The government is working on a big policy push that could change the way infrastructure gets financed in India.

According to reports, the upcoming Union Budget may announce a Rs 25,000 crore fund to help revive stalled infrastructure projects. This money would act as a risk guarantee and help lenders feel more confident about funding large projects. The aim is to clear financing bottlenecks that have held back many works across the country.

This move is mainly about reducing risk in project financing. Many projects slow down even after they are approved. The reason is funding uncertainty. Banks worry about delays, cost overruns and cash-flow gaps. A risk support fund can share part of that risk. That can help projects move faster from paper to the ground.

If this happens, the impact will not be equal across sectors. Road projects under engineering, procurement and construction (EPC) and hybrid annuity model (HAM) contracts may benefit first because they are closely tied to financial closure.

Operational road assets with tolls or annuity-style revenues may see earlier cash-flow visibility if projects get completed sooner. Rail and metro execution projects may also gain because they depend on layered funding and bank comfort.

For this article, we looked at stocks in these pockets. We checked three-year sales and profit growth, returns on capital, debt levels, interest coverage, margin stability and operating cashflows.

Companies with weak cash conversion, high leverage or volatile earnings were left out. The idea is to focus only on businesses where better funding support can genuinely improve execution and cash-flow timelines, not just sentiment.

However, most companies in the rail and metro execution projects run on thinner margins, weaker return ratios and more uneven cash flows, and therefore did not meet our financial comfort filters. So this sector has not been included in the final stock selection.

The Execution Engine: EPC & HAM Plays

Road EPC and HAM projects often slow down because funding and financial closure take time. A risk-support fund can reduce this uncertainty and help projects move into execution faster.

#1 KNR Constructions: The High-Efficiency Play

KNR Constructions, incorporated in 1995, is a Hyderabad-based infrastructure project development company providing EPC services in segments such as roads and highways, irrigation and urban water infrastructure management.

KNR Constructions was shortlisted because it fits our basic financial comfort filters. The company has delivered a return on capital in the 25–30% range in recent years, which is well above our minimum screen of 12–15%.

Debt has stayed low, with debt-to-equity below 1x, and that keeps the balance sheet in a comfortable band for an EPC and HAM-focused business. Operating margins have mostly been between 20% and 30%. This shows steady project execution and cash-flow discipline rather than big swings across cycles.

The past year has been slower on the execution side. Several projects moved ahead only gradually as clearances, certification and funding progress took time.

Consolidated revenue in the latest reported quarter was Rs 646 crore, a sharp fall from Rs 1,945 crore in Q2 FY25. Net profit for the quarter under consideration was Rs 105 crore down from Rs 580 crore reported a year ago.

Earlier quarters in the year also saw moderation in activity. With fewer projects moving quickly into active execution, near-term earnings visibility softened.

The company is now focusing on completing ongoing road packages and taking key HAM projects closer to closure and commissioning. Management is keeping its approach conservative on bidding and leverage, and expects activity to pick up as projects achieve financial closure and move back into the construction phase.

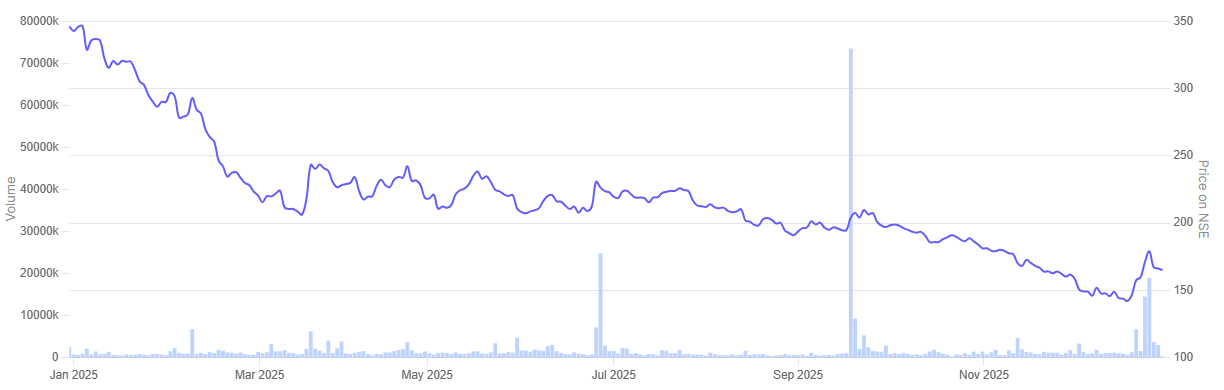

In the past year, KNR Constructions share price nosedived 52.4%.

