If you have been following the stock markets over the past year, it was around this time in 2024 that we wrote to you about holding companies and their new rule.

In 2024, SEBI introduced a new call auction mechanism for price discovery without price bands, for holding companies.

This meant that companies trading at a significant discount to their book values were up for a sharp re-rating.

Stocks like Authum Investment, Tata Investment, and Bajaj Holding have rallied post implementation of these new rules.

As we move to a new year, let’s examine 4 holding companies that could be up for a price discovery.

#1 Kalyani Investment Company

First on the list is Kalyani Investment Company.

Kalyani Investment was formed by demerging the investment business of Kalyani Steel and amalgamating the investment undertakings of three wholly owned subsidiaries of Kalyani Steel. The company primarily focuses on investing in Kalyani Group companies.

Some of its major holdings include Bharat Forge, one of India’s leading manufacturers of forged automotive components, and BF Utilities, which operates in power and infrastructure.

Additionally, Kalyani Investment has investments in preference shares and debentures, providing further diversification to its portfolio. These investments contribute to the company’s balance sheet and financial performance.

The company’s book value stands at Rs 19,996 per share as of March 2025, yet its current stock price is Rs 5,365 per share.

This takes its price to book ratio (PB) at 0.3, while its 5-year median PB has been around 0.2.

The significant discount to its book value, along with its strong stake in Kalyani Group companies, could be appealing for long-term investors, particularly those looking for exposure to the automotive, manufacturing, and infrastructure sectors.

Recently, Kalyani Investment announced a special call auction for its equity shares, scheduled for 29 October, on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

This is a part of a broader initiative for investment holding companies and aims to facilitate price discovery for its shares.

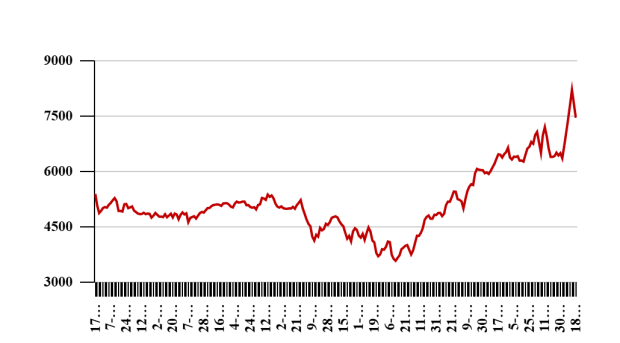

Kalyani Investment Share Price – 1 Year

#2 Kama Holdings

Next on the list is Kama Holdings.

Kama Holdings flagship unit is SRF which is a multi-business entity. It’s a core investment company, holding long-term investments in its subsidiaries.

Its key segments are the technical textiles business, chemicals business, and packaging film business, among others.

In the past five years, on a CAGR basis, its revenue has grown by 15%. While net profit has grown at a CAGR of 7% during the same time.

In-house expertise and support from SRF has helped grow Kama Holdings‘ subsidiaries in their respective chemical-based segment, where the revenue split is around 40%.

The stock is trading near its 52-week high, surging over 20% in the past one year.

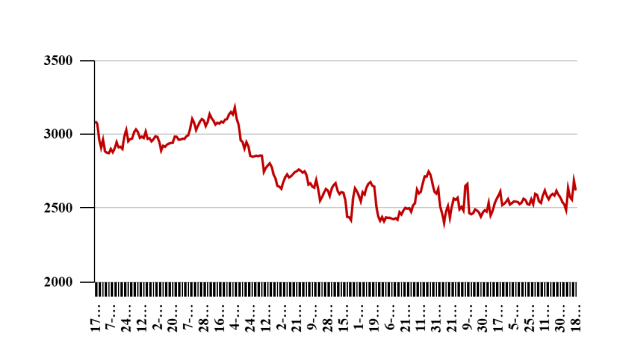

Kama Holdings Share Price – 1 Year

#3 Ramco Industries

Third on the list is Ramco Industries.

Ramco Industries is part of the Chennai-based Ramco Group, engaged in the manufacture of fiber cement (FC) sheets and calcium silicate boards (CSBs).

It’s also engaged in the spinning of cotton yarn, sale of surplus electricity generated from its windmills and computer software.

As part of its diversification efforts, the company has entered the non-asbestos based roofing products while it also has a presence in the Sri Lankan market.

