Foreign institutional investors (FIIs) are on a selling spree.

As of March 2025, their shareholding was down to 17.2%, while domestic institutional investors (DIIs) held 17.6%. Promoters held about 52%, while retail investors held the balance stake.

During the June 2025 quarter, FIIs poured in Rs 386.7 billion (bn) into Indian equities. Yet, even as broader indices held their ground, the undercurrents were different in the smallcap space.

Several well-known fundamentally strong companies saw sharp cuts as FIIs trimmed their exposure.

Here are four such stocks.

Take a look…

#1 Aditya Birla Fashion and Retail

First on the list is Aditya Birla Fashion and Retail.

Aditya Birla is the apparel retail venture of the Aditya Birla Group. The company deals in mass and value, luxury retail, as well as ethnic brands and digital-first brands.

Its brands include Pantaloons, StyleUp, The Collective, TMRW, Sabyasachi, Shantanu Nikhil, Masaba, Tarun Tahiliani, Tasva, and Jaypore.

The company has 451 mass and value stores, 659 ethnic brand stores, 41 luxury stores, and 16 TMRW brand stores.

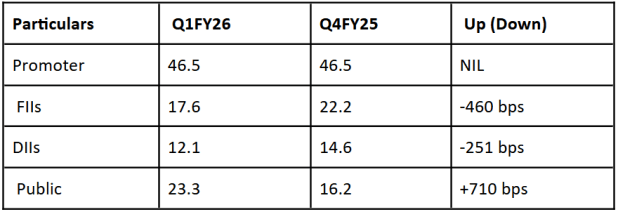

FIIs currently hold a 17.6% stake in the company, down from 22.2% in the March quarter. DIIs stake has also declined by 251 basis points (bps) to 12.1%.

At the same time, the share of public shareholders has increased from 16.3% to 23.3%.

Aditya Birla Shareholding Pattern (%)

Coming to its financials, revenue rose 14% year-on-year (YoY) to Rs 73.6 bn. Loss after tax (PAT) reduced by 31% to Rs 6.2 bn.

Pantaloons contributed 59% of revenue, followed by Ethnic (26%), TMRW (9%), and others (7%). Negative margins in the emerging TMRW contributed to its losses.

Looking ahead, the company has an aggressive growth plan. It aims to increase its revenue threefold and its margin twofold over the next 5 years.

The company’s current margin is 9% which it aims to double to 18%. To this end, it plans to turn loss-making ethnic businesses (TCNS and Taswa) and TMRW into profitable ones.

Independently, each business is expected to achieve profitability by FY27, while TMRW may take an additional year. The company also has a cash balance of Rs 23.5 bn to pursue expansion.

#2 Samhi Hotels

Second on the list is Samhi Hotels.

SAMHI is an institutional multi-branded hotel ownership company. Its business model focuses on acquiring hotel brands and scaling them.

The company has 32 hotels, totaling 4,948 rooms across 10 brands in 14 cities. The hotels are well-diversified across upper-scale, upper mid-scale, and mid-scale.

The company has tie-ups with Marriott (like Courtyard, Fairfield, Sheraton, and Renaissance), Hyatt (Hyatt Place and Hyatt Regency), and IHG (Holiday Inn Express).

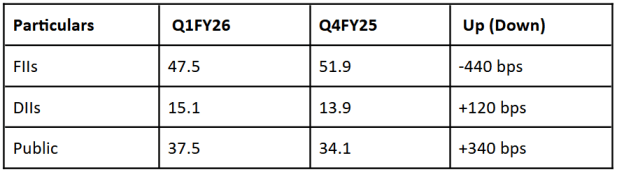

FIIs reduced their stake to 47.5% in Q1 FY26 from 51.9% in the March quarter.

At the same time, the stake of DIIs and public shareholders increased to 15.1% and 37.5%, respectively.

SAMHI Shareholding Pattern (%)

Samhi’s total revenue grew 17% YoY to Rs 11.5 bn, while the company swung to a profit of Rs 860 million (m) from a loss of Rs 2.3 bn. Its net-debt to EBITDA also improved from 4.4 times in FY24 to 3.2x.

About 72% of revenue came from rooms, 25% from food and beverages, and the rest from others.

Looking ahead, SAMHI expects overall revenue to grow in the early double digits in the long term. It also expects its EBITDA to expand by about Rs 600 m, driven by operating leverage.

