Mukul Agarwal needs no introduction. One of the most followed and highly respected super investors of India, currently holds 65 stocks in his portfolio worth over Rs 8,000 cr. Touted as a guru by many investors, he has carved a niche for himself when it comes to picking stocks and building a portfolio.

No wonder the investor circles go abuzz every time he shuffles hi portfolio. His followers and other investors try to understand the rationale behind the picks and drops. Especially new investors, as they could benefit from following his proven track record.

So, here are the 6 big changes he made to his portfolio as per the latest exchange filings.

The fresh buy

Turning Green Energy to Profits – Solarium Green Energy Ltd

Incorporated in 2018, Solarium Green Energy Ltd is a solar energy company which specializes in integrated solar solutions and turnkey services.

With a market cap of Rs 719 cr, Solarium Green Energy Ltd offers turnkey solar solutions, covering design, procurement, construction, commissioning, and O&M for solar power plants. It serves residential, commercial, industrial, and government projects and sells solar products like PV modules, inverters, and meters.

Mukul Agarwal just bought a 2.9% stake in the company worth Rs 21 cr as per the exchange filings for the quarter ending September 2025.

The sales of the company grew at a compounded growth rate of 11% from Rs 167 cr in FY22 to 230 cr in FY25. The company files half yearly numbers and the filing for the quarter ending September 2025 are awaited.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) went from Rs 5 cr in FY22 to Rs 26 cr in FY25, logging in a CAGR of an impressive 73%.

Club that with the compounded net profit growth of 109% in the last 3 years, and it could be a reason Agarwal decided to pick aa stake in the company.

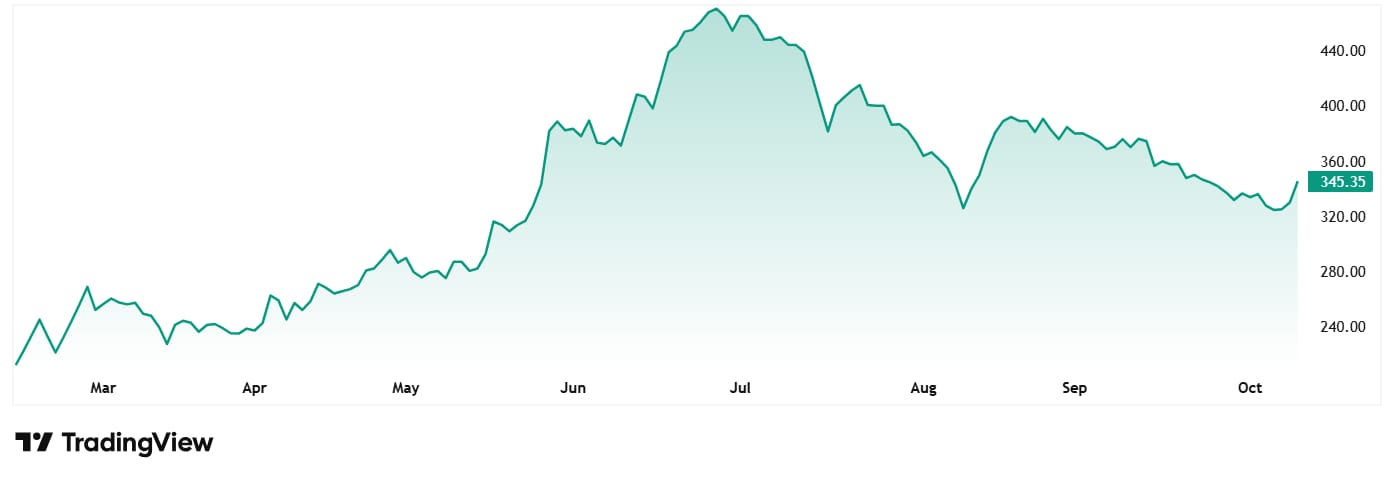

When it comes to the share price of Solarium Green Energy Ltd, it has jumped from Rs 211 on listening in February 2025 to its current price of Rs 345 (as of closing on 10th Oct 2025). That’s a jump of 64% in just over 7 months.

The stock is trading at a PE of 39x, which is much higher than the current industry median of 21x.

Solarium is rapidly scaling its residential rooftop and institutional EPC business, leveraging strong sectoral tailwinds and government policy support. Company is also executing a clear shift from trading to turnkey EPC, with robust order book and is investing heavily in people, technology, and channel development to support growth.

Apart from Solarium Green Energy Ltd, Agarwal also raised stake in two of his other holdings:

Monolithisch India Ltd: Agarwal raised his stake in the company from 2.3% in the quarter ending June 2025 to 3% for the quarter ending September 2025, making the total holding worth Rs 27.5 cr.

WPIL Ltd: Agarwal’s holding in this company went from 1.4% in the quarter ending June 2025 to 1.5% for the quarter ending September 2025, making the total holding worth Rs 67.2 lacs.

Those were the additions made. Let us now see the big drop from his portfolio.

Warren Buffett’s of India disagree – Raghav Productivity Enhancers Ltd

Incorporated in 2009, Raghav Productivity Enhancers Ltd is engaged in manufacturing of quartz based ramming mass, quartz powder, and tundish board. It sells its products under the brand name of “Raghav.”

