Global trade continues to move largely by sea. Even as supply chains diversify, shipping remains the most efficient way to move large volumes of goods across borders. As trade expands, pressure shows up first at ports. Congestion, turnaround time and handling capacity become real constraints. This makes port expansion less a choice and more a necessity for countries that want to remain competitive in global commerce.

The Catalyst: A ₹25,000 Crore Maritime Fund

India is now preparing for this next phase. In the Union Budget for 2025–26, the government announced the creation of a Maritime Development Fund with an initial corpus of Rs 25,000 crore. The objective is to support long-term financing for ports and shipping, while crowding in private capital. Over time, this initiative is expected to help mobilise investments of up to Rs 1.5 lakh crore across the maritime ecosystem by the end of the decade.

For India’s port and terminal operators, this marks an important shift. Port expansion is not just about adding capacity on paper. It improves asset utilisation, reduces idle time and allows higher cargo volumes to be handled without proportionate increases in costs. Over time, this operating leverage can translate into stronger cash flows and better return ratios. In that sense, port-focused companies stand at the front end of the investment cycle.

That is why this article focuses on direct beneficiaries. The companies selected own or operate port-linked assets such as container terminals, CFS facilities, ICDs or liquid cargo terminals, where higher cargo throughput feeds directly into revenues. These businesses are positioned to benefit first as port capacity expands, making them the most relevant picks within this theme.

However, given recent financial volatility of Kesar Terminal and Infrastructure, it is not discussed in detail here. The focus remains on businesses where the link between port expansion and earnings visibility is more clearly established.

#1 Container Corporation of India – The Backbone of India’s Containerised Trade

Container Corporation of India (CONCOR) is engaged in the business of providing inland transportation of containers by rail. It also covers the management of ports, air cargo complexes and establishes cold chains.

The Leader: Why CONCOR is the First Choice

Container Corporation of India reported a strong operating quarter in Q2 FY26, supported by higher volumes and improved asset utilisation. The company recorded its highest-ever quarterly throughput at 1.4 million twenty foot equivalent units (TEUs), taking first-half volumes to 2.7 million TEUs, up 11% year on year (YoY). On a standalone basis total income for Q2 FY26 grew 1.4% to Rs 2,447.2 crore, while net profit grew 1.5% to Rs 376.7 crore, despite softer domestic demand early in the year.

Margins improved during the period, helped by higher volumes and better utilisation. Rail freight margins rose to 27.8%, while operating margins improved to 31.4%. Lower empty runs and tighter rake planning supported this improvement. Capital expenditure in the first half stood at about Rs 420 crore. The company indicated that full-year spending could move higher as investments in terminals and rolling stock pick up.

Looking ahead, the focus remains on capacity-led growth. The planned connection of the Western Dedicated Freight Corridor to JNPT by March 2026 is expected to support wider use of double-stack container trains.

The company is also expanding into bulk cement logistics and port operations at locations such as Vadhvan and Bhavnagar. Overseas container movement to the Middle East is another area being developed. While execution will remain key, the company heads into the second half with margins holding firm and projects under way.

