Affluent Indians have never spent more. From destination weddings to designer bags, from five-star brunches to Rs 5 lakh sofas, the wallet of urban India is stretching wider every year. The number of affluent households is set to double by the end of this decade. And they aren’t saving – they’re spending, loudly and proudly.

According to The World Market for Luxury Goods 2025 report from Euromonitor International, the Indian luxury market is projected to reach $12.1 billion this year growing at a 74% compounded annual growth rate, among the fastest in the world.

Also, according to the report, 81% of global luxury sales still occur in physical stores, proving that the joy of “being seen while buying” still counts. As Euromonitor’s Fflur Roberts explains, luxury has turned from product-centric to experience-driven: wellness, lifestyle, and emotional resonance are the new status symbols.

That makes luxury consumption one of the most exciting themes on Dalal Street. When aspiration meets income, it creates an investment story too good to ignore. So in this article, we explore five luxury stocks that mirror this evolution-companies that could help investors tap into India’s growing appetite for premium experiences and products.

These companies were not selected on the basis of intricate financial models or valuation screens, but based on their clear positioning in India’s evolving luxury landscape. They represent brands that are visibly associated with aspiration, exclusivity, and lifestyle upgrades for the urban consumer.

Together, they reflect how India’s affluent class is redefining consumption-from necessity to experience and from access to distinction-and how investors can participate in this long-term structural trend.

#1 Titan Company

Titan Company is among India’s most respected lifestyle companies. It has established leadership positions in the Watches, Jewellery and Eyewear categories led by its trusted brands and differentiated customer experience. In 1984 it was established as a joint venture between TATA Group and Tamilnadu Industrial Development Corporation (TIDCO).

This Tata Group company’s luxury and premium portfolio keeps growing at a quick pace, driven by steady growth in jewellery, watches, and emerging lifestyle segments. The company’s Q2 FY26 revenue grew 21% year-on-year, due to strong festive demand across its luxury brands like Tanishq, Zoya, and CaratLane.

In one of its important global moves, in July 2025, Titan acquired controlling stake in Damas Jewellery. Damas is one of the most prestigious luxury retailers in the Gulf Cooperation Council (GCC) region. The acquisition aims to boost its international presence and brand name in the upscale markets.

The shift toward expensive choice was also visible in the company’s watch business. Brands such as Police and Aigner helped lift average selling prices in the watch segment. With a Rs 3 trillion market capital as of 30th September 2025 and over 3,300 stores across the world, Titan is one of India’s strongest consumer plays in the luxury space.

In the past one-year Titan share price has rallied 18.2%.

Titan 1 Year Share Price Chart

#2 Ethos

Ethos was incorporated on November 5, 2007 and promoted by KDDL. Ethos is India’s largest luxury and premium watch retail player.

Ethos reported a 26.7% YoY increase in revenues for Q1 FY26 on the back of fast-expanding demand for premium timepieces, coupled with an increasing high-net-worth clientele base.

The company launched its flagship, ‘City of Time’, a 22,000 sq. ft. Haute Horology destination housing exclusive boutiques for global watchmakers and lifestyle brands, setting a new benchmark in experiential luxury retail. It also introduced India’s first Messika Paris boutique to mark the formal entry of the French jewellery house into the country.

While the operating margins have been stressed at Ethos owing to currency rate volatility, that hasn’t held this business from investing in brand partnerships, boutique expansion, and experiences for the high-end customer. In the Indian market, where it has 80 stores across 26 cities, it is building a position as a gateway to international luxury brands.

