Prashant Jain is a name that needs no introduction. Former CIO of HDFC Mutual Funds, with over 30 years of experience and expertise under his belt, Jain is one of the country’s most accomplished and respected fund managers.

When he founded 3P Investment Managers in 2022 after parting ways with HDFC Mutual Funds, his goal was clear with the firm. It must reflect his core investment philosophy – Prudence, Patience and Performance. Hence the name 3P. As of August 2025, the company managed Rs 19,760 cr for over 1,193 families. That’s the trust these families have shown in 3P.

So, when such a fund manager makes changes to his holdings under the company, it deserves attention, as it is based on solid research. After all, their goal is to make money for the families that have trusted them. Here are 3 changes 3P made to its holding recently.

Centum Electronics: A defence play at premium valuations?

Founded in 1993, Centum Electronics Limited is one of India’s largest Electronics System Design and Manufacturing (ESDM) companies.

With a market cap of Rs 3,728 cr, the company offers an entire spectrum of design services and manufacturing of systems, subsystems for mission-critical products in Defence, Space, Aerospace, Industrial, Transportation and Medical sectors.

According to screener.in, 3P held a total of 5.5% stake in the company (across 2 equity funds) as of the quarter ending June 2025. However, as per the exchange filings made for the quarter ending September 2025, this holding went up to 7.5%, which is a holding worth Rs 280 cr.

Coming to the financials of this company…

The sales grew at a compounded growth rate of 6% from Rs 883 cr in FY20 to Rs 1,155 cr in FY25.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) logged a flat growth as it was Rs 97 cr for both, FY20 and FY25.

Net profits saw a bumpy ride and is an area which makes us wonder if there is a turnaround that Jain and 3P foresee.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profit/Cr | 16 | 12 | -53 | 7 | -3 | -2 |

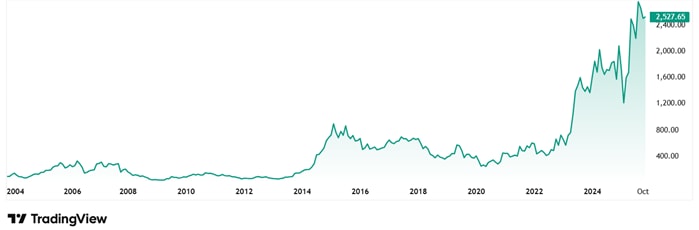

The share price of Centum Electronics Ltd looks like something that could catch investors’ attention. It was around Rs 275 in November 2020 and as on 17th November 2025, it was Rs 2,530 which is a jump of 820%. Rs 1 lac invested in the stock 5 years ago would have been about Rs 9.2 lacs today.

The stock is trading at an extremely high PE of 160x, while the industry median is 34x. The 10-year median PE for Centum is however 29x, which is same as the industry median for the same period.

In October 2025, the company signed an MoU with Garden Reach Shipbuilders & Engineers (GRSE) for joint R&D, manufacturing, integration, and trials of advanced naval navigation systems. The management says that this aligns with “Aatmanirbhar Bharat” and leverages Centum’s electronics expertise with GRSE’s shipbuilding capabilities. Another MoU was also signed with Bharat Electronics Ltd (BEL) to strengthen indigenous defense electronics (EW, radar, communications)

Can Fin Homes: A value bet in housing finance

Established in 1987, Can Fin Homes Ltd is a deposit-taking housing finance company (HFC) registered with National Housing Bank (NHB), that has a 30% stake by Canara Bank.

With a market cap of Rs 12,137 cr the company provides relatively smaller ticket-sized housing loans to salaried & professional and self-employed non-professional borrowers.

3P had a 3.26% stake in the company as of the quarter ending June 2025 which jumped to 3.56% as of the quarter ending September 2025, a holding of Rs 575 cr.

Here is a quick financial update on the company…

The revenue grew at a compounded rate of 14% from Rs 2,030 cr in FY20 to Rs 3,879 cr in FY25.

As per the latest investor presentation from October 2025, the loan book had reached Rs 39,657 cr

The Net Profits grew at a compounded rate of 18% from Rs 376 cr in FY20 to Rs 857 cr in FY25.

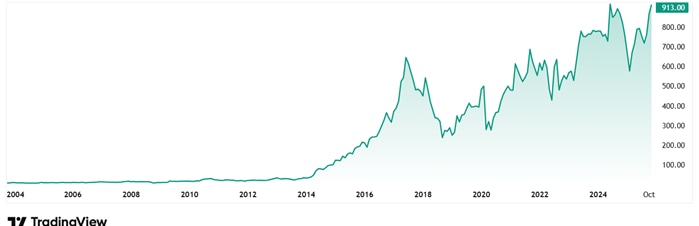

The share price of Can Fin Homes Ltd was around Rs 480 in November 2020 and as on 17th November 2025 it was Rs 912, which is a jump of 90%.

The company’s stock is trading at a PE of 13, while the industry median is 48x. The 10-year median PE for the company is 16x and the industry median for the same period is 17x.

The company also has a strong dividend yield of 1.33% which is higher than the current industry median of 0.44%.

Fidelity Funds – Asian Smaller Companies Pool, which is an FII (Foreign Institutional Investor), also bought a 1.23% stake in the company as reported for the quarter ending September 2025, making the overall FII holding of 12.5%.

West Coast Paper: From paper to optical fiber

Founded in 1955, West Coast Paper Mills Ltd is one of the oldest and the largest producers of paper for printing, writing, and packaging in India.

With a market cap of Rs 2,840 cr, the company produces premium papers, writing papers, boards, office stationery, etc under the Wesco brand.

3P just bought a 1.02% stake in the company worth Rs 29 cr, as per the filings for the quarter ending September 2025.

Coming to financials, the sales of the company grew at a compounded growth rate of 10% from Rs 2,493 cr in FY20 to Rs 4,062 cr in FY25.

EBITDA and Net Profits saw a bumpy ride the same period:

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| EBITDA/Cr | 618 | 261 | 638 | 1,647 | 1,095 | 493 |

| Net Profits/Cr | 406 | -4 | 346 | 1,087 | 786 | 336 |

The share price of West Coast Paper was around Rs 160 in November 2020 and as on 17th November 2025, it was Rs 430, which is almost a 170% jump in 5 years.

The stock is trading at a PE of 16x, while the industry median is 17x. The 10-year median PE for West Coast Paper is 7x, and the industry median for the same period is 10x.

In April 2025, the company commissioned a cutting-edge optical fiber manufacturing facility at Fab City, Rangareddy, Telangana, under West Coast Optilinks (a division of the company). The plant uses European technology to produce world-class, “Made in India” optical fiber, supporting national initiatives like BharatNet, FTTH, 5G, and 6G. It follows the doubling of OFC production capacity last year and is expected to reduce import dependency while boosting export potential.

Is Jain foreseeing some big turnaround?

The stake rise in the two companies clubbed with the fresh stake in one, makes looking into 3P and Jain’s investment style very interesting. As one of the most respected fund managers in India, Jain’s stock movements always cause a stir in the investor community.

However, what makes it more interesting is the different stories the 3 stocks we saw today tell. Centum and West Coast Paper seem to be struggling when it comes to profits. Which makes one think, does Jain see some big turnaround opportunity here that is missing the eyes of the average investor?

Well, we will know with time. But for now, one can consider adding these stocks to a watchlist and keeping an eye on them.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.