“The best investment opportunities are often hidden in plain sight, waiting for those who look beyond the obvious.”

Indian railway technology is one such imperative. A segment frequently overshadowed by news-making tales in other sectors like IT and electric cars. But soon there could be a well-deserved shift. As India goes big on its vision to develop a faster, safer, and smarter rail network, cutting-edge technology is assuming a lead role like never before.

New developments indicate that Indian Railways is formulating a detailed new master plan to revamp its train control and operating systems. This will finally take the place of outdated, century-old signalling and control systems with high-tech digital and automated ones for enhancing speed as well as security. A pillar of this tech revamp is KAVACH, India’s indigenous automatic train protection system intended to avoid collisions and reduce human errors — a daring leap towards establishing an entire ecosystem of fully automated rail.

This grand vision towards electrification, automation, and indigenous technology solutions is not merely a policy change; it is also laying fertile ground for railway electronics, signalling, control system, and safety technology companies.

Five Indian companies — each with a minimum market capitalization Rs 500 crore — are already making preparations to take advantage of this momentum. Though they are not pure-play rail tech companies per se, a significant portion of their business is based on railway projects, and they are betting big on this sector to ride the increasing demand.

Of course, this is not a definitive list. But for investors wanting to catch India’s next big infrastructure and tech story, these stocks provide a compelling place to start as they prepare to climb on board the railway tech express.

Here are details of these five stocks.

#1 Railtel Corporation

RailTel was incorporated in 2000, with the objective of creating nationwide broadband and VPN services, telecom, and multimedia network, to modernize the train control operation and safety system of Indian Railways.

It is a “Navratna” PSU of the Government of India. At present, RailTel’s network passes through around 6,000 stations across the country, covering all major commercial centres.

RailTel is at the forefront of making India’s rail network modern, transforming from an in-house telecom provider to a key technology and information and communications technology (ICT) solution partner. Its strong rail tech direction can be seen through initiatives such as electronic interlocking of 26 Northern Railway stations, integrated tunnel communication systems, and IP-based control communication on Western Railway.

The organization is promoting LTE-R projects, such as 4G LTE-R ground infrastructure on 523 RKM of Secunderabad Division, and pursuing KAVACH safety projects actively in a collaboration with Quadrant Future Tek. In the pursuit of developing expertise, it has initiated a Centre of Excellence with IITs in signalling, telecom, and cybersecurity.

In FY24, project segment of RailTel contributed Rs 1,302 crore, for the first time more than telecom services. It captured Rs 556 crore in railway orders, which is a proof of its good standing. With an order book of Rs 4,750 crore and a planned capex of Rs 250 crore in FY25, RailTel is ready for stable growth.

As it searches abroad for opportunities, such as at Vietnam Railways, RailTel is diversified in health, mining, smart cities, and cloud services, and is not strictly a rail tech company. All in all, its signalling, safety systems such as KAVACH, and digitalization focus places it firmly in the rail tech sector, with a balanced growth strategy.

