India aims to become Atmanirbhar in the Semiconductor industry. The India Semiconductor Mission aims to build a strong semiconductor and display ecosystem. It aims to establish India as a global hub for electronics manufacturing and design, and also to act as the nodal agency for the smooth and efficient implementation of the Semiconductor and Display Scheme. But there is a problem.

India’s share in the world’s freshwater resources is very small (4%), while it is home to about 18% of the world’s population, according to the World Economic Forum. This water scarcity could pose a challenge, as semiconductor fabs require huge volumes of ultra-pure water for rinsing, cleaning, cooling, and wafer cleaning throughout the fabrication process. The World Economic Forum estimates that an average chip factory uses 100 lakhs gallons of ultra-pure water every day, equivalent to the daily water use of 33,000 U.S. homes.

Converting municipal water into pure water is a water-intensive operation in itself– producing 1,000 gallons of UPW can require 1,400–1,600 gallons of feedwater before purification. Per BNP Paribas Asset Management, the global semiconductor industry is estimated to use around 12 lakh megalitres of water annually, driven by fab expansion and rising chip demand. This massive demand, along with water scarcity, is driving demand for wastewater treatment.

This is where the role of these two players comes into play.

#1 VA Tech Wabag: The ‘Asset-Light’ Bet on Solar & Semis

VA Tech Wabag is a renowned global water technology multinational company with a presence in more than 25 countries. Wabag is the third-largest private water operator worldwide and the third-largest desalination plant supplier.

Building Capabilities Across the Water Cycle

It is a pure-play water infrastructure provider offering solutions for the entire water cycle. This includes desalination, wastewater treatment, recycling, ultra-pure water (UPW), zero liquid discharge (ZLD), and sludge management for both the municipal and industrial sectors.

Wabag operates primarily under an asset-light business model, focusing on high-value engineering and procurement contracts and achieving a stable, annuity-style revenue stream through long-term operation and maintenance contracts.

The increasing contribution from the O&M business is aimed at long-term predictability of cash flows. Wabag considers solar, semiconductor, and data center sectors as part of its strategic focus on future energy solutions.

Wabag’s Emerging Growth Runway

Leveraging UPW Expertise for New Sectors

Wabag’s entry into the ultra-pure water segment is based on its proven expertise in producing demineralized and deionized water using both resin and advanced membrane technologies, as well as its long-term operation of ZLD systems.

It has also received an order to supply UPW, Effluent Treatment Plant (ETP), and ZLD solutions to a solar cell manufacturing facility (Reneusys in Hyderabad). This project involves designing and building an advanced technology plant featuring ultrafiltration, reverse osmosis, and electrodeionization to produce UPW, which is essential for wafer cleaning and conditioning in solar cell manufacturing.

Solar and Semiconductor Demand Accelerates UPW

Wabag estimates that growth in solar manufacturing (India targets 130 GW by 2030) will drive demand for 100 to 150 MLD of ultra-pure water capacity over the next 3 to 5 years. This represents a market potential of ₹3,500 crore. This capability positions Wabag to capitalize on similar opportunities in green hydrogen and semiconductor fabs.

Positioned for Rising Data-Center Needs

The company is also actively engaging with the market to explore emerging opportunities within the Data Center segment. Data center expansion across India is expected to drive a significant rise in demand for reliable water, particularly for cooling operations.

It proposes a sustainable approach for city administrations, recycling treated sewage using advanced membrane technology to promote water reuse in data centers. Leveraging its proven expertise with tertiary treatment reverse osmosis plants, including award-winning facilities in Chennai and Ghaziabad, it is ideally positioned to support India’s data center growth.

