Every infrastructure cycle follows a familiar pattern. The market initially chases the biggest names. Then it moves to the evident receivers.

And only much later, often after the returns have been made, does it discover the smaller players where the return potential is much greater.

The cables and wires sector in India is past the first stage now.

Railways, power transmission, green energy, EV charging, home electrification, and industrial capital expenditure are all generating demand for cables and wires.

Large names like Polycab and KEI have already been recognised, and their valuations reflect that. However, past trends suggest that the largest returns in infrastructure cycles seldom come from the leaders.

They often come from companies operating one level below —those with smaller balance sheets, improving utilisation levels, and margins that change shape when volumes grow.

We’ve zeroed in on three such cable makers for you. They are not turnaround stories. They are not momentum plays. They are operating-leverage-driven-driven opportunities.

The Cable Prospect: Most Investors Oversimplify

Cables are often treated as a commodity business. As soon as copper prices increase, the margins get pinched. Demand slows; earnings fall. That analysis ignores what truly drives success in this segment.

Cable companies make money when capacity utilisation expands, fixed costs are absorbed, and the distribution or execution grows faster than the overheads.

In a high capex situation, the volume matters far more than pricing.

That is where smaller cable manufacturers become interesting. When demand speeds up, their profits don’t rise linearly; they undergo a step change.

Dynamic Cables: The Operating Leverage Tale Hiding in Plain Sight

Dynamic Cables hardly ever features in typical market conversations, but its standing is direct and prevailing. The company manufactures low and high-tension power cables used in power transmission, substations, renewable energy projects, railways, and engineering installations.

These are not optional products. When projects are executed, cables move with them.

Dynamic Cables had a revenue of ~₹1,025 crore in FY25, up ~33.5% YoY from ~₹768 crore in FY24. Net profit (excluding exceptional items) rose from ~₹31 crore in FY22 to ~₹65 crore in FY25, a jump of ~110% YoY, indicating an improving operational control.

The second quarter of FY26 saw a revenue of ~₹282 crores, rising 20.3% YoY. The net profit excluding exceptional items was ~₹20 crore, moving up ~42% YoY.

