The Indian stock market is a very scary place for people who do not know what they are doing. Thousands burn up their hard-earned money every year. But even in that market, some investors stand out thanks to their deep research and strategical investing. These are super investors, who we like to call the Warren Buffetts of India. They are religiously followed by investors from across the board.

And two of these who are worthy of being called the true Warren Buffetts of India just sent shockwaves thrrough the investor community with their big sell offs. One of them is Radhakishan Damani, The Retail King of India and the other is Nemish Shah, the founder of ENAM Securities, that recently merged its investment banking and broking operations with Axis Bank.

Which are these stocks that lost favour from two of the most respected super investors of India. Let us take a deep dive…

A Tata Group global giant – Trent Ltd

Trent Ltd is a Tata Group company that started off as Lakme in 1952 and was formed when the group ultimately divested its cosmetics business and ventured into apparel retailing, recognizing the potential in that sector.

With a market cap of Rs 1,70,076 cr, Trent is engaged in retailing of apparels, footwear, accessories, toys, games, food, grocery & non-food products through various of its retail formats/ concepts.

Retail King Radhakishan Damani started with a 2.74% stake in the company that he held since December 2015 (as far as the data on Trendlyne.com shows), through his company Derive Trading and Resorts Private Limited. According to some sources, he bought the shares initially in 2010, but Trendlyne shows data only as far as December 2015.

For the quarter ending June 2025 his holding was 1.2% and as per the filings made for the quarter ending September 2025, that holding has fallen below 1%, meaning a full or partial exit.

So, what has made Damani sell this Tata Group company which he had been holding for a decade now.

The company’s sales were at Rs 3,486 cr for FY20 which climbed to Rs 17,135 cr for FY25, which is a compounded growth of 38% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Trent was Rs 529 cr in FY20 which grew to Rs 2,820 as of FY25, logging in a compound growth of about 40%.

The net profits for Trent saw a compound growth of 67%, from Rs 106 cr in FY20 to Rs 1,534 cr in FY25.

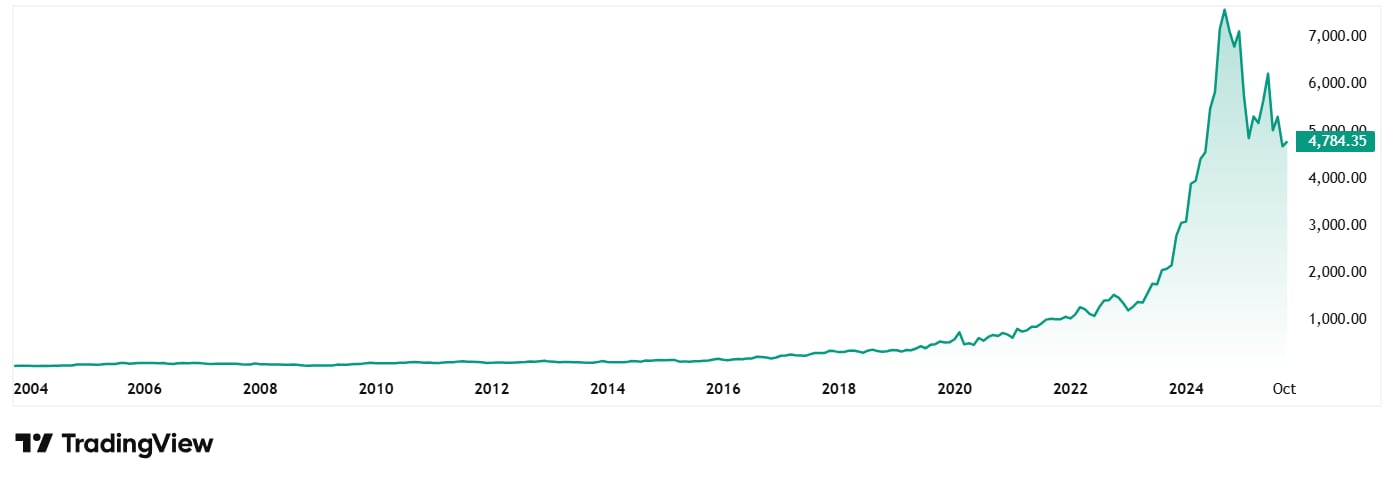

The share price of Trent was around Rs 635 in the latter half of October 2020, and as on closing of 23rd October 2025 it was at Rs 4,783, which is over a 650% jump in 5 years.

If one had invested just 1 lac in the company 5 years back, it would today be over Rs 750,000.

The share price however has seen a fall of over 36% from about Rs 7,500 in October 2024 to its current price of Rs 4,783. This is largely due to concerns regarding the company’s ability to continue growing rapidly in future as a result of which the valuation multiples have moderated.

Even then, the company’s share is trading at a PE of 107x, while industry median is just around 42x. The 10-year median PE for Trent is 151x, while the industry median for the same period is again around 42x.

Trent however boasts of a current ROCE (Return on Capital Employed) of 30% while the industry median is 17x. It means that for every Rs 100 Trent spends as Capital, it earns Rs 30 in profits. Plus, the company maintains a healthy dividend payout of

On the darker side, the company’s debt has gone from Rs 300 cr 5 years ago to Rs 2,237 cr. The stock is also trading at 31.1 times its book value and the dividend yield is just 0.10%.