KNR Constructions 1 Year Share Price Chart

#2 PNC Infratech: Execution-focused EPC and HAM developer

PNC Infratech is an infrastructure developer and EPC contractor, with a strong presence in road and highway projects.

The company undertakes infrastructure projects, including highways, bridges, flyovers, power transmission lines and towers, airport runways, industrial area development, and other infrastructure activities.

PNC Infratech was included in this theme using three basic financial filters. The company has maintained a return on capital in the 14–16% range in recent years. This is above our comfort band of 12–15%.

Debt has stayed reasonable, with debt-to-equity generally below 1x, which fits our leverage screen for road and EPC developers.

Operating margins have mostly remained between 20 and 25%, showing steady execution and disciplined cost control rather than sharp earnings swings.

On the other hand, the past year has been uneven on the execution side. Some road packages moved ahead more slowly as billing, certifications and funding milestones took time.

Consolidated revenue in the latest reported quarter was about Rs 1,128 crore which is lower compared to Rs 1,427 crore reported in September 2024 quarter.

However, net profit for the said quarter was Rs 216 crore, up 160% on a YoY basis. The profit jumped mainly because some projects turned more profitable during the quarter, with better margins and smoother execution, even though overall revenue was softer.

Activity in earlier quarters of the year also reflected this slower transition from award to full-scale construction. With project progress stretching out, near-term earnings visibility softened. That has weighed on investor sentiment.

The company continues to work through its mix of EPC and HAM projects.

Management is focusing on completing ongoing packages and moving key projects through clearances and financial closure. The approach remains measured on bidding and capital allocation. The company expects execution momentum to improve as projects move back into a stable construction rhythm.

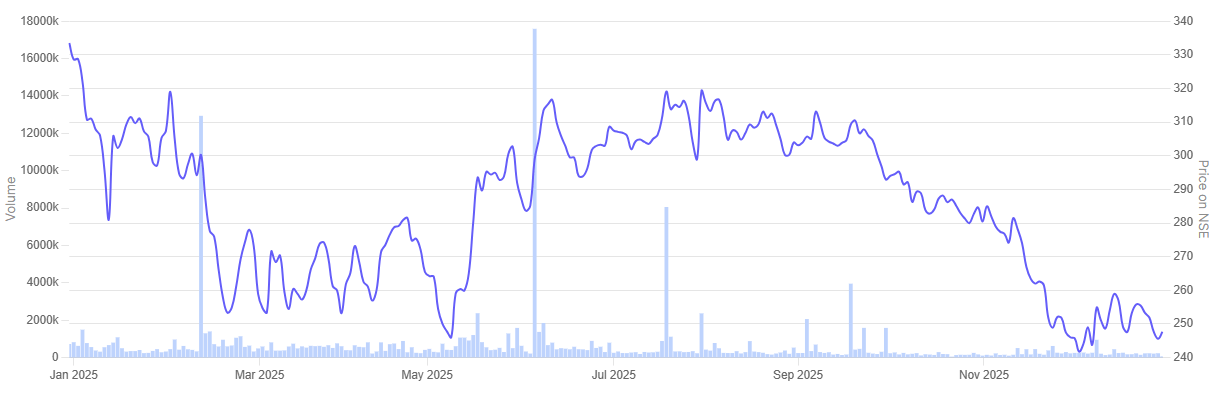

In the past year, PNC Infratech share price has tumbled 25.3%.