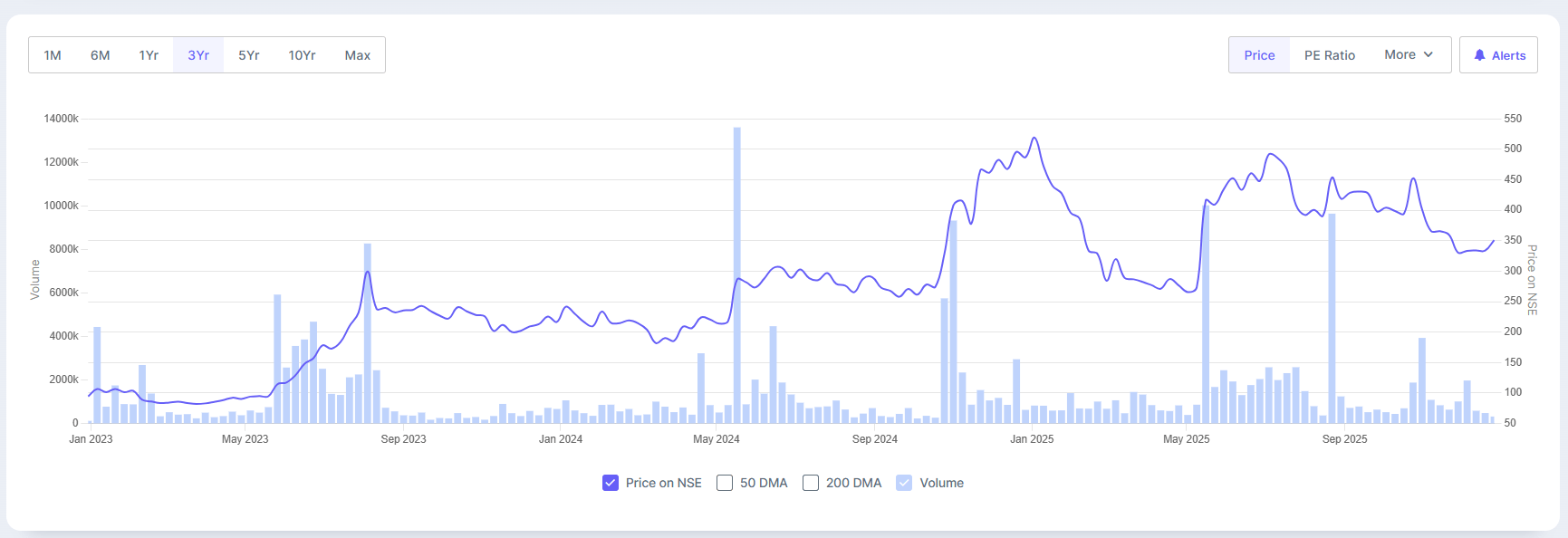

The profit grew at a compounded rate of 28% over the last three years, while the return on equity was 20%. The stock price grew at a CAGR of 61% during the same period.

Dynamic Cables 3-Year Share Price Trend

Moreover, debt has reduced further, with debt-to-equity standing at 0.19, allowing earnings growth to translate significantly into profits.

Why is it unnoticed

Dynamic neither has a retail brand nor a consumer narrative. Its gains were unstable in earlier cycles, which still colours market perception.

So, it continues to trade at valuation multiples below its peers like Polycab, RR Kable, and KEI Industries in the cable-electricals universe.

However, its P/E multiple of ~22x is slightly higher than the sector median of ~21x. Its enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortisation) at ~14x is also marginally higher than the sector median of ~13x.

The “Utilisation” Multibagger Trigger

Dynamic Cables is currently using around 85%of its manufacturing capacity, according to management disclosures.

If power transmission, renewable clearing, and grid extension persist at the current pace, Dynamic’s utilisation-led earnings growth could continue. When fixed costs are already covered, even modest volume growth can increase profits, which is the typical multibagger setup.

Universal Cables: The Project Expert Riding the Capex Drive

Universal Cables operates at the other end of the cable spectrum. Its strong suit lies in high-specification project cables, extra high voltage cables, mining applications, railway electrification, and industrial systems.

Financed by the MP Birla Group, the company is truly rooted in India’s organized capex pipeline.

As per Screener.in, Universal Cables declared a revenue of ~₹2,407 crore in FY25, up ~19.2% YoY from ~₹2,020 crore in FY24. Profitability depended on sector cycles, so the net profit (excluding exceptional items) was ~₹90 crore in FY25, low compared to the ~₹108 crore in the previous year. The profits fell due to losses and low margins during the slowdown.

The second quarter of FY26 saw a revenue of ~₹814 crores, rising 27.6% YoY. The reported net profit excluding exceptional items was ~₹48 crore, moving up ~161% YoY.