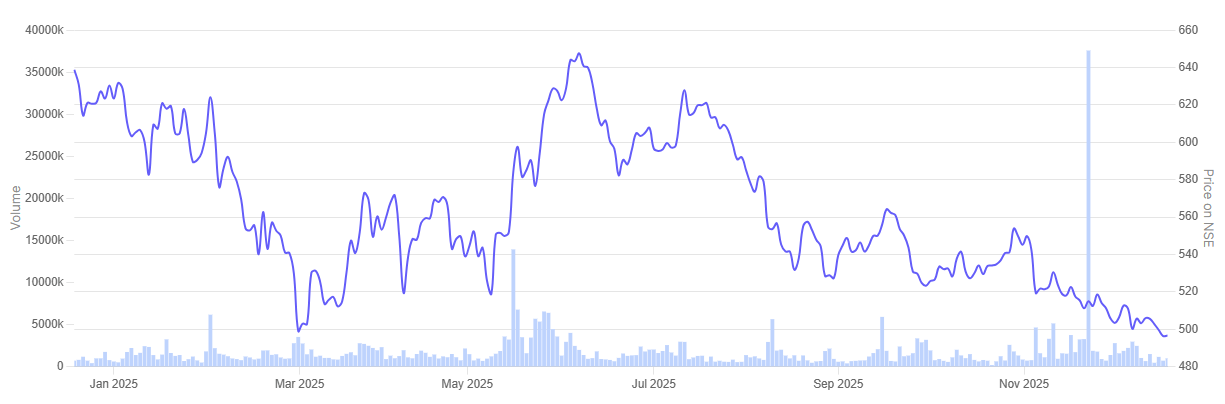

Container Corporation Of India tumbled 21.9% over the past year.

Container Corporation of India 1-year Share Price Chart

#2 Gateway Distriparks – Rail-Led Growth Riding the Dedicated Freight Corridor Opportunity

Gateway Distriparks is an integrated inter-modal logistics service provider. The company offers general & bonded warehousing, rail & road transportation, container handling services and other value added services.

The Challenger: Gateway’s Rail-Led Edge

Gateway Distriparks reported a strong operating performance in Q2 FY26, driven by higher rail and CFS volumes across key locations. Total throughput rose 5.9% YoY to 1.9 lakh TEUs, supported by steady growth in both rail-linked cargo and container freight station operations. For the first half, throughput increased 7.6% to 3.8 lakh TEUs, reflecting improved network utilisation.

Total income for the quarter rose sharply to Rs 570.4 crore, up 44.6% from the same period last year. Net profit increased 10.2% YoY to Rs 66.3 crore, aided by higher volumes and operating leverage, despite some cost pressures at the facility level.

On the operational front, the company continues to prepare for the next leg of growth. The expected connectivity of the Western Dedicated Freight Corridor to JNPT remains a key trigger for faster turnaround and higher asset utilisation. Management remains cautious on exports amid global uncertainties, but improving import flows and domestic rail services provide visibility for stable performance in the coming quarters.

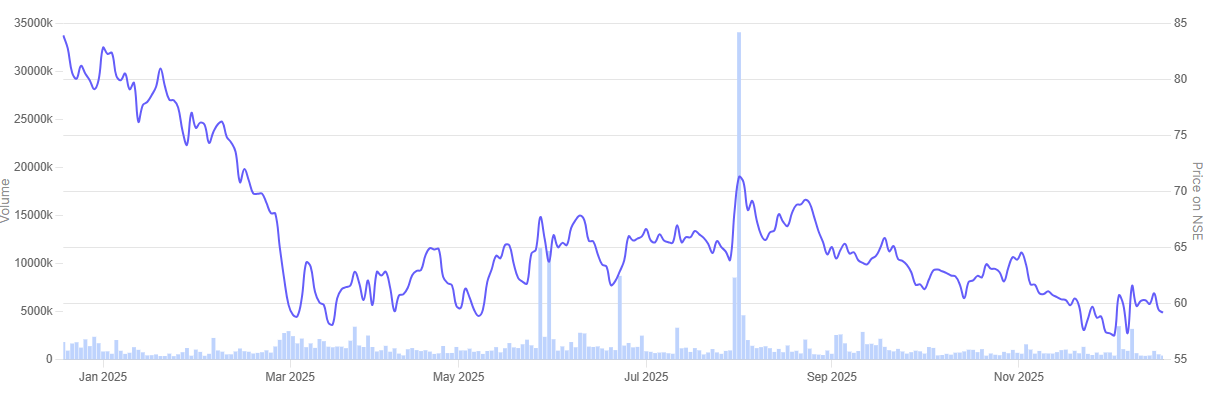

In the past one-year Gateway Distriparks tumbled 29.2%.

Gateway Distriparks 1-year Share Price Chart

#3 Navkar Corporation – High Operating Leverage, But Earnings Still Under Pressure

Navkar Corporation provides cargo transit services across container freight stations, private freight terminal, inland container depots and multimodal logistics parks.

