Agriculture has always been at the heart of India’s economy. It shapes livelihoods, supports rural families, and feeds the world’s largest population. But the food ecosystem is now changing. The real value is no longer created only on the farm. It is created when raw produce is cleaned, processed, packaged, and moved through a modern supply chain to reach store shelves.

A recent McKinsey report says many things are pushing this change. Farmers reach markets easily because the overall system is better. With easy transport and better storage, only little harvest is wasted. New digital tools are also helping companies to transport good quickly. These small changes, happening bit by bit, are lifting the farm sector in a big way.

At the same time, more families in the middle class are choosing packaged and easy-to-use foods, so the processing industry is seeing growth. This trend is rising quickly, making the food-processing industry more important than ever. The report also notes that companies with strong scale, wide distribution, smart use of technology, and culturally rooted brands tend to create the most value in this space.

These three stocks fit well together because each one does a different job in the farm-to-shelf chain. One takes the raw crop and turns it into the food people actually buy. Another focuses on getting these products out to shops on time, using smoother systems and a wide delivery network.

Together, they cover the full journey from raw produce to packaged goods and form the most coherent trio for this theme.

#1 AWL Agri Business: Dominating the quick-commerce surge

Incorporated in 1999, Adani Wilmar deals in edible oil and food and other FMCG products. Adani Group has exited the joint venture in FY24 to focus on other segments. AWL Agri Business is the new name decided in online voting.

AWL Agri Business showed steady progress in its agri-processing work in Q2 FY26, even though demand for edible oils was weak. Quick-commerce sales jumped 86%, and the company now holds more than half the market in categories such as soyabean oil. Management said cheaper imports from Nepal continued to put pressure on soyabean oil sales in several northern states.

The food and FMCG portfolio showed resilience. Normalised volumes were broadly flat, and profitability improved with a Rs 56-crore profit for the quarter. New facilities at Gohana, along with upcoming flour mills in Odisha and Bihar, are expected to support expansion towards the company’s FY27 revenue target.

The company also saw good momentum in newer selling channels. Quick-commerce orders went up sharply, almost doubling, and it now has more than half the market in categories such as soyabean oil. The management is hopeful about the rest of the year, as festival demand picks up, GST changes settle, and the crop situation looks better.

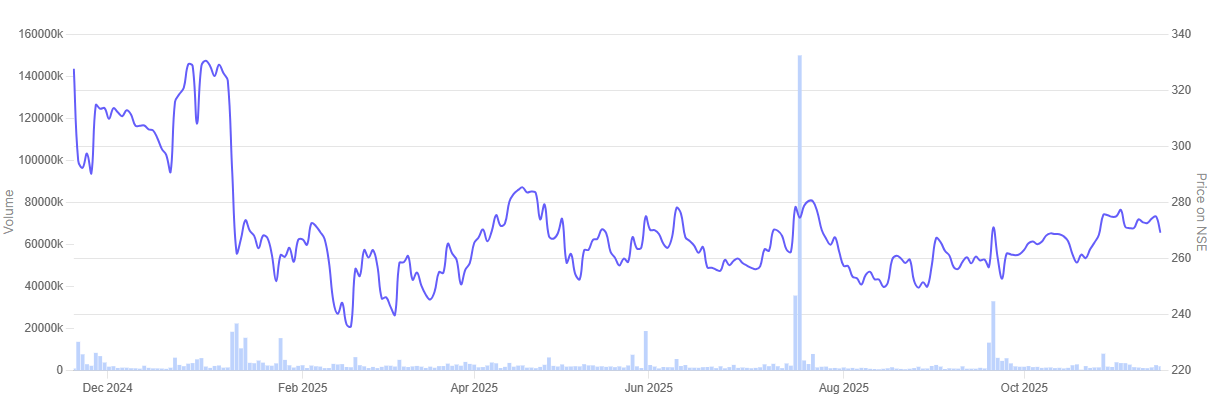

In the past one year AWL Agri Business share price tumbled 17%.

