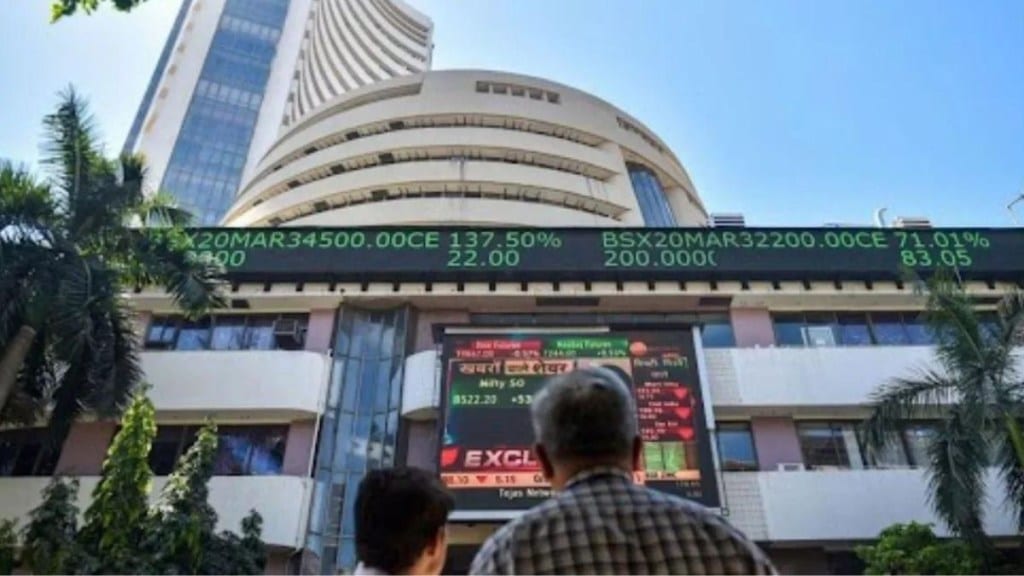

Domestic indices opened flat but within minutes fell half a percent on weekly F&O expiry. The NSE Nifty 50 fell 73.50 pts or 0.42% to 17,377.40 and BSE Sensex fell 321.82 pts or 0.54% to 59,089.26. The top gainers on Nifty 50 were Adani Enterprises (up 2.65%), Coal India (up 1.49%), Adani Ports (up 1.36%), Hero Motocorp (up 1.16%) and Bajaj Finserv (up 0.95%) while TCS (down 1.57%), Infosys (down 1.39%), Axis Bank (down 1.29%), Tech Mahindra (down 1.18%) and ONGC (down 1.10%).

Maruti Suzuki shares, Eicher Motors stock in focus today

Maruti Suzuki shares fell 1.16% to Rs 8662 after the car major reported a decline in production of passenger cars and light commercial vehicles of 6% on-year. The total production in February was 159,873 units. The current shortage of electronic components may have an impact on the production print in February as compared to recent months.

Eicher Motors shares fell 1.14% to Rs 3103 after its motorcycle brand Royal Enfield reported monthly sales figures. The company sold 71,544 motorcycles in February 2023, growing 21% over 59,160 motorcycles sold in the same period last year but motorcycles with engine capacity over 350cc segment registered a 30% YoY decline at 6,734 units.

Sectoral Indices

Most of the sectoral indices were trading in the red. Bank Nifty fell 74.35 pts or 0.18% to 40,623.80 pts, Nifty IT was down 1.41%, Nifty Realty climbed 0.67%, Nifty Pharma was down 0.35% and Nifty Auto slipped 0.54%.

Asian and US stock markets

Asian markets were trading mixed with Japan’s Nikkei 225 falling 0.29%, Hong Kong’s Hang Seng tanking 1.06% while China’s Shanghai Composite index rose marginally by 0.02% and South Korea’s KOSPI climbed 0.27%.

The US markets ended the overnight session mostly lower with S&P 500 falling 0.47%, Nasdaq dipping 0.66% while Dow Jones Industrial Average rose marginally by 0.02%.

FII and DII data

Foreign institutional investors (FII) net sold shares worth Rs 424.88 crore, while domestic institutional investors (DII) acquired equities worth Rs 1498.66 crore on 1 March, according to the provisional data available on the NSE.

NSE F&O Ban

The National Stock Exchange has put no stock/security in its F&O ban list for Thursday, 2 March. According to the NSE, stocks are prohibited in the F&O sector once they have exceeded 95% of the market-wide position limit (MWPL). During the F&O ban period, no new positions are permitted for F&O contracts in that stock.