The year 2025 has offered little comfort to equity investors.

The market entered the year on a weak footing, hit by a sharp correction that was aggravated by geopolitical disruptions, including the brief India–Pakistan conflict and the imposition of a steep 50% tariff by the US.

That was followed by a prolonged phase of consolidation, during which broad-based returns remained elusive, and stock selection became critical.

The Nifty is up about 6% over the past year, largely supported by strength in Bank Nifty and some auto names. Beneath that, the picture weakens sharply.

But the broader Nifty 500 has delivered just 1.8%, and the Nifty Smallcap 250 is actually down 8%, underscoring the stress in the broader market.

Small-cap stocks, in particular, have borne the brunt of valuation mean reversion, with elevated valuation multiples correcting sharply.

But even in this difficult environment, a handful companies stood out, delivering multibagger returns.

Surprisingly, most of them have not only reported strong financial growth but also have embarked on an ambitious mid-term outlook.

Here is a closer look at five such stocks that defied the broader market narrative in 2025.

#1 Force Motors

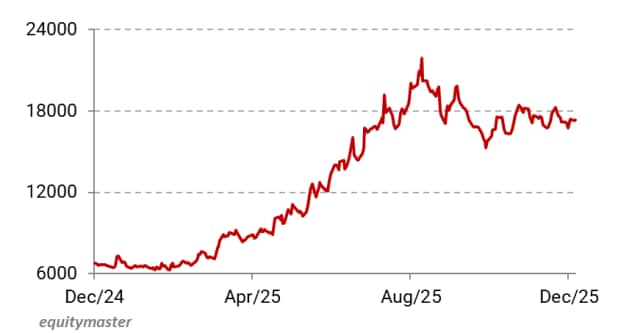

First on the list is Force Motors, which is up 155% over the last one year.

Force Motors is the market leader in the traveler vehicle segment, with approximately 65% market share.

Its vehicles are widely used for passenger transport, delivery vans, and school buses (where it is the fastest-growing manufacturer), and it’s also India’s most preferred ambulance platform.

It also supplies light strike vehicles built on the Force Gurkha platform to the Indian Armed Forces, as well as mission-specific solutions such as mobile medical units, police vans, and troop carriers.

Force also manufactures over 150,000 engines and 140,000 axles for every Mercedes-Benz car and SUV made in India. The company also manufactures Series 1600 engines for Rolls-Royce.

From a financial perspective, revenue increased by 7% year-on-year (YoY) to Rs 20.6 billion (bn), driven by broad-based sales growth. Profit after tax (PAT) increased by 148% to Rs 3.5 bn, while the margin increased by 300 basis points (bps) to 17%.

Force Motors Share Price Performance- 1 Year

Source: Equitymaster

Looking ahead, Force aims to rank among the top ten van manufacturers globally. This is underpinned by key strategic pillars focused on digital and modernisation.

To this end, Force launched a 2-year, Rs 1.5 bn initiative to create a tech-driven, future-ready enterprise. It is also leveraging AI, machine learning, and cloud-based SaaS platforms to improve its operations.

Force plans to focus on the Traveler segment, where it remains the market leader. In the premium segment, new platforms like Urbania are carving out a niche in shared urban passenger mobility in India while gradually expanding into global markets.

The company has also entered the EV segment with the e-Traveler Smart Citybus EV.

#2 Lumax Auto Tech

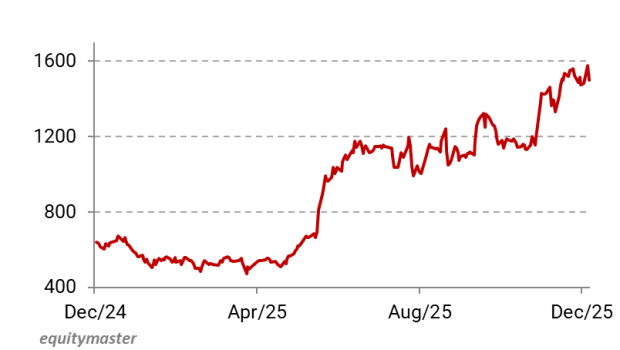

Second on the list is Lumax Auto Tech, which is up 137% over the last one year, driven by the company’s ambitious mid-term outlook.

Lumax is part of the DK Jain Group and focuses on automotive components and solutions.

The company manufactures an EV-agnostic product portfolio for passenger vehicles (PVs), two and three-wheelers (2/3Ws), and commercial vehicles (CVs).

