India’s cement consumption continues to move up. According to data released by the Commerce and Industry Ministry, cement production rose 14.5% year on year (YoY) in November. The numbers reflect steady demand from infrastructure projects, housing construction, and ongoing urban development.

Rising cement demand does not only mean more bags being sold. It also means cement plants are operating at higher utilisation levels for longer periods. When plants run harder, equipment faces more stress. Kilns, grinding mills, conveyors, and material handling systems are pushed closer to their limits. Breakdowns become costlier, and downtime becomes harder to afford.

The “Recurring Revenue” Advantage

This is where maintenance and upgrade spending comes in. Cement companies are forced to invest in wear parts, plant overhauls, efficiency improvements, and brownfield upgrades. These expenses are not optional. They are required to keep plants running smoothly, safely, and in line with efficiency and emission norms.

The stocks selected in this article are directly linked to this maintenance cycle. They supply grinding media, refractories, gears, and engineering solutions that are used inside cement plants on a recurring basis. Broader capital goods or EPC names were avoided because cement is only a small part of their business.

These four companies have a clearer and more consistent connection to cement plant maintenance and upgrade spending, which makes the investment logic simpler and more focused.

#1 AIA Engineering: Wear Parts That Work Harder as Cement Plants Run Longer

AIA Engineering manufactures high-chrome grinding media, liners and diaphragms, collectively known as mill internals. These are used for crushing and grinding operations in the cement, power utility & aggregates and mining industries.

AIA Engineering delivered a steady performance in the September quarter, broadly in line with the previous quarter. Revenue for Q2 FY26 stood at Rs 1,029 crore, marginally lower than Rs 1,030 crore reported in the same quarter last year. Net profit for the quarter rose 8.2% YoY to Rs 277 crore. The numbers reflect a stable operating environment, even as volume growth remained limited.

On the business front, the quarter saw an important strategic development. AIA Engineering secured a long-term order from a large mining customer in Chile. This marks the company’s first meaningful breakthrough in the South American market. The 18-month contract is expected to translate into annual volumes of around 15,000 tonnes, with shipments likely to begin from the March quarter.

The company continues to focus on solution-led offerings that combine grinding media and liners. Capacity utilisation is currently around 55–60%, leaving room for growth as ongoing trials convert into orders. Management expects annual capital expenditure to average about Rs 150 crore, including spending on renewable power and overseas expansion.

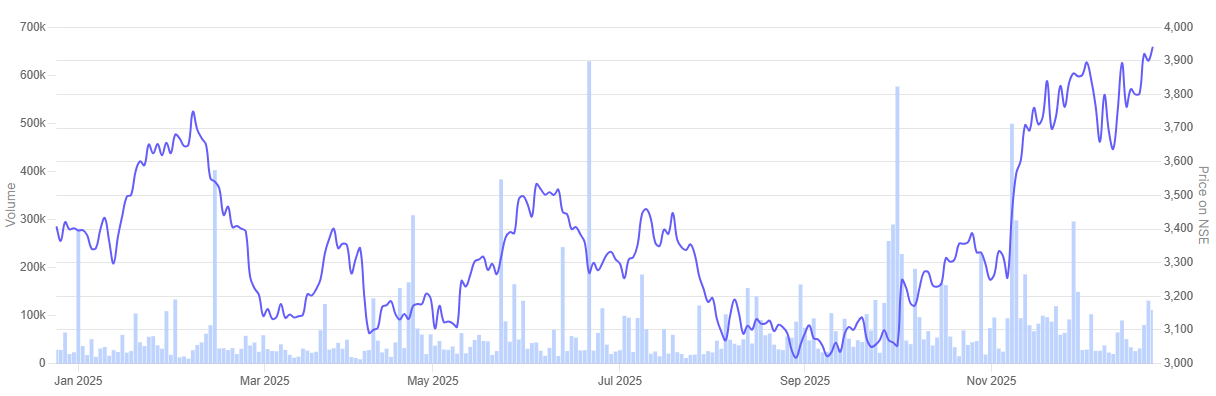

In the past year AIA Engineering share price is up 14.8%.