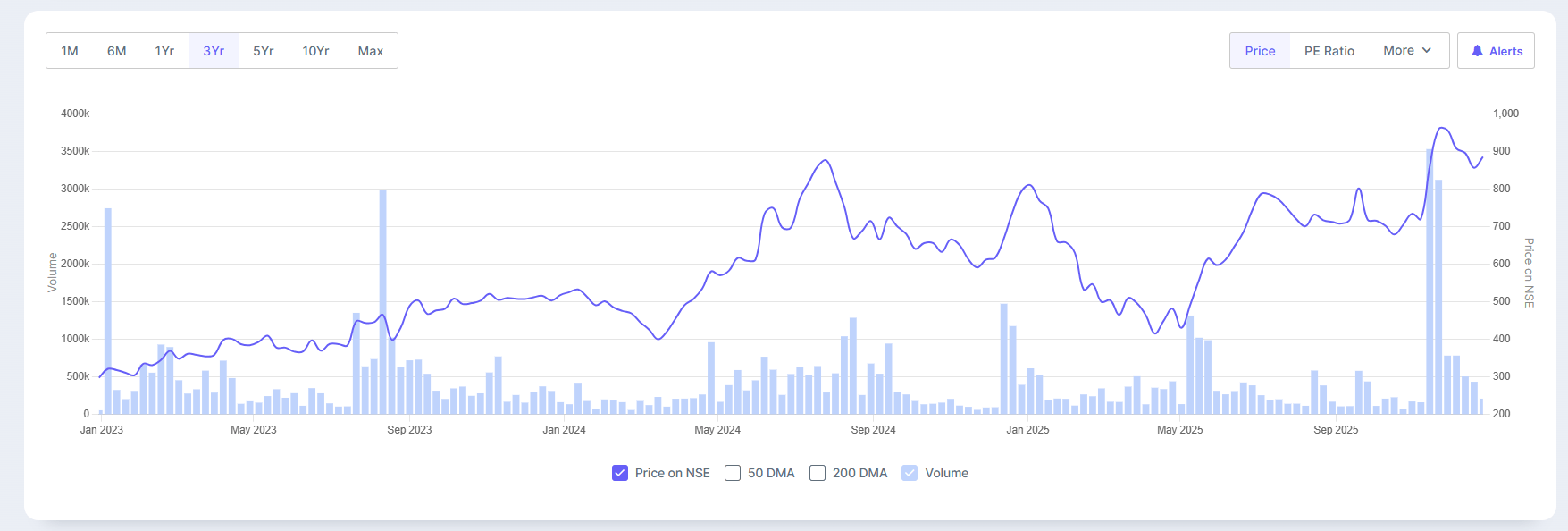

The profit grew at a compounded rate of 6% over the last three years, and the ROE was 7%. During the same period, the stock price grew at a CAGR of 50%.

Universal Cables 3-Year Share Price Trend

Moreover, with the debt-to-equity standing at 0.54, it is still manageable and can be reduced with more effort.

Why is it unnoticed

Universal does not contribute to the ongoing retail electrification. It does not sell wires for homes or consumer electronics. That keeps it out of widespread cable stories, even though project-led demand is more robust than festive demand.

However, its P/E multiple of ~21x is at par with the median of ~21x. Its EV/EBITDA (earnings before interest, taxes, depreciation, and amortisation) at ~12.5x is the same as the sector median.

Riding the Cycle Normalisation

This is all about cycle-normalisation and not a glamour play. Universal Cables has large manufacturing facilities for EHV power cables, railway electrification, and industrial applications, where capacity utilisation is still below peak levels. This makes the company’s earnings highly sensitive to execution.

If railway electrification, mining capex, and grid investments continue to grow, the returns can normalise meaningfully from depressed bases. Markets tend to re-rate such businesses late, but dramatically.

Paramount Communications: The Small-Cap Capex Lever Few Are Watching

Paramount Communications is arguably the most “hidden” of the three.

The company focuses on railway signalling cables, power cables, defence applications, and exports, with restricted exposure to retail branding wars.

Screener.in data shows FY25 had a revenue of ~₹1,574 crore, compared to the ~₹1,068 crore in FY24, rising ~47.4% YoY. Net profit (excl. exceptional items) stood at ~₹86 crorein FY25, a sharp improvement from its low single-digit profits before in FY22.

The second quarter of FY26 saw a revenue of ~₹428 crores, rising 20.3% YoY. The net profit excluding exceptional items posted was ~₹13 crore, falling sharply by ~35% YoY. Severe margin compression and issues with operations led to the fall in profitability.

