The central government’s FY27 Union Budget is reportedly looking to significantly increase safety-related expenditure for Indian Railways. Media reports, which the Financial Express could not independently verify, suggest that spending on rail safety could exceed ₹1.3 lakh crore.

This would be the largest allocation ever for railway safety initiatives. If finalized, this would represent about half of Indian Railways’ total capital expenditure for FY27. At the same time, the overall railway capex is projected to rise 10% to around ₹2.75 lakh crore from ₹2.52 lakh crore this year. The increase isn’t just strategic; it’s a response to high-profile derailments.

This increase in budget is expected to benefit companies that manufacture the Kavach system, especially given its role in preventing train accidents. Kavach is also a key focus area of the government under India’s Mission Raftar initiative.

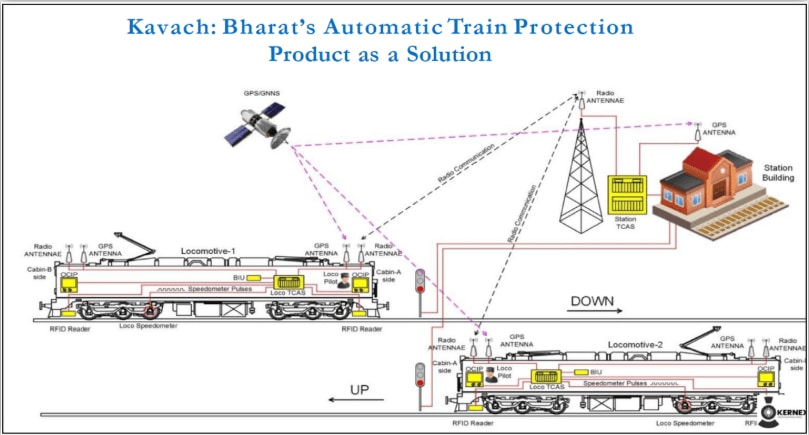

It is an indigenously manufactured, designed, and patented product, jointly owned by Indian Railways and three Original Equipment Manufacturers (OEMs). The system automatically applies brakes when crossing a signal at danger or exceeding the speed limit, helping prevent accidents.

Inside the Tech: How Kavach Prevents Collisions

Indian Railways plans to implement the Kavach project in a phased manner across over 40,000 kilometers of its total railway network of about 85,000 kilometers. Currently, the focus is on setting this up in high-density, high-speed corridors, which are expected to be completed by 2030-32. Concorde Control Systems estimates the market potential of around ₹50,000 crore.

That said, the renewed focus on railway safety, coupled with an enhanced budget, could benefit a handful of companies. Let’s take a look at three of them…

#1 HBL Engineering: Scaling the Kavach ‘Flood

Kavach is HBL Engineering’s flagship indigenous train collision avoidance system, developed for higher safety on the Indian Railways network. The development of Kavach has been a long-term investment for HBL, spanning 20 years from conception to profitability. It showed the concept on tracks in October 2012 under specification v3.1.

The earlier specification v3.2 protected trains up to 110 kmph, while v4.0 offered protection for trains running at 160 kmph. HBL pioneered the v4.0 showcase in 2024 before becoming the first to secure certification in May 2025. HBL has a competitive moat, as only two (including HBL) were qualified for v4.0 as of late 2025.

The v4.0 Transition: Why HBL’s Order Book is ‘Flooded’ After a Dry FY25

The transition from version 3.2 to 4.0 caused a temporary slowdown in orders during FY25. However, as of Q2 FY26, the management described the situation as a “flood” of orders. HBL has orders worth about ₹4,000 crore. This includes 6,980 km of track, 2,425 locomotives, 758 stations, and 460 level crossing gates.

The ₹4,000 Crore Visibility

Kavach is currently a primary contributor to HBL’s revenue and profits. The company expects Kavach sales to remain steady at about ₹1,300-1,500 crores per year in FY26, FY27, and FY28. HBL states that covering the entire railway network with Kavach will take longer than five years. Thus, with the higher budget allocation, HBL is likely to be a key beneficiary.

The company expects Kavach sales to eventually dip post-FY28. Thus, HBL plans to grow its Train Management Systems (TMS) and Centralised Train Control businesses to compensate for the revenue loss. HBL has already installed 4-6 TMS systems. Although the contract value is lower than Kavach’s, the company expects to receive significant recurring opportunities.