AIA Engineering 1-Year Share Price Chart

#2 Elecon Engineering Company: Gears and Material Handling Systems That Keep Plants Moving

Elecon Engineering Company, incorporated in 1960, manufactures and sells power transmission and material handling equipment in India and internationally. In addition, it engages in the steel and non-ferrous foundry business.

Elecon Engineering posted a steady set of numbers for the September quarter, led by firm domestic demand. Revenue for Q2 FY26 rose 13.8% YoY to Rs 578 crore. Growth came from better execution in both the gear and material handling equipment businesses. Net profit stood at Rs 88 crore, largely unchanged from last year, as overseas execution was impacted by delays.

The gear division, which contributes most of the company’s revenue, saw demand from power, cement and steel projects. Some international orders were deferred due to geopolitical issues, but management said customer interest remained strong. Order inflows during the quarter rose 28% YoY to Rs 688 crore, offering comfort on near-term execution.

The material handling business continued to perform well, supported by demand from cement, mining and port sectors. Elecon is pushing exports more aggressively and aims to raise their share to 50% of revenue by FY30. The company plans capital expenditure of around Rs 400 crore over the next three years to support capacity expansion, efficiency improvement and overseas growth.

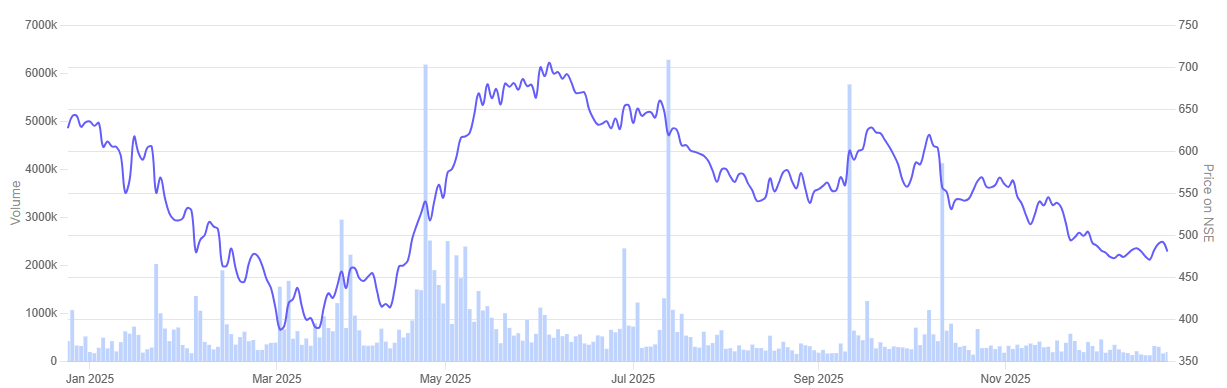

In the past year Elecon Engineering Company share price tumbled 23.5%.

Elecon Engineering Company 1-Year Share Price Chart

#3 RHI Magnesita India: Refractories at the Heart of Kiln Maintenance Cycles

RHI Magnesita India earlier known as Orient Refractories (ORL) is in the business of manufacturing and marketing special refractory products, systems and services to the steel industry in India and Globally. It is a leading player in the special refractories space in India, and its products are also supplied to customers in several overseas markets because of their consistent quality.

RHI Magnesita India posted its highest quarterly revenue in Q2 FY26. Revenue for the quarter was Rs 1,035 crore, up 19.4% YoY, driven by higher volumes and a stronger share of business from steel and cement customers.

Shipment volume rose to 141 kilo-tonnes, helped by stronger demand and seasonal project work in the cement segment. The company said growth was broad-based. There was improvement in iron-making, coke oven, DRI and pellet businesses. It also saw progress in long-term TRM and 4PRO contracts.