AWL Agri Business 1 Year Share Price Chart

#2 Patanjali Foods: The backward integration play

Patanjali Foods is one of the leading edible-oil and food-processing companies in India, with robust manufacturing capabilities across various locations. This company principally focuses on backward integration, oilseed crushing, and value-added packaged foods.

With a wide product range and growing distribution network, the company turns out to be one of the key players in India’s modern food-processing ecosystem.

Patanjali Foods had a good quarter in Q2 FY26. Revenue increased 20.9% YoY to Rs 9,798.8 crore. EBITDA was up 22.2% at Rs 603.3 crore with a margin of 6.1%. The company noted that GST 2.0 triggered a brief period of destocking, but demand started picking up in late September.

The edible oil business remained the main contributor, posting Rs 6,971 crore in revenue with most sales coming from branded oils. The palm plantation segment, too, has grown. It has reported Rs 599.4 crore in revenue and a margin of 24.1 per cent. Over one lakh hectares are now under cultivation.

The FMCG business delivered stable growth across ghee, biscuits, dry fruits, and nutraceuticals. The company is implementing SAP HANA and deploying AI and ML tools to enhance planning and costs. Management expects volumes to rise in the second half of FY26 as GST-led formalisation increases and festival demand picks up.

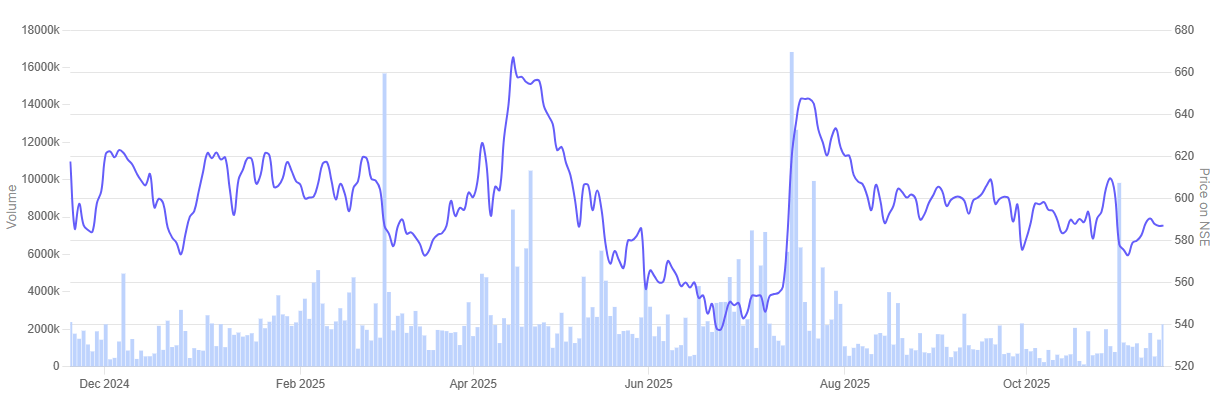

In the past one year Patanjali Foods share price is down 5.2%.

Patanjali Foods 1 Year Share Price Chart

#3 Britannia Industries: A century of trust meets modern dairy

Britannia Industries is one of India’s leading food companies with a 100-year legacy. It is among the most trusted food brands, and manufactures India’s favourite brands like Good Day, Tiger, NutriChoice, Milk Bikis and Marie Gold which are household names in India.

Britannia’s product portfolio includes biscuits, bread, cakes, rusk, and dairy products including cheese, beverages, milk and yoghurt.

Britannia Industries reported steady progress in its processing and supply-chain operations during Q2 FY26. The company said commodity inflation remained largely stable, with flour, sugar, and milk moving within a narrow range, helping maintain cost control.

Capacity expansion in wafers continued, supported by new lines being added in the North, while croissants and rusk posted strong double-digit growth. The Ranjangaon dairy plant too remained a focus area, where Britannia is pushing efficiencies to become a low-cost operator.

