India’s good old couple, who are an inspiration to many, Sudha & Narayana Murthy need no introduction. The founder of Infosys and his wife’s life story is well known. Despite being amongst some of the richest people in India, the down to earth life and demeanour of the Murthy duo has taught a lesson or two to all generations.

Catamarans Ventures, the Murthy’s professionally managed investment vehicle, holds just two stocks, and both of them are trading at a discount of over 40%. But the fund managers at Catamaran still trust these companies despite the decline. Recently, the fund managers had sold off their position in SJS Enterprises as per the exchange filings for the quarter ending June 2025. The fund now holds less than 1% of the company, which means they have partially or completely sold off their stake.

Which makes us wonder, are these golden buying opportunities to get in at cheap prices, or traps waiting for someone to get in? Let us try and find out.

Gokaldas Exports Ltd – Turning Rs 1 Lac into Over Rs 12 Lacs

Incorporated in 2004, Gokaldas Exports Limited is engaged in the business of design, manufacture, and sale of a wide range of textiles including garments for men, women, and children and caters to the needs of several leading international fashion brands and retailers.

With a market cap of Rs 5,318 cr, Gokaldas Exports Ltd is a premier apparel manufacturer in India, which specializes in designing, manufacturing, and exporting apparel products to 50+ countries. The company serves some of the world’s most prestigious fashion brands.

Murthy’s Catamarans Ventures has held a stake in the company since September 2023, which as of the end of June 2025 is at 1.6% worth Rs 86 cr.

The sales for Gokaldas Exports grew from Rs 1,371 cr in FY20 to Rs 3,864 cr in FY25, logging in a compound growth of 23% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) went from Rs 86 cr to Rs 371 cr in the same period, marking a compound growth of a 34%.

The net profits also recorded a compounded growth of 40% from Rs 30 cr in FY20 to Rs 159 cr in FY25.

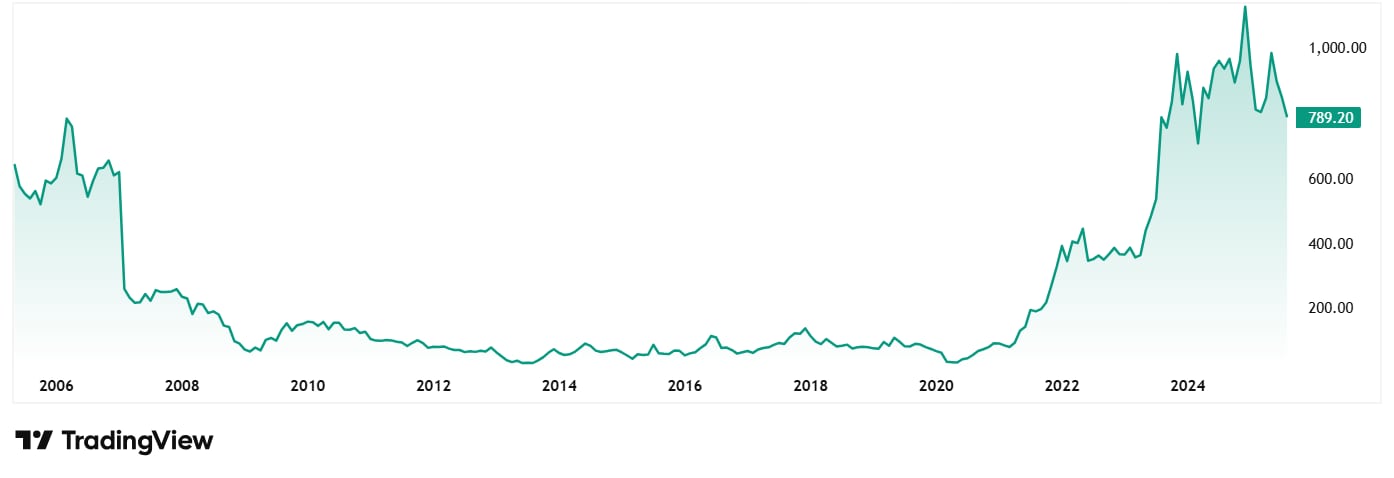

The share price of Gokaldas Exports Ltd was around Rs 59 in August 2020 as of closing on 18th August 2025 it was Rs 726, which is a jump of 1,130% in just 5 years. Rs 1 lac invested in the stock 5 years ago would have been Rs 12.3 Lacs today.

Gokaldas Exports Ltd Price Chart

At the current price of Rs 787, the stock is trading at a discount of almost 38% from its all-time high price of Rs 1,262.

The company’s share is trading at a PE of 31x, while the industry median is 30x.

Apart from the Murthy’s, FIIs (Foreign Institutional Investors) like Goldman Sachs India Equity Fund, Vanguard Total International Stock Index fund, Fidelity’s India Focus Fund amongst other hold a total of 25% stake in the company.

DII’s (Domestic Institutional Investors) SBI Mutual Funds, Nippon India, HSBC Funds, Aditya Birla Sun Life Insurance, Tata Mutual Funds etc together make the DII holding in the stock 37%.

As per the recent investor presentation from August 2025, Gokaldas Exports is navigating a highly volatile and uncertain global trade environment with a prudent, flexible, and diversified strategy. While near-term headwinds (U.S. tariffs, customer discounts, cost inflation) are significant, the company is positioning itself for medium-term growth and margin improvement through capacity expansion, vertical integration, and geographic diversification. Management remains conservative on leverage and capex, prioritizing adaptability and return to normalized profitability by FY27, contingent on tariff and FTA outcomes.