SAMHI also aims to generate free cash flow of Rs 3.6 bn in FY26, which will be used to improve its balance sheet. To achieve growth, it also has a strong asset pipeline.

In the short term, Sheraton Hyderabad is adding 54 new rooms, and Hyatt Regency Pune will add 22 rooms. Both are expected to start contributing to existing revenue from FY26.

A 362-room Westin and Tribute dual-branded hotel is expected to contribute from FY26 onwards. A 170-room Marriott’s W brand hotel is scheduled to commence operations in the second half of FY27.

The company has also formed a partnership with GIC to reduce debt and pursue growth opportunities.

#3 Hi-Tech Pipes

Third on the list is Hitech Pipes.

Hi-Tech Pipes manufactures and supplies steel pipes and related products. As of Q4 FY25, it has an installed capacity of 7.5 lakh MTPA.

Its product portfolio includes electric resistance welded (ERW) pipes and hollow sections, color-coated coils, galvanised iron (GI) and galvanised plain (GP) pipes, cold rolled (CR) coils, among others.

It has a diverse market presence in 19 states with 350+ dealers and distributors and over 100 original equity manufacturers.

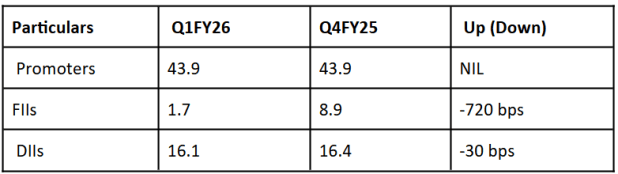

FIIs have reduced their stake to 1.7%, while DIIs have also reduced their stake marginally to 16.1%.

Hi-Tech Shareholding Pattern (%)

In FY25, revenue increased 14% to Rs 30.7 bn, driven by a 24% increase in sales volume. PAT rose even higher by 66% to 729 m, as operating leverage kicked in.

EBITDA per metric ton – a key metric – also improved 12% to Rs 3,297.

Its sales are diversified, with 60% revenue from general products and 37% from value-added products (VAP). The company plans to increase VAP share to 42-43% by FY26.

Looking ahead, the company plans to achieve 1 m tonnes of annual production capacity by FY26, and 2 m tonnes of installed capacity by FY29.

To achieve this, it is building a new greenfield plant in Secunderabad. This plant will meet infrastructure, defense, and renewable energy.

The company is also expanding its Sanand unit and is doing a greenfield expansion in Sri City, Chennai.

#4 ITD Cementation

Fourth on the list is ITD Cementation.

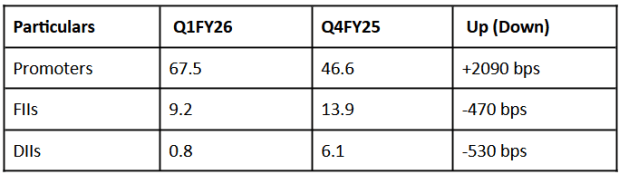

ITD Cementation was part of the Thailand-based ITD Thai group until May 2025. However, it is now part of the Adani Group with 67.5% holding, after its group entity bought the ITD promoter holding.

The company provides design, engineering, procurement, and construction services to the infrastructure projects in India. This includes maritime, water, wastewater, hydro, roads, railways, and metros.

FIIs have reduced their shareholding to 9.2%, while DIIs now hold only 0.8%.

ITD Cementation Shareholding Pattern (%)

Coming to its financials, revenue rose 18% to Rs 91 bn in FY25. PAT, on the other hand, rose 36% to Rs 3.7 bn.

As of March 2025, its order book stands at Rs 183 bn, providing revenue visibility of about 2 years. The order book is also geographically diversified across sectors.

Marine (35%), metro and urban infrastructure (18%), and buildings and industrial structures (25%) contribute the most to the order book.

ITC expects both its revenue and profit to grow by 25% in FY26, driven by order book execution.

It is also targeting new order inflows of around Rs 150 bn out of a project pipeline of Rs 900 bn in FY26.

Conclusion

FIIs sell their stakes for a variety of reasons.

These can include shifting capital to better opportunities elsewhere, concerns over stretched valuations, weak earnings outlook, or even broader macroeconomic risks.

Sometimes, it’s simply profit booking after a strong rally. In this editorial, all the four businesses are fundamentally strong, with ambitious growth outlooks and expansion plans.

Nonetheless, instead of relying only on hype, it’s necessary to carefully analyse the company’s fundamentals, including financial performance, corporate governance practices, and growth prospects.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.