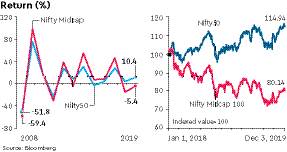

The Nifty Midcap and SmallCap indices, which usually outperform the benchmarks, have fared poorly for second year in a row as investors remained concerned over slowing economic growth and subdued growth in corporate earnings.

The two-year consecutive underperformance of Nifty Midcap relative to Nifty50 has happened after 13 years. The last time, Nifty Midcap had underperformed benchmark Nifty50 was in 2005 and 2006.

While the gauge for mid-cap stocks has given up about 20% since the start of 2018, 70% of its constituents have lost value. The Nifty Smallcap Index has suffered a bruising 37.08% since January last year, and nearly 80% of its members have seen a fall in prices. The benchmark Nifty50 yielded a return of 14.9% during the same period.

Gautam Chhaochharia, head of India Research, UBS Securities, said, “Typically, small and mid-cap stocks will do well when there is a clearer visibility of growth in the near term. At the same time, the fund flow environment needs to be much more benign as was the case after demonetisation and lastly, corporate sentiment is insufficiently positive right now.”

As many as 15 companies from Nifty Midcap index have lost more than Rs 10,000 crore in market capitalisation over the last two years. The market valuation of SAIL — the worst performer on Nifty Midcap Index — has seen an erosion of Rs 22,342 crore to Rs 15,717 crore as of Tuesday.

Interestingly, public sector undertakings (PSUs) dominate the list of losers with Bharat Electronics, BHEL, NBCC, Mangalore Refinery & Petrochemicals, PNB Housing Finance and Indian Bank losing between `12,047 crore and Rs 20,145 crore.

The PSU stocks have destructed significant value over time even though these companies generate adequate cash flows. However, experts believe that the recent cut in corporate tax rate and government’s decision to privatise a few of them have turned bright for investors.

Analysts at Citi Research believe, “Valuation discount of mid-caps versus large caps is close to 10-year highs, highlighting the improved risk-reward and low expectations. In two years, mid-cap sentiment seems to have gone from extreme optimism to huge pessimism.”

From the small-cap space, Vakrangee and Dewan Housing Finance have plummeted over 90% during the last two years with market cap eroding to the tune of Rs 40,206 crore and Rs 17,684 crore, respectively.

According to Citi Research, only 2% of small caps have become large caps over the past 10 years, while 20% either no longer exist or are no longer listed. The foreign brokerage prefers cement producer ACC, Biocon, L&T Finance Holdings, Polycab and JustDial from the midcap universe.