There was big news recently in India’s aviation world. Prime Minister Narendra Modi inaugurated a new aircraft engine maintenance, repair, and overhaul (MRO) facility in Hyderabad.

This centre was built by a global aerospace company. It will service engines that power commercial planes. It is being called a major step in India becoming a global aviation MRO hub.

This news matters because for years India has sent much of its maintenance work overseas. That meant higher costs and long wait times for airlines. Now, with big facilities coming up in India and more global players investing here, the opportunity for Indian MRO companies is growing fast.

With this backdrop, it is a good time to look at the Indian companies that could benefit if aviation MRO work shifts more to India. This shift is not just about engines. It is about aircraft services, support systems, and the broader aviation ecosystem getting stronger at home.

In choosing the companies for this article, we kept the approach simple. We focused only on businesses where the link to aviation maintenance and servicing is clear and meaningful. We also looked at stability of earnings and operating track record.

Ramco Systems could be an indirect beneficiary of the MRO shift because of its aviation software business. So, we have included it in the list here.

The Pure Plays: Engineering & Parts#1 TAAL Tech

Incorporated in 2013, TAAL Tech is in the business of providing aircraft charter services.

TAAL Enterprises, which has now been renamed TAAL Tech, completed an important transition during FY25. The name change reflects the company’s shift toward engineering and technology-led services with a strong focus on aviation and industrial design work.

During the year, the company also completed the merger of its wholly owned subsidiary, TAAL Tech India Private Limited, with the listed parent. The move brought the core engineering business under a single structure and reduced duplication across business units. It also allowed the company to operate under one consolidated brand.

The management said the restructuring will help improve operational clarity and support future expansion in overseas and domestic markets. Board-level changes and compliance actions were taken through the year to align the organisation with the new structure.

TAAL Tech now describes itself as an engineering and technology solutions firm with work across aviation support, industrial equipment and related sectors. The company plans to build on its existing projects while scaling its global engagement in a gradual manner.

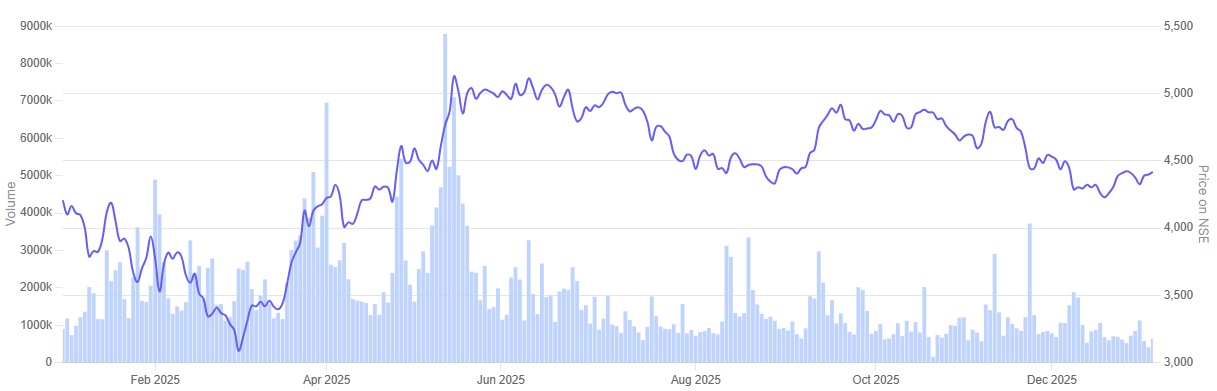

In the past year, TAAL Tech share price is up 3.5%.

TAAL Tech 1-Year Share Price Chart

#2 Taneja Aerospace and Aviation

Incorporated in 1994, Taneja Aerospace and Aviation manufactures and sells various parts and components to the aviation industry, providing services related to air field & MRO and allied services.

Taneja Aerospace and Aviation said FY 2024-25 was a steady year for its aviation services and maintenance work. The company continues to operate in aircraft component manufacturing, airfield services and maintenance-related aviation support and MRO-linked activities.

The annual report notes that much of the business during the year came from rental services, facility upkeep and training activity at its aviation premises. The company also has long-term service contracts, with part of this work scheduled to be recognised in FY 2025-26. This provides visibility on near-term execution timelines and project commitments.

The board declared two interim dividends during the year after reviewing the company’s cash position and business outlook. The management said governance, compliance and operational discipline remained key focus areas through the period.

Taneja Aerospace and Aviation remains positioned within India’s aviation services and MRO ecosystem. The company is gradually building its pipeline in aviation support and allied services as it prepares for upcoming contract and execution milestones in the year ahead.

