Alcoholic beverage sector in India is a fast-evolving industry, marked by shifting consumer trends, growing levels of disposable income and rapid rates of urbanization.

While whisky, beer and rum consumption continue dominating the market, varieties of wine and craft beverages have become increasingly popular.

Even in the face of strict regulatory compliance and high taxation, varying from state to state, India is one of the largest global markets for alcoholic drinks, catering to a growing size of both the young and middle-aged demographics.

A shift towards premiumization and consumer inclination toward quality over price-sensitivity, continues attracting both domestic and international players to cash in on this massive market in the country.

Before coming to the individual stocks we want to focus on today, let’s dig in more into the industry and find out what’s happening in the industry in more detail.

Market Segmentation

In terms of beverage type, spirits are anticipated to generate the highest share of the market due to high preference for premiumization among young adults in India.

Increasing exposure to global brands and mixology trends are driving the demand for premium spirit brands and ready-to-drink cocktails based on whisky, vodka, rum and gin.

Savvy digital marketing campaigns, wider array of flavours and innovative packaging are also adding to the appeal of this segment.

With over 70% of India still within middle or low-income brackets, moderately-priced alcohol brands are expected to occupy around 40% share of the market.

State-level Regulatory Policies

The Uttar Pradesh government launched the “single counter” system for beer, wine and other liquors through its 2025-2026 excise policy. Also, it rolled out an e-lottery for new licences. These policy changes are anticipated to elevate the prices of alcohol in the state. Liberalisation of retail licenses have boosted the market in states like Andhra Pradesh and Rajasthan. With spike in the costs of raw materials, packaging, labour and transportation, alcohol producers have been advocating for WPI-linked price hike.

More stability in excise policies, state-level tweaks in excise rates, licensing fees and duty structures have buoyed further demand for alcoholic beverages in India. For instance, in February 2025, Indian government cut the import tariff on bourbon whisky brands like Suntory’s Jim Beam. This will give a boost to the import and consumption of such foreign whisky brands in India.

Moreover, the recent GST reforms which have come into effect from September 22 of this year, is also expected to lead to an increase in the consumption of alcohol in India. Prominent beer manufacturer United Breweries Ltd. MD & CEO cited that he projects a 6-7% volume growth for the company in FY26.

Premiumisation – A Key Growth Driver

The premium beer and Indian Manufactured Foreign Liquor (IMFL) segments report higher profitability as opposed to mainstream brands. Premiumisation has ushered in a crucial structural shift as it shields the sector from the impact of adverse regulatory policies and cost inflation pressures. While premium IMFL has an alcohol level of 40-45%, premium beer has a salience level of 20-25%. Both segments offer ample leeway for alcohol producers to scale up in alcohol content.

Hence, the trend of premiumisation has brought about an increase in innovation and manufacturing investments. JM Financial anticipates higher EBITDA/PAT growth in the Prestige & Above (P&A) segment of the IMFL and premium beer brands of all the 3 leading players namely United Breweries, United Spirits and Radico Khaitan.

Industry Outlook

Industry analysts estimate that the sector is projected to see a growth of 8-10%, reaching a revenue of INR 5.3 lakh crore by FY 2026. As per JM Financial, the Indian alcoholic beverages market has a current market size of over 1,100 million cases, with beer and IMFL brands representing 400 million each. By 2030, India is anticipated to register 25% of the global growth in consumption of alcohol as about 100 million Indians are expected to reach the legal drinking age.

Let’s take a deep dive into three market leaders which are riding high on the premiumisation trend in the Indian alcoholic beverage sector.

#Radico Khaitan

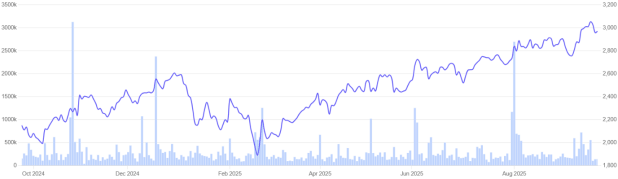

Valued at a market cap of INR 39,708 crore, Radico Khaitan stock has returned approximately 38% to shareholders in the past one year.

Incorporated in 1943, Radico Khaitan is one of the most reputed IMFL brands in India. It is one of the largest suppliers of IMFL to the Canteen Stores Department (CSD) and one of the largest exporters of alcoholic beverages.

In May 2025, Radico Khaitan made a splash in the super-premium spirits market with the launch of two luxury whisky products – Morpheus Super Premium whisky and TRIKAL Indian Single malt. In September 2024, the company launched a new variant of Rampur Indian Single Malt Whisky, the Barrel Blush, alongside 2 whiskies from the Rampur Jugalbandi series. For FY 2026, the company has set a target of INR 500 crore from the luxury spirits segment, reflecting a topline growth of 30%.

During FY 2025, the company sold 31.36 million cases of IMFL, a surge of 9.2% from 28.7 million cases in the previous fiscal. For the reported fiscal, the company clocked in a revenue of INR 340 crore from its portfolio of luxury spirits. The price range varies from INR 4,000 per bottle and going as high as INR 5 lakh for particular variants of single malt.

Consolidated net revenue from operations for Radico Khaitan in FY25 came in at INR 4,851.2 crore, a YoY growth of 17.8%. Net profit came in INR 345.6 crore, up 31.8%. Its EBITDA margin grew from 12.3% in FY24 to 13.8% in FY25, highlighting an improvement of profitability metrics for the company.

The stock is currently trading at a trailing price-to-earnings multiple of 95.2. The stock currently has an EV/EBITDA ratio of 51.6, as compared to the industry median of 17.3.

