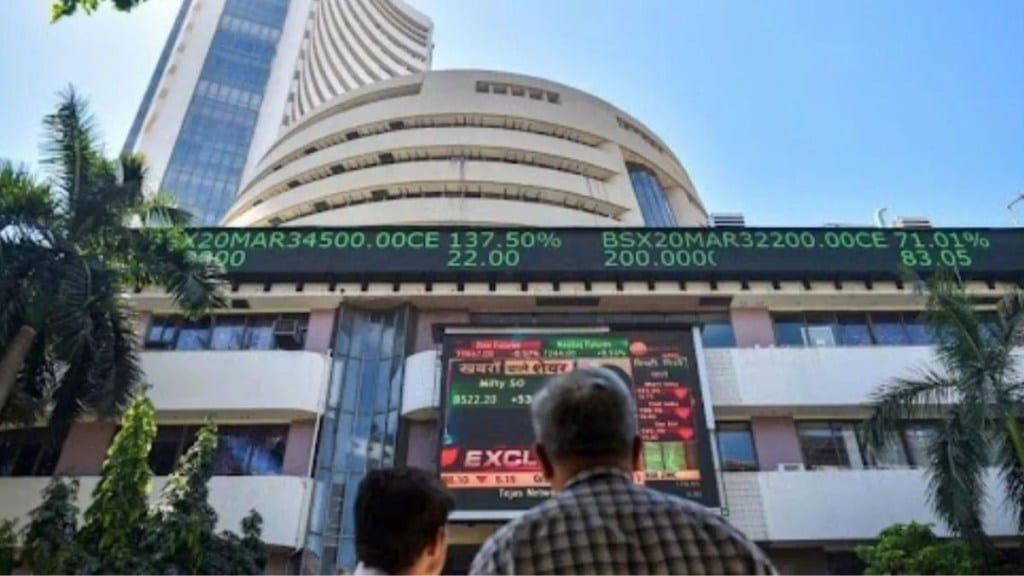

Domestic indices opened the week lower. The NSE Nifty 50 fell 210.20 pts or 1.23% to 16,889.85 and BSE Sensex tanked 698.46 pts or 1.20% to 57,291.44. Bank Nifty plunged 442.20 pts or 1.12% to 39,155.90. The top gainers on Nifty 50 were Dr Reddy, Divis Lab, Hindustan Unilever Ltd (HUL), Titan and BPCL while the losers were Adani Enterprises, Hindalco, Infosys, TCS and IndusInd Bank.

Adani Group stocks in focus today

Adani Group stocks fell on Monday with Adani Enterprises shares falling 3.4% to Rs 1813.40 after the reports of Gautam Adani-led group suspending a Rs 34,900 crore petrochemical project at Mundra in Gujarat to focus on resources to consolidate operations and address investor concerns following a damning report by Hindenburg Research LLC.

Sectoral Indices

All the sectoral indices were trading lower. Bank Nifty tanked 1.21%, PSU Bank plunged 2.19%, Nifty IT fell 1.55%, Nifty Metal was down 2.25% and Nifty Auto was down 1.66%.

Asian and US stock markets

Asian markets were trading mostly in red with Japan’s Nikkei 225 falling 0.66%, Hong Kong’s Hang Seng tanking 1.65%, South Korea’s KOSPI dipping 0.09% while China’s Shanghai Composite index rose 0.33%.

The US market ended Friday’s session broadly in red with major indices falling over 1%. The Dow Jones Industrial Average tanked 1.19%, S&P .500 sank 1.10% and the tech-heavy Nasdaq plunged 0.74%.

FII and DII data

Foreign institutional investors (FII) net sold shares worth Rs 1,766.53 crore, while domestic institutional investors (DII) net acquired equities worth Rs 1,817.14 crore on 17 March, according to the provisional data available on the NSE.

NSE F&O Ban

The National Stock Exchange has GNFC and Indiabulls Housing Finance on its F&O ban list for 20 March. According to the NSE, stocks are prohibited in the F&O sector when they have exceeded 95% of the market-wide position limit (MWPL). During the F&O ban period, no new positions are permitted for F&O contracts in that stock.