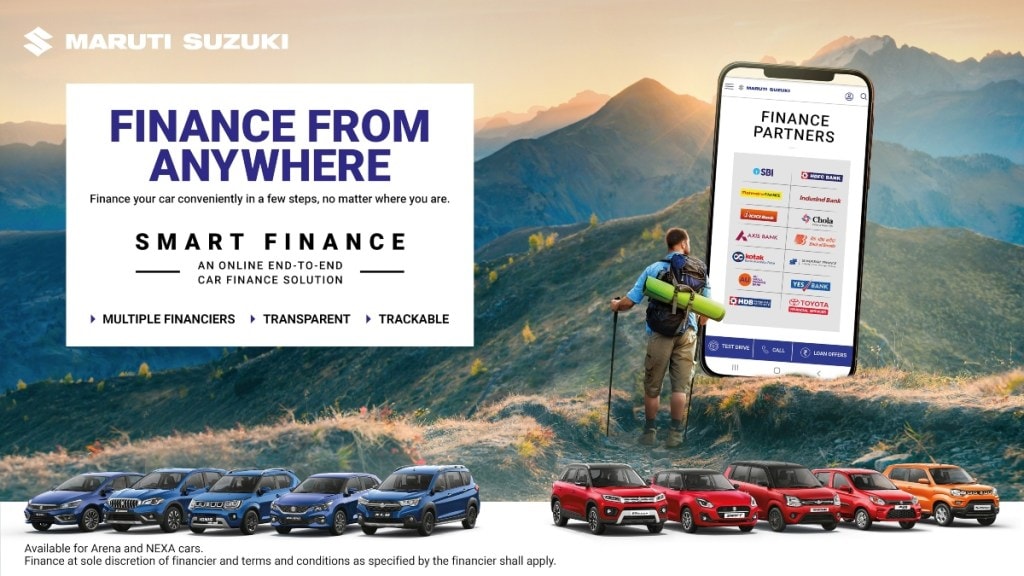

Maruti Suzuki launched the Smart Finance platform in India in the year 2020. The company has today introduced a new marketing campaign “Finance your car from anywhere” to amplify the category-first offerings of the Smart Finance platform. The company claims that since its launch, Maruti Suzuki Smart Finance has disbursed Rs 15,000+ crores worth of loans to over 2.6 lakh customers in the country. Through this new campaign, Maruti Suzuki aims to spread awareness about how the Smart Finance platform has redefined the modern car buying experience.

Speaking on the campaign, Shashank Srivastava, Senior Executive Director (Marketing & Sales), Maruti Suzuki India Limited, said, “Maruti Suzuki Smart Finance since its launch disrupted the market with an evolved digital solution that empowered customers, to avail financing easily and conveniently. We identified that there are three major customer pain points in the car finance process—lack of proper information, lack of transparency and lack of convenience. In a revolutionary move to enrich the customer experience, we have addressed each of these challenges innovatively and thoughtfully with Maruti Suzuki Smart Finance.”

He further added, “Now with an AI-driven, online, end-to-end financing, along with the largest range of financiers, the platform has completely reimagined car-buying for the future. Breaking free from the conventions, with Maruti Suzuki Smart Finance, customers can finance their Maruti Suzuki vehicles from anywhere. Through our campaign, we want to educate customers about the transparency, ease and superior convenience of using the Smart Finance platform.”

Maruti Suzuki Smart Finance platform is available for both Arena as well as NEXA customers and it covers a wide range of customer profiles to meet the demands of a diverse range of customers across India. The company has onboarded 16 financiers including State Bank of India, HDFC Bank, Mahindra Finance, IndusInd Bank, ICICI Bank, Cholamandalam Finance, Axis Bank, Bank of Baroda, Kotak Mahindra Prime, Sundaram Finance, AU Small Finance Bank, YES Bank, HDB Financial Services, Toyota Financial Services (India), Federal Bank and Karur Vysya Bank.