If there is one thing experienced market participants agree on, it is that sector leadership changes when no one is paying attention. Breakouts are rarely dramatic events, and when a sector finally breaks out of a multi-year range, the markets typically reward it with an average rally period of nearly ~40 months.

This brings us to one of the most misunderstood and often ignored sectors of the last decade, PSU Banks.

For years, this pocket of the market was seen as sluggish, overburdened and undeserving of investor trust. A sector synonymous with underperformance had slowly become a space most investors avoided. But every market cycle has a turning point. And if the latest price action is any indication, PSU Banks seem to be writing a comeback script that few anticipated.

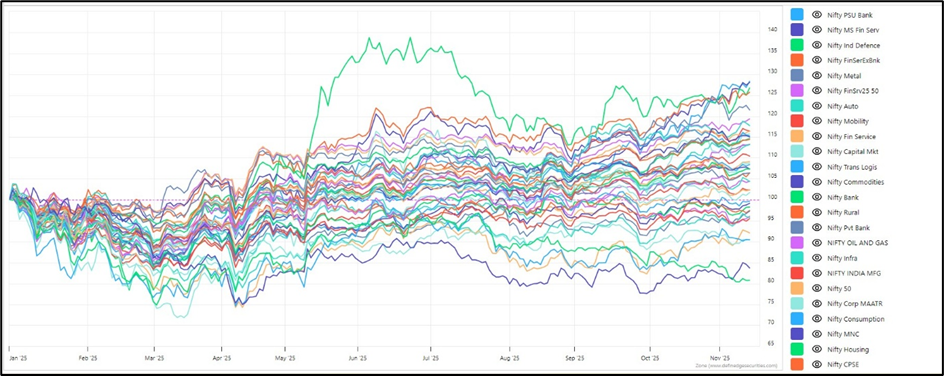

A Stunning 2025 so far: Sectoral performance tells the story

As we approach the end of Week 46 of 2025, the sectoral scoreboard reveals something extraordinary.

NSE Sector Performance for 2025

- Nifty PSU Bank sits right on top with a 28% gain

- Nifty MS Fin Serv and Nifty India Defence are second and third on the table

What makes this performance even more impressive is the continuity.

After delivering 14.48% returns in 2024, the PSU Bank Index has already doubled that strength in 2025. Trends like these are not accidental. They often hint at a deeper, structural shift that could unfold over the coming year.

With the indices demonstrating powerful follow-through, 2026 is shaping up to be another year in which PSU banks could take the lead.

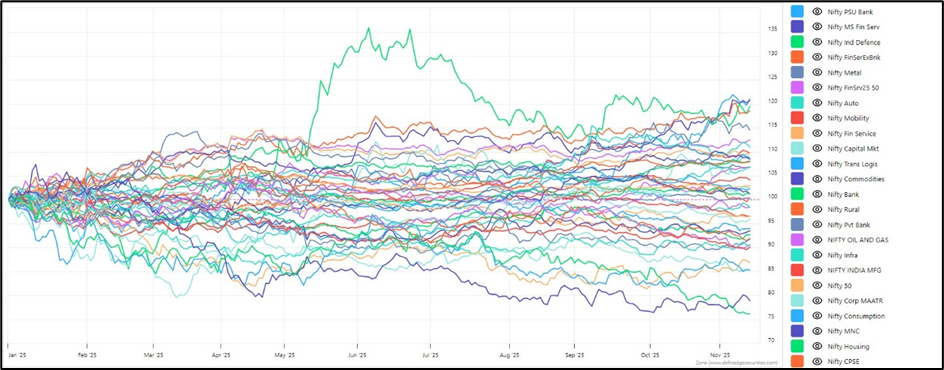

Why ratio charts make the case stronger?

Many retail traders rely purely on absolute performance. However, experienced analysts view the ratio chart through a different lens, which compares a sector’s strength against a broader benchmark, the Nifty 500.

In this case, we evaluate sector performance against the Nifty 500, a more representative basket than the Nifty 50 because sectoral indices themselves include a mix of large, mid, and even smaller constituents.

NSE Sector Ratio Performance

On this ratio chart, PSU Banks are not just outperforming, they are leading by a wide margin. This suggests that:

- The rally is broad-based

- The component stocks are carrying their weight

- The sector is displaying genuine relative strength, not just a tactical bounce

This brings us to the most important part of the analysis, the index chart that reveals how the story truly began.

