Nifty Realty Index tanked over 20% in the past year. This was despite the rate cuts by the RBI totaling 125 basis points during the period. Generally, decreasing interest rates lower EMIs, which spur demand for the real estate. Ideally this should be good news for investors in real estate stocks.

Perhaps, inflated starting point valuations of Indian realty stocks has taken its toll. Many major real estate developers had witnessed their stock prices doubling in the past 12-18 months. In the absence of fresh triggers, the interest in these stocks has waned.

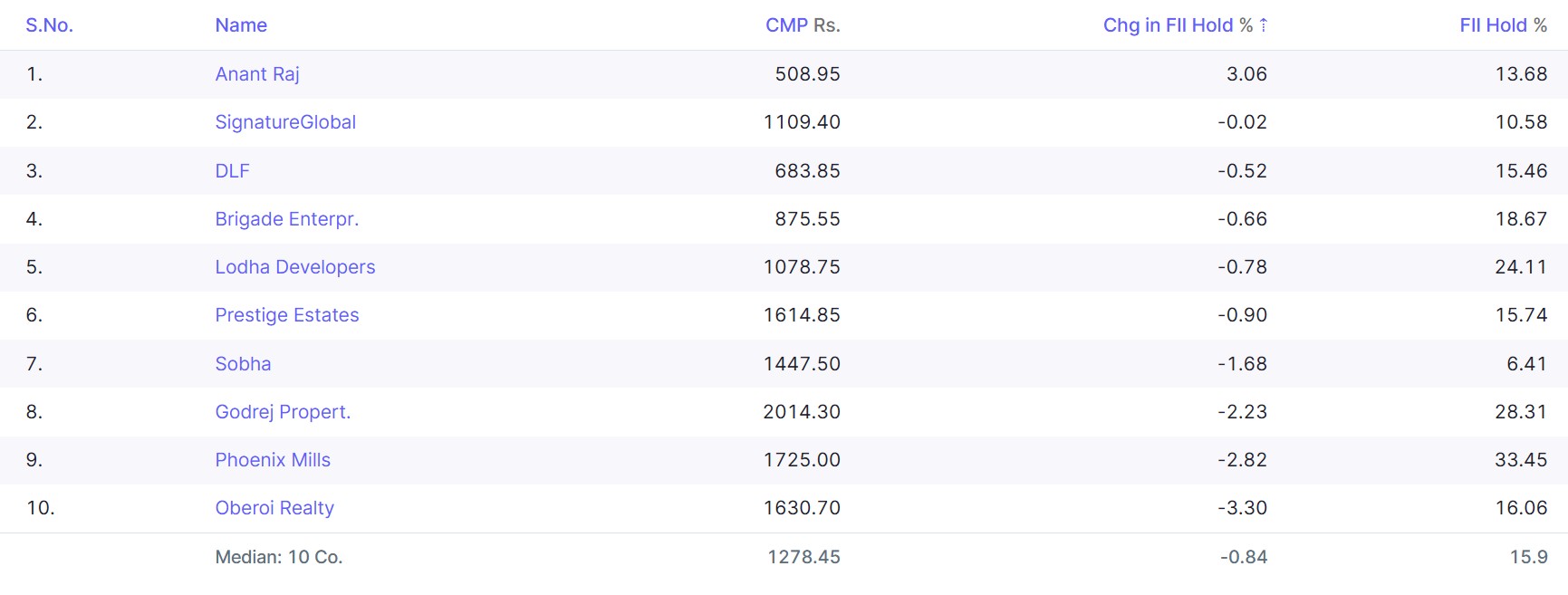

Amidst all this, Foreign Institutional Investors (FIIs) aggressively bought one realty stock during the July-September quarter. Out of ten stocks in the Nifty Realty Index, there is only one stock that saw FIIs increase their holding. On the flip side, FII holding in the other nine stocks declined.

So, which stock FIIs are going gaga over?

Anant Raj Ltd.

Nifty Realty Stocks: A FII Check

Let’s try to figure out why FIIs added more of this realty stock to their portfolio while the overall sentiment across the sector is so negative.

Anant Raj Limited – A Silent Game Changer

Anant Raj Ltd. is engaged in developing and constructing a variety of real estate projects ranging from IT Parks to shopping malls, residential complexes, hospitality projects, and more. And of course, a key reason for why stock has been so much in the limelight – its data center business.

The realty giant is prominent across the states of Haryana, Andhra Pradesh, Rajasthan, and most importantly in the capital of the country, Delhi, and nearby areas.

