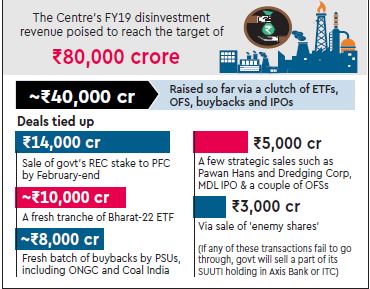

While only half of this fiscal’s estimated disinvestment revenue of Rs 80,000 crore has so far been garnered, a robust pipeline of transactions, including a large PSU-to-PSU deal and about half a dozen buybacks by PSUs, will ensure that the target be met without too much reliance on private/retail investors in the remainder of the year.

In the Interim Budget speech, finance minister Piyush Goyal has stated that the disinvestment target for the current fiscal would be achieved. Of the receipts so far, Rs 25,325 crore or 63% came through exchange-traded funds (ETFs). At least Rs 14,000 crore is assured from the proposed Power Finance Corporation’s purchase of the Centre’s 52.63% stake in Rural Electrification Corporation for which the Cabinet has already accorded in-principle nod.

ETFs’ contribution to disinvestment receipts this year could touch Rs 35,000 crore; while Rs 25,000 crore has already been collected via this route, a new tranche of diversified Bharat-22 ETF to raise Rs 10,000 crore will hit the market later this month.

Also read| In Anil Ambani’s RCom’s bankruptcy, here’s how Ericsson has managed to stay in the game

Of the Rs 12,000 crore expected from buybacks by PSUs, the Centre has already mopped up about Rs 4,000 crore and the remaining Rs 8,000 crore would flow in by March. The companies that will undertake buybacks include ONGC, Coal India, Indian Oil and Oil India.

“A total of 36 transactions were planned for this year and they are at various stages of execution. Many transactions were delayed to the fourth quarter as there was a liquidity problem in the third quarter,” said Atanu Chakraborty, secretary, department of investment and public asset management (Dipam).

About Rs 5,000 crore is expected from relatively smaller deals such as the sale of the Centre’s entire stake in Pawan Hans (worth about Rs 800 crore) and Dredging Corporation of India (up to `850 crore); listing of Mazagon Dock Shipbuilders and a couple of offers for sale (OFS) may also go through before March-end. The Centre also has a robust pipeline of OFSs in PSUs such as GIC, New India Assurance, BEL, Hudco, NBCC, etc.

The Dipam will sell also ‘enemy shares’ worth over Rs 3,000 crore. The Cabinet had given an approval in this regard in November 2018 to dispose of these shares lying unused since the Enemy Property Act came into force in 1968.

If any of the above-mentioned transactions fail to materialse, the Dipam could monetise a portion of its SUUTI holdings in ITC or Axis Bank. The SUUTI stake in ITC (7.97% valued at `27,013 crore and Axis Bank (9.56% worth Rs 18,226 crore) are worth about Rs 45,000 crore at current market prices. Achieving the FY19 disinvestment target is a must for the government to stick to the upward revised fiscal deficit target of 3.4% of GDP.

In a post-Budget interview with FE, Chakraborty had said that the divestment pipeline for FY20 (the target set is Rs 90,000 crore) might include the sale of the Centre’s 63.8% stake in SJVN to NTPC, a new ETF, about 10 IPOs, a clutch of offer for sales, buybacks and a new instrument for the CPSEs’ asset monetisation.