In the latest Annual report, the Chairman Noel Tata said “Two years ago, I had envisioned that Trent would one day be ten times bigger. Since then, the revenue run rate has doubled. The head room for growth remains enormous, and I am confident that we will reach this milestone in the not-too-distant future.”

Driving India’s auto component industry – The Hi-Tech Gears Ltd

Incorporated in 1986, The Hi-Tech Gears Ltd is an auto components manufacturer primarily engaged in the business of manufacturing gears and transmission components.

With a market cap of Rs 1,479 cr, The Hi-Tech Gears is an auto component manufacturer which supplies engine and transmission components to various OEMs in India and abroad.

One of the Warren Buffetts of India, Nemish Shah, bought a 7% stake in the company in December 2015 as per data on Trendlyne.com. He might have held it earlier, but Trendlyne shows data for as far as 2015. As of the quarter ending June 2025, his holding was 3.09% which according to the recent exchange filings for the quarter ending September 2025, fell below 1% hinting at a partial or complete sell off.

The company’s sales grew from Rs 722 cr in FY20 to Rs 927 cr in FY25, which is a compounded growth of 5%. However, the FY25 figure was a fall from the previous financial year’s figure of Rs 1,107 cr.

Same is the case with EBITDA. It grew from Rs 84 cr in FY20 to Rs 136 cr in FY25 logging in a compound growth of 10%, but the FY25 figure of Rs 136 cr was a decline from previous years Rs 150 cr.

The net profits is an area that could have been a concern for a value investor like Nemish Shah, as it saw a good upward trajectory but failed to sustain the same.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 8 | 29 | -1 | 23 | 114 | 40 |

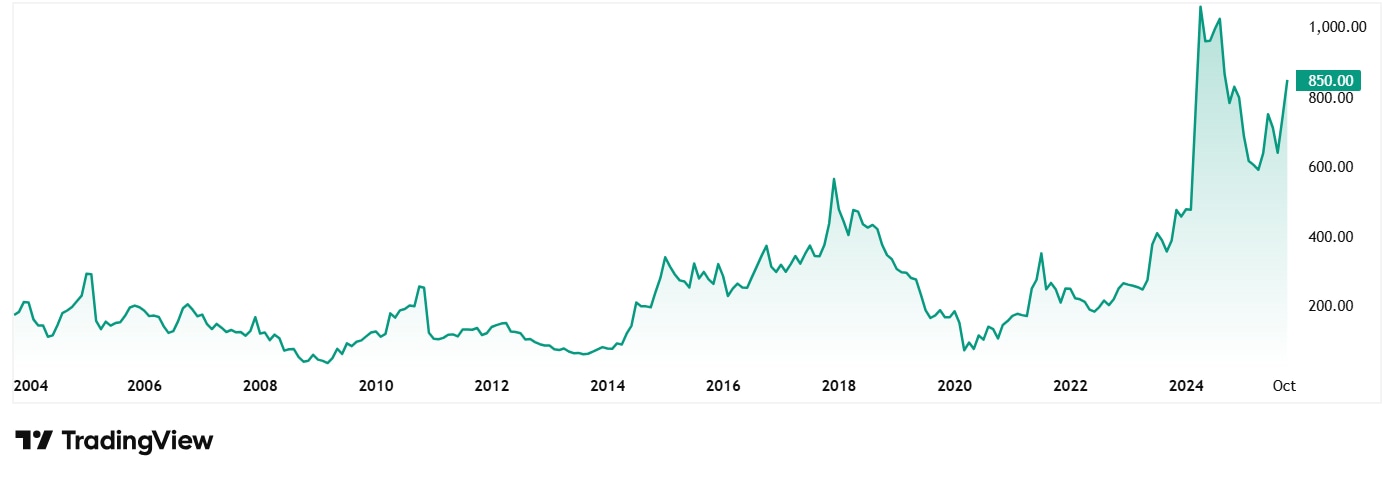

Hi-Tech Gears share price was around Rs 106 in October 2020 which has grown to its current price of Rs 825 as of closing on 23rd October 2025. That is a jump of almost 680%.

The share is trading at a PE of 46x, while the industry median is 32x. The 10-year median PE of Hi-Tech Gears is 25x and the industry median for the same period is 31x.

As per the recent investor presentation form August 2025, the company is betting big on Electric Vehicles (EVs) and advanced technologies to drive growth. The company is diving deep into the EV market, producing differential assemblies for high-torque, high-speed applications, and securing EV business from giants like Hero MotoCorp and Dana, while actively quoting for more.

Strategic exits or landmine tragedy averted?

When investors like Radhakishan Damani and Nemish Shah sell stocks that they held for a decade, it deserves the attention of every smart investor. Especially when the stocks in question are known names and have a strong future plan in place according to their management.

While Trent’s stock price fall in the last year could be attributed to concerns related to growth prospects, its overall fundamentals seem right in place. On the other hand, Hi-Tech Gears saw backing by Nemish Shah for a decade, but its lack of a sustainable profit’s trajectory could have pushed Shah away, but it’s only an assumption at this point. The reason behind these exits is best known to the two Warren Buffetts of India.

But what should a smart investor who either holds these stocks in their portfolio, or was planning on adding them to it, do now? Well, the best course of action right now would be to add these stocks to a watchlist and keep a very close eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.