The company is deepening regional manufacturing by tailoring recipes and production lines to state-specific demand. Besides, it is strengthening its joint venture in Africa where the performance remains healthy. Management expects these initiatives to support a shift toward volume-led growth as GST-related disruptions ease and distribution normalises.

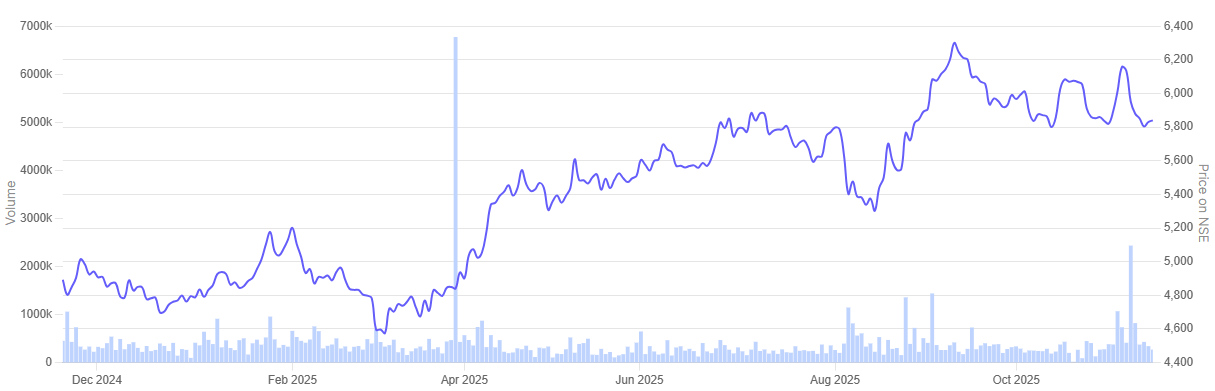

In the past one year Britannia Industries share price rallied 19.6%.

Britannia Industries 1 Year Share Price Chart

Valuations

Let’s now turn to the valuations of the agritech and food processing companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of Agri Tech and Food Processing Companies in India

| Sr No | Company | EV/EBITDA | Respective Industry EV/EBITDA Median | ROCE |

| 1 | AWL Agri Industries | 13.5 | 13.8 | 20.9% |

| 2 | Patanjali Foods | 31.2 | 13.8 | 15.6% |

| 3 | Britannia Industries | 39.8 | 30.0 | 53.0% |

The numbers show a mixed picture. AWL Agri Business trades almost in line with its industry median. Patanjali Foods trades at more than double the median. Britannia Industries trades well above the broader packaged-foods benchmark.

This reflects a broader re-rating across the food value chain. Demand for branded and processed foods has risen sharply. Supply-chain upgrades and stable commodity trends have also supported this shift. But current prices already reflect much of the positive sentiment.

Investors should check if the market has already considered the growth potential. Good companies often trade at higher levels, but when a stock gets too expensive, the upside can shrink. The point is to figure out whether these prices still leave room for decent returns as the businesses grow.

Conclusion

A new phase has begun in India’s food system, wherein value is being created as much in processing, packaging, and distribution as on the farm. The companies discussed here illustrate how this shift is unfolding on the ground.

Each of these companies is adding capacity, modernizing supply chains, and building deeper regional reach to keep pace with the rise in demand for packaged and value-added foods. Their efforts highlight the rising importance of scale, technology, and efficiency in the agri-processing landscape in India.

But the market has taken note of this transformation. Valuations across the sector already reflect stronger demand, better logistics, and improving execution. That suggests investors now have to look beyond broad trends and into the balance sheet, growth visibility, and competitive position of each company.

Any investment decision needs a broad-based evaluation beforehand. The opportunity is real, but the best outcomes will come from identifying businesses where long-term potential still outweighs what the market has already priced in.

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.