Two stocks from the portfolio of the Big Whale of the market, Ashish Kacholia, are currently grabbing the attention of many investors for a couple of reasons. One, that Kacholia has added these stocks to his holdings in 2025. And two, that both are trading at deep discounts from their all-time high prices.

The attention is not completely wrong as Kacholia is one of the most followed super investors of India with holdings across diverse sectors like hospitality, education, infrastructure and manufacturing etc. He currently holds 48 stocks in his portfolio worth Rs 2,700 cr, but these two stocks are currently stealing all the limelight.

What are these two stocks and what does Kacholia see in them? Let us try and find that out along with if they are worth the Watchlist 2026.

#1 Naman In-Store: The SME Bet Trading at Book Value

Established in 2010, Naman In-Store (India) Limited is a retail furniture and fittings company providing retail solutions to various industries and retail outlets.

With a market cap of Rs 82 cr currently (was Rs 112 cr when Kacholia bought in), Naman In-Store manufactures modular furniture for offices, beauty salons, kitchens with limited space, educational institutions, and shelving solutions for supermarkets.

Ashish Kacholia bought an 8.3% stake in Naman In-Store (India) Ltd worth Rs 9.3 cr, as per the filings for the quarter ending March 2025. Currently the holding percentage is the same, but the holding value has dropped to Rs 6.5 cr.

Let’s dive into financials to see if we can figure out what Ashish sees in the company. Do note that the company reports half yearly results, as per SME Exchange norms.

The sales have seen a compounded growth of 86% between Rs 13 cr in FY21 and Rs 156 cr in FY25. And for H1FY26, the sales logged were Rs 69 cr. Note: There is a base year effect here as FY21 was impacted by Covid.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Naman In-Store which was Rs 1 cr in FY21 climbed to Rs 15 cr in FY25, which is a compound growth of 97%. As for the quarter ending September 2024, Naman In-Store had logged in Rs 3 cr in EBITDA.

The company wasn’t making any profits as of FY21, but closed FY25 at Rs 6 cr in profits. And for H1FY26, the company has once again logged no profits.

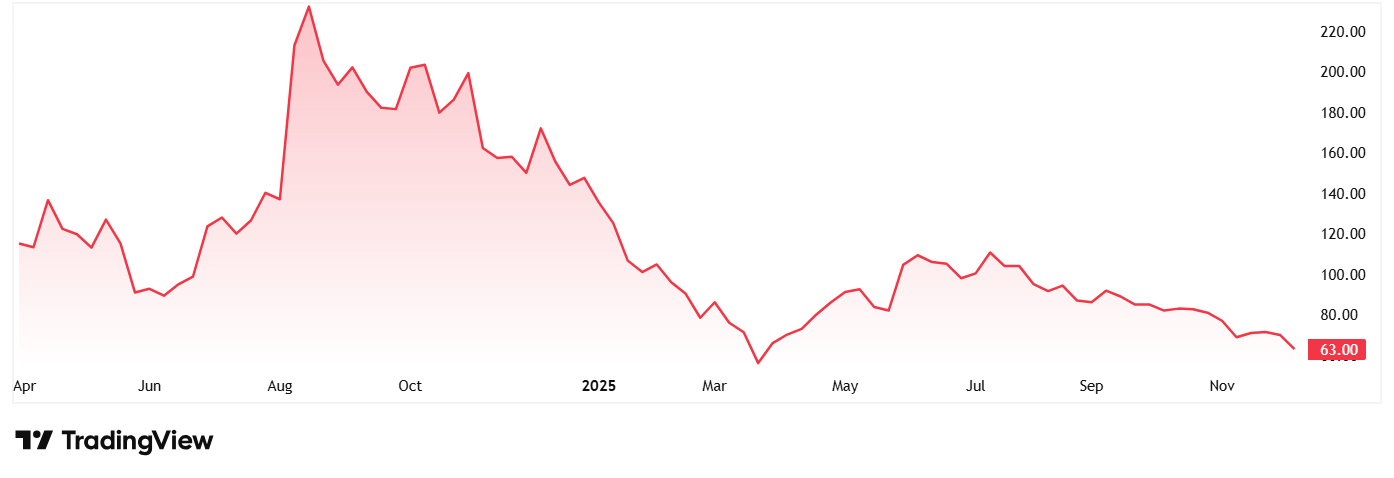

The share price of Naman In-Store when it was listed in April 2024 was around Rs 115, and has seen a steep decline as its current price as on 11th December 2025 is Rs 63. The stock is trading around its book value which is Rs 61.

At the current price of Rs 63, the stock is trading at a discount of 75% from its all-time high price of Rs 257.

As for valuations, the company’s share is trading at a current PE of around 46x, and the industry median is around 38x. While it would be too soon to look at the 10-year median PE for the company, the industry median for last decade is 42x.

One fact that is considered by many as a red flag is that the company is listed on NSE’s SME Index (Emerge). SME stocks could turn out to be liquidity traps due to mandatory ‘lot trading,’ which often makes exiting impossible during a fall. Their small equity base allows easy rigging of prices, giving air to ‘pump and dump‘ schemes that lure retail investors. Combined with simpler reporting norms, this often masks poor financials that investors are too late to find out. So, Caveat Emptor (Let the buyer beware).