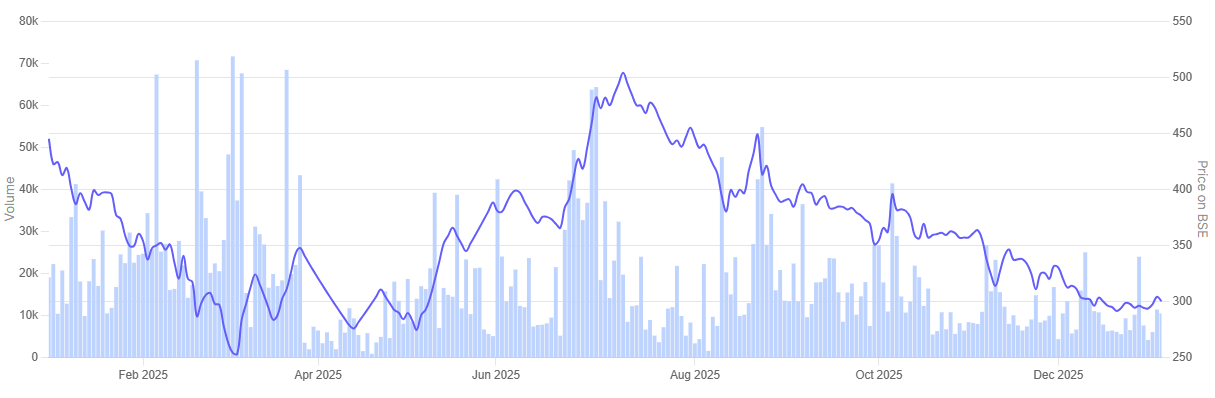

In the past year, Taneja Aerospace and Aviation share price tumbled 32.6%.

Taneja Aerospace and Aviation 1-Year Share Price Chart

The Giants & Tech Enablers #3 Hindustan Aeronautics

Hindustan Aeronautics is engaged in the business of manufacture of aircraft and helicopters and repair, maintenance of aircraft and helicopters.

Hindustan Aeronautics Ltd said FY2024-25 was a year of steady progress across manufacturing and maintenance programs. The company closed the year with a larger order book of about Rs 1.9 lakh crore, supported by new aircraft, engine and repair-and-overhaul (ROH) contracts. These include orders for helicopters, engines and upgrade programmes across multiple defence platforms.

The management said more orders are under consideration, including additional LCA Mark-1A aircraft, helicopters and Dornier upgrades. Further ROH contracts are also expected over the next few years, which are likely to keep production and overhaul lines busy through the coming period.

HAL has drawn up a five-year capital expenditure plan of about Rs 14,000–15,000 crore. The plan focuses on adding capacity for aircraft and helicopters and on building new ROH facilities for engines and platforms.

The company said this mix of manufacturing, lifecycle servicing and overhaul work is a key part of its long-term strategy. With more servicing activity expected to shift into India, HAL’s expanding overhaul infrastructure places it closely within the country’s growing aviation MRO and defence maintenance ecosystem.

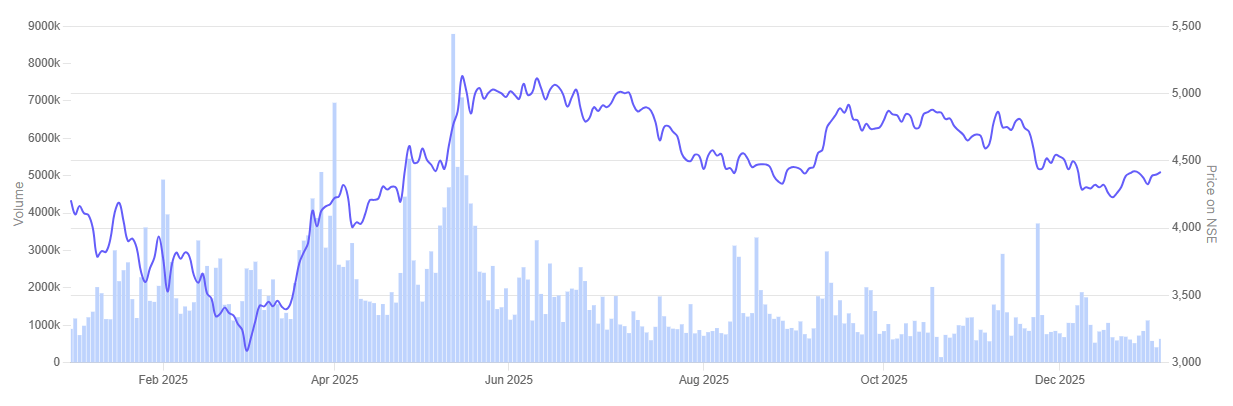

In the past year, Hindustan Aeronautics share price is up 5%.

