As an investor, it is easy to get caught up in the hype of big companies and fast-growing trends. The prime-time discussion and the videos most people follow speak a lot about them after all. But the Warren Buffetts of India are a different breed. They are known to see things most investors tend to miss. They are always on the lookout for a ground floor entry into what they think are future multibaggers.

Especially when the less known companies demonstrate they are champions of capital efficiency by making the most on the capital they put into their business. These companies might not be the most famous, but they have a knack for turning every rupee they invest into enviable profits. Some of the Warren Buffetts of India have already found a couple of these hidden gems.

Let us look at 2 such less known smallcap companies, that have caught the attention of some of the biggest names in the investor circles.

When you think of ice cream, one of the first names that pops up in your mind is this company.

Incorporated in 1985, Vadilal Enterprises Ltd does marketing and distribution of ice cream, dairy products, frozen desserts and processed food products. It is a part of Vadilal Group along with Vadilal Industries Ltd. As a brand, Vadilal is the 2nd largest ice cream brand in India, with a 16% market share in the organized Indian ice cream market.

With a market cap of Rs 689 cr, VEL has a current ROCE (Return on Capital Employed) of almost 39%. Which in simple words means that the company makes Rs 39 on every Rs 100 it puts into the business as capital.

The company can then use this money to expand or pay back to investors as dividends. When compared to the peers in its group, VEL has higher ROCE than its contemporaries like Adani Enterprises (9.9%), Aegis Logistics (15%) and Cello World (36%).

Sanjiv Dhireshbhai Shah, is one of India Warren Buffetts and a prominent Indian businessman. He is also a philanthropist known for his significant contributions to various industries. Shah has been holding a stake in the company since March 2016 (That is as far as the data on trendlyne.com shows).

He currently owns a 6.64% stake in VEL, which is higher than the 3.10% stake in exchange declarations made for the quarter ending September 2024.

The sales of the company could be one of the reasons Sanjiv has been interested in this company. Here is how the sales numbers have grown in the last few years.

| FY19 | FY20 | FY21 | FY22 | FY23 | FY24 |

| 573 | 592 | 340 | 548 | 930 | 999 |

*All figures in Rs Cr

As seen the sales grew at a compounded rate of 12% in the last 5 financial years.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) was Rs 13 cr in FY19 which grew to Rs 14 cr in FY24. The CAGR growth for EBITDA in the last 5 years has been around 1.5%.

The net profits show a complete turnaround story as they grew from almost nothing in FY19 to Rs 8 cr in FY24, logging in a compounded growth 137%.

High profits, big ROCE and growing sales, no wonder Sanjiv has been invested in the company all these years.

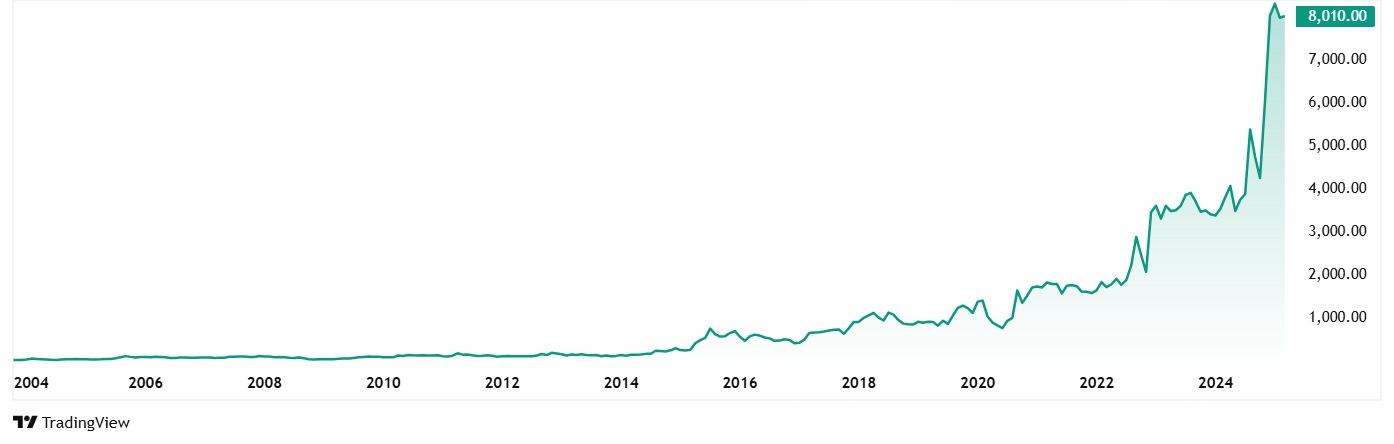

The current share price of VEL is Rs 8,010, which is a big 483% jump from the 5-year-old price of Rs 1,375.