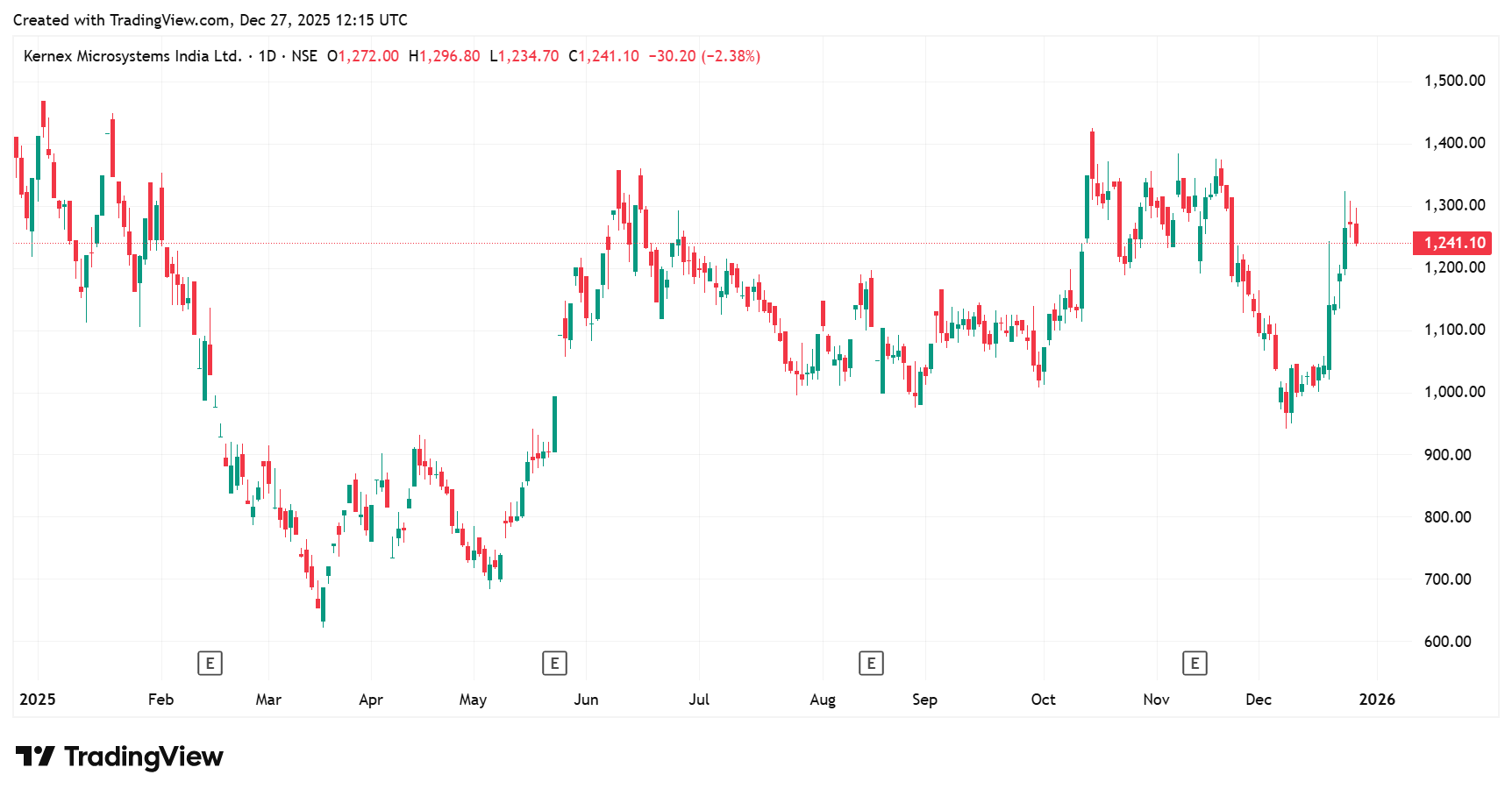

#2 Kernex Microsystems (India): The Pure-Play Pioneer in Railway Safety

Kernex is an electronic manufacturing services provider, specialising in the design, development, and integration of railway safety systems. It offers full turnkey solutions, including embedded software and hardware development, and mechanical assembly. It also installs towers and relay rooms for railway infrastructure.