IRIS Business Services Ltd – The Murthy Madhusudan Marvel

Incorporated in 2000, IRIS Business Services Ltd offers Regtech solutions to regulators and enterprises.

With a market cap of Rs 640 cr the company is a RegTech SaaS company that helps enterprises, business registers, regulators, central banks, stock exchanges, BFSI, and other organizations meet their regulatory compliance requirements through technology-driven solutions like Artificial Intelligence, Machine Learning, and Robotic Process Automation.

Catamarans Ventures bought a stake in the company in the quarter ending December 2023, as per Trendlyne, and currently holds a 1.5% stake in the company worth Rs 9.5 cr.

The company’s sales jumped from Rs 51 cr in FY20 to Rs 126 cr in FY25 which is a compound growth of 20% in 5 years.

EBITDA also grew from Rs 8 cr in FY20 to Rs 19 cr in FY25, logging in a compound growth of 19%.

In case of the net profits the company has seen an enviable turnaround, with a compounded growth of 94% in the last 5 financial years.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit (Rs/Lac) | 0 | 400 | 100 | 400 | 900 | 1,300 |

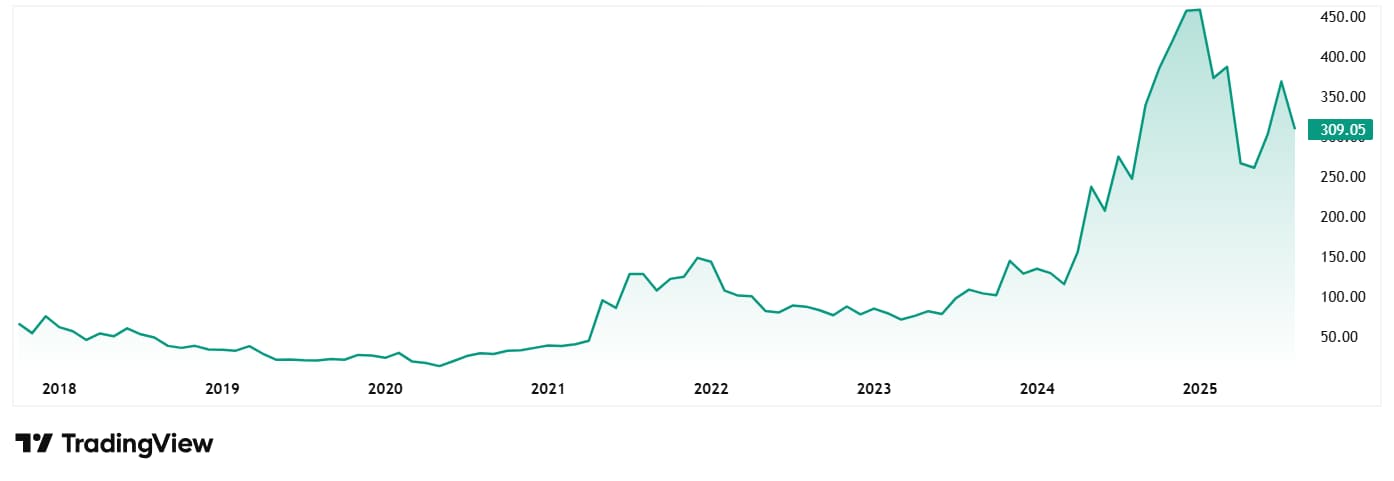

The share price of IRIS Business Services Ltd was around Rs 29 in August 2020 and as of closing on 14th August 2025, it was Rs 309, which is a growth of almost 970%. Rs 1 lac invested in the stock 5 years ago would have been Rs 10.7 lacs today.

IRIS Business Services Ltd Price Chart

At the current price of Rs 309, the company’s share is trading at a discount of almost 47% from its all-time high price of Rs 577.

The company is currently trading at a PE of 62x, which is higher than the current industry median of 31x.

Apart from the Murthy’s, Madhuri Madhusudan Kela, wife of ace investor and a Warren Buffett of India, Madhusudan Kela also holds 5.2% stake in the company worth Rs 33.2 cr. DIIs also hold another 11% stake in the company.

According to the last released investor presentation in May 2025, IRIS is working on a disciplined approach to scaling, investing in product and geographic expansion, while navigating industry headwinds like mandate delays. All this while maintaining a clear focus on recurring revenues and value-added solutions.

Catamaran’s Faith: Undervalued Stars or Market’s Red Flags?

Gokaldas Exports Ltd and IRIS Business Services Ltd, the only two stocks held by the Murthy’s via Catamarans Ventures, are currently trading at over 40% discounts form their all-time high prices. While companies boast of some strong growth, some aspects do hint at market challenges like trade issues or delayed contracts.

The trust of Catamaran Ventures in these companies is backed by big investors like Goldman Sachs, domestic fund and Madhusudan Kela suggests a long-term promise. While Gokaldas is expanding globally and streamlining operations, IRIS is planning to use AI to boost its RegTech solutions.

These discounts could be a chance to buy low or even a sign of trouble in paradise. As both companies battle industry hurdles, their low prices could tempt investors ready to balance opportunity with risk. Adding these stocks to the watchlist would not be such a bad idea.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.