India’s ‘Atmanirbhar Bharat’ slogan has proved to be a boon for the defence sector, which has, in the true sense, achieved self-reliance. The country is not only producing for itself but also exporting to other nations. The numbers validate this transformation. India’s defence exports have surged 34 times in 11 years, from just ₹6.8 billion in FY14, recording a 12% year-on-year growth in FY25 to reach a record high of ₹236.2 billion.

This growth was led by both the Defence Public Sector Undertakings (DPSUs) and the private sector. The private sector contributed 64.5% (₹152.3 billion) to total exports, while DPSUs accounted for the remaining ₹83.9 billion. In FY25, DPSU exports grew 43.8%, whereas the private sector remained largely flat.

These numbers reflect the growing acceptability of Indian products in global markets and the ability of the domestic defence industry to integrate into the global supply chain. In a major boost to exports, a wide range of items — from ammunition, arms, and sub-systems to parts and components — were shipped to around 80 countries in FY25.

The country is now marching towards the ambitious target of increasing defence exports to ₹500 billion by FY29. But as we speak, a handful of companies have been the key drivers of this export surge. Let’s take a look at the major contributors.

#1 Astra Microwave Products: Expanding Export Through High-Value Defence Electronics

Astra Microwave is engaged in the business of designing, developing, and manufacturing defence, aerospace, and space electronics, subsystems, and components. It is one of the few companies in India that designs and develops radar, tactical, and space electronics systems and sub-systems.

Exports Poised to Play Bigger Role

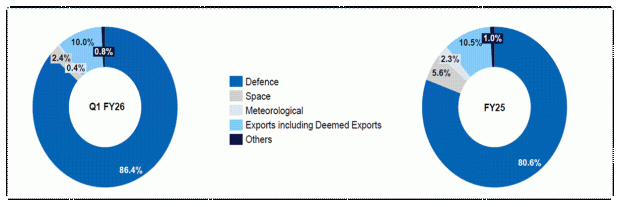

Astra operates across several key sectors, including Defence, Aerospace, Space, Meteorology, and Telecom. In Q1FY26, the company generated 86.4% of its revenue from defence, and 10% from exports, which is similar to FY25 (10.5%). The company aims to increase export revenue contribution to 30% in the next 2-3 years, with domestic contribution at 70%.

Exports contributed 10% to revenue in Q1FY26.

The company estimates the potential total addressable market opportunity for exports to be around ₹10 billion by FY28. Astra is focusing on upgrading its Monolithic Microwave Integrated Circuit chips portfolio (currently over 40 chips) to compete in the global markets.

It sees a potential to sell chips in excess of $50 million or more over the next 5 years from this portfolio alone. The company is building global relationships, such as with Teledyne, to enable these sales. Astra also intends to market its new solutions, including its three new 100% Astra radars and anti-drone systems, to the global market.

Financial Performance Strengthens with Margin Expansion

Coming to its financials, Astra’s revenue grew 29% year-over-year to ₹2.0 billion in the first quarter of FY26. Its operating margin also expanded by 500 basis points (bps) to 20.5%. As operating leverage kicked in, profit after tax (PAT) grew 126.2% to ₹160 million. It enjoys high gross margins (8-10%) on export business, while margins on domestic business are 40-45%.

Its order book stood at ₹18.9 billion as of Q1FY26, which gives revenue visibility of about 2 years as per FY25 revenue (₹10.5 billion). Management also expects to book another ₹11 billion or so by FY26 end, and targets a total order win of around ₹13-14 billion for the financial year.It aims to grow its top line by around 20% to ₹12 billion, and bottom line by 18% in FY26.

Valuation at Premium

From a valuation perspective, it trades at a price-to-earnings (PE) of 65x, well-above its 10-year median of 34x, but lower than the industry P/E of 71.6x.

#2 Data Patterns: Leveraging Radar Strength and Indigenous Tech

Data Patterns is a fully integrated defense and aerospace electronics solutions provider. The company focuses on in-house design, prototype testing and qualification, production, and manufacturing of high-reliability electronics systems. It serves customers such as the Ministry of Defence (MOD), DRDO, Defence Public Sector Undertakings (DPSUs), and the private sector.

Broad Platform Presence with Radars Leading Revenue

The company caters to the entire spectrum of Defense and Aerospace platforms, including space, air, land, and sea. The company possesses domain expertise in key areas of defense electronics, including Radars, Electronics Warfare (EW), Communication systems, Avionics, Satellite, and Test Equipment.

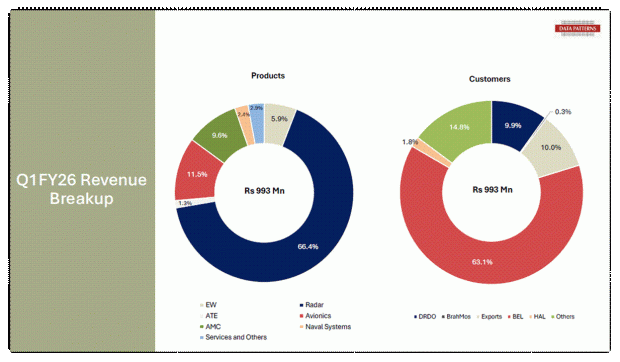

Radars contributed 66.4% to revenue in Q1FY26, making it the largest revenue driver. By customer mix, Bharat Electronics accounted for 63.1% of revenue, followed by exports (10%), DRDO (9.9%), Hindustan Aeronautics (1.8%), and others (14.8%).

