Oil and gas stocks, especially of ONGC and Oil India, witnessed sell-offs on Thursday following reports that the government may levy a windfall tax on oil producers as part of a permanent solution it is working on for moderating the spiralling retail prices of petrol and diesel.

Oil and gas stocks, especially of ONGC and Oil India, witnessed sell-offs on Thursday following reports that the government may levy a windfall tax on oil producers as part of a permanent solution it is working on for moderating the spiralling retail prices of petrol and diesel.

There were also fears that the government will ask the oil producers to share the country’s fuel-subsidy burden.

The S&P BSE Oil and Gas index ended in the red, closing the session 1.72% lower at 13,525.50 points. Additionally, in the last six months, S&P BSE Oil and Gas index has lost 16.1%. “The government is mulling over an idea of taxing multinational oil producer who gets the benefits of higher revenue when crude oil price crosses above $70 mark. The windfall tax, if implemented may hurt the profitability of India’s biggest oil-producing stock ONGC,” said an analyst from Bonanza Portfolio.

Global rating agency Moody’s, in a report, pointed out that ONGC and Oil India could once again face an increasing risk of subsidy sharing.

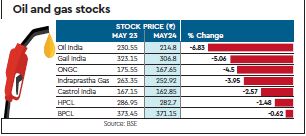

ONGC and Oil India has not contributed to fuel subsidies since June 2015, but have in previous years paid for over 40% of the country’s annual subsidy bill. ONGC closed the session 4.50% lower at Rs 167.6 and Oil India ended 6.83% down at Rs 214.8 on the Bombay Stock Exchange (BSE). ONGC hit an intra-day low at Rs 155.45 before closing at Rs 167.6 and Oil India hit an intra-day low at Rs 204.65.

Other players in the S&P BSE index too closed in red except Indian Oil Corporation (1.59%), Reliance Industries (0.42%) and Petronet LNG (0.02%) that closed the day on a flat note. Oil India’s (-6.83 %) stock was the biggest loser of the day, followed by Gail India (-5.06), ONGC (-4.50), Indraprastha Gas (-3.95%), Castrol India (-2.57) and Hindustan Petroleum (-1.48%).

“On the issue of price deregulation, the government is unlikely to reverse fuel pricing deregulation because it remains committed to reforms,” added Vikas Halan, senior vice president at Moody’s.

Moody’s also said oil marketing companies such as Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation have been asked to share less than 1% of total fuel subsidies since fiscal 2011-12, and it is unlikely that the proportion of such costs will rise.