India’s infrastructure story is entering a new phase, one that’s not just about mega highways or urban metro lines, but about the ecosystem that powers them. Behind every road construction and mining project lies a network of equipment manufacturers quietly fuelling this momentum. As government and private capital expenditures rise in tandem, these companies, often serving as a proxy play, begin to capture investor attention.

The government allocated Rs 11.11 trillion in the Budget 2025 to support infrastructure development. However, the road construction sector in particular has seen relatively weak momentum, with construction activity slowing due to fewer contracts being awarded. Amid this slowdown, these three proxy plays can be added to the watchlist. Let’s take a look…

#1 BEML

BEML manufactures a wide range of heavy earthmoving equipment for the mining and construction industry, vehicles for defence forces and coaches for the metro and Indian Railways. Mining and construction is the largest sector (54% of sales), followed by defence and aerospace (27%) and rail and metro (19%).

Diversifying beyond earthmovers

The Mining and Construction vertical specialises in manufacturing heavy-duty earth-moving equipment for surface and underground mining, as well as the construction and infrastructure sector. Key products include Dump Trucks, Dozers, Rope Shovels, and Motor Graders.

The Mining and Construction sector contribution is expected to fall to about 40% in FY26. At the same time, the Defence, Rail and Metro sectors are projected to rise to 60%. It’s because the Defence, Rail, and Metro sectors are poised for expansion due to the Government of India’s strong emphasis on reducing import dependency.

BEML is also diversifying into the maritime sector, focusing on the indigenous development of systems such as aircraft carrier aggregates and Cutter Suction Dredgers. BEML is also benefiting from the increase in domestic coal production. Although infrastructure projects have slowed down, momentum is expected to pick up from Q4FY26 onwards.

Additionally, evolving geopolitical conditions are creating new opportunities for collaboration among Indian manufacturers to meet the rising global demand for equipment. In the defence sector, the company estimates turnover to more than double in FY26 if 100% of the order book is executed.

In the rail and metro sector, the company expects to manufacture 20 train sets for the Bangalore Metro. Additionally, BEML plans to begin supplying the remaining nine Vande Bharat trains starting in July.

The company also expects to manufacture approximately 15 Linke-Hofmann-Bosch coaches this year. To prepare for future order inflow, BEML is undertaking a massive capacity expansion. It is also investing ₹18 billion to achieve an annual manufacturing capacity of 800 metro coaches.

Strong order pipeline and improving outlook

From a financial perspective, the company’s revenue remained flat in Q1 FY26 at ₹6.3 billion, while it reported a net loss of ₹640 million, compared to a ₹700 million loss in the previous quarter of FY25. But BEML has set an aspirational growth target of at least 25% year-on-year growth in FY26. The management estimates the margin to improve by 150 bps, from 13.2% in FY24.

Order book expansion signals earnings recovery

This improvement is expected due to a favourable product mix (including more commuter rail, high-end mining, and defence systems), an enhanced contribution from systems, and a reduction in material costs. BEML expects its order inflow in FY26 to be around twice that of FY24 (₹68 billion) and anticipates closing FY26 with an order book of about ₹230 billion.

#2 Action construction equipment: World’s largest pick & carry crane manufacturer