With a market cap of Rs 3,323 cr, Raghav Productivity Enhancers Ltd is the largest manufacturer of Silica Ramming Mass, a high-purity refractory material used to line induction furnaces, shielding them from extreme temperatures and chemical reactions during metal melting, while offering strong thermal and mechanical durability.

Mukul Agarwal had held a stake in Raghav at least since December 2022 as per Trendlyne.com. However, as per the recent exchange filings for September 2025, the holding has gone below 1%, meaning a partial or a complete sell off.

What makes this exit more interesting is that as Agarwal exited the stock, his fellow Warren Buffetts of India, Utpal Sheth and Rekha Jhunjhunwala held on strong to the stock with 3.7% and 4.8% stake, respectively.

The sales of the company jumped from Rs 65 cr in FY21 to Rs 200 cr in FY25 which logs in a compound growth of 32.5% in 4 years.

EBITDA grew from 15 cr to Rs 54 cr in the same period, logging in a compounded growth 38%. The Net Profits climbed at a compound rate of 43% from Rs 9 cr in FY21 to Rs 37 cr in FY25.

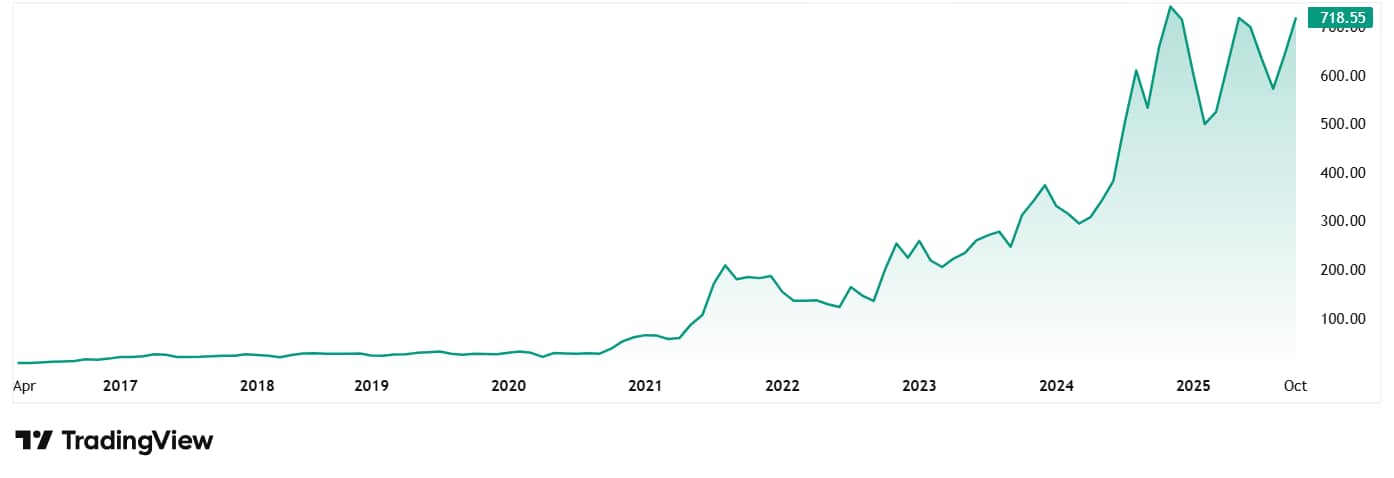

The share price of Raghav Productivity Enhancers Ltd was around Rs 35 in October 2020 and as of closing on 110th Oct 2025, the price was Rs 724, which is a jump of almost 1970%. Rs 1 lac invested in the stock 5 years ago would have been close to Rs 21 lacs today.

The company’s stock is trading at a PE of 82x, while the industry median is 46x. The 10-year median PE for the company is 59x and the industry median for the same period is 27x.

The company recently declared a dividend of Rs 1 per share in August 2025. In November 2024, the company had also executed a 1:1 bonus share issue.

According to the investor presentation from August 2025, the company is going to focus on 2 areas for capacity expansion of Ramming Mass rapid offtake of value-added ramming mass driving full utilization of new capacity in less than 2 years of commissioning. And rising global demand from induction furnaces fuelling the need for new greenfield projects to increase ramming mass capacity.

Apart from the selloff of Raghav, Agarwal also trimmed stake in two holdings:

PDS Ltd: Agarwal dropped his stake in the company from 2.5% to 2.4% between the quarters ending June 2025 and September 2025. The overall stake is now worth Rs 104.5 cr.

Vasa Denticity Ltd: The company saw a drop in Agarwal’s stake as he trimmed it from 2.5% to 2% between quarters ending June 2025 and September 2025.

Strategic Rejig or Hidden Signals?

The big changes by Mukul Agarwal we saw today are remarkably interesting changes. And given that Agarwal’s movements usually influence the investor community, it makes a lot of sense to find out as much as possible about these changes.

Every company we discussed today has a different story to tell and why Agarwal decided to buy, sell off, add stakes, or trim stake in them is something only he could answer. Only time will tell if this was a strategic rejig or were there hidden signals that investors ignored.

But one thing is sure! Mukul Agarwal is not one to make such big reshuffles without a solid reason or rationale. There might be something deeper here that only time will reveal. A good strategy would be to add these stocks to a watchlist and keep a very vigilant eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, he was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.