In the first instance of resolution of a stressed power asset outside the insolvency and bankruptcy code (IBC) mechanism where the promoters have retained management control, a consortium of lenders led by Power Finance Corporation (PFC) has agreed to take a 38% haircut against their exposure of Rs 6,575 crore to RattanIndia Power’s 1,350 MW Amravati plant.

Aditya Birla Asset Reconstruction Company (ARC) will take over the power plant’s balance Rs 4,050-crore debt with funding from foreign funds including Goldman Sachs and Varde Partners. After this arrangement, the old lenders’ consortium and the ARC will own 15% each in RattanIndia Power. A 15% stake in the firm is worth a little over Rs 800 crore at current market prices. The promoters hold 53% in RattanIndia Power.

The Amravati plant has power purchase agreement for its full capacity with Maharashtra and has adequate fuel supply agreements with Coal India. It ran into stress due to short supply of coal and payment-related litigation. With the current deal, the plant has become the first in the power sector to benefit from the June RBI circular, which relaxed compulsory referral of stressed units to the bankruptcy court after the Supreme Court in April declared the banking regulator’s February 12, 2018, fiat as ‘ultra vires’.

“The deal marks the return of foreign debt funding into the country and sets an example of how a win-win solution can be achieved outside the National Company Law Tribunal,” Rajiv Rattan, chairman, RattanIndia Group, told FE. The development comes at a time when major power conglomerates are cash-strapped and power plants are finding it difficult to find new takers.

Apart from PFC, other lenders to the Amravati plant were State Bank of India, Axis Bank, UCO Bank, Life Insurance Corporation of India, Bank of India, Central Bank of India, Punjab National Bank, Canara Bank, United Bank of India, Syndicate Bank and REC.

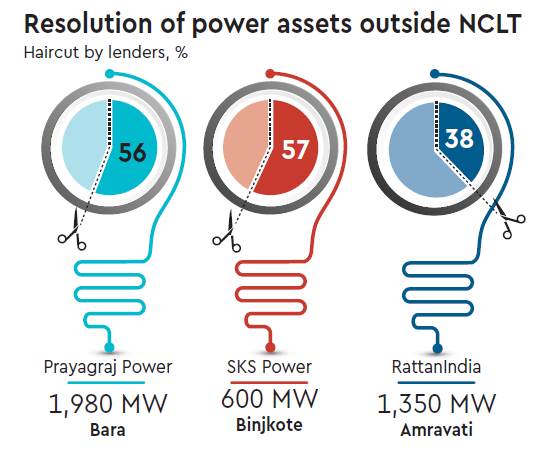

Lenders had taken much larger haircuts for other stressed plants resolved outside the NCLT. Tata Power acquired 75% stake in Prayagraj Power Generation Company’s 1,980 MW Bara power plant for Rs 6,000 crore, reflecting a haircut of more than 50%, while Hong Kong-based Agritrade Resources agreed to purchase 100% of the equity in SKS Power’s Binjkote power plant for Rs 2,170 crore, which is 57% lower than the loan outstanding from the unit.

Power minister RK Singh recently said out of the 34 stressed power projects worth Rs 1.8 lakh crore, 13 projects worth Rs 59,000 crore have been resolved. Three plants worth Rs 27,000 crore are in final stages of resolution and another 10 projects worth Rs 38,000 crore have been admitted in the NCLT. As many as eight projects, valued at Rs 49,000 crore, have been referred to the NCLT, but not admitted as yet. State-run NTPC is preparing to bid for the 600-MW Jhabua power plant in the NCLT.

As of September 30, financial creditors recovered Rs 1,37,919 crore, or 41.5% of their admitted claims via the NCLT process, since the insolvency law came into being in late 2016, according to the latest data compiled by the Insolvency and Bankruptcy Board of India.