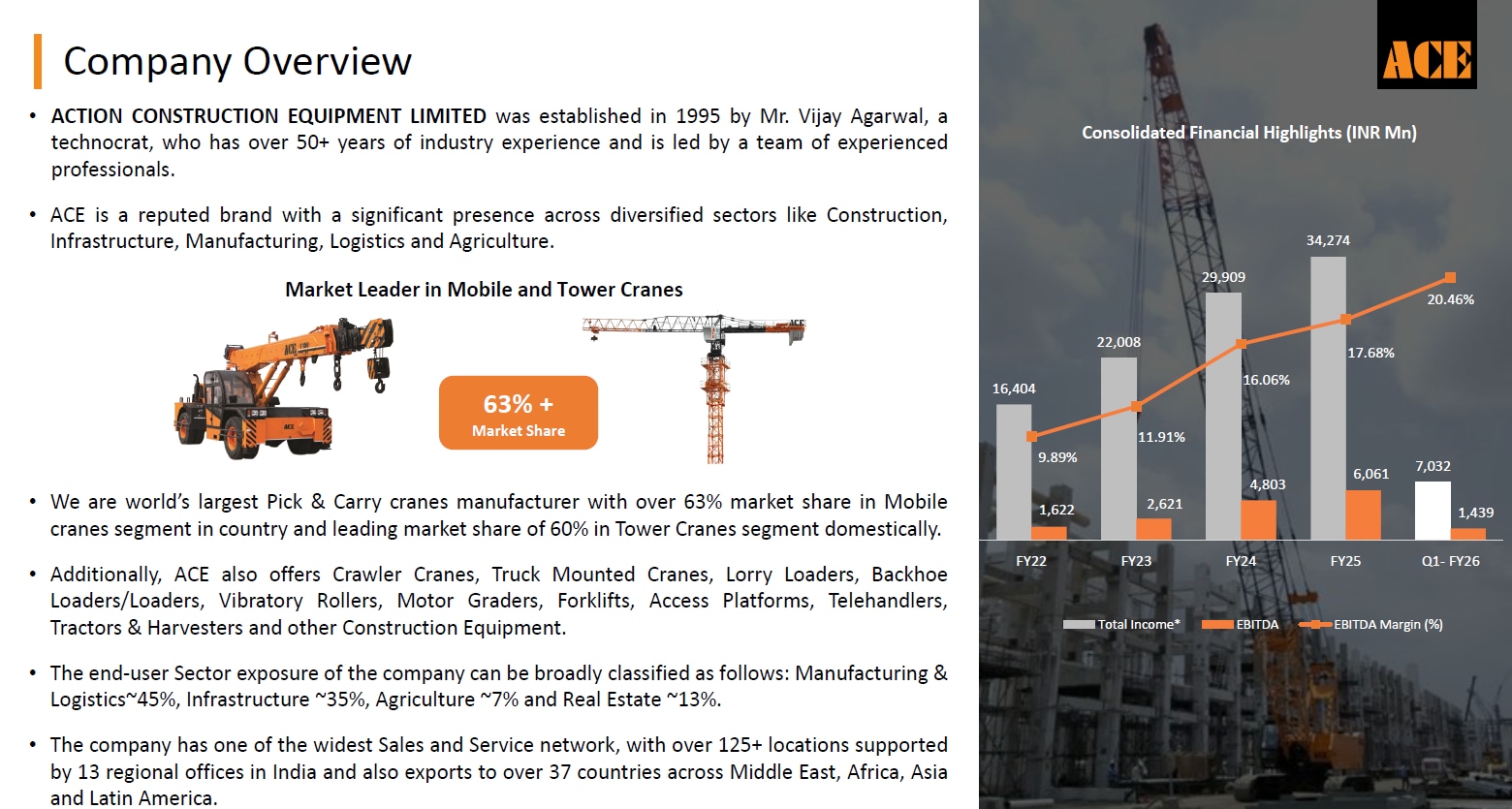

Action Construction Equipment (ACE) is a diversified construction Equipment Manufacturer. ACE operates across major economic sectors, including infrastructure, construction, Manufacturing, Logistics, and Agri sectors, leveraging over 30 years of industry presence. It is the world’s largest Pick & Carry Crane manufacturer and holds over 63% market share in Mobile and tower cranes.

ACE has a broad product portfolio encompassing Cranes, material handling and construction equipment, and agricultural equipment. In FY25, its end-user sector exposure was classified as Manufacturing & Logistics (45%), Infrastructure (35%), Real Estate (13%), and Agriculture (7%). It serves both domestic and international markets, exporting to over 37 countries.

ACE Financial Performance

Defence foray adds a new growth stream

A notable strategic development for ACE is its expanding presence in the Defence sector. The company received its first order from the Ministry of Defence for 1,121 Rough Terrain Forklifts, valued at ₹4.2 billion, which will be partially executed in FY26. Going forward, the management estimates a continuous pipeline of about 3-4% of yearly revenue from the defence space.