The main product categories include advanced plastics (cockpit and consoles, door panels), mechatronics (power window switches, antennas), structures and control systems (smart actuators, gear shifters), and alternative fuels.

In the revenue mix (H1 FY26), advanced plastics accounted for 52% of revenue, followed by structures and control systems (18%), aftermarket (10%), mechatronics (6%), and alternate fuels (8%).

Additionally, PVs are the largest segment, contributing 55% to the revenue, followed by 2/3W (24%), aftermarket (10%), and CVs (9%).

M&M is the largest customer, contributing 29% to the revenue, followed by Bajaj (13%), Maruti Suzuki India (8%), Hyundai Motors (6%), and Tata (6%).

From a financial perspective, revenue increased 37% year-on-year (YoY) to Rs 11.6 bn in Q2 FY26. EBITDA grew by 45% to Rs 1.7 bn, and the margin expanded by 70 basis points to 14.7%. Profit after tax (PAT) increased by 50% to Rs 776 million (m).

Lumax Auto Tech Share Price – 1 Year

Source: Equitymaster

Looking ahead, the company has outlined an ambitious mid-term plan for FY26-31 under a strategic initiative titled BRIDGE (Bold Roadmap Integrating Diverse Growth Engines), aimed at driving the next phase of growth through multiple business levers.

Lumax’s goal is to transform from a Tier-1 to a Tier-0.5 system integrator. To achieve this, the company has set key financial and strategic targets outlined in its ‘Northstar: 20.20.20.20’ vision for this period.

It plans to increase revenue by a minimum of 20% CAGR to reach Rs 110 bn by FY31, from Rs 36.4 bn in FY25. Clean mobility will be the main driver, with its share in revenue expected to increase from 6% to 20% in FY31.

To achieve this, the recent acquisition of a 60% stake in Greenfuel Energy is expected to be a key growth driver over the next 3-5 years. This expansion plan is expected to translate into operating leverage, with EBITDA projected to double to Rs 10 bn by FY28 from Rs 5 bn.

Alongside this, margins are expected to expand to 16% from 14%, with a longer-term target of 20%. Return on capital employed is also expected to improve to 20% from 18%.

The company plans to achieve this goal through product diversification, deeper engagement with automobile companies, increased content per vehicle, and acquisitions.

The company is setting up a mega mechatronics plant in Manesar, consolidating four JVs (Lumax Yokowo, Lumax Alps Alpine, Lumax Ituran, and Lumax FAE) starting April 2026.

It’s further strengthening its position by entering the software-defined mobility and body control module markets, while expanding into higher-value vehicle electronics to deepen OEM integration.

#3 Apollo Micro System

Third on the list is Apollo Micro Systems, which is up 134% over the last one year.

It’s an Indian technology provider specialising in mission-critical solutions for the defence and aerospace sectors. This company maintains the highest level of private sector participation in DRDO’s indigenous missile program. Apollo manufactures naval mines, rockets, ammunition, aerial systems, and fuses.

From a financial perspective, revenue increased 40% YoY to Rs 2.3 bn in Q2 FY26, driven by execution of the order book. With operating leverage, margins expanded by 630 bps to 26.3%, leading to 91% increase in PAT to Rs 300 m.

Apollo Micro Systems Share Price – 1 Year

Source: Equitymaster

Looking ahead, the company expects a 45-50% CAGR in revenue over FY26 and FY27. This is expected to be driven by an Rs 7.8 bn order book, which provides revenue visibility of about 1.5 years.

It’s moving up the value chain from a system and subsystem provider to a tier-1 manufacturer. It has also acquired IDL Explosives, positioning it closer to becoming a fully integrated Tier-1 defence OEM.

This acquisition provides both backward and forward integration for the company, providing end-to-end solutions in the ammunition and weapons value chain. IDL is expected to post a profit by Q2 of FY27.

The management expects to bag orders for indigenous defence programs, explosives, propellants, underwater mines, anti-submarine warfare rockets, and short and medium-range rockets.

The company is also expanding its international footprint via exports. It’s also engaged in due diligence processes with companies from the Middle East and Europe for mature naval technologies.

#4 Ather Energy

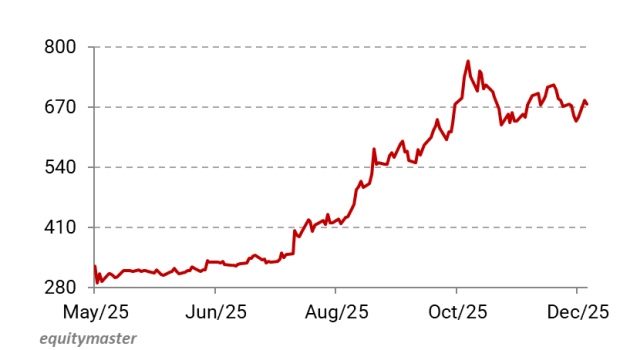

Fourth on the list is Ather Energy, which is up 124% from its listing on 6 May.