Profit after tax for the quarter was Rs 38 crore, lower than Rs 46 crore in the same period last year. Margins came under pressure due to higher magnesia costs and changes in product mix. Management expects margins to recover gradually as raw-material costs cool off and recipe optimisation efforts start to reflect in numbers.

RHI Magnesita is moving some of its global product lines to India, including ANKRAL and Radex cement bricks. The idea is to improve plant utilisation and bring down costs. The company is also spending on productivity upgrades and on refurbishing the Dalmia plant. Some of the key equipment from these projects is expected to come onstream by CY26.

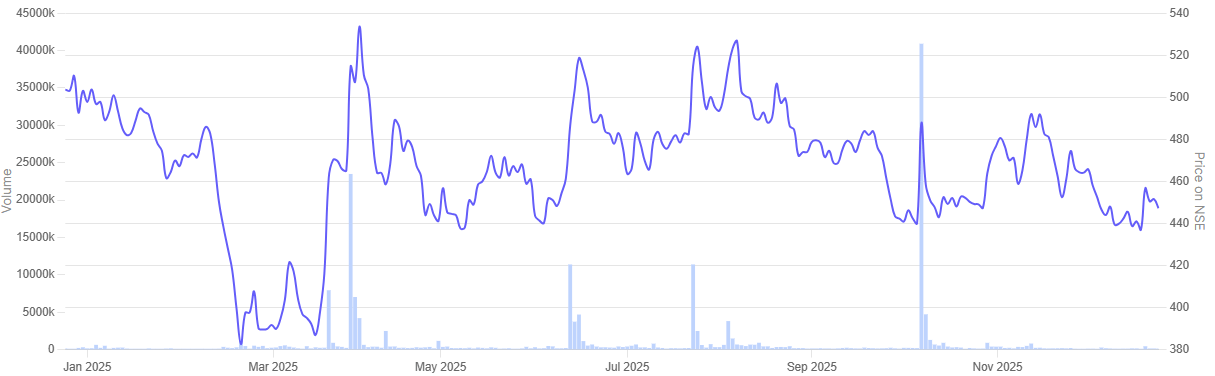

In the past year RHI Magnesita India share price is down 11.1%.

RHI Magnesita India 1-Year Share Price Chart

#4 ISGEC Heavy Engineering: Brownfield Upgrades, Shutdown Projects and Plant Efficiency Work

ISGEC Heavy Engineering is a diversified heavy engineering company engaged in manufacturing and project business with an extensive global presence. It manufactures process plant equipment, presses, Iron & Steel castings & Boiler pressure parts.

While ISGEC is a diversified engineering company, part of its project and upgrade work also includes cement plants, along with other industrial sectors.

ISGEC Heavy Engineering reported a steady performance in Q2 FY26. Revenue for the quarter was Rs 1,725 crore, up 3% from the same period last year. Growth came mainly from the standalone business and a better contribution from Saraswati Sugar Mills. Profit after tax, including discontinued operations, was Rs 56 crore. This was lower than Rs 96 crore a year ago because of losses related to overseas assets that are planned to be sold.

The company said the order book remains strong. Orders in hand stood at Rs 8,789 crore as on 30 September 2025, compared with Rs 7,066 crore a year earlier. Export orders were Rs 1,644 crore, showing an improvement in international demand.

ISGEC is also increasing its manufacturing capacity in multiple product segments. The new Bhartoli facility is expected to be ready by July 2026 and may add about Rs 225 crore in annual revenue. A skids and modules plant at Dahej SEZ is being developed in two phases, with potential revenue of Rs 160–275 crore.

Management said enquiry levels are healthy and expects execution to improve as these expansion projects become operational.