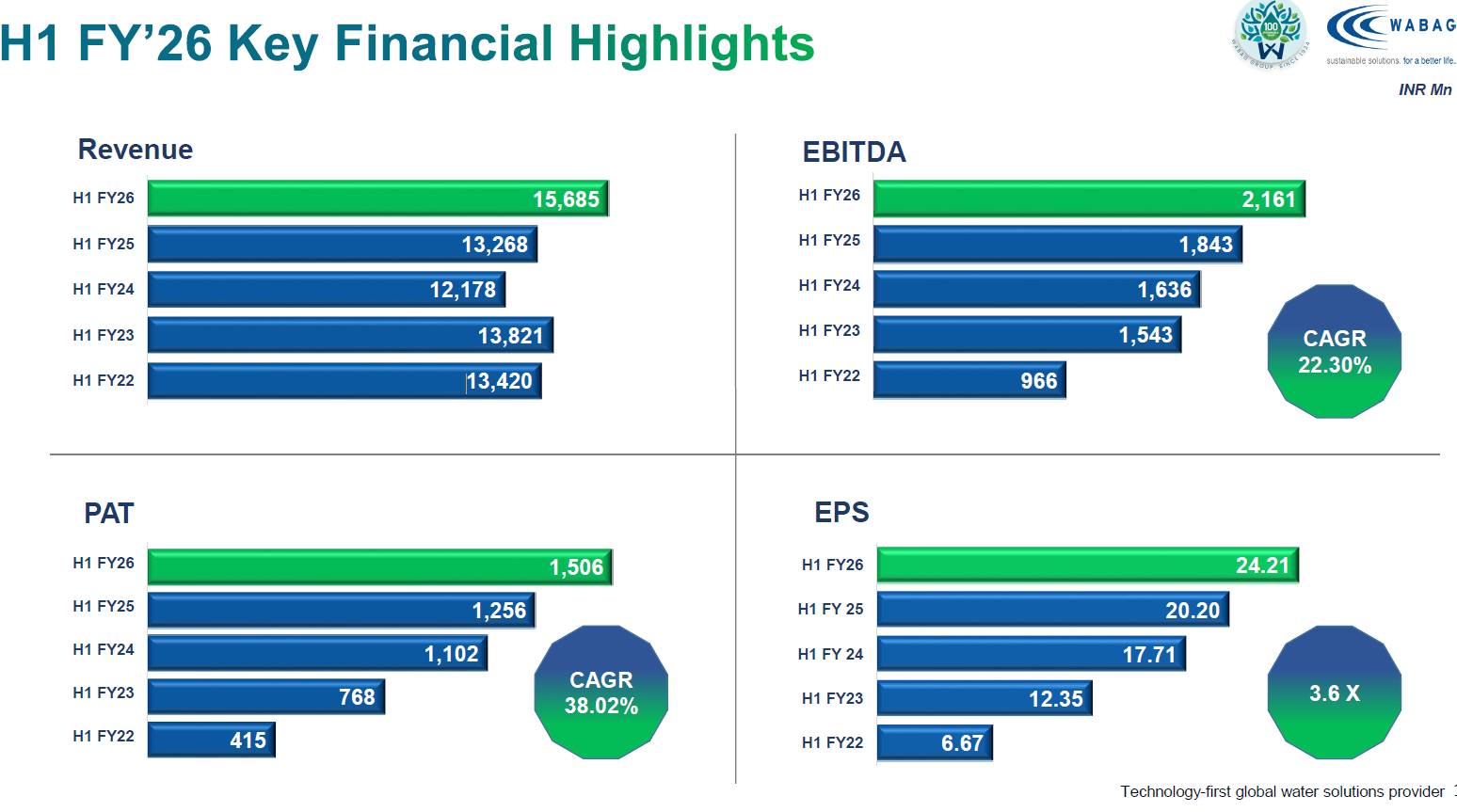

Strong Order Book Extends Visibility

Wabag reported strong growth in the first half of FY26. Revenue increased 18.2% year-on-year to ₹1,568.5 crore, driven by timely project completions. EBITDA (earnings before interest, taxes, depreciation, and amortization) also increased 17.2% to ₹216.1 crore, with margins at 13.8%. Net Profit surged by 19.9% to ₹150.6 crore, faster than revenue growth.

VA Tech Wabag Financials

As of September 2025, the consolidated order book stood at over ₹16,000 crore, a 17% increase from the beginning of the year. This provides revenue visibility for about five years based on FY25 revenue of ₹3,290 crore. Furthermore, Wabag reported being a preferred bidder (L1) for projects worth over ₹3,000 crore. This is expected to be converted in the coming months.

#2 ION Exchange: High Margins but Lower Visibility

Ion Exchange, a pioneer in water and wastewater treatment and environmental solutions, operates under the vision of “Refreshing the Planet.” It has a presence in 67 countries, and exports accounted for 35% of turnover in FY25. The company categorizes its business into three main segments, including Engineering, Chemicals, and Consumer Products.

Shift Toward High-Purity Water Solutions

The engineering segment is a major one, accounting for 61% of FY25 consolidated revenue. This segment provides integrated solutions for water, wastewater, and solid waste management, serving industrial and municipal needs. Offerings include seawater desalination, Recycle and ZLD plants, advanced membrane technologies, and operation and maintenance services.

The balance 29% comes from the chemical division and 10% from consumer products. The consumer business serves households and institutional customers (such as hotels, hospitals, railways, and defense) and offers solutions for safe drinking water and sustainable waste management under the flagship brand ZeroB.

Emerging Demand from New-Age Sectors

The company now sees specialized water-treatment needs in data centers, semiconductors, and solar as established customer segments. It also views these sectors as important emerging growth opportunities for its Engineering business.

The Engineering segment is focusing on improving competitiveness and margins by expanding its presence in technology-intensive areas such as ultra-pure and high-purity water. This type of ultra-purified water is essential for semiconductor manufacturing. It has also developed osmosis-sanitizable Reverse Osmosis membranes, which are relevant for Biopharma.

