What connects your favourite dessert to the cycle that you use to burn all the calories the next day? What connects your prized car to the loan that you took to fund it? Well, behind all of this is one Group with over Rs 90,200 crore turnover and a legacy of 125 years.

It is the Murugappa Group.

The Murugappa Group, which has gone from strength to strength in recent years, is also synonymous with scripting successful turnaround stories. Most analysts we spoke to highlighted that the Group “has built a strong reputation for trust and prudence in financial services and beyond.” That’s saying a lot in a business world where trust and reputation is not very common.

So, what’s the secret strategy that’s enabled the group to transition from being a so-called legacy player to a Group that stands out for its future focus?

Before we delve deeper into that, here’s an interesting fact. The Murugappa family secured the seventh position in the top 10 most valuable Indian family businesses in 2025, as per the most recent Barclays Private Clients Hurun India Most Valuable Family Businesses List. With a value of Rs 2.9 lakh crore and led by Vellayan Subbiah, the family business was founded in 1900 and is now run by the fourth and fifth generations.

From Burma to a billion-dollar conglomerate

It all started with a vision by Dewan Bahadur AM Murugappa Chettiar in 1900. Beginning as a banking and money-lending enterprise in Burma (Myanmar) before World War 1, it is a conglomerate today spread across diverse sectors, including agriculture, fertiliser, financial solutions and engineering. The Group has 10 listed entities in the Indian stock markets, including marquee names like EID Parry, Cholamandalam Investment and Finance, Tube Investment, Coromandel International, Shanthi Gears and CG Power.

Some of the best-known brands by the Group and ones that resonate with millions include the likes of Hercules, BSA, Chola MS, Gromor, Coromandel, Montra, Parry’s and a lot more.

The Murugappa Group moved their assets to India before the Japanese invasion of then Burma (now Myanmar) in World War II. After establishing companies in core industrial sectors in independent India and re-entering the financial services sector, the 1980s saw the beginning of the big transition stories that the Murugappa Group has become synonymous with today.

The big turnaround stories

The Murugappa Group has manufacturing facilities across 10 countries and often refers to the ‘Presence that makes a difference’. While Indian companies expanding globally has become a norm, what stands out is the ‘success stories’ that the Group has had when it comes to takeovers and acquisitions.

CG Power and Industrial Solutions – Powering ahead

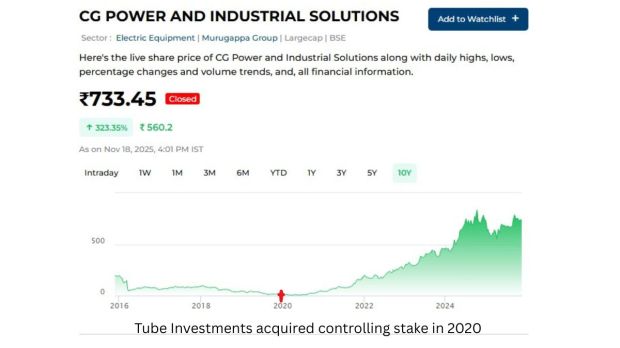

The acquisition of CG Power and Industrial Solutions is perhaps one of the best turnaround stories, not just for the Murugappa Group, but for Corporate India as well. Tube Investments of India (TII), a multi-crore Murugappa Group company, acquired the controlling stake in CG Power and Industrial Solutions in 2020.

As reported by FinancialExpress.com on November 27, 2020, and as per the exchange filing on November 26, 2020, Tube Investment completed acquisition of 50.62% stake in CG Power on November 26, 2020. The share purchase agreement between the two was signed by the two in August 2020 and got the CCI nod in October of the same year.

A careful study of the CG Power share price graph in the last 5 years perhaps brings forth the story best.

CG Power had a debt of Rs 2,161 crore as of March 31, 2020. Crippled by accounting fraud, rising debt burden and promoter malpractices, the company’s financials and operations were in bad shape.

Vellayan Subbiah, known for a few other success stories by the brand, spearheaded the transition and revival journey.

Cut to 5 years since the acquisition, the once struggling company has guided for “sustained export growth, rising transformer and switchgear demand, a stable outlook in the industrial segment and a long-term scale-up in semiconductors. EV motors and GIS substations are identified as new growth areas.”

In fact, working towards future-proofing the business, CG Semi launched one of India’s first end-to-end OSAT facilities in Sanand in August this year, establishing CG as a full-scale OSAT provider in both traditional and advanced packaging. Construction for a second OSAT facility is under way and likely to finish by 2026-end, scaling up to 14.5 million units/day.

Today, CG Power’s market capitalisation is over Rs 1,15,000 crores. This is more than 100x the valuation of the company in early 2022. Talk about wealth creation.

Shanthi Gears – Celebrating synergies

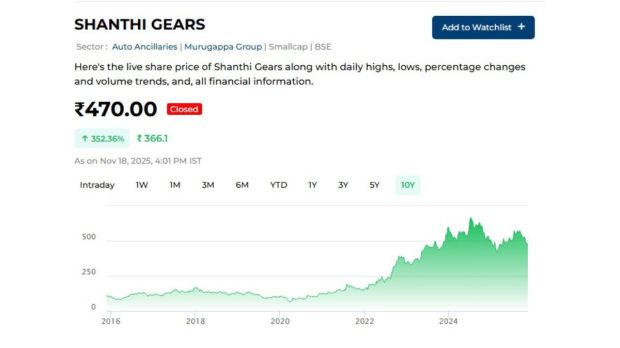

Another engineering firm that saw a similar turnaround is Shanthi Gears. The acquisition was again via Tube Investments of India. In 2012, Tube Investment bought 44.1% in this Coimbatore-based firm as it looked to diversify and get a stronger foothold in the non-auto sector. This acquisition made Shanthi Gears a leading gearbox manufacturer in India.