Coming to its valuations, Ramco Industries trades at a PB multiple of 0.53, a discount of almost 50% from its book value.

The median average PB multiple for Ramco has remained in the range of 0.5-0.6.

Ramco Industries is currently planning to raise NCDs for acquisition of shares in its associate company, The Ramco Cements.

The company currently has a substantial market value as its investments in The Ramco Cements (21.36% direct stake and 1.26% through subsidiary) and Ramco Systems (20.07%).

With incremental investment of Rs 1 billion (bn) by the company in Ramco Cements, its stake has further increased by half percent.

However, investors should also keep in mind that Ramco’s revenue and margin is vulnerable to regulatory risks associated with the threat of ban on usage or manufacturing of asbestos-related products as well as on the mining of asbestos in asbestos-producing countries.

For this simple reason, the company has been diversifying into non-asbestos businesses.

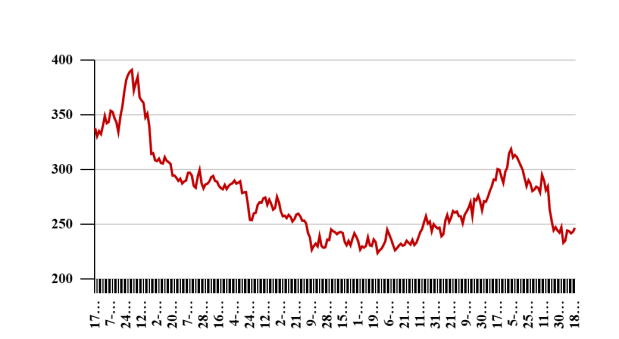

Ramco Industries Share Price – 1 Year

#4 TVS Holdings

Last on the list is TVS Holdings (erstwhile Sundaram Clayton).

TVS Holdings is one of the largest auto components manufacturing and distribution groups in the country. It’s a leading supplier of aluminium die castings to the automotive and non-automotive sectors. It also had a spare parts trading (mainly TVSM parts) business.

In March 2024, TVS Holdings received the Core Investment Company (CIC) licence from the RBI. As part of the CIC approval, the spare parts trading business has ceased to exist with TVS Holdings from October 2024.

The company has enjoyed a stellar run over the last 5 years. It’s revenue and profit have shot up by a 5-year CAGR of 13.4% and 8.5% respectively. The average return on equity (ROE) over the last 5 years stands at 26.5%.

At the current price, it trades at a price to book value of 6, compared to its 5-year average of 2.3.

It’s core holding is its 50.26% stake in TVS Motors, which is valued at over Rs 800 bn as of September 2025.

The company is supported by long tailwinds, including technological tie-up with BMW Motorrad for manufacturing two-wheelers and expansion in export markets.

It’s enhancing its presence in the electric vehicle (EV) space, with major investments expected over the next 3-4 years across categories.

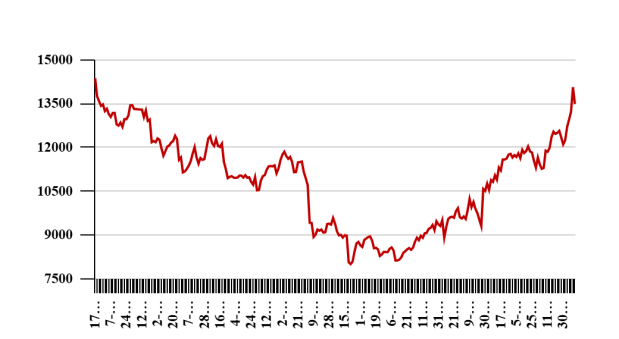

TVS Holdings Share Price – 1 Year

Conclusion

Investing in holding companies requires a long-term mindset and it’s a good method of constructing a portfolio in general – focusing on cash, keeping debt low, focusing on 3 to 4 verticals, and thinking in decades.

If you plan to invest in top holding companies, make sure you do your research, and understand what sort of events could give them the visibility needed to move the stock and the key capital allocations of the company.

And make sure to check for keyman risk.

Holding companies are usually controlled by a talented asset allocator at the top. When there is a transition from one generation to another, it becomes a completely different company.

In one of Europe’s holding companies, the family head stayed on too long and by the time his son took over, it was too late to repair the situation and the stock dropped by 90%.

Evaluate all these factors and also check for the group’s corporate governance before making an investment decision.

Investors should therefore have a high risk tolerance before considering any of these funds.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.