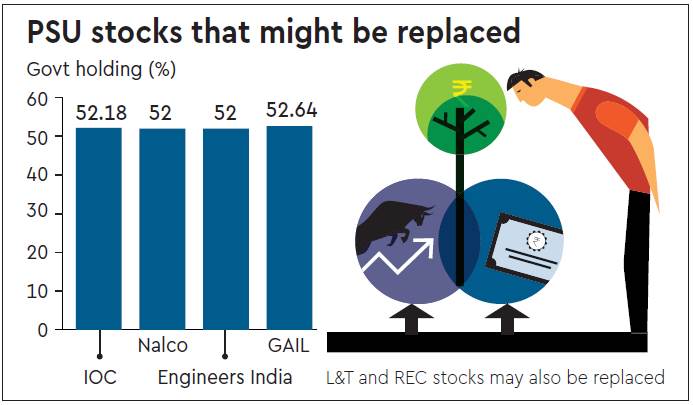

Successful utilisation of exchange-traded funds (ETFs) to mop up more than half of its Rs 85,000-crore disinvestment receipts in FY19 has prompted the Centre to consider replacing half-a-dozen stocks from the Bharat 22 ETF and two from the CPSE ETF, and use them to mobilise a major chunk of the Rs 90,000-crore disinvestment planned for FY20. Stock rejig has become necessary as the Centre’s holding in many PSUs has reached the threshold limit of 52% (the minimum shareholding prescribed for the PSUs in the ETF baskets) in Bharat 22 ETF, a diversified index of 22 stocks. These include Indian Oil (4.05% weight in the index), Nalco (5.78%), GAIL (4.41%) and Engineers India (0.98%).

Besides, two more stocks in the index also need to be removed for some other reasons. The Centre’s holding in L&T (15.77% weight) via SUUTI has been exhausted in FY19, hence these have to be dropped. Similarly, the Centre has sold its 52.63% stake in REC (0.82% weight) to PFC, leaving no further scope to divest in the company. In February, Bharat 22 ETF had to buy three stocks, including REC from the market, to maintain their weight in the index as the government had no more headroom to divest in these companies.

In the CPSE ETF, now comprising 11 PSU stocks, the government needs to drop at least two companies — IOC (for reaching the 52.18% government-holding threshold) and REC (as the government exited it). If the stocks are not replaced with new ones, the Bharat 22 ETF (managed by ICICI Prudential) and the CPSE ETF (managed by Reliance Nippon) would have to buy such stocks from market to maintain their weight in the index.

The new stocks that could find place in the ETF baskets might include state-run firms such as NMDC, GIC Re, New India Assurance, HAL and HUDCO, among others. The Centre garnered Rs 45,080 crore via the two ETFs — Rs 26,350 crore from CPSE ETF and Rs 18,730 crore from Bharat-22 ETF — helping it mobilise 53% of the total disinvestment receipt in FY19.

“Disinvestment via ETFs will continue to be a focus area in FY20,” an official aware of the matter told FE. Besides the two ETFs, the department of investment and public asset management could also construct new theme-based ETFs this year.

The CPSE ETF was first launched in March 2014, and it held 10 CPSE stocks, including that of ONGC, IOC and Coal India, among the Maharatna CPSEs. It was rebalanced in November 2018: NTPC, SJVN, NLC and NBCC were included in the CPSE ETF while GAIL, EIL and Container Corporation were removed, making it a 11-stock index. In the biggest divestment transaction via ETFs, the Centre mopped up `17,000 crore in November 2018.