At the time of acquisition, Shanthi Gears’ sales were slipping, it was not functioning at optimum level and was also facing some operational issues.

Tracking the journey of the company over the last 13 years since the acquisition, Shanthi Gears’ FY13 revenue was Rs 146 crore and it closed FY25 with Rs 604.62 crore revenue.

As Chairman, M A M Arunachalam put in his note to shareholders outlining the company’s focus, “Innovation remains central to our strategy. Leveraging global best practices, we’ve expanded our specialized product offerings catering to high-growth sectors such as renewable energy, infrastructure, mining, aerospace, defence and mobility.”

As of Q2FY26, the unexecuted order book was Rs 254 crore. In Q2FY26, it has booked orders worth Rs 138 crore, up 7% compared to the same period last fiscal.

The market capitalisation of Shanthi Gears today is over Rs 3,600 cr, which is 7.8 times the value at the start of 2012. Again, a solid turnaround this.

Cholamandalam Investment and Finance- Creating value

The Murugappa Group buying out the DBS stake in its JV in Chola DBS and regaining controlling stake in Cholamandalam Investment and Finance is another classic example of the Murugappa family’s deep strategic value creation across the Group.

In March 2010, under the leadership of Vellayan Subbiah, the Group companies, Tube Investment and New Ambadi Estates, bought out the 37.48% stake held by DBS. Since then, it’s seen an upward growth trajectory. The company demonstrated consistent profit growth and has seen significant addition to the assets under management.

The market capitalisation of Cholamandalam Investment and Finance is Rs 1,42,604.51 crore now. This is more than 200 times the value at the start of 2010.

The share price of Cholamandalam Investment and Finance has delivered over 34% return in 1 year and risen over 400% in the last 5 years. The steep surge in the share price of this NBFC since 2010 highlights investor confidence in the stock over the last 15 years.

From being deeply impacted by the 2008 financial crisis globally, the NBFC has come a long way. In recent years, the company has expanded into consumer and small enterprise loans (CSEL), secured business and personal loans (SBPL), and SME finance, reinforcing its position as a diversified lender.

As per the management guidance after the Q2FY26 results recently, the company is confident about growth pick-up in the second half of FY26. They maintained the “AUM growth guidance of 20% driven by a likely stronger recovery in demand in H2FY26.”

According to the management, “credit losses in CSEL have now peaked, and the company expects the impact to moderate going forward.” Margins too are expected to improve 10–15 bps in H2FY26.

EID Parry – A sweet deal

The last in this list but surely not the least exciting – The Murugappa Group’s takeover of EID Parry in 1981 made headlines. It was one of the oldest commercial names in India, and the management, struggling with debt, requested the Murugappa Group to take over. Today, EID Parry is not just the largest sugar manufacturer in southern India, Parry’s is the only sugar brand to be conferred the ‘SuperBrand’ status in India.

EID Parry has also been recognised as the ‘Best Sugar Plant in Private Sector’ at the Sugar and Ethanol International Awards (SEIA) 2024.

The company has not just made it big in agro products but is also expanding into bio-energy and clean fuel. However, what’s interesting is how the company continuously evaluates its business strategy to optimise gains ranging from biofuels to consumer products. Muthiah Murugappan – Whole Time Director – EID- Parry(India) highlighted, “We’re doing a strategy revisit or really an evaluation of where we stand and what our strategy needs to be going forward. We have certain product category areas which we are interested in.” He reiterated that the “the focus will be on the enablers for growth.”

The Murugappa Playbook: Capital allocation & professional control

However, there are many other noteworthy diversification and inorganic expansion initiatives undertaken by this 125-year old group. Apart from the focus on innovation and strategic sectoral diversification, the Group’s holding structure and leadership have also carved out a unique place. Unlike many other family-run businesses, the leadership of the individual group companies has been handed over to professionals, with the family members moving to the board.

Ambadi Investments is the primary holding company and has a key stake in most of the listed entities. The independent Group companies also have stake held by family members as well as unlisted companies of the Group.

What started as a banking business in Burma employs over 94,000 employees today. Tracking the 125 years of the Group’s evolution, perhaps there are many changes with times and evolving customer dynamics; however, one aspect that stands out is the legacy of value built over years.

The Final Chapter?

Continuing the legacy also requires a fair bit of vision and focus on value creation. The Group is no doubt standing at a crucial juncture. One of the architects of the Group’s phenomenal expansion, former Chairman Arunachalam Vellayan passed away recently. Is this a start of a new chapter in the Group’s evolution?

The continuing buzz seemed to indicate that the promoters may look at a new family settlement that can help carve out three equal groups in a tax-efficient manner. Talks about the possible three-way division of the group continues, though there has been no clear decision yet.

For now, it’s a wait-and-watch game, as we await what the future unfolds.