Exports Gain Traction with NATO Orders and New Products

Data Pattern export surge has increased from 6% of total revenue in FY24 to the current level of 10%. This growth was partially attributed to developing and supplying new radars to NATO countries in FY25, in addition to regular exports to its UK customer. It also exports to East Asia. The export order book stands at ₹980 million.

In the export market, the company plans to expand geographies and build a marketing organisations for exports. Several of Data Patterns’ internally developed products are identified as having export potential, such as the Radio Frequency (RF) and Infrared (IR) seekers for missiles. It also anticipates an increase in defence spending by European and NATO countries to provide a decent portion of opportunities to Indian companies.

Exports contributed 10% to the Revenue Mix.

Revenue Dips in Q1, But Growth Guidance Remains Strong

The company’s revenue declined 4.6% year-on-year to ₹993 million in Q1FY26. EBITDA declined 13.7% to ₹321 million, with margin falling by 340 bps to 32.7%. PAT decreased by 22.2% to ₹255 million. As of Q1FY26, the order book stood at ₹8,140 million, which provides revenue visibility of about a year.

The company is targeting a revenue growth of 20-25% over the next 2-3 years, with an EBITDA margin of 35-40% in FY26. The company is planning for an additional ₹150 Crores capex over the next two years to build infrastructure. It trades at a PE of 74x, well-above its 4-year median of 68.9x, and the industry P/E of 71.6x.

#3 Bharat Dynamics: Riding Export Wave Through Akash Missile and Missile Portfolio

Bharat Dynamics is a public sector undertaking, specializing in missile technology and allied defence equipment. The company has evolved from being solely a missile manufacturer into a comprehensive weapon system integrator for various missile platforms.

Evolving Beyond Missiles with Integrated Systems

It is a multi-product, multi-location organization serving the Army, Navy, and Air Force. The company is identified as the key player in manufacturing among indigenous entities and is the sole player in India for Surface-to-Air Missiles (SAMs), torpedoes, and Anti-Tank Guided Missiles.

Exports Surge on Akash Approvals and Global Interest

Bharat Dynamics achieved an all-time high export sales of ₹12.7 billion in FY25, from ₹1.6 billion in FY24. Exports accounted for 35.9% of total sales, versus 6.7% in FY24. The company aims to maintain at least a 25% share of export business by FY29. To this end, it hopes to benefit from the approval of the export of the Akash weapon system to nine countries.

It is also attracting interest from several countries for its other offerings. The company is pursuing partnerships with foreign manufacturers for new weapons and potential transfer of technology (TOT), aiming to become a partner in the global missile system supply chain. Its revenue surged 29.8% to ₹2.4 billion in Q1FY26, while PAT rose by 157% to ₹180 million.

Robust Order Book Sets Stage for Ambitious Growth

Looking ahead, as of 31 March 2025, the company’s order book stands at about ₹228.1 billion. Moreover, it expects to receive orders worth about ₹200 billion over the next 2–3 years. The company has an ambitious target of achieving a turnover of ₹100 billion by FY31. It trades at a P/E of 102x, well-above the 5-year median (37.1x), and the industry (71.5x).

#4 Zen Technologies: Tapping Global Demand with Anti-Drone and Simulator Exports

Zen Technologies specialises in defence systems, primarily simulators and anti-drone technology. Zen views the simulator market as having significant remaining potential, having currently tapped only about 7-8% of the overall simulation market.

Strengthening Edge in Anti-Drone Systems

Zen also has a dominant position in anti-drone systems in India. Zen’s systems can detect and jam non-commercial and military frequencies across a wideband range (e.g., 100 megahertz to 6 or 8 gigahertz), unlike many competitors who focus only on commercial frequencies. Zen is now heavily focusing on hard kill techniques (shooting down drones).

Exports Set to Pick Up from H2FY26

The contribution of exports as a percentage of total turnover was 38% in FY25. In Q1FY26, the company has not exported anything yet. But, its diversified consolidated order book holds export orders worth ₹1.1 billion. Exports are expected to begin from H2FY26, including both simulators and anti-drone systems.

The management estimates FY27 to be a significant year for exports. Zen is focusing on securing orders from Africa, the Middle East, and Southeast Asia. Zen is also actively pursuing expansion plans in the US, South America, and NATO countries, with orders expected by FY27. Zen’s subsidiary, Vector, is currently discussing exports to Europe and the US.

Order Book Provides Near-Term Visibility Amid Slow FY26

Zen’s revenue declined to ₹1.5 billion in Q1 FY26 from ₹2.5 billion in Q1FY25. This was due in part to a delay in revenue recognition (₹600-700 million) due to design changes. EBITDA fell 24.5% to ₹865 million, but margins expanded by 972 bps to 54.7%, higher than Zen’s benchmark of 35%. However, PAT declined 32.9% to ₹530 million.

The company’s order book stood at ₹7.5 billion, providing revenue visibility of less than a year. The company aims to achieve a targeted cumulative revenue of ₹60 billion over the next three fiscal years (FY26/27/28). But, FY26 is expected to be a “slow year” or a “year of consolidation.”

Valuation-wise, Zen is trading at a P/E of 52.5x, lower than the 10-year median of 76.4x and the Industry’s (71.5x).

Bottomline

India’s sharp rise in defence exports reflects a structural shift rather than a temporary surge. Backed by policy support, indigenous R&D capabilities, and rising global acceptance, companies such as Astra Microwave, Data Patterns, Bharat Dynamics, and Zen Technologies are emerging as the key beneficiaries.

While execution timelines remain watchpoints, their expanding order books, export pipelines, and strategic partnerships position them well to ride the next leg of India’s defence export growth story.

Disclaimer

Note: Throughout this article, we have relied on data from Screener and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.