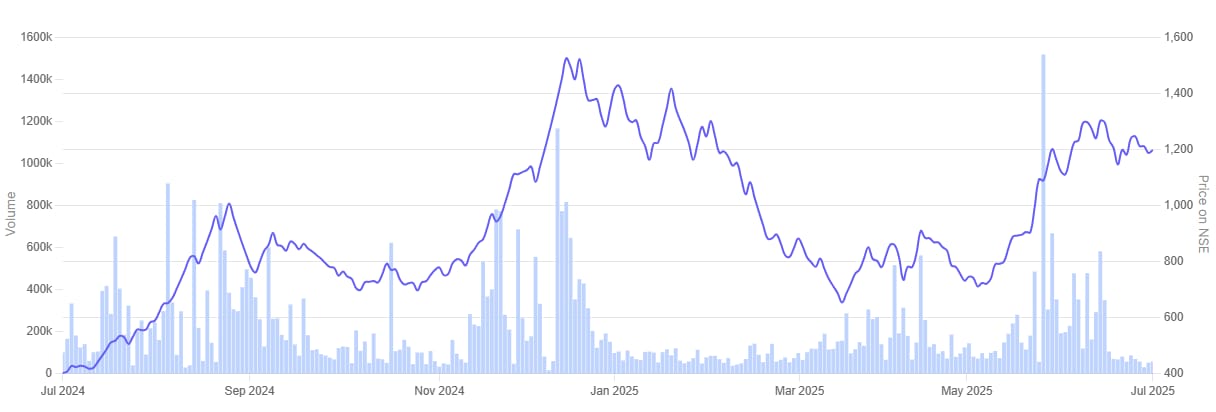

Railtel Corporation – 1 Year Share Price Chart

#2 HBL Engineering

Incorporated in 1983, HBL Power Systems manufactures and services different types of batteries, e-mobility, and other specialized engineering products.

Reflecting its strategic diversification away from conventional battery and power offerings to new age engineering domains such as railway electronics, defence technology, and e-mobility, the company formally renamed itself as HBL Engineering on 13 November 2024 upon approval from the Ministry of Corporate Affairs.

It earned RDSO certification for Version 4.0 of its Kavach train protection system, the first company to achieve this certification. Until May 2025 it was the sole company with this certification. This milestone will allow it to fulfil an order book of Rs 3,764 crore, to be executed in 24 months.

In spite of this robust pipeline, FY25 sales declined to Rs 1,946 crore from Rs 2,209 crore in FY24, mainly on account of delayed Kavach tenders, which resulted in a Rs 141 crore shortfall. Yet, the firm hopes sales will recover to nearly Rs 3,000 crore in FY26 as these projects scale up.

The electronics business — which encompasses rail-tech offerings such as Kavach — added Rs 2,984 crore in FY25. While not exclusively from railways, it points to the segment’s increasing significance.

In the future, HBL intends to ramp up production of Kavach, work on next-generation electronics, and enter international markets. The management is cautious, recognizing challenges such as delays in tenders and risk in execution.

While its rail concentration is building, HBL is still diversified into industrial and defence batteries and thus not a pure-play rail tech company. On balance, HBL is consistently targeting rail tech opportunities by virtue of leadership in safety systems such as Kavach, supplemented by a diversified growth strategy.

HBL Engineering – 1 Year Share Price Chart

#3 Kernex Microsystems

Incorporated in 1991, Kernex Microsystems manufactures and sells safety systems and software services for railways.

Kernex Microsystems is strongly committed to the railway safety and signalling industry and is a specialist company without being diversified. It produces and installs Train Collision Avoidance Systems (TCAS), branded as Kavach, with robust in-house R&D and a production capacity of 450 units per month.

For FY25, Kernex registered standalone revenue of Rs 9,450 crore, up sharply from Rs 2,119 crore in FY24, driven by strong growth in rail-centric orders. Its order book was Rs 2,124 crore as of March 2025, comprising Rs 1,735 crore from sole Kernex orders and the balance with partners.

The future pipeline is robust, with bids of Rs 3,023 crore already in the bag and more bids of 4,250 km amounting to Rs 889 crore, along with upgradation bids of Rs 121 crore. The major projects under way are TCAS installation in NCR, level crossing gates in ENR, and automatic block signaling to be implemented in December 2025.

Kernex is also concluding TCAS 4.0 hardware and software and creating new solutions such as network management systems, pulse generators, and radio modems, to be rolled out between 2025.

Although well placed, Kernex is exposed to risks of execution delays and reliance on government tenders, with some of its project milestones already running over schedule.

In total, Kernex is consolidating its position as a core rail tech player, chasing ambitious but realistic growth on India’s railway modernization while carefully handling execution challenges.

