Defence stocks, the poster boy of the market , in early 2025 and after India’s success during Operation Sindoor, have been on a downward trend in recent weeks. In fact, the Nifty India Defence Index is down close to 12% in the last 1 month. Counters like Zen Tech, Mazagon Dock, BEL are deep in the red. Interestingly, if you check the returns over 3 months, it projects a completely different picture. The question is what changed.

Well, in the last one month, the list of defence sector stocks have seen significant correction ranging between 7-10% on average, and in some cases, the cut is even deeper. The one cardinal fact is that the normalisation of the situation, peacetime sentiment, may have cooled down prices a bit, but that’s not all.

Defence stocks: Near-term positives priced in

Many market observers and analysts tracking the defence sector believe that most of the positives are already priced.

Harshit Kapadia,Vice President, Elara Capital, who tracks capital goods and defence sector stocks, pointed out that “all the positives have been built into the defence sector post Operation Sindoor. Every development is now known and has been priced in. The new order flow is slightly slower than anticipated. This is also weighing on investor sentiment.

Dr. Vikas Gupta, CEO & Chief Investment Strategist at OmniScience Capital, added that, “In the last month, Defence stocks have corrected by around a 7-10%. The immediate reaction could be due to the not-so-exciting quarterly financial reports from most companies. It could also be a “normalisation” after the extreme positive sentiments post Operation Sindoor and the subsequent interest globally for Indian defence products.

Defence stocks: The big valuation worry

Valuations of the defence stocks in another big factor to watch out for. Most of these stocks have run up significantly in a short time, and execution remains a key factor to watch out for. Elara Capital’s Kapadia added that, “Moreover, if you look at the valuations, they are significantly rich at the moment. The valuation of PSU defence stocks are ranging between 35-40x and the private sector defence companies are trading close to 50x. As a result, you are seeing these stretched valuations getting corrected.”

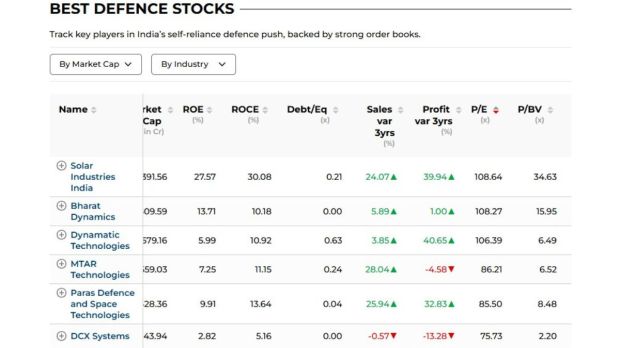

As per the ‘best defence stocks screener‘ on Financial Express.com, some of the counters, like Bharat Dynamics, are trading at 108x its earnings. Even price to earnings ratio of stocks like Paras Defence, Garden Reach Shipyard, Cochin Shipyard and BEML are ranging between 50-80x.

A high PE numbers is also an indicator that the stock price may be more expensive in comparison to the relative earnings. Investors are normally paying for the growth that they are anticipating; if that fails, valuations would be considered high.

In comparison, the return-on-equity for many of these counters is between 10-20%. Often ROE below 15% may be considered less satisfactory, but one also needs to understand that this metric differs from sector to sector.

Defence stocks: Future perfect

Though these concerns could be impacting sentiment in the near-term, the sector analysts are gung-ho about the long-term prospects of these stocks. The focus on increasing allocation for defence capex is seen as a major positive factor. Kapadia explained that “for the long term, we are positive on the defence space. Globally there is an expectation of huge capex on the defence side. Even in the Indian context, the capex on the defence side is likely to move to 2.5x of GDP from the earlier 1.9x GDP. Even the pace of order inflow is set to improve in the second half of the fiscal year, and this will lead to pick-up in momentum for the defence stocks.”

Gupta too reiterated the long-term opportunities and said, “the order books for most of these companies remains strong with more than 3-5 years’ worth. New orders are likely to continue coming in. The long-term budget allocation, as estimated in our earlier Defence Reports, clearly shows the budget is likely to increase at a much faster pace compared to GDP growth over the next 10 years, reaching 3-4% of GDP. This is still small compared to 5% of GDP being targeted by NATO countries. “

One also needs to be mindful of the fact that despite the recent fall, the Nifty India Defence Index is still hovering close to 58-60 PE. Also, execution remains a key monitorable for most companies. If they don’t execute despite having order books, the valuations might turn out to be too high eventually.