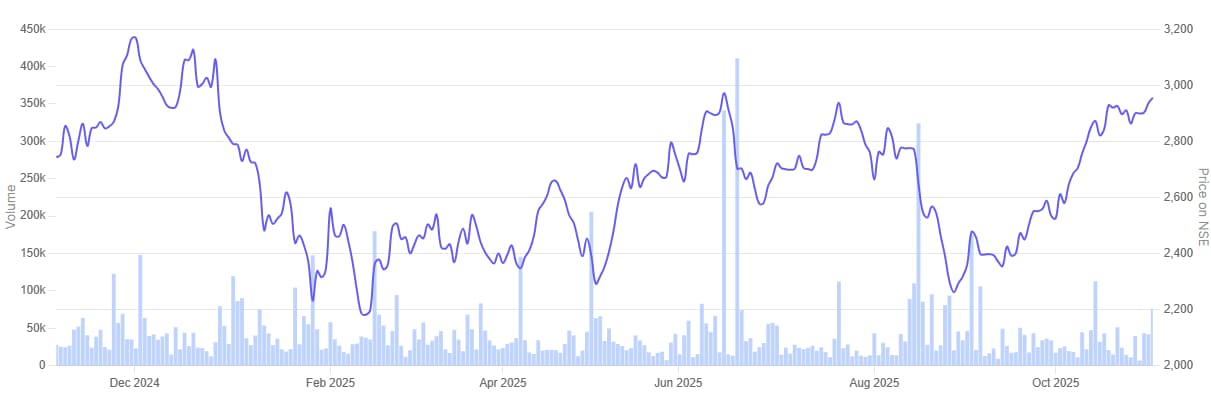

In the past one-year Ethos share price is up 7.5%.

Ethos 1 Year Share Price Chart

#3 Indian Hotels

Indian Hotels Company (IHCL) is one of India’s leading hospitality companies. IHCL and its subsidiaries comprise diversified portfolio across luxury, upscale/upper upscale and lean luxury/midscale segments. IHCL’s operations are spread across four continents, 12 countries and over 100 cities.

Many of the marquee projects of The Indian Hotels Company remain on track as the firm marks its leadership position in the luxury and upper-upscale segments.

Major renovations were completed at The Chambers in the Taj Mahal Palace, Mumbai, while construction started at the upcoming Taj properties in Lakshadweep, Ranchi and Taj Bandstand as the Taj Hotel, Mumbai completed 50 years in Q2 FY26.

This will be further supplemented by key brownfield expansions, including Taj Ganges Varanasi and Taj Lucknow, expected before FY27. The company is also likely to add 30 hotels of over 3,000 keys in FY26, besides the acquisition of its Clarks deal that will add 135 hotels and over 6,800 keys.

With more than 85% occupancy and an ARR of over Rs 16,000 at its flagship Taj properties, IHCL leads the Indian luxury hospitality landscape. It will most likely continue to record steady double-digit revenue growth through FY26.

In the past one-year Indian Hotels share price is up 11.6%.

Indian Hotels 1 Year Share Price Chart

#4 Aditya Birla Fashion and Retail

Aditya Birla Fashion and Retail (ABFRL), is among India’s largest apparel and lifestyle companies under the Aditya Birla Group. It owns brands such as Louis Philippe, Van Heusen, Allen Solly, and Peter England, and partners with global labels like Ralph Lauren and Ted Baker.

The company recently demerged its Madura Fashion business to sharpen focus on premium, luxury, and international brands — a strategic shift aligning with India’s rising affluent consumer base.

ABFRL has posted 13% YoY growth in revenue during Q2 FY26, riding on growth from its businesses comprising luxury and ethnic wear.

The luxury segment, comprising The Collective and various international mono-brand stores, witnessed a 13% YoY growth on the back of new openings and continued online traction. It has also introduced the ultra-luxury department store format under the brand Galeries Lafayette at Kala Ghoda in Mumbai.

The designer-led brand portfolio comprising brands such as Shantanu & Nikhil, Tarun Tahiliani and Sabyasachi also reported healthy growth across categories. It houses over 46 luxury and international brand stores, reaffirming ABFRL’s position as a critical bridge between global fashion and the emerging affluent consumer base of India.

In the past one-year Aditya Birla Fashion and Retail share price has tumbled 26.2%.

Aditya Birla Fashion and Retail 1 Year Share Price Chart

#5 Stanley Lifestyles

Incorporated in 2007, Stanley Lifestyles manufactures and trades furniture and leather products.

