As many as five Public Sector Banks (PSBs), including the Punjab National Bank (PNB) and Canara Bank, are on the verge of being put on RBI’s watch for high bad loans and an early recall of AT-I bonds which may “partially negate” the massive recapitalisation plan, according to a report ICRA.

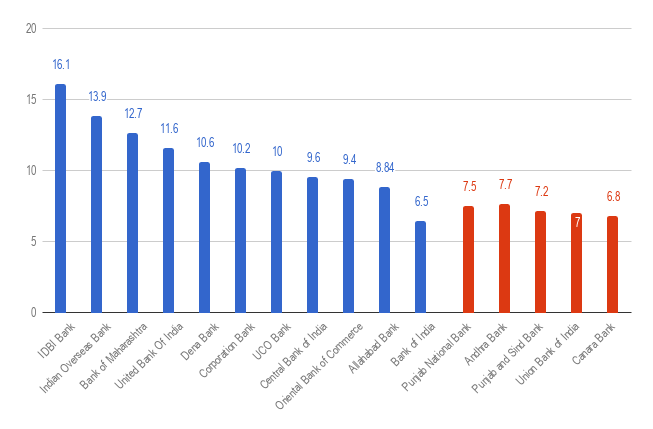

The Reserve Bank of India (RBI) puts banks under its watch initiating Prompt Corrective Action (PCA) under which restrictions are imposed on fresh loans and dividend distribution. Currently, 11 out of 21 PSBs are already under the PCA for their net Non-Performing Asset (NPA) higher than 6%.

RBI’s decision to put a bank under PCA is dependent on three factors capital adequacy ratio (CAR), net NPAs, and return on assets (RoA).

The report has said that Punjab National Bank, Andhra Bank, Union Bank of India, Punjab and Sind Bank, and Canara Bank are not under PCA but can be included. In the last four years, PSBs have raised Additional Tier – I (AT-I) bonds totalling Rs 60,3851 crore in the backdrop of losses.

ICRA estimates that these five PSBs can come under the PCA framework as the massive bank recapitalisation plan by the government triggered a ‘Regulatory event’ and an early recall of AT-I bonds by banks under the PCA. 11 PSBs under PCA Rs 21,900 crore of AT-I bonds, which are likely to be called off during the next few weeks.

Also Read: What RBI’s Prompt Corrective Action is

“Depending on AT-I bonds issued by individual banks, the capital ratios can reduce by 0.7-2.0% of risk-weighted assets of these banks,” ICRA said.

What AT1 bonds are:

AT1 bonds, also known as additional tier 1 bonds, are perpetual bonds issued by banks with no fixed time period. Banks can recall the bonds any time they wish to. As against Tier II bonds with 7.75% interest rate, AT1 bonds carry an interest rate of 9%, which is the main attraction for investors. The AT1 bonds pose a risk of capital losses to banks.