One of India’s Warren Buffetts, ace investor Ashish Kacholia just added some new possible feathers to his hat. He has added 3 news stocks to his portfolio worth almost Rs 170 cr. Kacholia, known as the Big Whale, started out with Prime Securities and later joined Edelweiss before incorporating his own broking firm, Lucky Securities in 1995. He also co-founded Hungama Digital with Rakesh Jhunjhunwala in 1999 and started building his own portfolio from 2003.

Kacholia now owns 49 stocks in his portfolio worth Rs 2,678 cr, spanning across diverse sectors like hospitality, education, infrastructure, and manufacturing etc.

The icing on the cake is that all the three companies that he has bought stakes in have a ROCE (Return on Capital Employed) of over 25%! Let us dive in to find more about these picks.

V-Marc India Ltd

Incorporated in 2014, V-Marc India Ltd manufactures PVC Insulated Wires & Cables.

With a market cap of Rs 1,389 cr, V-Marc India manufactures various types of wires & cables in Single & Multi-core with Copper /Aluminium Conductors and possess properties of FR, HRFR, FRLS, HFFR etc.

As per Trendlyne.com Ashish Kacholia has just bought a 2.7% stake in the company, which is about 661,000 shares worth Rs 37.3 cr.

Let us look at the company financials to see if we can find out what is it that Kacholia sees in V-Marc India. Please note that the company reports half yearly financials.

The company’s sales have seen a compounded growth of 39% from Rs 170 cr in FY20 to Rs 896 cr in FY25. The figures for the quarter ending September 2025 are awaited.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for V-Marc was Rs 14 cr in FY20 which climbed to Rs 98 cr in FY25. That is a compound growth of 48%.

The net profits saw a compound jump of 49% between FY20 and FY25 from Rs 5 cr to Rs 36 cr.

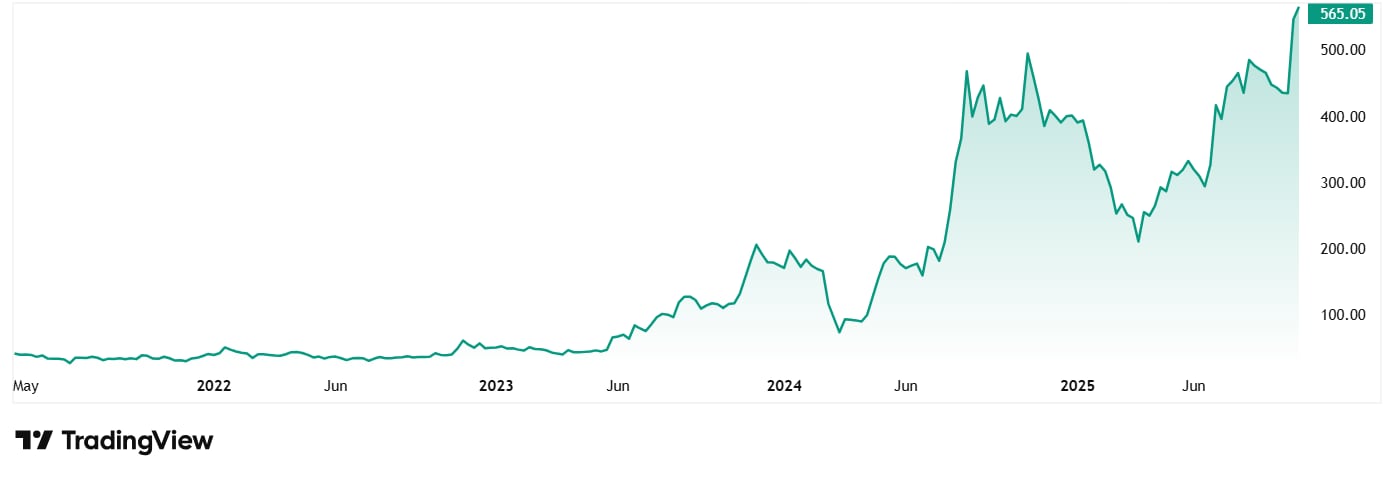

The share price of V-Marc India Ltd when it was listed in April 2021 was around Rs 41, which has now grown to Rs 569 as on 16th October 2025, a jump of 1,288%. Rs 1 lac invested in the stock at listing would have been close to Rs 14 lacs today.