Radico Khaitan Share Price Return: 1 year

Source: Screener.in

#Tilaknagar Industries Ltd

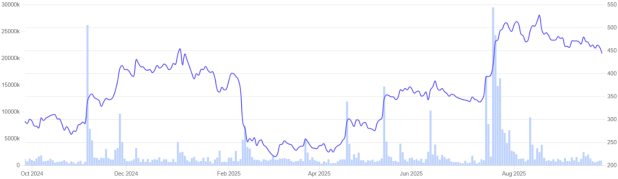

Valued at a market cap of INR 8,612 crore, Tilaknagar Industries stock has returned approximately 51% to shareholders in the past one year.

Primarily involved in the manufacture and sale of IMFL, this company is distinguished for Mansion House Brandy, the popular brandy in India and second-largest by global sales.

In July 2025, Tilaknagar Industries signed a deal to acquire Pernod Ricard India’s Imperial Blue whisky business for a landmark amount of INR 4,150 crore. In August, the company announced plans to invest INR 35-50 crores in the capacity expansion of its Prag Distillery unit in Andhra Pradesh. This will enable a production increase from 6 lakh cases to 36 lakh cases annually.

Premiumisation remains a key focus area for the company across all its IMFL categories. This includes launch of luxury brandy Monarch Legacy Edition, expansion of the premium segment within the CNB family suite and introduction of the Mansion House Whisky in the semi-premium segment. Moreover, in July 2025, the company announced its plans to purchase a larger stake in Spaceman Sprits Lab (SSL). This follow-on investment of INR 10.7 crore will help the company to fortify its presence in the premium craft spirits market.

For FY25, net revenues came at INR 1,434 crore, a moderate uptick of 2.9% year over year. Net profit for the fiscal surged almost 63% to INR 229.8 crore. EBITDA for the fiscal amounted to INR 255 crore, up 37.4% from FY24.

The stock is currently trading at a trailing price-to-earnings multiple of 30.8. The stock currently has an EV/EBITDA ratio of 26.7, as compared to the industry median of 17.3.

Tilaknagar Industries Share Price Return: 1 year

Source: Screener.in

#Piccadily Agro Industries Ltd

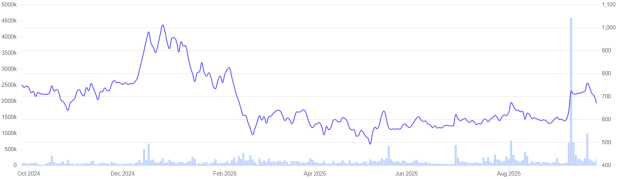

Valued at a market cap of INR 6,611 crore, Piccadily Agro Industries Ltd. (PAIL) stock has declined approximately 10.7% to shareholders in the past one year.

Founded in 1994, the company started its operations as a sugar processing company. In 2007, the company forayed into the manufacture of alcoholic beverages by setting up its distillery business segment. It specialises in a portfolio of premium brands like Indri – single malt whisky, Whistler & Royal Highland – blended malt whisky brands and Camikara – premium sugarcane juice aged rum.

Around the end of 2024, PAIL invested INR 1,000 crore to execute the brownfield expansion of its distillery and malt manufacturing unit in Indri, Haryana. This capex infusion will increase the production capacity of the facility to 250 kilo litres per day. The capacity expansion plan also includes a greenfield distillery in Mahasamund, Chhattisgarh, and the setup of its first global distillery in Scotland.

In Q2 FY 2025, the company rolled out its Indri Diwali Collector’s Edition 2024 and ‘The City Series’ Oloroso-Sherry cask expression exclusively for Bengaluru Duty Free. It also holds the recognition of being the first alco-bev company to leverage ForgeStop technology to prevent counterfeit production of its Indri Single Malt.

For FY 2025, the company reported revenue from operations amounting to INR 893 crore, up 8% YoY. This was primarily driven by the 40% growth of revenues of its IMFL business segment. EBITDA for the fiscal was INR 191 crore, a growth of 25.4% over the FY24 figure.

The stock is currently trading at a trailing price-to-earnings multiple of 61.4. The stock currently has an EV/EBITDA ratio of 34.4, as compared to the industry median of 17.3.

Picadilly Agro Share Price Return: 1 year

Source: Screener.in

Valuation Comparison With Peers

| Company | TTM P/E | ROCE | ROE | EV/EBITDA |

| Picadilly Agro Industries | 61.4x | 22.7% | 20.1% | 34.4 |

| Radico Khaitan | 95.2x | 16.2% | 13.6% | 51.6 |

| Tilaknagar Industries | 30.8x | 28.2% | 29.6% | 26.7 |

| United Spirits | 60.2x | 26.5% | 19.7% | 36.6 |

| United Breweries | 101x | 13.9% | 10.8% | 52.1 |

| Industry Median | 32 | 13.3 | 11.7 | 17.3 |

Source: Screener.in

It is to be noted that while most of the players have an above-industry average metric valuation, Tilaknagar Industries has a modest valuation, indicating that it may be potentially undervalued relative to its peers.

Conclusion

Despite a highly regulated structure of the industry and volatility of material costs, it has been noted that alcoholic beverages have not exhibited any signs of underperforming other FMCG players. Even recent disruptions like steeper excise duty on IMFL whisky in Maharashtra and beer price hikes Karnataka are also unlikely to stall the long-term growth trajectory of the sector in India. Hence the country is expected to remain one of the fastest- growing and largest global markets for alcohol consumption.

Sriparna Ghosal is an experienced financial writer. She has studied Economics at the Calcutta University. She started her career as a financial writer with Zacks Investment Research. Post that, she moved into consulting firms like Crisil. Her interest extends to global stocks as well.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.