Stanley Lifestyles performed steadily in the luxury home segment despite a cautious consumer environment and delays in property handovers. Revenue stood at Rs 1,087 million for Q1 FY26, up 7.9% YoY due to a 25% increase in retail sales for brands Stanley Level Next and Sofas & More.

All stores opened in FY25 have reached their breakeven, reflecting efficient execution and location strategy. During the quarter, two new stores were added to take the total count to 68 outlets. 60% of revenues come from company-owned, company-operated stores.

The company further acquired Shrasta Décor, expanding its presence in Hyderabad with three new stores planned over the next two quarters. With a continuing focus on the premium COCO model and high-end urban markets, Stanley will be well-placed for India’s growing demand for luxury furniture.

In the past one-year Stanley Lifestyles share price has nosedived 42.9%.

Stanley Lifestyles 1 Year Share Price Chart

Growth

Now let’s take a look how the rise in high-end consumer has boosted the sales of these five companies in the past five years.

Sales Growth of Luxury Stocks in India

| Sr No | Company Name | 5 Year CAGR Sales Growth |

| 1 | Titan Company | 23.5% |

| 2 | Ethos | 22.3% |

| 3 | Indian Hotels | 13.3% |

| 4 | Stanley Lifestyles | 15.6% |

*Note: Aditya Birla Fashion and Retail has been excluded from the table, as its Madura Fashion & Lifestyle division was demerged in FY24. Prior to the restructuring, the company recorded a sales CAGR of approximately 15% between FY20 and FY23.

The sales growth data highlights how the luxury leaders of India have gradually expanded their revenues along with the country’s rising need for premium goods and experiences.

Titan and Ethos have outdone peers, reflecting strong brand pull and widening customer bases within jewellery and high-end watches. Indian Hotels’ growth reflects the increase in demand of premium hospitality, while Stanley’s steady performance shows the gradual formalization of the luxury home segment.

In short, these numbers suggest India’s luxury story is not a short-term trend but a sustained consumption upgrade – one that keeps creating long-term opportunities for well-positioned brands.

Valuations

Let’s now turn to the valuations of the luxury companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of luxury stocks in India

| Sr No | Company | EV/EBITDA | Respective Industry EV/EBITDA Median | ROCE |

| 1 | Titan Company | 47.5 | 17.8 | 19.1% |

| 2 | Ethos | 37.4 | 17.8 | 13.8% |

| 3 | Indian Hotels | 34.0 | 16.5 | 17.2% |

| 4 | Aditya Birla Fashion and Retail | 12.1 | 15.6 | -2.9% |

| 5 | Stanley Lifestyles | 15.4 | 24.2 | 10.1% |

Valuations through the EV/EBITDA lens reflect a sharp divergence in investor perception across India’s luxury stocks.

Titan, Ethos, and Indian Hotels have a trading multiple well in excess of their respective industry medians, representing market confidence in their pricing power, brand equity, and capability to monetize the affluent demand.

The multiple on Titan represents the near monopoly it enjoys in aspirational jewellery; Ethos is at prices in its niche dominance but modest returns, while Indian Hotels capture optimism in high-end travel and premium hospitality.

On the other hand, Aditya Birla Fashion & Retail and Stanley Lifestyles are trading below their respective industry medians. This reflects how investors continue to wait for stability and rising earnings. This difference in EV/EBITDA level just shows how the market rewards brand name but punishes for execution failure even when the company trades within the same luxury theme.

Conclusion

The India luxury consumption story is still in its early stage. As incomes rise and the line between aspiration and affordability blurs, spending on jewellery, premium travel, designer wear, and upscale living evolves from indulgence to identity.

It’s a broad-based trend, led by younger earners and non-metro affluence, which would suggest that the luxury market of today is no longer the preserve of a small elite. At the same time, though, with valuations rising across most premium consumer names, investors need to be aware that much of this optimism is already priced in.

Success here will be sustained based not on sentiment but on brand relevance, execution, and scalability. Investors need to take a deep dive into the fundamental evaluation, strength of the balance sheet, and growth visibility to identify businesses that can truly compound value over time before taking exposure.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.