‘The true investor will do better if he forgets about the stock market and pays attention to his dividends’

– Benjamin Graham

A high dividend yield indicates a stock offering substantial dividend payouts relative to its price.

In 2025, several high dividend yield stocks experienced a sharp decline.

This downturn has caught the attention of income-focused investors. Is this a sign of deeper financial concerns or a golden opportunity to buy quality dividend-paying stocks at discounted prices?

While market volatility and economic factors have contributed to the decline, understanding the reasons behind it is crucial for making informed investment decisions.

We used a screener to identify the biggest declines among high dividend yield stocks. From the beginning of 2025, these stocks have fallen up to 35%.

Additionally, for better results, low liquidity stocks were removed. Also, these high dividend yield stocks were filtered with a market capitalization criterion of more than Rs 10 billion (bn).

These are not stock recommendations. Investors should do their own research and do due diligence before considering any investment in the stock market.

Also, investors should pay close attention to corporate governance while performing their due diligence.

So, let’s look at the 5 high dividend yield stocks that have fallen up to 35% in 2025, the key reasons behind this sharp correction, its impact on investors, and the outlook for these stocks going forward.

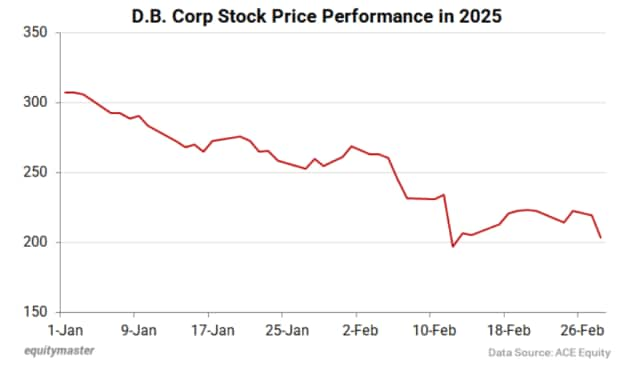

#1 D.B. Corp

First on this list is D.B. Corp.

D.B. Corp is engaged in publishing newspapers, radio broadcasting, providing integrated internet and interactive mobile services, and event management.

Its major brands include Dainik Bhaskar (Hindi daily), Divya Bhaskar and Saurashtra Samachar (Gujarat daily), and Divya Marathi (Marathi daily).

As of 3 March 2025, the company has a dividend yield of 6.4%.

Since the start of 2025, D.B. Corp’s shares have fallen 34%.

Stocks in the media sector have been underperforming the market.

The company’s net sales have grown at an annual rate of only 0.7%, and operating profit growth has been similarly sluggish. This lack of robust growth within the sector has also negatively impacted DB Corp’s stock performance.

In February 2025, promoters of DB Corp purchased over Rs 40 bn worth of the company’s shares during significant market declines. While such insider buying can signal confidence, it may also reflect attempts to stabilize the stock amid challenging market conditions.

However, the company’s net profit has grown at a compounded average growth rate (CAGR) of 9.2% in the last five years.

The company’s five-year average return on equity (RoE) and return on capital employed (RoCE) were 12.1% and 16.7%, respectively.

As of 31 March 2024, the company is net debt free.

In Q3 FY25, the company reported total revenue of Rs 6.6 bn, down 1.4% year-on-year (YoY) from Rs 6.7 bn in Q3 FY24 due to a high election base.

DB Corp’s management emphasized maintaining financial performance despite a high base from election-related advertising in the previous year.

With regards to the advertising revenue, the management expects potential flat growth in Q4 FY25 due to prior election impacts but remains optimistic about the education sector’s normalization.

DB Corp is having discussions with suppliers regarding forward contracts for newsprint pricing to mitigate future cost increases.

The company is not actively seeking acquisitions and is focused on returning capital to shareholders through dividends.

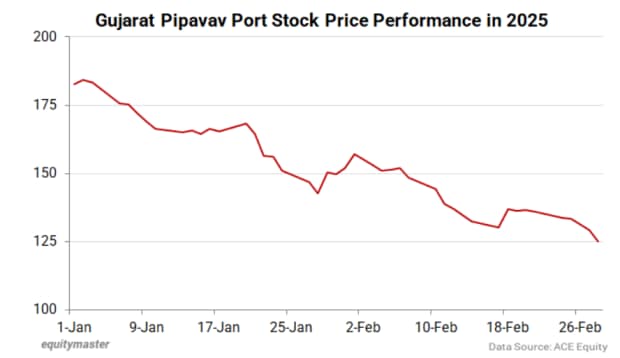

#2 Gujarat Pipavav Port Ltd (GPPL)

Second on this list is Gujarat Pipavav Port.

Gujarat Pipavav Port is India’s first private sector port located on the south-west coast of Gujarat near Bhavnagar.

The port is strategically placed to an international maritime trade route which connects India with US, Europe, Africa, Middle East on one side and the far east on the other side.

