When we look at the super investor portfolios for India, Akash Prakash’s name will be tough to find. The founder and CEO of Amansa Capital Pte Ltd, the holding company of which holds 26 stocks worth almost Rs 20,000 cr, is rarely found in search results when looking for super investors.

Akash has a strategic, research-driven approach and his goal is to generate sustainable returns for his company’s clients by identifying and investing in high-potential businesses. With the same goal, he founded Amansa Capital Pte. Ltd. a Singapore-based investment management in 2006.

As smart investors gear up for 2026, the top two 2025 buys of this less known Warren Buffett of India deserve attention. Especially because both the companies are loss making, raising valid questions about Akash’s investment in them worth over Rs 1,600 cr.

Let us see if we can decode what strategy is at play here.

ABFRL: The demerger bet hiding in plain sight

Aditya Birla Fashion and Retail Ltd emerged after the consolidation of the branded apparel businesses of Aditya Birla Group comprising ABNL’s Madura Fashion division and ABNL’s subsidiaries Pantaloons Fashion and Retail (PFRL) and Madura Fashion & Lifestyle (MFL) in 2015.

With a market cap of Rs 9,575 cr, the company is a part of the Aditya Birla Group, a US$ 48.3 billion Indian multinational, in the league of Fortune 500.

As per screener.in, Akash Prakash’s holding company Amansa Holdings Private Limited bought a 1.8% stake worth Rs 172 cr in the company per the filings made for the quarter ending March 2025. This purchase coincides with the stakes bought by Quant Small Cap Fund, Nippon India Small Cap Fund and HDFC Life Insurance Company Limited.

The company’s financials for the last 5 years do not seem strong enough, which has raised a lot of questions about Akash’s buying. Take a look…

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 8,788 | 5,249 | 8,136 | 12,418 | 6,441 | 7,351 |

| EBITDA/Cr | 1,259 | 583 | 1,138 | 1,557 | 408 | 699 |

| Profits/Cr | -165 | -736 | -118 | -59 | -736 | -456 |

The company has seen a bumpy ride in terms of core financials. Sales and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) have seen a compounded drop in the last 5 years.

But the net profits are where many investors are seeing a red flag. The company hasn’t logged a profit in the last 5 years.

When we put all this together, it does seem like a company most average investors would stay away from. However, Akash’s picks and sells are always backed by rock solid research. So, when he makes these bets, it warrants attention.

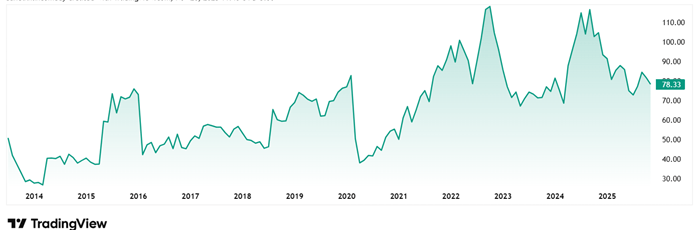

The share price of Aditya Birla Fashion & Retail Ltd was around Rs 56 in November 2020 and as on 20th November 2025 it was about Rs 79, which is a jump of 41%. However, the price has seen a drop between January and November 2025.

The company’s share is trading at a negative PE due to a string of losses it has recorded, but the current industry median is 39x. The 10-Year median PE for the company is however 28x, while the industry median for the same period is 46.

By means of a vertical demerger, the Madura Fashion and Lifestyle business got demerged from the company into a separate entity, Aditya Birla Lifestyle Brands Limited (ABLBL) w.e.f. May 1, 2025.

According to the latest investor presentation from November 2025, the company’s management is willing to tolerate near-term margin moderation to establish brand moats, especially in mass-premium/value (Pantaloons; OWND!) and new digital brands (TMRW).

Paytm: A regulatory reset and the AI pivot

Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants.

With a market cap of Rs 82,174 cr, the company owns and operates India’s leading mobile payments and financial services distribution brand Paytm. It has built the largest payment ecosystem with a registered merchant base of 4.2 Cr, and 112 lakh payment devices facilitating over 1,100 transactions as of Q2 FY25.

According to screener.in, Amansa Holdings bought a 1.34% stake in the company, per the filings made for the quarter ending March 2025. However, this holding has gone up to 1.8% per the filings for quarter ending September 2025 (Worth over Rs 1,470 cr).

Let us look at the financials for One97, which again raise some valid questions.

| FY | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Sales/Cr | 3,279 | 2,801 | 4,974 | 7,990 | 9,978 | 6,900 |

| EBITDA/Cr | -2,685 | -1,838 | -2,384 | -1,644 | -943 | -1,506 |

| Profits/Cr | -2,942 | -1,701 | -2,396 | -1,776 | -1,422 | -663 |

While the company’s sales have seen a compounded growth of 16% between FY20 and FY25, however this growth has not yet been translated into operating or net profits.

The share price of One 97 Communications Ltd was around Rs 1,560 when it was listed in November 2021, which was at Rs 1,285 as on 20th November 2025. That is a worrisome drop!

The company’s share is trading at a negative PE due to consistent losses, while the current industry median is 37x.

In January 2024, the RBI restricted all services of Paytm Payments Bank Ltd (PPBL), a 39% associate of the company, permitting only the withdrawal of the existing customer balances however in October 2024, NPCI approved the company to onboard new UPI users. In Oct 2023, RBI also imposed a monetary penalty of Rs. 5.4 Cr on PPBL.

In the earnings call in November 2025, CEO Vijay Shekhar Sharma said, “The future growth of Paytm in revenue and bottom line is going to come from India’s expansion of financial services, replication of this product technology elsewhere and AI stack, right from infrastructure to the use-case. So, it’s phenomenal. I’m super excited.”

Big turnaround or big mistake?

Akash Prakash might be less known, but his investment strategies under Amansa are not something that can be ignored. Clients trust him and his company, and in return they have maintained an enviable track record.

However, these two picks of 2025 have many investors worried and rightly so. For two giants in their niches, both the companies we saw today, Aditya Birla Fashion & Retail and One 97, are having difficulty in logging any profits at all. The share prices have also not given any signs of big growth.

But Akash and Amansa probably see something in these two stocks that the average investor is missing. Or this could be a big speed breaker for Amansa’s otherwise smooth and fast ride to profits. Only time will tell. For now, it would be smart to add these stocks to the watchlist for 2026 and follow them closely.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.