The Turnaround: Navkar’s New Life Under JSW

Navkar Corporation, which is now part of the JSW Infrastructure group, saw an improvement in operating activity during Q2 FY26, as cargo volumes picked up across its ICD and CFS facilities. Domestic cargo volumes rose sharply during the quarter, while EXIM volumes also improved on a year-on-year basis, pointing to better asset utilisation at key locations.

Financially, the picture remains cautious. Navkar’s performance is consolidated under JSW Infrastructure’s logistics segment, which recorded total income of about Rs 164 crore in Q2 FY26 and profit after tax of around Rs 4 crore.

However, margins have compressed materially over the last few years. Standalone financials show operating margins falling from nearly 40% levels earlier in the decade to low single digits recently. Losses were reported in FY24 and FY25, driven by a combination of high fixed costs and higher depreciation and finance charges.

Even so, the company’s ownership of port-linked assets means it remains exposed to any recovery in cargo volumes. But the investment case hinges on sustained volume growth translating into margin recovery, rather than near-term earnings visibility.

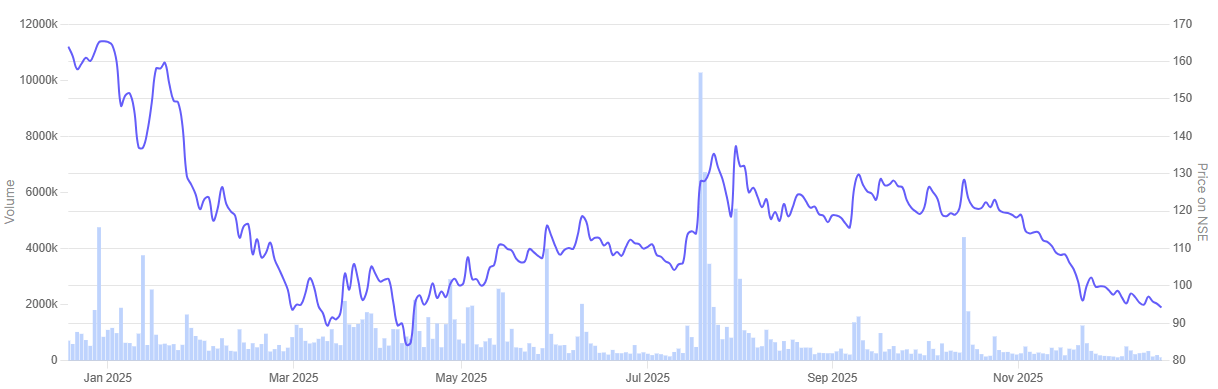

In the past one year Navkar Corporation tumbled 42.5%.

Navkar Corporation 1-year Share Price Chart

#4 Brace Port Logistics – A Small-Cap Port Services Player With Expanding Reach

Incorporated in 2020, Brace Port Logistics is in the business of providing logistics services.

The Small-Cap Bet: Brace Port’s Global Ambitions

Brace Port Logistics saw its business expand in FY25 as cargo movement increased and its port-related services widened during the year.

The company operates across freight forwarding, container handling, coastal movement and multimodal transport, with a focus on asset-light execution and improving service reach. Over FY25, Brace Port expanded its domestic footprint and added new clients along key trade routes, which supported higher cargo handling and better utilisation of its network.

On the financial side, the company posted revenue of ₹85.6 crore for the year, up from the previous year, aided by an increase in shipment volumes. Profit after tax came in at ₹6.9 crore, with margins holding up despite a competitive freight market and uneven trade conditions.

