The government is unlikely to set a target to complete any new disinvestment transaction, including sale of any public sector bank, next fiscal as it will focus on concluding a few deals where the process has already begun. The disinvestment receipts target for FY24 would, therefore, be not very ambitious and may be fixed at Rs 50,000-60,000 crore.

The scaling down of the agenda to raise non-debt capital receipts via this route is in recognition of the fact that FY24 will be the last financial year before the general elections in April-May 2024. The ruling BJP-led National Democratic Alliance reckons that big-ticket deals like sale of PSBs and oil companies could be politically inopportune.

“Next year, we will pursue the transactions that have been approved (by the Cabinet) and are already in various stages. These include IDBI Bank, ConCor, BEML, Shipping Corporation of India, NMDC Steel, HLL Lifecare and PDIL,” department of investment and public asset management secretary Tuhin Kanta Pandey told FE.

Finance minister Nirmala Sitharaman had in the FY22 Budget mentioned that two PSBs and one general insurance company will be privatised, without specifying any time-frame. However, little progress has been made nearly two years after that announcement. The government did not introduce a Bill in the monsoon session of Parliament to facilitate the privatisation.

The government has taken a go-slow approach on PSB sales despite Niti Aayog having recommended privatisation of Indian Overseas Bank (IOB) and Central Bank of India (CBI). Analysts’ view that given the uncertain market conditions, a sell-off bid at this point is unlikely to generate good proceeds also apparently influenced the government’s decision. The Centre had earlier indicated that it is open to the idea of offloading its entire equity in the two banks that are proposed to be privatised, instead of the initial plan to retain a 26% stake, to garner greater interest from potential investors.

A recent paper by Poonam Gupta, NCAER director general and member of the economic advisory council to the Prime Minister, and former Niti Aayog vice-chairman Arvind Panagariya has suggested that the government privatise all state-run banks, barring SBI.

On February 1, 2021, a new public sector enterprises policy was unveiled to limit the number of CPSEs to a minimum in strategic sectors while the government will fully exit the non-strategic sector businesses. This triggered speculations that dozens of CPSEs, including banks, fuel retailers, among others, would be privatised in the coming years. But the process for sale of oil marketer BPCL was shelved amid volatility in global crude prices, which raised questions of the lack of real pricing autonomy for state-run oil marketing companies.

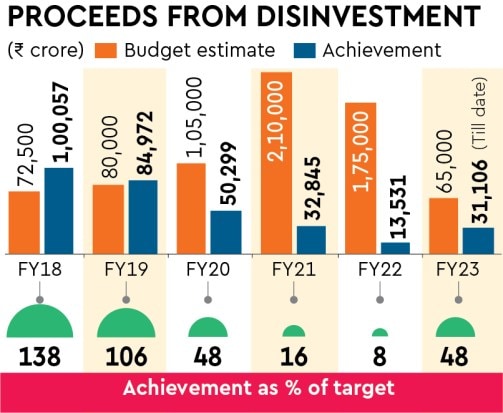

Except for an OFS tranche of HZL, not many big transactions are expected by March 2023. Given that transactions are time-consuming in many deals due to issues such as delays in getting approvals and demerger of non-core assets, the disinvestment target of Rs 65,000 crore for FY23 would likely be missed by a significant margin. The Centre has received Rs 31,106 crore via disinvestment so far, 48% of the annual target. The shortfall in FY23 would depend on how much the Centre would garner from the HZL stake sale by March.

“We want to exit HZL. In how many tranches the exit will happen will be based on the advice of merchant bankers,” Pandey said. HZL share price closed at Rs 338.3 on Monday, up 1.48% from the previous closing price. The Centre’s 29.54% stake in HZL is worth about Rs 42,225 crore at the current market prices.

On Saturday, the government received multiple expressions of interest (EoIs) from domestic and foreign investors for the 60.72% stake in IDBI Bank, which will go to the successful bidder along with management control. “It will take at least 3-4 months to complete all the processes by transaction adviser including due diligence of EoIs, getting a fit-and-proper assessment by the RBI and giving access to data room on the bank to shortlisted bidders. The financial bids would be called after that,” Pandey said.

The official said a suitable period would be available to the winning bidder to comply with the minimum public shareholding norm to grow the business and create value before diluting the stake. The 60.72% stake worth over Rs 38,389 crore at current market prices comprises 30.48% (Rs 19,270 crore) from the government and 30.24% from LIC.

“We are working on the ConCor EoI and we are substantially thought with it. Hopefully, it will be out by end-January or a few days later,” Pandey said, adding that the transaction would move fast thereafter as no demerger of non-core assets is there in this case. The government plans to sell a 30.8% stake in ConCor worth about Rs 14,000 crore at current market prices, out of its 54.8% holding in the container business company along with management control to a strategic buyer.

Another relatively decent size transaction would be the government’s disinvestment of 60.79% stake in NMDC Steel at Nagarnar in Chhattisgarh, which could garner around Rs 10,000 crore. The Centre has already invited EoI for the 50.79% stake sale in NMDC Steel and it would sell its residual 10% in the company to NMDC after a strategic buyer is identified.

With the demerger of non-core assets such as land and building almost done, the financial bids for BEML and SCI are expected before March 31, the officials said. The majority stake sale in SCI could be around Rs 2,300 crore and Rs 1,600 crore in BEML. The financial bids for 100% stake in relatively smaller HLL Lifecare (HLL) and Projects & Development India (PDIL) are expected shortly. All these transactions would conclude in FY24.