The company is also a major beneficiary of the government’s infrastructure spending. It is also hopeful that anti-dumping duties will be imposed on imports of construction equipment from China. With these duties, ACE estimates an addition of ₹5-10 billion in revenue over the next 3-5 years. The company is also investing ₹2.5-3 billion on capacity expansion in FY27 and FY28.

ACE estimates the manufacturing and Logistics sectors to grow at a 6.5% CAGR between 2025-2034, reaching $803 billion. This will be driven by the Make in India initiative and the China+1 supply chain strategy.

The warehousing and logistics sector is specifically expected to attract investments of about $10 billion over the next 4-5 years. The Indian real estate sector is projected to grow at a CAGR of 10.5% to reach $1,184 billion by 2033, up from $482 billion in 2024.

Margins expand despite near-term slowdown

ACE’s total income declined 7.7% year-over-year to ₹7.0 billion in Q1FY26. The industry-wide adoption of stricter CEV-5 emission norms, the early onset of monsoons, and lingering global uncertainties impacted its revenue growth. However, despite that, the company’s profitability improved.

EBITDA increased 14% to ₹1.4 billion, with the margin expanding by 389 basis points (bps) to 20.46%. Margins expanded due to a mix of factors, primarily due to price hikes implemented by the company and accommodative commodity prices. As a result, PAT increased by 16% to ₹977 million.

#3 Ajax Engineering: Market leader in self-loading concrete mixers

Ajax Engineering provides concrete equipment services across the entire concrete application value chain, including engineering, production, transportation, placement, paving, and printing. It is the leader in self-loading concrete mixers (SLCM) in India, with a 75% market share by volume. It is also India’s second-largest manufacturer of concrete equipment.

Market Leadership in the SLCM Segment

Export push and capacity expansion on track

The company is pursuing several strategic growth drivers. A new facility is being developed at Adinarayanahosahalli (close to the Obadenahalli plant), which is expected to be commissioned in H2FY26. It is expanding its pan-India dealer network with a new B2B channel focused on the top eight metro cities to target larger buyers directly.

Exports contributed 5% of total revenue in Q1FY26. Ajax is focusing on regions including South Asia, Southeast Asia, Africa, the Middle East, Central America, and the Caribbean. Despite short-term challenges, the company remains confident of long-term growth. It estimates the Indian mechanised concrete equipment market to nearly triple from ₹61 billion in 2024 to ₹178 billion by 2029.

Short-term pain, long-term growth intact

Ajax also faced challenges in Q1FY26 due to early arrival of monsoon, changes in emission norms, and a slower pace of project execution. Revenue from operations stayed flat at ₹4.6 billion. However, EBITDA declined 23% to ₹614 million, while margin fell 390 bps to 13.2%. PAT declined by 21% to ₹529 million. Volume growth in FY26 is projected to be in the early double digits, with momentum expected to pick up in H2FY26.

Where Do Valuations Stand Now?

From a valuation perspective, BEML is trading at a price-to-earnings (P/E) ratio of 60x, slightly above its 10-year median of 50x. ACE is trading at a P/E of 31x, which is in line with its 10-year median (34.6x), while Ajax is valued at 27.6x. Due to the lack of historical data, we have not considered Ajax’s average multiples. However, only ACE and Ajax are trading at a discount to the industry median multiple of 34.3x.

Valuation Comparison (X)

| Company | P/E | 10-Year Median P/E |

| BEML | 60 | 50 |

| ACE | 31 | 34.6 |

| Ajax | 27.6 | NA |

| Industry P/E | 34.3 | |

While near-term demand remains subdued, the medium-term outlook for equipment makers appears encouraging. Strong order books, government-led infrastructure spending, and improving private capex are likely to drive growth from FY26 onward. Among the three, ACE and Ajax trade closer to fair valuations, while BEML’s premium pricing reflects higher expectations from its defence and metro segments.

Disclaimer

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.