Nifty PSU bank: A multi-year breakout that changes everything

Look at the monthly chart of Nifty PSU Bank, and the price action almost speaks like a storyteller. Between 2015 and 2022, an eight-year period of sideways movement, the index traded within a range with a ceiling of between 4,400 and 4,600. Very few sectors experience this kind of prolonged stagnation and then rebound with strength.

But in 2023, something changed.

The index sliced through the long-standing ceiling. From 4,600, the index sprinted to nearly 8,000 in just nine months. PSU Bank rallies are typically steady, rather than explosive. But this one told a different story, a story of structural re-rating.

Then came the market-wide profit booking phase. PSU Banks were not spared, correcting towards 5,530. Yet, what followed was a breakout indicating the bullish follow-up momentum. This kind of behaviour is typical of sectors entering long-term bullish phases.

And that’s why many analysts now believe that PSU Banks could quietly become the defining theme of 2026, even though very few would have predicted this a year ago.

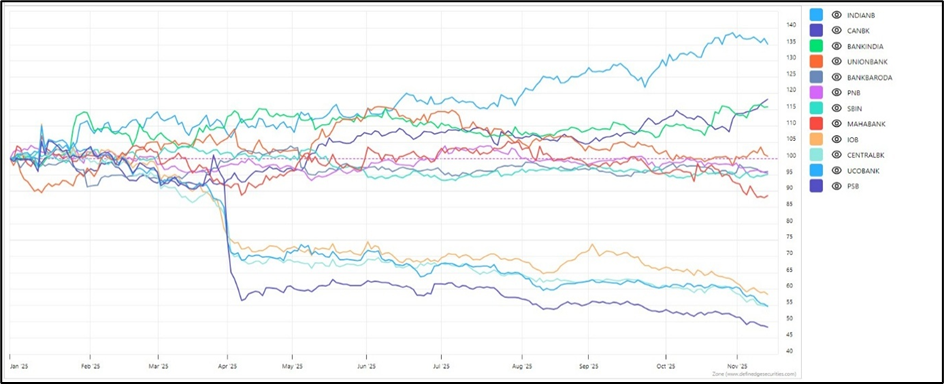

The leaders that are driving the trend

Using a top-down approach, we analysed the components of the PSU Bank Index. Three stocks that are outperforming their peers are:

- Indian Bank

If there is one PSU bank that has consistently surprised traders and investors with its strength, it is Indian Bank. Following its breakout in 2023, the stock has been a clear outperformer.

An outperformance on the follow-up bullish momentum is a sign of strength in the stock.

Today, Indian Bank is seen as one of the most balanced PSU opportunities, combining stability, strong price behaviour, and momentum.

Hence, Indian Bank is the first stock on the market watch from PSU sector for 2026.

- Canara Bank

Canara Bank has steadily transformed itself into one of the most consistent PSU performers. The stock boasts a smooth, confident price structure, underpinned by improving fundamentals and robust participation.

It now trades close to its (adjusted) all-time high near Rs. 165. If the stock can sustain above this zone, it could ignite a new leg of a long-term rally, reinforcing its leadership status within the PSU universe.

3. Bank of India

The Bank of India is showcasing one of its strongest long-term structures in over ten years. The stock has broken a decade-old falling trendline, a strong technical pattern. A series of higher highs and higher lows is the icing on the cake for the bulls.

The minor hurdle at its previous swing high of Rs. 158 will trigger a potential breakout and the stock will enter a fresh bullish territory.

Are These the Best Stocks for 2026?

As of today, the charts suggest that Bank of India, Canara Bank, and Indian Bank are potentially the strongest candidates for continued leadership within the PSU Bank Index. They have the technical strength, long-term structure, and improved sentiment alignment.

Of course, no rally is linear. And no sector remains in favour forever. But when a long-ignored sector breaks out of a multi-year range and follows it up with sustained performance, history shows the uptrend can last much longer than most expect.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia is an Independent Research Analyst and is engaged in offering research and recommendation services with SEBI RA Number – INH000022075. He has two decades of experience in India’s financial markets as a trader and technical analyst.

Disclosure: The writer and his dependents do not hold the stocks discussed here. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.