The company’s ROCE (Return on Capital Employed) could be another factor that attracted Kacholia. The current ROCE is 27%, which means for every Rs 100 the company spends as capital, it makes a profit of Rs 27 on it. The industry median ROCE is just 20%.

The company’s share is trading at a current PE of around 39x, while the industry median is around 24x. It would be too soon to find a 10-year median PE for V-Marc, but the 10-year industry median is 21x.

In the company’s last annual report, the Managing Director Vikas Garg said that the company will remain committed to consolidating its strengths and accelerating growth by focusing on the strategic priorities like: Technological Empowerment, Export Acceleration and Sustainability Alignment.

Pratham EPC Projects Ltd

Incorporated in 2014, Pratham EPC Projects Ltd in the business of Pipeline Construction of Oil & Gas and Water Engineering Procurement Construction.

With a market cap of Rs 265 cr, Pratham EPC Projects Ltd is an ISO 9001:2008 certified provider of end-to-end construction solutions in engineering, procurement, and construction for India’s Oil and Natural Gas sector, oil and gas pipelines, irrigation, power and industrial projects, water, and environment solutions.

Ashish Kacholia has just bought a 1.2% stake in the company, which is 226,245 shares worth Rs 3.4 cr.

The company’s sales have seen a compound growth of 33% from Rs 50 cr in FY22 to Rs 119 cr in FY25. The company reports half yearly numbers and the figures for the quarter ending September 2025 are yet to be filed.

EBITDA went from Rs 7 in FY22 to Rs 17 cr in FY25, making it a compound growth of 34%.

The net profits grew from Rs 4 cr in FY22 to Rs 14 cr in FY25 which is a compounded growth of 45%.

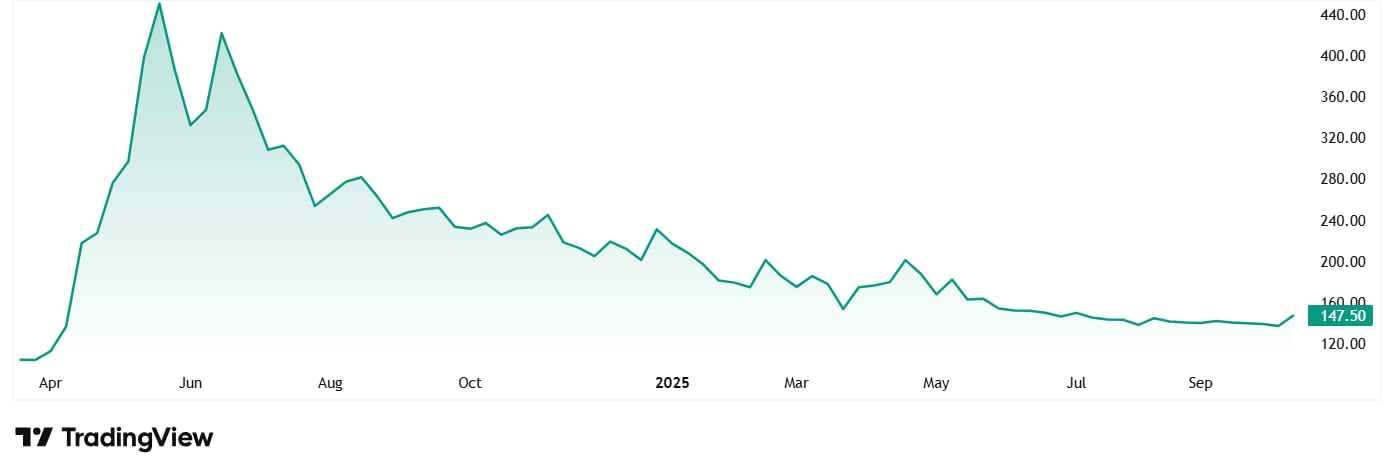

The company was listed in March 2024 at a share price of about Rs 103, which has jumped to Rs 151 as on 10th October 2025. That is a jump of almost 47% since listing. But as is evident from the chart below, the share price is sharply down from its highs.