Kernex’s most significant competitive advantage is its involvement in the Kavach programme. Kavach was developed in collaboration with Kernex and two other players (Medha Servo Drives and HBL Engineering). These three companies are the only OEMs approved to design and deploy this technology.

The segment is protected by high barriers to entry due to complex technical requirements and the need for Safety Integrity Level 4 standards, the highest safety level for such systems. In October 2025, Kernex received approval for Kavach v4.0. This is expected to lead to swifter project execution and accelerated revenue growth in the near future.

Unleashing a ₹2,500 Crore Backlog

As of 30 September 2025, the company’s order book stood at ₹2,563 crore, providing revenue visibility for more than a decade. This includes a significant order worth ₹1,730 crore for the supply of 2,500 TCAS units to Chittaranjan Locomotive Works. The company also bid for an order worth ₹3,020 crore for a distance of 9,505 kilometers.

Beyond Kavach, Kernex is also developing MIE 3.0 cards based on Microchip/Xilinx FPGAs. This will serve as the foundational components for Moving Blocks and Communications-Based Train Control systems. The prototype platform is expected by Q3FY26. Kernex is also developing Network Monitoring Systems and Pulse Generators.

The Monopsony Trap

However, a risk remains because Kernex’s revenue is entirely dependent on Indian Railways. This dependence exposes it to the risks of tender-based procurement, in which contracts are often awarded to the lowest bidder.