The company is also taking measured steps to widen its services and overseas reach, including operations through a subsidiary in Dubai. Since Brace Port is not required to publish quarterly results, disclosures on more recent performance are limited. Its growth trajectory will depend on sustaining cargo volumes and maintaining cost discipline as port activity improves

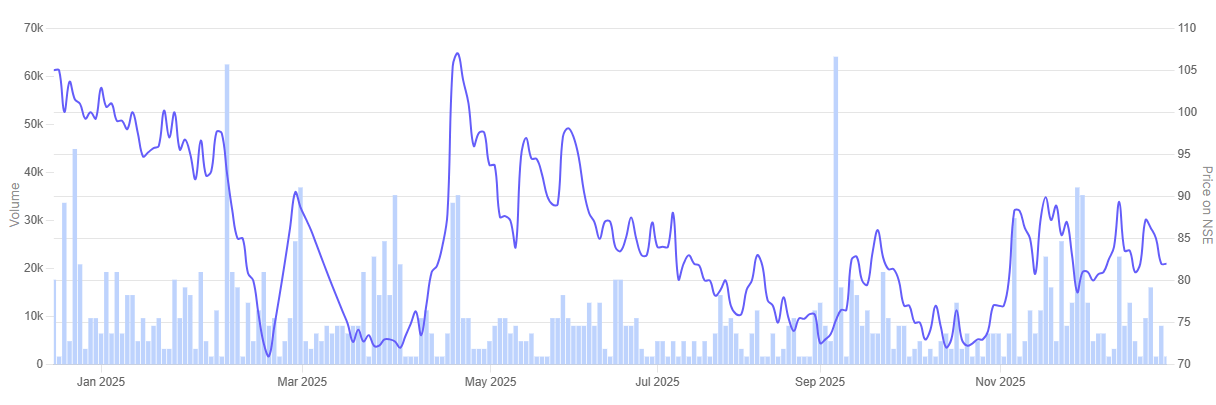

In the past one-year Brace Port Logistics tumbled 16.7%.

Brace Port Logistics 1-year Share Price Chart

Valuations

Let’s now turn to the valuations of the port and terminal operators companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Port and Terminal Operators Stocks in India

| 1 | Container Corporation of India | 15.0 | 11.7 | 13.9% |

| 2 | Gateaway Distriparks | 7.8 | 10.6% | |

| 3 | Navkar Corporation | 44.7 | -1.8% | |

| 4 | Brace Port Logistics | 9.2 | 35.2% |

As the table shows, valuations across this space are far from uniform. Container Corporation of India is trading at a premium to the sector median. This largely reflects its size, nationwide rail network and the steadier nature of its cash flows. Gateway Distriparks is valued below the median, which suggests that investors are still cautious about execution and the pressure on margins in the near term.

Navkar Corporation presents a different picture. Despite weak profitability and a negative return on capital, the stock is quoting at a much higher multiple than the sector average. The valuation appears to be driven more by expectations of a recovery in volumes than by recent financial performance. Brace Port Logistics is priced closer to the sector median. Its return ratios are stronger, though these are being generated on a relatively small base.

While the long-term outlook for port-led growth remains supportive, stock prices indicate that part of this optimism is already built in. Investors will need to be selective rather than rely on the theme alone.

While the long-term direction of the sector is favourable, investors need to judge how much of the upside is already reflected in current valuations, and whether higher cargo volumes can translate into durable earnings growth from here.

Conclusion

India’s port expansion push clearly creates a favourable backdrop for companies operating at the heart of the cargo-handling ecosystem. Port operators and logistics firms with assets close to ports are likely to feel the impact of expansion first, as additional capacity and better rail and road links help improve asset usage. How far this improvement feeds into profits, however, will differ from company to company. Much will depend on how efficiently assets are run, how costs are managed and how smoothly projects are executed on the ground.

Valuations therefore need to be looked at carefully. Some stocks appear to be priced on fairly measured assumptions, while others seem to factor in a large part of the expected benefit from higher cargo movement. Investors will need to assess whether current prices leave enough room for returns if volumes rise more gradually than expected. In such cases, any delay in volume recovery or pressure on margins could weigh on returns.

As always, sector tailwinds alone do not guarantee investment success. Investors would be well advised to carry out a comprehensive evaluation of each company’s fundamentals, balance sheet strength, cash flow profile and valuation before making any investment decisions. Port expansion is a long-term theme, and the most attractive opportunities are likely to emerge where growth potential and financial discipline align.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Disclaimer:

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.