FIIs increased their stake by 3.06% points in this company during the Q2FY26, taking the total holding to 13.7% at the end of the quarter.

A Diversified Real Estate Powerhouse

The continuous interest of the FIIs might be a result of the widely diversified portfolio of real estate projects the company engages in.

Some of their flagship residential projects include –

- The Estate Floors, which offer 3-4 bhk luxury homes – Phase 1 of the project has been completed, and already handed over and occupied.

- The Estate Apartments, which is another luxury project launched in Q1FY26, is currently under construction and development phase and expected to generate revenues of around ₹750 crore.

- Aashray 2 is also under the construction phase and expected to be completed by June 2027. The projected revenue for this property is around ₹350 crore.

They also have an annuity business segment where they generate revenue via rent and lease. For this, they have Data Centers, which is one of their focuses right now.

Then there are commercial buildings, hotels and IT parks, and office spaces.

Strategic Growth Drivers

For any developer, having a land bank that they have acquired for a nominal cost can be the biggest asset. Anant Raj is sitting on a land bank of 83.43 acres, and it spans across different parts of Delhi.

Apart from the massive land bank, the company is exploring Data Centers and already has an operational capacity of around 28 megawatts (MW) of IT Load capacity in its Data Centers, and it is planning to increase it to a whopping 307 MW by 2032.

Consistent Growth Through Market Cycles

While the leading real estate giants witnessed sluggish sales growth in Q2FY26, Anant Raj has been resilient. Sales of the company have gradually increased from ₹513 crore in Q2FY25 to ₹631 crore in Q2FY26, growing at 23% Year-on-Year (YoY). The net profit also grew from ₹106 crore to ₹138 crore during the period, rising at 31% YoY.

Zero-Debt – High Dividend

Another aspect that might have caught the eyes of the FIIs is the significant reduction in debt levels over the years. The company has reduced its net debt from ₹1,497 crore in FY21 to just ₹50 crore in FY25. Q2FY26 is actually the fifth consecutive quarter during which the company successfully kept the net debt within the ₹50 crore level, becoming a near Zero Debt company.

And that’s not all, apart from consistent revenue generation, that too which keeps the debt level at a minimum, the company also consistently paid dividends to its shareholders. The dividend as a percentage of face value has gone up from 5% FY21 to a whopping 36.5% in FY25.

This can be another perspective that the FIIs are drawn towards, as the median debt-to-equity ratio for the industry stands at 0.44, while that of the company stands at just 0.13.

Reasonably Valued

The stock is currently trading at a Price/Earnings (P/E) of 36.8x, which is slightly higher than the industry median of 34.3x, suggesting the stock is fairly valued at the current market price.

1-year Share Price Chart of Anant Raj Ltd.

Potential Risk Factors To be Considered

Even though the Anant Raj story sounds compelling, there are some risks one needs to factor in.

- Inherent Sectoral Risk: The domestic real estate sector is cyclical in nature, leading to fluctuations in the saleability of the properties and also in the realization of the sale proceeds. On top of that, Anant Raj deals mostly in luxury properties, where consistent demand is a challenging thing to expect, which, if things turn for the worse, can further affect the sales and collections.

- Government Regulations: The Real Estate sector is highly dependent on government regulations. Different approvals are required even for a single project, making construction and development work challenging. Changes in property laws and government regulations can affect the future projects of the company.

- Slow Demand for Physical Data Centre: Anant Raj is investing its residential business segment’s profits into expanding its Data Centre business. While this is definitely helping them keep the debt under check, there is no guarantee that demand for physical data centers will continue to grow at the pace many expect it to. Earlier this year, upon the arrival of DeepSeek, the share price of Anant Raj tanked drastically as many deduced that there may not be a need for so many data centers after all, as the AI models could be trained with lesser than expected resources. Then there is a competitive angle too here. There are big players in the market, such as Reliance and Adani, who are building Gigawatt-scale Data centers, which can be a major threat to the 307 MW target of Anant Raj.

Wrapping up

Anant Raj stands resilient in a sector that is otherwise being shunned by investors. This is perhaps owing to its diversified business ventures, steady business growth, with consecutively increasing revenue and profit figures, a low-cost land bank, and a zero-debt profile. And of course, it’s interests in the fast-growing Data Center business.

Whether the company can continue to meet expectations, only time will tell. Until then, maybe keep the stock on a watchlist.

We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

Disclaimer:

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Maumita Mitra is a seasoned writer specializing in demystifying the world of investment for a broad audience. She has a keen eye for detail and a knack for explaining complex financial concepts in the simplest manner possible.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.