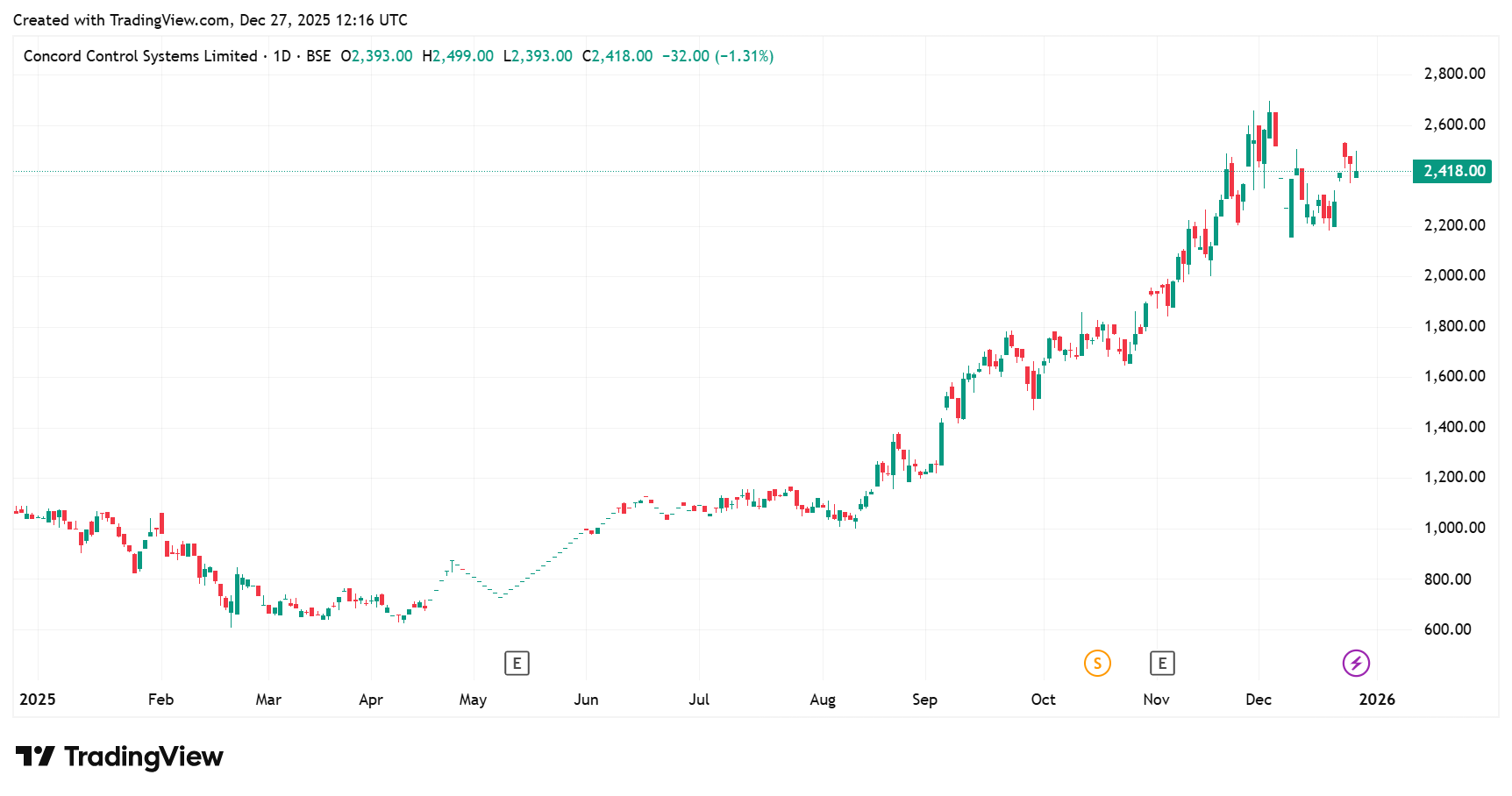

#3 Concord Control Systems: The Low-Cost Challenger

Concord Control recently received technical prototype clearance for Kavach v4.0 equipment. This validation confirms the system’s design, safety, and interoperability, allowing the company to move from development to field trials and commercial deployment. Concord operates in the Kavach primarily through its associate company, Progota India, in which it holds a 46.5% stake.

Concord received technical prototype clearance for Kavach 4.0 wayside equipment. Post this, Progota India is now officially recognized as a developmental vendor for all upcoming Kavach v4.0 tenders. As a developmental vendor, the company is eligible to bid for up to 20% of tender quantities. The system has moved to mainstream deployment.

The High-Margin Challenger in the Kavach Race

Concord is positioned as one of the lowest-cost SIL-4 systems globally, with trackside installation costing about ₹50 lakhs per kilometer and loco-fitment at roughly ₹70 lakhs per unit. Also, Kavach is expected to deliver high EBITDA margins of 25% to 30%. Kavach also creates a long-term revenue stream through maintenance and upgrades for up to 15 years.

EBITDA stands for Earnings before interest, tax, depreciation, and amortisation.

Concord secured its first order worth ₹19.5 crore for Kavach 4.0 field trials. This trial covers a 53-kilometer section in the South Central Railway zone (Kacheguda to Mahbubnagar). This project involves installing and commissioning 5 stations, 6 Remote Interface Units, and 10 local Kavach systems.

The company expects to receive full certification after completing 5,000 loco-kilometers of successful operation. Management estimates that with three trains passing the section daily, these trials could be completed in roughly 31 days of uninterrupted running.

The ₹450 crore Order Book

As of 26 December 2025, Concord’s consolidated order book exceeded ₹450 crore. This order book provides revenue visibility for more than four years, based on the FY25 revenue of ₹124 crore. Management expects this order book to be executed over the next 18-24 months. It expects further pickup in the order book, driven by the Kavach v4.0 approval.

Are Valuations Pricing in a Railway Safety Premium?

Though Kavach offers a significant opportunity over the next 6-7 years, valuations have also come down of late. Thanks to better profitability, these three companies show strong return ratios, including both return on capital employed and return on equity.

Valuation-wise, HBL is trading at a price-to-earnings (P/E) multiple of 37.6x, which is below its 3-year median but above the industry valuation. Similarly, Kernex is trading at 38.8x, which is in line with both its own median and the industry multiple. However, Concord is trading at more than double its median and the industry multiple.

Kavach Peers: Decoding the Multiples (X)

| Company | P/E | 3-Year Median | Industry Median P/E | RoE (%) | RoCE (%) |

| HBL | 37.6 | 51.7 | 29.5 | 20.6 | 27.3 |

| Kernex | 38.8 | 39.3 | 35.1 | 38.0 | 23.8 |

| Concord | 80.5 | 47.9 | 33.0 | 27.4 | 36.8 |

While valuations across Kavach-linked stocks have corrected sharply, the upcoming opportunity remains significant. It is hoped that this budget will give the order book new momentum, which has slowed recently. Still, since this is a government-to-business opportunity, order-book lumpiness and technology upgradation could be key risks to watch out for.

HBL Power Systems appears best placed to benefit from scale and diversification, while Kernex offers a more direct but concentrated play on the Kavach theme. Concord, though smaller, could surprise as it transitions from a product supplier to a systems partner for Indian Railways.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data were unavailable have we used an alternate, widely accepted, and widely used source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.