Ather Energy is an asset-light pure-play E2W manufacturer. It also offers an ancillary product ecosystem.

Ather maintains control over 80% of key hardware and 100% of its software stack. In Q2 FY26, Ather had a 17% market share and is a market leader in South India (25%) and Gujarat (23.8%).

The company sources 99% of E2W components domestically. Ather’s Hosur factory in Tamil Nadu has an annual installed capacity of 420,000 E2Ws and 379,800 battery packs.

Ather operates a three-tier retail model, comprising 524 Experience Centers. It also has ExpressCare services for quick maintenance and is upgrading its service experience with Ather Gold Service Centres.

From a financial perspective, revenue increased by 64% to Rs 15.4 bn in H1 FY26, as volumes grew 78% to 111,673 units. About 12% of its revenue came from the non-vehicle (accessories) segment.

The EBITDA margin improved from negative 25% to negative 12%. As a result, the net loss declined to Rs 3.3 bn, from Rs 3.8 bn in H1 FY25.

Ather Energy Share Price – 8 Months

Source: Equitymaster

Going ahead, the strong Q2 FY26 performance with EBITDA losses narrowing, bodes well for Ather.

The management expects margins to improve as higher accessory attach rates and service revenues from maturing stores kick in.

Ather is also launching its EL platform next year. This is designed for scalability and a better cost structure compared to the existing 450 and Rizta platforms.

The company also aims to reach about 700 ECs by the end of FY26, which will help drive volume growth.

For Ather, these distribution-led expansions, especially beyond its core South Indian markets, mark a critical next phase of growth. Ather is expanding into North, West, and Central India through a wider dealer network to tap into a much larger addressable market.

It also aims to expand its charging network to enable intercity rides.

#5 Axiscades Technologies

Fifth on the list is Axiscades Technologies, which is up 122% over the last one year

Axiscades’ main domains are Aerospace, Defense, and ESAI (Electronics, Semiconductors, Artificial Intelligence). These core domains contributed 79% of the company’s total revenue in Q2 FY26.

Defence is the largest vertical, accounting for 38% of revenue, followed by Aerospace (30%), HE & Auto (18%), ESAI (11%), and Energy (4%).

Within defence, the company designs and manufactures critical systems, including radar, electronic warfare, airborne, and naval systems. Its aerospace vertical serves global OEMs and is involved in both design engineering and manufacturing.

From a financial perspective, revenue increased 13% YoY to Rs 3.0 bn in Q2 FY26, driven by execution of the order book. Margins expanded by 310 bps to 15.7%, leading to an 89% surge in PAT to Rs 230 m.

Axiscades Share Price – 1 Year

Source: Equitymaster

Looking ahead, the overall strategic goal is guided by its Power930 initiative, which sets an ambitious revenue target of Rs 90 bn by FY30.

To achieve this, the company aims to grow core over 40% YoY in FY26 and FY27, with acceleration to over 70% from FY28 through FY30.

For this, it’s shifting from a service-centric to a product-driven business model. This shift is evident in the revenue mix, where product revenues increased from 32% to 38% in H1 FY26 compared to H1 FY25.

The strategy will be supported by new facilities, which are expected to be operational by 2027.

A largely completed, partially operational facility is focused on electronic semiconductors, AI, and test systems, with dedicated PCB assembly and testing lines. It’s also building a plant that will be one of India’s largest private-sector centers for radar, strategic electronics, and aerospace supply chains.

In addition, land has been allotted in Hyderabad for a defence manufacturing facility focused on missiles and missile subsystems, including rocket motors, seekers, and onboard electronics. This is targeted for completion by March 2027.

The company is also forming strategic alliances with global leaders such as Indra, CILAS, EBC, Aldoria, and EEA to enhance its capabilities and revenue growth.

Conclusion

The performance of these five stocks underscores a clear takeaway from 2025. Even in a subdued market, fundamentals continue to matter.

Strong execution, improved earnings visibility, and credible long-term strategies enabled these companies to stand out despite weak broader indices.

Instead of relying on hype, investors should carefully analyse the company’s fundamentals, including financial performance, corporate governance practices, and growth strategies.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary