One of India’s most respected and highly followed super investor, Ashish Kacholia, also known as the Big Whale of the market, has just added 2 new stocks to his portfolio worth Rs 72 cr .

Kacholia currently holds 48 stocks in his portfolio across diverse sectors like hospitality, education, infrastructure and manufacturing etc worth Rs 2,861 cr. His track record of picking winners is known to all, which is why he deserves a spot in our list of the India’s Warren Buffetts.

These two stocks that he has added to his portfolio have clocked 60% and 95% compounded profit growth in the last 3 years and have also recorded solid returns on capital employed. Is this the right time to follow Kacholia and get in on the stocks?

A defence-focused manufacturer – refrigeration & HVAC

Incorporated in 2006, Shree Refrigerations Ltd is a defence-focused manufacturer of advanced refrigeration and HVAC systems.

With a market cap of Rs 926 cr, the company is engaged in the business of manufacturing Chillers, refrigeration and air conditioning appliances and other parts of Heating, Ventilation, Air Conditioning (HVAC) Industry.

The company is actively involved in manufacturing of marine chillers, having approved supplier registrations from various professional directorates of Indian Navy (Directorate of Electrical Engineering and backed by Directorate of Quality Assurance – Warship Projects).

Ashish Kacholia bought a 3.4% stake in the company worth Rs 32 cr, as per the exchange filings for the quarter ending September 2025.

The company’s sales have grown from Rs 13 cr in FY20 to Rs 99 cr in FY25, which is a compounded growth of 50% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) in the same period grew from a loss of Rs 1 cr to a profit of Rs 27 cr.

As for the net profits, the company recorded a turnaround, as from making losses of Rs 3 cr in FY20 it grew to making profits of Rs 14 cr in FY25, In the last 3 years however (FY22-FY25), the compounded profit growth is 60%.

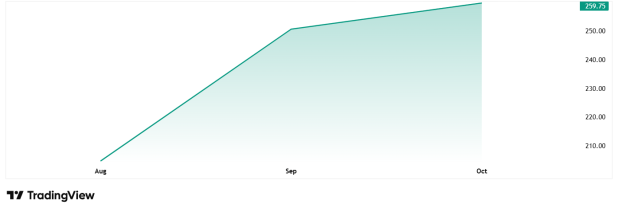

The share price of Shree Refrigerations Ltd was about Rs 175 on listing in August 2025 and as of closing on 27th October 2025, it was at Rs 260, which is a jump of almost 49%.

The company’s share is trading at a current PE of 67x, while industry median is 36x.

As per the company’s last annual report, the management is cautiously optimistic and expects to leverage its strengths to reinforce market leadership and pursue selective expansion, supported by disciplined financial management and operational excellence, despite potential external challenges.

An engineering profit champion

Incorporated in 2008, Vikran Engineering Limited is an Engineering, Procurement, and Construction (EPC) company.

With a market cap of Rs 2,652 cr the company is a comprehensive EPC company specializing in infrastructure projects, power transmission, EHV substations, and water infrastructure. They provide end-to-end services encompassing design, supply, civil works, construction, testing, and commissioning.

Kacholia bought a 1.5% stake in the company worth Rs 40.5 cr. Mukul Agarwal, another Warren Buffett of India also bought a 1.2% stake in the company,

The company’s sales jumped from Rs 441 cr in FY20 to Rs 916 cr in FY25, logging in a compound growth of 16% in the last 5 years.

EBITDA has grown at a compound rate of 19% from Rs 68 cr in FY20 to Rs 162 cr in FY25.

The net profits of Vikran Engineering grew at a compounded rate of 18% in the same period. However, for the last 3 years (FY22-FY25), it grew at a compounded rate of 95%.

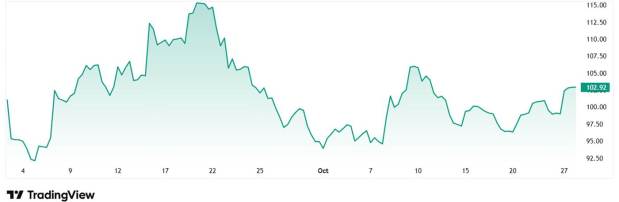

The share price of Vikran Engineering Ltd was around Rs 95 when listed in early September 2025 and as on closing of 27th October 2025, it was Rs 103.

The share is trading at a PE of 34x, while the industry median is 22x.

As per the company’s latest investor presentation from September 2025 says, “As of June 30, 2025, the total orders stood at Rs. 5,120.21 crore, of which Rs. 2,442.44 crore is balance for execution, providing strong revenue visibility. The Company has delivered a robust growth trajectory with a CAGR of over 32.17% during the last three years and is on track to achieve even better growth backed by favourable market conditions and its diversified execution capabilities.”

Will the big whale’s small catches make him richer?

Ashish Kacholia is an investor whose portfolio movements are watched very closely by investors of all categories. His track record is proof that he is in the game to win it. So, when he is interested in lesser-known stocks that were recently listed, it is bound to have the market take notice.

Both the companies we saw today have shown strong profit growth and sales trajectory. However, the stocks prices are still to see any big growth Which means there is some strategy he has behind these small buys, which we could only make assumptions for.

But given the interest of an investor like Kacholia, these stocks deserve to be looked at. For now, a smart plan would be to add these stocks to a watchlist and follow them closely.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.