Kernex Microsystems (India) – 1 Year Share Price Chart

#4 Siemens

Siemens offers products and integrated solutions for industrial applications. It serves various manufacturing industries and provides drives for process industries. The company also focuses on intelligent infrastructure and smart buildings. It works on efficient and clean power generation from fossil fuels and for oil & gas applications.

Siemens is active in the transmission and distribution of electrical energy. It also supports passenger and freight transportation. This includes rail vehicles, rail automation, and rail electrification systems.

The company has a January–December calendar year.

It is making Mobility a major growth pillar. The areas of focus are locomotives, metro systems, and signalling enhancements such as Kavach. Its 9,000 horsepower locomotive project is moving forward, and Siemens will accelerate production from 5 units to start with to 100 units annually in the next few years.

Mobility revenue for H1 FY25 was Rs 740 crore. The order book remains healthy at Rs 2,420 crore, up almost 300% compared to last year. Margins reduced slightly to 8.2% on account of pre-execution investments but will increase as volumes pick up.

In the rail technology domain, Siemens is concentrating on cutting-edge signalling, rolling stock propulsion systems, and metro electrification. It is playing an active role in metro and high-speed rail projects and views signalling as a significant long-term opportunity. Siemens anticipates that these technologies will have strong demand in the next five to seven years but does not give discrete revenue figures for rail tech in this interview.

Management remains conservative because of execution risks and reliance on public capex. The strategy is margin-driven and consistent, not too aggressive. Siemens is looking to develop a robust, sustainable rail tech business over the next few years.

Siemens shares are down about 18.2% over the past year. This reflects market caution on public capex dependency and execution risks. It comes despite strong mobility order wins and long-term growth plans.

Siemens (India) – 1 Year Share Price Chart

#5 Jupiter Wagons

Jupiter Wagons (JWL) is primarily involved in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components.

JWL continues to consolidate its position as a rail-centric engineering and mobility solutions provider. During FY25, it registered standalone revenue of Rs 3,905 crore, an increase of 6.6% YoY, while the consolidated revenue stood at Rs 4,008 crore. The rail business remains central on the back of wagon manufacturing, brake systems, and wheels.

JWL delivered 8,700 wagons in FY25 and targets 10,000 wagons in FY26, subject to wheel set availability. The Odisha wheel and axle facility is a major strategic project, with Rs 3,500 crore investment and capacity for 100,000 wheel sets annually. It is expected to add Rs 3,000 crore revenue once fully operational by FY28–FY29.

The brakes business segment achieved over Rs 100 crore in FY25 and is likely to double in FY26. JWL has a leadership private market share, having been aided by robust container rake orders.

Diversifying into EVs and batteries, rail being the anchor, revenue is guided towards Rs 8,000–Rs 10,000 crore by FY28. The management continues to be guarded on supply chain concerns and likes to take conservative guidance.

Its share price is down approximately 44% over the past year. Share price declined due to market concerns over supply chain bottlenecks and project execution delays, despite strong growth in wagon production and forward-looking capacity initiatives,

Jupiter Wagons – 1 Year Share Price Chart

Conclusion

India’s rail tech industry is undoubtedly at a tipping point, stepping out of the shadows to be a compelling long-term tale. With the impetus towards safety systems, automation, and high-speed modernization, the foundations are being set for revolutionary growth. Yet even as this “tech express” gathers pace, investors must view it with a balanced eye.

In addition to the euphoria of new projects and big order books, it is essential to analyse every company on the basis of fundamentals including valuations, order execution capacity, balance sheets, and margin durability. Paying close attention to items such as return ratios, working capital cycles, and management record can distinguish short-term mania from genuine long-term potential.

In the end, though, the promise of opportunities in rail tech will be realized by sticking to disciplined fundamentals rooted in solid financial and operating metrics. To those who peer beneath headlines and balance these underlying fundamentals, the ride on rail tech could be an attractive — and, more importantly, sustainable — investment proposition.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.