Even as the market is grappling with mixed global signals, five large cap stocks have sprinted ahead, delivering impressive one-month returns. This is particularly striking as the Sensex and Nifty has been almost flat in the same period. From news to fundamentals, here is a quick update on the top triggers in these stocks

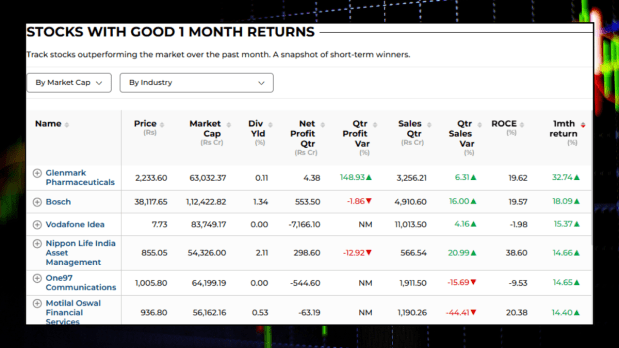

The top 5 large cap gainers in the last month

Here’s a closer look at five such outperformers that have gained up to 32% in the past 30 days. We have used the stocks with good 1 month return stock screener on Financial Express.com. Stocks that are large caps have been sorted as per the gains.

Glenmark Pharmaceuticals

Glenmark Pharmaceuticals tops the list with a staggering 32% monthly return. The stock has surged 38% so far in 2025, and with a 52-week low of Rs 1,274.70 and a high of Rs 2,286.15.

On July 10, the company announced that its US subsidiary, Ichnos Glenmark Innovation (IGI), signed a licensing deal with American pharma giant AbbVie for ISB 2001, a treatment for multiple myeloma. The deal includes $700 million (Rs 6,000 crore) upfront, potential payouts of $1.225 billion, and double-digit royalties on future global sales.

Bosch

Bosch has had an impressive run recently, clocking an 18% gain in one month, with a consistent five-day uptrend. The stock is gaining traction ahead of its Q1FY26 results, slated for August 4, 2025.

With the auto sector on a recovery path, and Bosch seen as a key player in EV and traditional engine parts, the stock has climbed 12% in the year so fa

Vodafone Idea

The surprise package among large caps, Vodafone Idea (Vi) has risen nearly 17% in just a month. The rally was triggered by its 5G rollout, with Mysuru becoming the second city in Karnataka to receive Vi’s 5G network after Bengaluru.

Currently, Vi’s 5G services are live in 23 cities, and it plans to expand to 17 more. The company has also upgraded its 4G infrastructure in Karnataka, enhancing capacity by 41%.

The shares of the company are currently trading nearly 2% higher. Over the past month, this telecom operator has delivered a solid return of around 17%, with the stock surging nearly 8% just in the last week.

Motilal Oswal Financial Services

Motilal Oswal Financial Services delivered a clean 14% gain over the past month, backed by its asset management arm crossing the Rs 1.5 lakh crore milestone in AUM across mutual funds, PMS, and AIFs.

The AUM has seen a 34% CAGR over five years, growing from Rs 35,180 crore in 2020. In the past week, the company’s share price has inched up by 1%. Over the last 52 weeks, the stock has traded between a low of Rs 487.85 and a high of Rs 1,063.40.

One97 Communications (Paytm)

Paytm’s parent company, One97 Communications, has gained 14% over the past month, with a 10% rise in the last week alone. The stock is riding a wave of optimism ahead of its Q1FY26 earnings, due on July 22, 2025.

This rise also marks its fifth consecutive session of gains, marked by renewed focus on operational efficiency and profitability.