The company has a current ROCE of 26% and its share is trading at a 42% discount from its all-time high price of Rs 262.

The share is trading at a PE of 21x which is close to the industry median 22x.

As per the last annual report, with a Net Worth of Rs 74.4 cr, the company has strong execution capabilities, and a strategic foothold in the Middle East, making it well positioned for accelerated growth in the coming years. The Company’s focus on strengthening its order book, exploring new geographies, and maintaining operational efficiency will continue to create long-term value for stakeholders.

Jain Resource Recycling Ltd

Incorporated in 2022, Jain Resource Recycling Limited is engaged in the recycling and manufacturing of non-ferrous metal products.

With a market cap of Rs 11,331 cr, Jain Resource Recycling Ltd is engaged in manufacturing of non-ferrous metal products through large-scale recycling of metal scrap.

Ashish Kacholia has just bought an 1.1% stake in the company, which is over 38,90,760 shares worth Rs 124.5 cr, through his company Suryavanshi Commotrade Private Limited.

The company’s sales have grown at a compounded rate of 196% from Rs 236 cr FY22 to Rs 6,143 cr in FY25.

The EBITDA grew at a compounded rate of 115% from Rs 35 cr to Rs 345 in the same period.

The net profits jumped from Rs 28 cr to Rs 211 cr between FY22 and FY25, which is a compound growth of 95%.

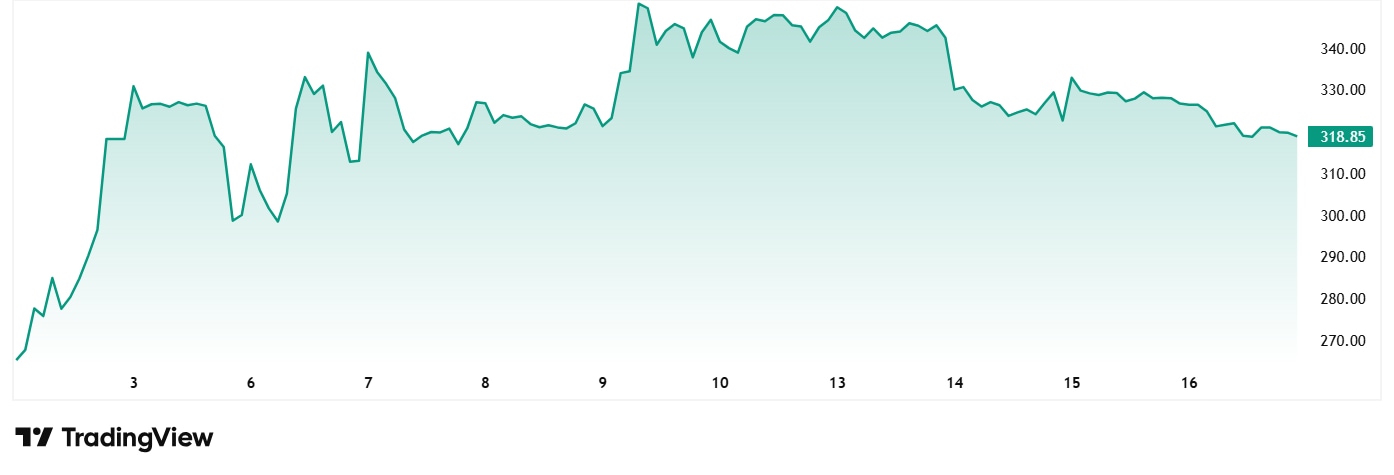

The shares of Jain Resource Recycling was recently listed in early October 2025 at a price of Rs 318 and is currently trading at Rs 328 as on 16th October 2025.

The company has a current ROCE of 27% while the industry median is 17%.

The company’s share is trading at a current PE of around 54x, while the industry median is around 53.

Join the big whale’s high ROCE Party?

When an investor like Ashish Kacholia buys or sells stocks, it creates ripples in the investor community.

So, his latest 3 buys have investors across the board taking notes and trying to find out if it would be a good plan to follow the big whale. All the 3 stocks have some solid financials and high ROCE, showing promise for the years to come.

It would be a good idea to add these stocks to a watchlist and track them closely, so that one does not miss out on any big movement.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.