#2 Quadrant Future Tek: The ‘Kavach’ Play in Deep Red

Incorporated in 2015, Quadrant Future Tek Ltd manufactures specialty cables and develops train control & signalling systems.

With a market cap of Rs 1,054 cr the company develops next-generation Train Control and Signalling Systems under the KAVACH project for Indian Railways and operates a specialty cable manufacturing facility with an Electron Beam Irradiation Centre. The cables are used in railway rolling stock and the naval (defense) industry.

Kacholia bought a 1.9% stake in the company (through Suryavanshi Commotrade Private Limited) worth Rs 35 cr as per the filings for the quarter ending March 2025. He continues to hold the same percentage, but the holding value has since dropped to Rs 20 cr. Kotak Mahindra Manufacture in India Fund also holds another 2.2% stake in the company.

Looking at the financials, the company’s sales jumped from Rs 73 cr in FY21 to Rs 150 cr in FY25, logging a compound growth of 20%. For H1FY26, sales of Rs 63 cr have been logged.

EBITDA saw a huge drop from Rs 11 cr in FY21 to Rs 1 cr in FY25. For H1FY26, losses of Rs 23 cr have been recorded for EBITDA.

When it comes to the net profits, the company recorded its first loss in the last few years for FY25.

| Year | FY21 | FY22 | FY23 | FY24 | FY25 |

| Net Profit/Cr | 5 | 2 | 14 | 12 | -20 |

For H1FY26, losses of Rs 30 cr have already been recorded.

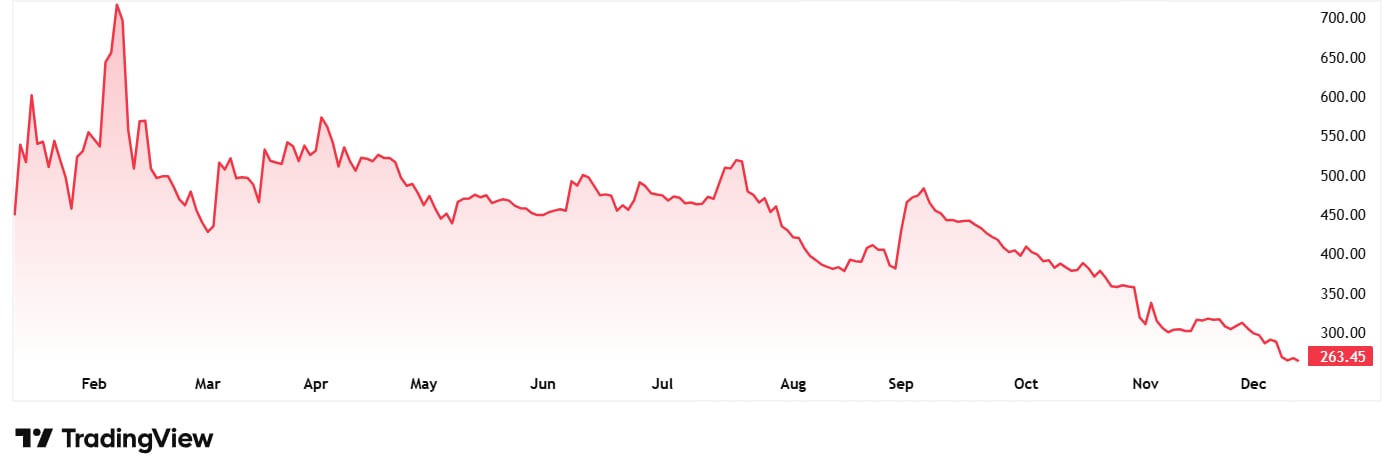

The share price of Quadrant Future Tek Ltd was around Rs 444 when listed in January 2025 and as on 11th December 2025 it was Rs 263, which is a big drop.

At the current price of Rs 263, the company’s share is trading at a discount of 65% from its all-time high of Rs 744.

The share is trading at a negative PE due to the recent losses, and the current industry median is 21x.

In the company’s latest investor presentation from November 2025, Managing Director Mohit Vohra said, “Looking ahead, we remain focused on deepening our presence in our core cables domain, while strategically evaluating opportunities to foray into other high-growth sectors where our technical capabilities and manufacturing excellence can deliver differentiated value. With BIS approval secured for our Solar cable portfolio, we are now positioned to participate in the Solar segment, while continuing to build out our EV cable offerings.”

Mistakes or Turnaround Bets?

Ashish Kacholia is definitely not one to buy or sell stocks based on the market noise and social media traffic. So, when two of his recent picks grab the attention of investors for the wrong reasons, the market takes notice.

The two stocks we saw today, Naman In-Store and Quadrant Future Tek, were added by Kacholia to his holdings just in 2025. And when we look at the financials and mainly the stock price chart, the companies have seen more red than a wall next to a paan shop. Naman comes with its risks for being on the SME exchange, and Quadrant is struggling to return to profitability.

But given that they both are still backed by the Big Whale, they do deserve the attention of smart investors. Will these two turn out to be mistakes or turnaround bets for Kacholia? It will be fascinating to watch as things unfold. But for now, the smart decision would be to add these stocks to a watchlist and follow them closely.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.