It handles four types of cargo including container, dry bulk, liquid bulk, and RoRo (roll-on/off – service designed to carry wheeled cargo).

As of 3 March 2025, the company has a dividend yield of 5.7%.

Since the start of 2025, Gujarat Pipavav Port’s shares have fallen 32%.

The company’s stock faced selling pressure due to weak financial performance and the recent stock market volatility.

In Q3 FY25, GPPL reported a 14.4% YoY decline in net profit, amounting to Rs 993.7 m. Revenue decreased 2.5% to Rs 2,628.9 m.

Additionally, increased selling, general, and administrative expenses, which rose 19.3% YoY, adversely affected profitability.

The stock faced high volatility, with a six-day decline resulting in an overall drop of 8.7%. Such fluctuations can erode investor confidence and contribute to further declines.

Coming to the financials, the company’s revenue has grown at a CAGR of 7.1% in the last five years while its net profit has grown at a CAGR of 11.5%.

This has resulted in healthy return ratios. The company’s five-year average RoE and RoCE were 13.1% and 18.4%, respectively.

As of 31 March 2024, the company is net debt free.

In Q3 FY25, container volume was down 15.8% YoY. The geopolitical tensions in the Red Sea region have disrupted shipping routes and services.

This crisis has led to reduced shipping activity and altered trade routes, further exacerbating the decline in container volumes at GPPL.

APM Terminals Management B.V., which operates GPPL, has pledged an investment of Rs 33.2 bn to expand the port’s cargo handling capacity.

Additionally, in collaboration with Welspun New Energy Limited, GPPL aims to establish a green hydrogen ecosystem at the port. This initiative involves setting up facilities to produce green hydrogen, leveraging renewable energy sources.

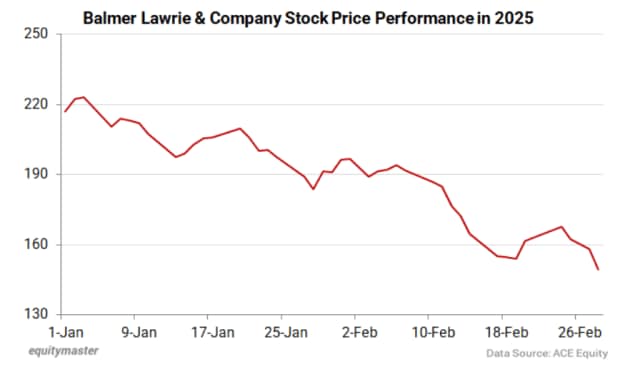

#3 Balmer Lawrie & Company

Next on this list is Balmer Lawrie & Company.

Balmer Lawrie & Company is engaged in the business of industrial packaging, greases & lubricants, leather chemicals, logistic services and infrastructure, refinery & oil field, and travel & vacation services in India.

It is a central public-sector undertaking under the administrative control of Ministry of Petroleum and Natural Gas, government of India, since 1972.

As of 3 March 2025, the company has a dividend yield of 5.5%.

Since the start of 2025, Balmer Lawrie & Company’s shares have fallen 31%.

The company’s stock faced selling pressure due to weak financial performance, operational challenges and leadership changes. It reported a 6.1% YoY decline in its consolidated attributable profit to Rs 625.3 m in Q2 FY25.

The company has also faced operational issues, including fines imposed by stock exchanges for Q2 FY25, attributed to factors beyond the company’s control. These challenges have raised concerns about operational efficiency and governance practices.

In January 2025, there was a change in the company’s compliance officer due to amendments in SEBI regulations.

Additionally, the cessation of directorship of Amit Bansal, a government nominee director, occurred in January 2025 following the withdrawal of nomination by the Ministry of Petroleum and Natural Gas.

Such leadership changes can lead to uncertainty and affect investor confidence.

Coming to Balmer Lawrie & Company’s financials, the company’s revenue has grown at a CAGR of 5.5% in the last five years while its net profit has grown at a CAGR of 1.5%.

The company’s five-year average RoE and RoCE were 11.6% and 16.3%, respectively.

As of 31 March 2024, the company is net debt free.

With regards to expansion into new business verticals, the company plans to invest Rs 3.3 bn in establishing ethanol production facilities, utilizing rice and maize as feedstock.

Additionally, an investment of Rs 2.2 bn was allocated for setting up an FTWZ (Free Trade Warehousing Zone) in Mumbai, aiming to enhance logistics and warehousing capabilities.

Going forward, Balmer Lawrie aims to enter the third-party logistics sector, expanding its service offerings. It also intends to enhance its presence in the automotive sector by expanding its product range and increasing its distribution network.

Also, the company has signed a Memorandum of Understanding (MoU) with the government, targeting a revenue of Rs 34 bn for the current financial year.

Lastly, regarding diversification of logistics services, Balmer Lawrie has ventured into rail logistics by signing an agreement with Steel Authority of India Ltd (SAIL) for transporting finished steel products, marking its entry into rail cargo services.