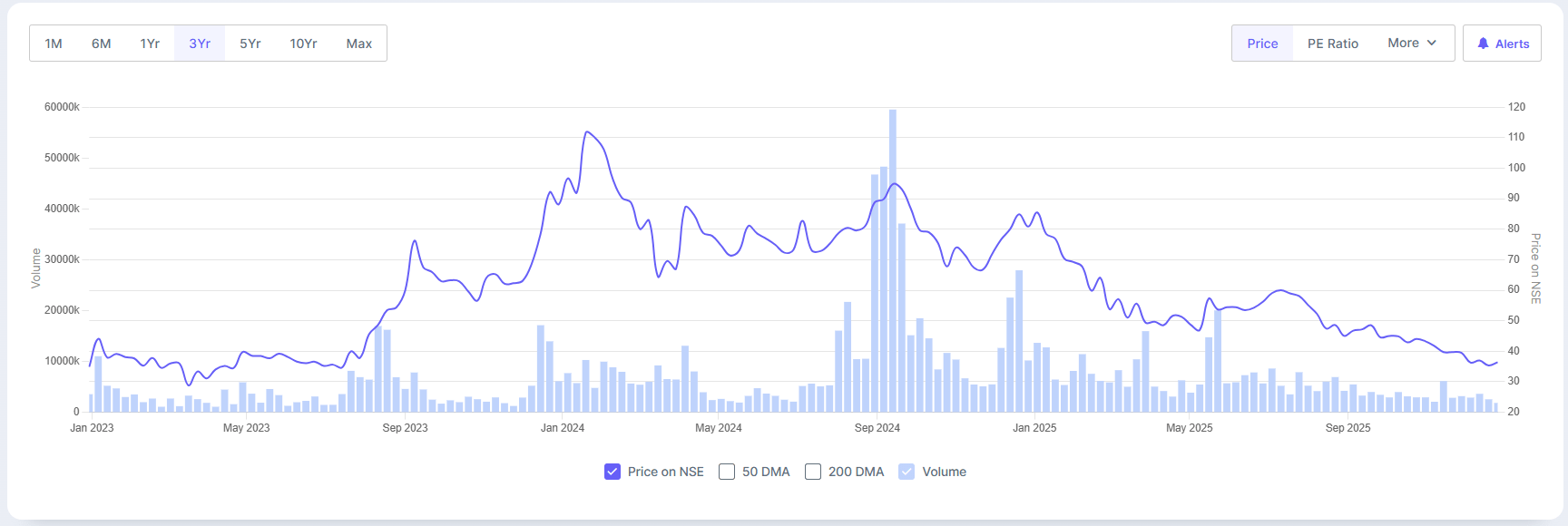

However, the profit grew at a compounded rate of 119% over the last three years, and the average ROE was 16%. During the same period, the stock price grew at a CAGR of 9%.

Paramount Communications 3-Year Share Price Trend

Debt is manageable, with debt-to-equity around 0.14; it can be controlled in a rising demand environment.

Why is it unnoticed

Paramount is small, project-focused, and irregular in its past performances. It lacks brand recall and has seen stress in its balance sheet in earlier cycles. That heritage continues to restrict valuation.

Its P/E multiple of ~15.4x is much lower than the median of ~21x. Its EV/EBITDA (earnings before interest, taxes, depreciation, and amortisation) at ~9.3x is also below the sector median of ~13x.

Low Base, High Velocity Growth

Paramount Communications has built manufacturing capacity across power, railway, and defence cables that is currently under-utilised relative to installed capacity.

If order execution stabilises and capex demand sustains, Paramount’s earnings can scale excessively from a low base.

It is the kind of stock where earnings increase matters more than valuation expansion initially, which is how most multibaggers begin.

The Common Thread

These three cable companies look different at first glance. One is power-focused. Another is project-heavy. And, the last one is small and hidden.

But they share a fundamental connection: they sit where volume growth can transform the shape of their earnings. They are not wagering on price surges. They are arranged for utilisation, scale, and operating leverage.

That is where multibaggers usually emerge, not from excellence, but from advancement.

Risks, and Why They Cannot Be Ignored

Cable stocks continue to be cyclical. Copper and aluminium price instability can reduce margins temporarily. Smaller players face working-capital pressure as volumes scale faster than receivables.

Execution risk is real. Delays in project implementation or cost overruns can quickly disrupt earnings visibility.

And infrastructure cycles do not run forever; when capex slows, corrections can be sharp. Their multibagger potential can magnify upside and downside.

India’s cable demand story is no longer a secret. What remains undervalued is where the operating leverage still lies.

Polycab and KEI may offer stability. But history hints that massive returns often come from companies just below that tier, where earnings are progressing, balance sheets are healing, and expectations remain small.

Dynamic Cables, Universal Cables, and Paramount Communications are not assured successes. They are potentials.

For investors willing to look beyond the obvious leaders, this is where the next chapter of the cable story could silently begin. Maybe it’s worth adding them to your watchlist.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.