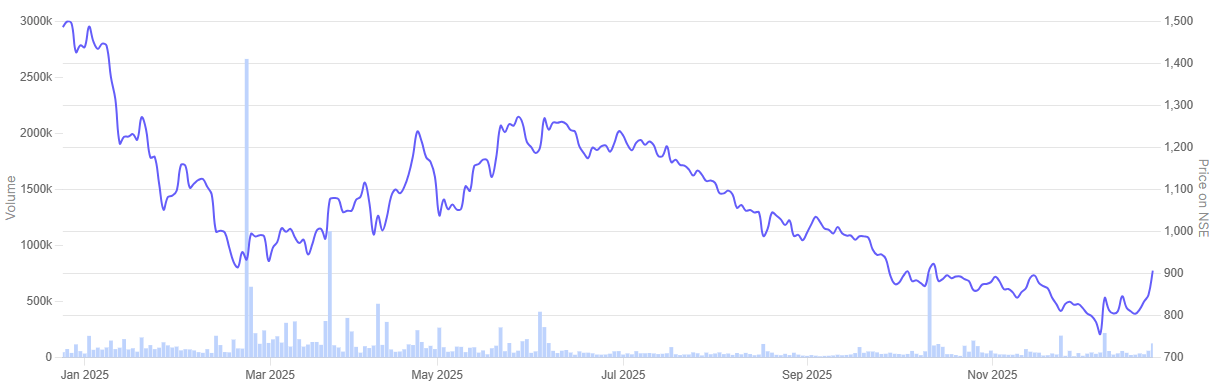

In the past year ISGEC Heavy Engineering share price nosedived 34.7%.

ISGEC Heavy Engineering 1-Year Share Price Chart

Valuation: Growth vs. Cyclicality

Let’s now turn to the valuations of the cement plant maintenance companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Cement Plant Maintenance Companies in India

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | AIA Engineering | 23.7 | 14.6 | 18.9% |

| 2 | Elecon Engineering Company | 15.9 | 22.1 | 28.5% |

| 3 | RHI Magnesita India | 21.8 | 18.9 | 7.1% |

| 4 | ISGEC Heavy Engineering | 12.6 | 10.8 | 14.8% |

The valuations here are not the same for all companies. Some are trading at levels higher than the industry median, while a few are below it.

AIA Engineering is trading at an EV/EBITDA of 23.7. The industry median is 14.6. Investors appear to be giving weight to the company’s stable performance and the customer relationships it has built over the years.

RHI Magnesita India is also trading at a premium. Its EV/EBITDA is 21.8, while the industry median stands at 18.9. Its ROCE is 7.1%, which is on the lower side. This suggests that the valuation may be more about growth expectations and its importance in critical refractory supply than about current return ratios.

Elecon Engineering is in a different zone. It trades at an EV/EBITDA of 15.9, below the industry median of 22.1, even though it has a strong ROCE of 28.5%. The market could be taking a cautious view on cyclicality or waiting to see how its export plans scale up.

ISGEC Heavy Engineering trades closer to the broader range, at 12.6 versus an industry median of 10.8. Its ROCE is 14.8%, which reflects better execution and a stronger order book, while some of its expansion projects are still in the process of ramping up.

Overall, while some of these companies enjoy valuation premiums due to business strength and earnings visibility, investors still need to ask how much of future growth is already captured in current prices — and whether the reward justifies the risk at these levels.

Conclusion

The cement industry is seeing steady demand from housing, roads and government projects. When plants run harder to meet this demand, the work does not stop at production alone. A lot of spending also goes into keeping the plants running well — through repairs, replacements and upgrades. The companies discussed in this article operate in that part of the value chain, and their fortunes are closely linked to plant maintenance cycles.

At the same time, this is not a risk-free theme. In some quarters, orders may come in large chunks, while in others the pace may slow down. Earnings can also be influenced by changes in input costs, project schedules and overall demand from global markets. Valuations differ widely across these stocks, and in some cases, a part of the growth story may already be reflected in current prices.

These are not stock recommendations. They are ideas for further study. Investors should look at the business, the financials and their own risk comfort carefully before deciding whether to invest.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

Disclaimer:

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.