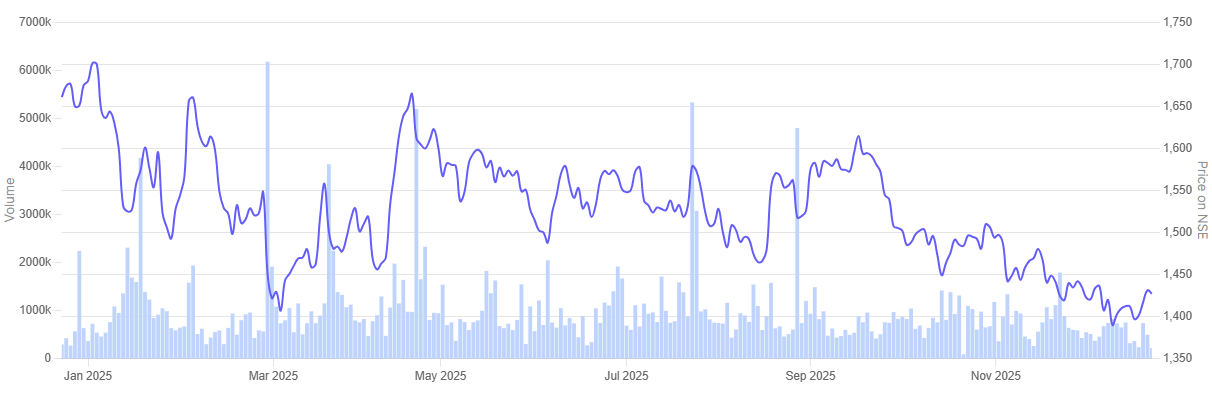

In the past one-year Havells India share price is down 14%.

Havells India 1-Year Share Price Chart

#4 CG Power and industrial solutions: Heavy equipment at the heart of grid and power capex

CG Power & Industrial Solutions operates in the electrical equipment space, supplying products and systems used by utilities, industries and large consumers. Its business is split mainly between power systems and industrial systems.

The company reported a strong September quarter in FY26, helped by better execution and a noticeable improvement in order inflows. Consolidated revenue rose 21.1% from a year earlier to Rs 2,923 crore. Net profit increased 29.1% to Rs 284 crore during the quarter.

Order book explosion

Orders picked up sharply. Fresh inflows stood at Rs 4,210 crore, up 32% year on year. This pushed the order book to Rs 13,568 crore, giving the company better revenue visibility over the coming quarters.

The power systems business did most of the heavy lifting. Revenue from this segment rose 48% to Rs 1,254 crore, supported by steady progress on large projects and improved operating leverage. Margins expanded on better price realisation and operating leverage. The industrial systems business remained flat during the quarter as some railway projects were pushed back. Management said this was largely a matter of timing, with execution expected to pick up in the coming periods.

CG Power is an indirect beneficiary of the renewable energy push. Its transformers, switchgear, and motors are used in power evacuation, grid upgrades, and transmission projects linked to solar and wind capacity additions.

Ramping up for demand

During the quarter, the company advanced several expansion plans. Transformer capacity was scaled up from 15,000 MVA to 40,000 MVA, with further expansion underway. The board also approved a Rs 748 crore greenfield switchgear project to meet rising domestic and export demand. Management remained constructive, citing strong inquiry pipelines and sustained demand from power and infrastructure segments.

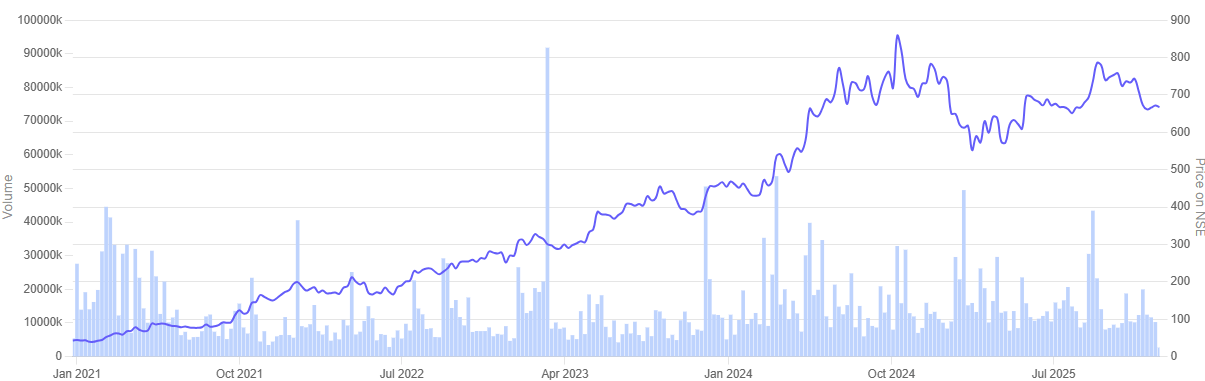

In the past one-year CG Power & Industrial Solutions share price is down 8.5%.

CG Power & Industrial Solutions 1-Year Share Price Chart

Valuations

Let’s now turn to the valuations of the renewable energy enablers companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Renewable Energy Enablers Stocks in India

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | Polycab India | 29.9 | 12.5 | 29.7% |

| 2 | Apar Industries | 19.7 | 18.2 | 32.7% |

| 3 | Havells India | 36.4 | 12.6 | 25.3% |

| 4 | CG Power and Industrial Solutions | 64.3 | 22.7 | 37.5% |

At first glance, it is clear that most of these companies are trading above their respective industry medians. This kind of pricing is not limited to one or two names. It mirrors what has happened across industrial and electrical stocks over the last few years. Balance sheets have cleaned up. Order visibility has improved. And the power and infrastructure capex cycle has given investors more comfort than before.

Even so, the premium is not uniform. Polycab and Havells trade well above their sector averages, helped by scale, brand strength and steady cash flows. Apar Industries sits much closer to its industry median, despite delivering strong returns on capital. CG Power, on the other hand, commands a much higher multiple, largely because of expectations around sustained order inflows, expanding capacities and its exposure to grid and power equipment.

The broader trend is still supportive, but current prices leave less room for error. A good part of the growth story is already reflected in valuations. Investors will need to judge whether future earnings and returns can keep pace with what the market is assuming today. As always, the best opportunities emerge when strong businesses offer room for upside, not just certainty.

Conclusion

India’s renewable energy push is no longer just about adding capacity on paper. It is about execution on the ground. Making this shift work on the ground requires basic electrical equipment. Power has to be carried from generation sites to cities, factories and homes. That depends on cables, conductors, transformers, switchgear and other industrial systems doing their job quietly in the background. The companies discussed in this article operate quietly in the background, but their role is essential in making the energy transition work.

What stands out is that all four businesses are well placed within their respective segments. They benefit from long-term structural demand rather than short-term policy triggers. The return numbers show that capital is being used well. At the same time, valuations across the space have already moved up, reflecting optimism around future growth and sector visibility.

For investors, this makes careful evaluation important. One needs to look beyond headlines and themes. Balance sheets, execution track record, competitive position, and valuation comfort all matter. Renewable energy is a long-term theme, but returns will depend on picking the right companies and paying the right price.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.