PNC Infratech 1 Year Share Price Chart

The Cash Cows: O&M & Annuity Plays

These businesses benefit when projects reach completion earlier and start earning toll or annuity revenues sooner. Faster commissioning improves visibility on cash flows and operating earnings.

#3 IRB Infrastructure Developers: Operating-asset toll road platform

IRB Infrastructure Developers is an infrastructure development and construction company in India with extensive experience in the roads and highways sector. It is also in other business segments in the infrastructure sector, including maintenance of roads, construction, airport development and real estate.

IRB Infrastructure Developers was reviewed using the same basic financial comfort filters as the rest of the theme.

The screen looked at return on capital in the 12–15% range, steady margins, debt levels that do not strain cash flows, and whether operating earnings convert into cash in a predictable manner. These filters were used to focus only on companies where better funding support can genuinely improve execution and timelines.

In the latest reported quarter, IRB posted consolidated revenue of about Rs 1,751 crore, up 10.4% on a YoY basis. Net profit for the quarter stood at Rs 141 crore, up 40.1% YoY. The rise in revenue and profit during the quarter was driven mainly by stronger O&M and annuity income from operating road assets, higher toll collections across key stretches, and improved traffic volumes.

The past year has seen periods of uneven execution and delayed project ramp-ups, which affected earnings visibility.

Management is focusing on strengthening the O&M and annuity portfolio, improving cash generation from mature assets and aligning debt within key project special purpose vehicles (SPVs). The pipeline includes build, operate, transfer (BOT), HAM and toll-operate-transfer (TOT) opportunities, with bidding plans linked to funding clarity and traffic performance trends.

The near-term outlook depends on execution pickup, refinancing progress and project completions. If the policy environment supports smoother financial closures, the company could see more stable cash flows and better visibility from its operating road assets.

In the past year, IRB Infrastructure Developers share price tumbled 26.6%.

IRB Infrastructure Developers 1 Year Share Price Chart

The Valuation Verdict: Bargain or Trap?

Let’s now turn to the valuations of the companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Companies in focus

| Sr No | Company | EV/EBITDA | Industry Median | ROCE |

| 1 | KNR Constructions | 6.5 | 10.9 | 28.6% |

| 2 | PNC Infratech | 7.1 | 13.9% | |

| 3 | IRB Infrastructure Developers | 10.8 | 7.8% |

KNR Constructions is trading at an EV/EBITDA of about 6.5, which is lower than the broader industry median of 10.9. Its ROCE is around 28.6%. This is a strong return profile. The valuation is still on the lower side, which suggests that the market is treating KNR more as a steady executor, and not fully re-rating it yet, even though the business runs with better capital efficiency.

PNC Infratech is valued at about 7.1 times EV/EBITDA, and its ROCE stands at around 13.9%. This puts it in a middle zone. The market seems to be giving some credit for stable execution and gradual improvement in cash flows, while also remaining cautious because project timelines and working capital movements can affect earnings from time to time.

IRB Infrastructure Developers trades at a higher EV/EBITDA of about 10.8, while its ROCE is lower at 7.8%. The higher multiple appears linked to its toll and operating-asset income, which gives longer-term visibility. At the same time, the lower return profile and phases of uneven cash flows over the past year help explain why the stock has faced pressure, despite having an operating-asset base.

Overall, the difference in valuations across these companies reflects how the market is weighing returns, leverage and cash-flow certainty, rather than treating all of them in the same way.

Conclusion

At its heart, this theme is about money moving more smoothly into projects and helping work start on time. If the proposed risk-support fund goes ahead, it can make lenders more confident and reduce delays in financial closure. That matters most in businesses where cash flows depend on project completion and steady execution, not just on new orders being announced.

The companies discussed in this article were chosen using simple and clear numbers. We looked at returns, debt levels, margins and cash-flow stability, and left out names that did not meet these filters. The idea was to focus only on businesses that can genuinely benefit if funding becomes easier and stalled or slow-moving projects begin to pick up pace.

At the same time, valuations in parts of the sector already reflect some of this hope. The real test now is how much of the improvement in execution and cash flows actually plays out on the ground over the next few years, and how much of it is already factored into current stock prices.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.