Indian equity markets have declined recently influenced by a steep correction in IT stocks, after the US government announced its plan to charge a US$ 100,000 fee on H-1B visa applications.

Foreign portfolio investors (FPIs) have withdrawn Rs 79.45 bn from Indian equities in September 2025, contributing to a cumulative net outflow of Rs 1,380 bn so far this year.

There is a risk-averse environment globally, as geopolitical tensions and macroeconomic issues keep affecting market sentiment.

Against this background, some sectors have shown resilience. Infrastructure and energy stocks have performed well.

In such market conditions, embracing a diversified investment approach has become even more important. Multi-cap funds, which invest in large, mid, and small-cap stocks, provide diversified market exposure with a reduction in sectoral risk.

This diversified approach helps investors to grab opportunities across all market segments, with portfolios positioned to handle volatility while being invested in potential areas of growth.

Thus, multi-cap funds are a balanced way of dealing with market volatility while achieving long-term growth.

In this editorial, we have shortlisted 3 multi-cap funds through a robust evaluation framework, which considers three-years XIRR returns, risk-adjusted performance, and other critical metrics.

All funds have been rated through our own proprietary internal model to provide a holistic analysis of growth potential as well as portfolio fit.

Investing in a multi-cap fund through SIP enables investors to ride market cycles and average out entry points. A disciplined monthly SIP of Rs 10,000 in these funds would have resulted in significant long-term wealth generation.

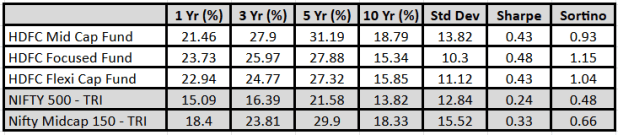

Performance Snapshot – Top 3 HDFC Mutual Funds

(Source: ACE MF)

The table demonstrates that these funds have provided good SIP returns over 3, 5, and 10-year periods, surpassing the category average as well as benchmark indices.

The risk metrics also shows how effectively such funds have navigated volatility and generated returns.

This blend of stable performance and positive risk-adjusted returns validates their position as core holdings in a portfolio of an investor.

#1 Axis Multi Cap Fund

Axis Multi Cap Fund has proven itself to be a core option for investors looking for diversified exposure by market sizes. In the last three years, the fund has provided a rolling CAGR of 24.18% with a steady risk-adjusted performance, underlining its value style of disciplined investing.

As of August 2025, Axis Multi Cap Fund oversees assets of Rs 83.29 bn, highlighting consistent investor faith in its approach and record. The scheme is invested in large caps to the extent of 46.95%, in midcaps of 26.18%, and 24.38% in small cap stocks.

The portfolio is diversified, w more than 80 stocks, with large exposures in structural growth opportunity sectors. Major holdings are HDFC Bank (6.29%), ICICI Bank (4.09%), Reliance Industries (3.17%), and Fortis Healthcare (2.51%).

Sector-wise, the fund focuses on banks (15.38%), healthcare (12.16%), and automobile & ancillaries (10.93%), balancing cyclical and long-term growth themes.

#2 Nippon India Multi Cap Fund

Nippon India Multi Cap Fund was launched during March 2005. It follows a strategy of tactfully distributing funds between large, mid, and small-cap shares.

In the last 3 to 5 years, the fund has registered rolling CAGR of 22.6% and 25.51%, based on consistent risk-adjusted performance, which is a testament to the efficacy of its research-backed stock selection methodology.

As of August 2025, the fund holds assets of Rs 462.16 bn, reflecting high investor confidence and its strong long-term track record.

The portfolio is diversified and generally has about 45.52% in largecaps, 25.26% in midcaps and 26.61% in smallcaps with significant exposure to industries likely to see sustainable growth.

Top holdings are HDFC Bank (5.14%), Axis Bank (3.64%), and ICICI Bank (3.32%), riding structural growth patterns and expansion based on innovation.

Sectorial exposures are led by banks (14.68%), capital goods (9.67%), and finance (8.76%), combining cyclical and secular growth prospects effectively.

With its multi-cap strategy of allocation, prudent stock choice, and capability to steer through fluctuating market scenarios, Nippon India Multi Cap Fund is suitable for investors seeking portfolio diversification as well as exposure to India’s growth story.

#3 ICICI Pru Multi Cap Fund

ICICI Prudential Multi Cap Fund was launched in October 1994 to provide diversified equity exposure to investors with potential for growth combined with risk mitigation.

The fund’s active investment strategy enables it to alter the positioning according to the state of the market, participating in growth opportunities while preserving stability during times of turmoil.

In the last 3 to 5 years, the fund has reported a rolling CAGR of 19.86% and 20.85% respectively. The steady risk-adjusted performance indicates a thorough investment process as well as a sound research framework.

As of July 2025, ICICI Prudential Multi Cap Fund has assets under management of Rs 152.81 bn, reflecting investor confidence and its consistent long-term performance.

The portfolio is diversified across largecaps, midcaps, and smallcaps, generally with a holding of 43.74% in largecaps, 26.56% in midcaps and 26.53% in smallcaps, with strategic play in high-growth sectors.

Core holdings are ICICI Bank (5.48%), Reliance Industries (3.36%), and Infosys (3.35%), which provide exposure to financials, energy, and industrials—segments that are well-positioned to benefit from both cyclical rebound and structural growth.

Sector weightings focus on banks (15.2%), chemicals (7.09%), and healthcare (6.45%) – a balanced combination of stability and growth opportunities.

Conclusion

As the Indian equity market navigates a phase of sectoral shifts and selective growth, multi-cap funds provide a flexible way to participate across large, mid, and small-cap opportunities.

Their diversified approach allows portfolios to capture emerging trends while maintaining exposure to established leaders, making them well-suited for investors seeking a measured participation in equities.

Investments via SIPs that assist in controlling timing risks and offer a structured path to build wealth across market cycles.

In today’s market scenario, incorporating multi-cap funds in one’s portfolio could be an intelligent approach to accommodate both changing market dynamics and long-term investment objectives.

Table Note: Data as of September 22, 2025

The securities quoted are for illustration only and are not recommendatory

Past performance is not an indicator for future returns.

Returns are on XIRR basis and in %. Direct Plan-Growth option.

Those depicted over 1-Yr are compounded annualised.

Risk ratios are calculated over a 3-year period assuming a risk-free rate of 6% p.a.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.