#4 Hindustan Petroleum Corporation Ltd (HPCL)

Fourth is Hindustan Petroleum Corporation.

HPCL is engaged in refining crude oil and marketing of petroleum products, production of hydrocarbons as well as providing services for management of exploration & production blocks.

As of Q2FY24, ONGC (Oil & Natural Gas Corporation Ltd) holds 54.9% equity in the company.

As of 3 March 2025, the company has a dividend yield of 7.1%.

Since the start of 2025, the company’s shares have fallen 29%.

The company’s stock faced selling pressure due to budget allocation reductions, rising crude oil prices and disappointing quarterly earnings.

In the union budget 2025, the government reduced the LPG subsidy allocation from Rs 147 bn for FY25 to Rs 121 bn for 2026. This reduction raised concerns about HPCL’s profitability, as the company reported LPG under-recoveries of Rs 76 bn in 9M FY25.

In January 2025, brent crude prices surged above US$ 81 per barrel, the highest in over three months. This increase led to higher input costs for HPCL, squeezing profit margins.

Despite HPCL’s third-quarter net profit rose nearly sixfold to Rs 30.2 bn, falling short of analyst expectations of Rs 31.3 bn. The shortfall was primarily due to lower marketing margins and LPG segment losses, exacerbated by rising crude prices and unchanged domestic LPG prices.

However, the company’s revenue has grown at a CAGR of 9.5% in the last five years while its net profit has grown at a CAGR of 19.5%.

The company’s five-year average RoE and RoCE were 15% and 9.5%, respectively.

Its debt-to-equity ratio was 1.5 as of 31 March 2024.

The company recorded its highest ever crude throughput at 18.5 million metric tons (MMT) in 9M FY25, operating at 106% of installed capacity, a 12.4% increase over the previous year.

In Q3 FY25, capex was approximately Rs 29 bn, with cumulative spending of around Rs 95 bn from April to December.

HPCL received approval for a Rs 47 bn lube modernization and bottom upgradation project at Mumbai refinery which is scheduled for completion by March 2028.

The company recorded a market share gain of 0.4% in Q3 FY25, outperforming industry growth rates (8.2% for HPCL vs. 6.3% industry growth).

Additionally, the company is pursuing value unlocking initiatives for the lubricant business and actively seeking government approval for a business carve-out.

#5 Chennai Petroleum Corporation Ltd (CPCL)

Last on this list is Chennai Petroleum Corporation (CPCL).

CPCL is in the business of refining crude oil to produce & supply various petroleum products and manufacture and sale of lubricating oil additives.

The main products of the company are LPG, motor spirit, superior kerosene, aviation turbine fuel, high speed diesel, naphtha, fuel oil, lube base stocks, and bitumen.

These products are marketed by parent company IOCL (Indian Oil Corporation Ltd).

As of 3 March 2025, the company has a dividend yield of 12.2%.

Since the start of 2025, Chennai Petroleum Corporation’s share have fallen 29%.

The company’s stock faced selling pressure due to substantial profit decline and operational losses.

In Q3 FY25, CPCL reported a net profit of Rs 207.8 m, a sharp decrease of 94.3% compared to Rs 3,652.8 m in the same quarter the previous year.

The company faced operational challenges, including a standalone net loss of Rs 6,294.9 m in Q2 FY25, contrasting with a net profit of Rs 11,905.6 m in Q2 FY24. This loss was primarily attributed to reduced revenue from operations, which declined 26.9% YoY.

Coming to the financials, the company’s revenue has grown at a CAGR of 9.9% in the last five years while its net profit has grown at a CAGR of 168.8%.

The company’s five-year average RoE and RoCE were 20.7% and 18.2%, respectively.

Its debt-to-equity ratio was 0.3 as of 31 March 2024.

CPCL, in partnership with IOCL, is constructing a 9 MMTPA (million metric tons per annum) refinery at Tamil Nadu, with a Rs 315.8 bn investment. The project is expected to be completed in 45 months.

Additionally, a desalination plant with a 60 MLD (million liters per day) capacity will be developed to meet the water needs of the new refinery.

Lastly, CPCL plans to produce 35,000 MTPA of pharma-grade hexane with an investment of Rs 671.5 m, expected to be completed within the current quarter.

Conclusion

The sharp decline in high dividend yield stocks in 2025 presents both challenges and opportunities for investors.

While a drop of up to 35% may raise concerns, it could also offer a chance to buy quality stocks at attractive valuations.

Investors should carefully assess the fundamentals of these companies, ensuring that dividends remain sustainable, and that the downturn is temporary rather than a sign of deeper financial trouble.

Additionally, conducting due diligence on these companies and including corporate governance as a key criterion in your selection process is essential.

At the same time, assess your financial goals, risk tolerance, and investment horizons before making investment decisions.

By focusing on strong, well-managed businesses, long-term investors can turn this market weakness into a potential opportunity for steady income and future growth.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.