Let us look at the valuations now. The company is currently trading at a price to earnings (PE) multiple of 119x. The median PE for the last 10 years is 50x, which would suggest that the current valuation multiple is at a premium to its long-term median. The current industry median when compared to peers is 30x.

Incorporated in June 2017 after a demerger from Prakash Industries Ltd, Prakash Pipes Ltd is engaged in the manufacturing of PVC pipes & fittings and packaging products.

PPL has also branched out into flexible packaging, building a top-notch plant in Uttarakhand. They are making high-quality films and pouches for everything from food to pharmaceuticals, focusing on cost-effective, innovative solutions.

With a market cap of Rs 1,066 cr, PPL currently has a ROCE of 33%, which is higher than its peers like Astral Pipes (23%) and Finolex Industries (11%)

Dolly Khanna’s stake began from 1.35% in December 2021 as per the farthest data available inn trenndlyne.com and is today at 3.71%. Mukul Agrawal currently has been steadily holding 2.51% in PPL since December 2023 according to trendlyne again.

The sales for PPL have grown at a compounded rate of 14% in the last 5 years.

| FY19 | FY20 | FY21 | FY22 | FY23 | FY24 |

| 341 | 385 | 476 | 617 | 709 | 669 |

*Sales/ All figures in Rs Cr

EBITDA was Rs 39 cr in FY19 which jumped to Rs 107 cr in FY24, making it a CAGR of about 23%.

The profit after Tax grew form Rs 29 cr in FY19 to Rs 90 cr in FY24, which means it grew at a compounded rate of 26%.

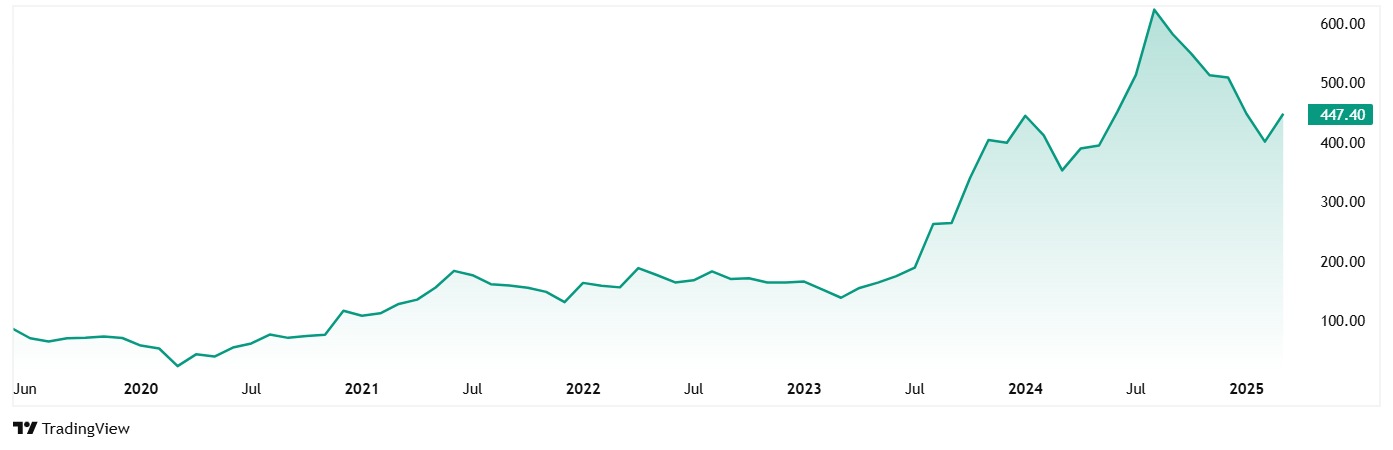

The current share price of PPL is Rs 446 as on closing of 7th March 2025, which is a jump of about 230% from Rs 135 in the last 5 years.

The company’s share is currently trading at a PE multiple of 11x. The median PE for the last 10 years is 8x, which would once again suggest that the current valuation multiple is at a small premium to its long-term median.

PPL plans to expand its packaging capacity to 36,000 MTPA by FY26, focusing on extrusion-coated and laminated structures. It also plans to introduce a new product line for HDPE drums, which is crucial for the pharmaceutical, chemical, and food processing industries.

Sweet and Strong, Lock In?

The two companies we saw today, Vadilal Enterprises and Prakash Pipes, are building solid businesses with a focus on making the most of every rupee they invest. That is something that even the Warren Buffetts of India cannot ignore. And with names like Sanjiv Shah, Mukul Agrawal, and Dolly Khanna already on board, it has definitely got merit in analysing these stocks.

How these two companies and their numbers change in the coming time, good or bad, is something only time will tell. But given that such big names are baking these stocks for a few years now, it might not hurt to add them to the watchlist and keep an eye on them.

Disclaimer:

Note: We have relied on data from www.Screener.in and http://www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.