Hindustan Aeronautics 1-Year Share Price Chart

#4 Ramco Systems

Incorporated in 1997, Ramco Systems develops ERP Software solutions, and provides that with related solutions and services.

Ramco Systems said FY 2024-25 was a year of steady work on its aviation and enterprise software businesses. The company continued to focus on its aviation MRO software platform, which is used by airlines and maintenance operators in India and overseas.

The management says there is progress on project deliveries and product upgrades for customers across the Middle East, Europe and Asia. These included improvements in digital maintenance records, planning tools and workflow systems for larger fleet operations.

Management said the year was spent strengthening product stability and tightening project execution across global delivery centres. The company also continued work on modules linked to maintenance scheduling, parts tracking and regulatory compliance, which support long-term aircraft servicing cycles.

Ramco said it will remain selective in expansion while focusing on aviation and logistics software as key growth areas. In the backdrop of more aircraft servicing activity moving to India and the region, the company’s aviation platform continues to operate as a technology partner to the wider MRO ecosystem, supporting maintenance and lifecycle servicing for client fleets.

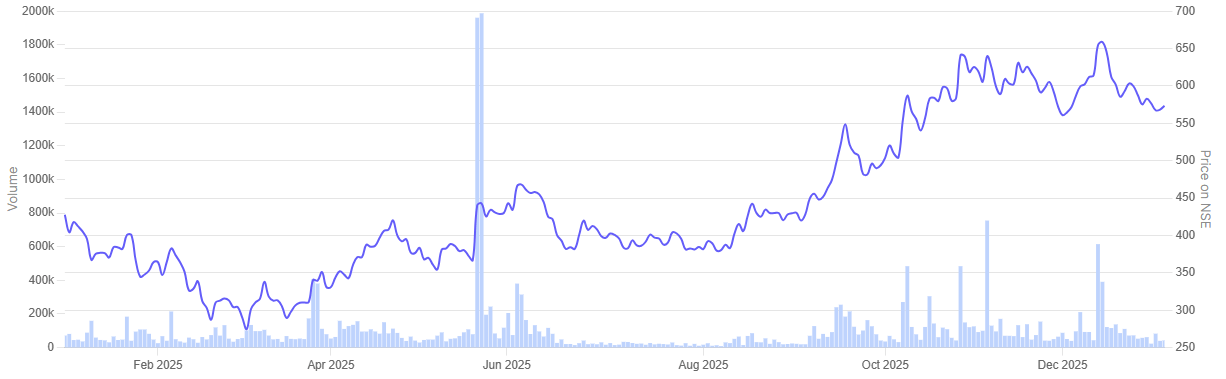

In the past year, Ramco Systems share price is up 34.9%.

Ramco Systems 1-Year Share Price Chart

Valuations

Let’s now turn to the valuations of the companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Companies in focus

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | TAAL Tech | 11.8 | 12.0 | 32.7% |

| 2 | Taneja Aerospace and Aviation | 27.0 | 34.3 | 17.4% |

| 3 | Hindustan Aeronautics | 19.6 | 34.3 | 33.9% |

| 4 | Ramco Systems | 16.2 | 20.2 | -5.4% |

TAAL Tech is trading close to the industry median multiple. Its ROCE is on the higher side. This shows that the business has been using its capital well and has been running its operations in a stable manner. For investors, the real question is whether these returns can hold as the company grows further.

Taneja Aerospace and Aviation, on the other hand, is trading at a lower valuation multiple than the industry median. Its ROCE is lower compared to some of the other companies in this group.

HAL trades at a relatively lower multiple, even though its ROCE remains strong. The market still appears conservative in valuing its defence and overhaul businesses, despite a long order pipeline and visibility in lifecycle servicing work.

Ramco Systems trades below the industry median and reports a negative ROCE. The losses in recent years are a key reason for this. Any meaningful re-rating would depend on a turnaround in execution and financial performance in its aviation software business.

In the end, investors need to see how much of the future growth story is already priced in, and whether current valuations leave enough margin of comfort.

Conclusion

The MRO story in India is still taking shape. More aircraft servicing and overhaul work coming into the country can create steady, long-term work for companies that operate in maintenance and aviation support.

But the market has already recognised this theme to some extent. In a few names, valuations reflect expectations of stronger growth ahead. In others, the pricing is still more measured, even though the order book and business visibility look healthy.

That is why each company needs to be seen on its own. Balance sheets, consistency of execution and stability of cash flows will matter as much as the broader theme.

For investors, the real comfort will be where business strength and reasonable valuations meet — and not just where the story sounds exciting.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.