Additionally, ION has implemented predictive AI using IoT and Edge solutions to improve performance, reduce outages, and enhance customer experiences, providing value-added services for large, critical infrastructure such as data centers. It has already secured a few orders in ultra-pure and high-purity water projects within the solar and pharmaceutical segments.

High-Margin Projects Set to Ramp

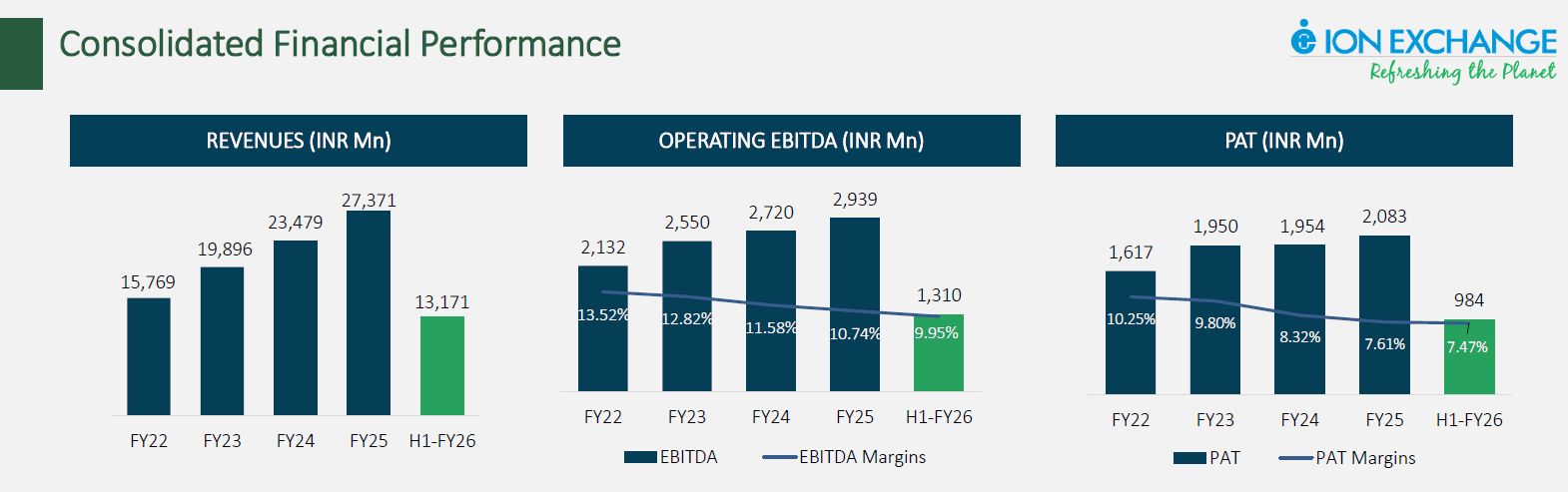

From a financial perspective, operating income increased 8.7% year-over-year to ₹1,317 crore in the first half of FY26. Operating EBITDA declined 1.2% to ₹120 crore, with a margin of 9.9%. Net profit increased 3.1% to ₹98.0 crore. Margins were affected by elevated infrastructure costs (planned investments) and the continuing effect of a legacy project. The company cites the ongoing year to be tough.

Financial Performance

Order Book Supports Near-Term Visibility

The current order book stood at ₹2,710 crore as of 30 September 2025, giving revenue visibility for only one year. Projects with better margins will start billing in the third and fourth quarters, enhancing overall profitability. Furthermore, new orders won in Q2 with strong profitability are expected to begin billing in the fourth quarter or early next year. That said, it is expected to report revenue growth of 9-10% in FY26.

Returns Tell One Story, Valuations Tell Another

From a return ratio perspective, ION Exchange leads in both return on capital employed (22.3%) and return on equity (19.7%), compared with VA Tech’s 19.7% and 14.6%, respectively. In terms of valuation, VA Tech’s recent re-rating has placed its valuation at a premium to both the industry and its 5-year median. ION Exchange’s valuation is at a discount to its median but at a premium to the industry.

Valuation Assessment (X)

| Company | P/E | 5-Year Median P/E | RoE (%) | RoCE (%) |

| VA Tech Wabag | 24.3 | 15.6 | 14.6 | 19.7 |

| ION Exchange | 24.6 | 27.2 | 19.7 | 22.3 |

| Industry Median | 16.7 | 18.7 | 23.8 | |

India’s push toward semiconductor self-reliance brings water to the forefront as a strategic resource. With fabs, solar plants, and data centers demanding ultra-pure, reliable water, VA Tech Wabag and ION Exchange are well-positioned. Their order books, sector alignment, and technological depth place them at the centre of this emerging opportunity.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.