Most investors will smile and say “Gold and Silver” when you ask them what they will remember about 2025. Gold rose 82% on the Multi Commodity Exchange of India (MCX), and Silver surprised everyone with a huge 175% rise. It seemed like bullion was the only thing that mattered this year, and the stock markets were just watching from the sidelines.

The Nifty 50 went up 10%, and the BSE Sensex went up about 9%, not a great year for equity investors, but steady enough to keep long-term investors in the game.

By the end of 2025, the charts of Mid-cap and small-cap stocks did worse than large-cap stocks. A lot of investors saw this as a sign to “play it safe.” When things are uncertain, money usually goes to comfort zone.

Even though mid-caps and small-caps were having a hard time, a few micro-caps quietly kept getting stronger.

We thought 2026 may probably bring back the opportunities in mid-caps, small-caps and micro-caps as the margin of safety in the gold and silver investments offers high risk. So instead of chasing the stories of the micro-cap stocks, we followed a simple technical checklist on weekly, monthly, and quarterly charts:

- RSI > 60 on Weekly, Monthly and Quarterly Charts.

- MACD should be above Integer Line with Bullish Crossover on Weekly, Monthly and Quarterly charts.

- ADX > 25 on Monthly Chart.

Three stocks in the Nifty Microcap space stood out after going through these filters.

1. Strides Pharma Science Ltd (STAR)

STAR Monthly Chart

History, not news, is what makes STAR interesting. The stock price of Strides Pharma has broken out of a 14-year price range on the monthly chart. In India, 14 years makes us think of Ram Vanvas, which is a long time of waiting for things to change.

Long consolidations like this can change the way a stock behaves. When they break, the move is usually big and lasts a long time. If the momentum keeps going, STAR could surprise investors with a strong long-term run through 2026.

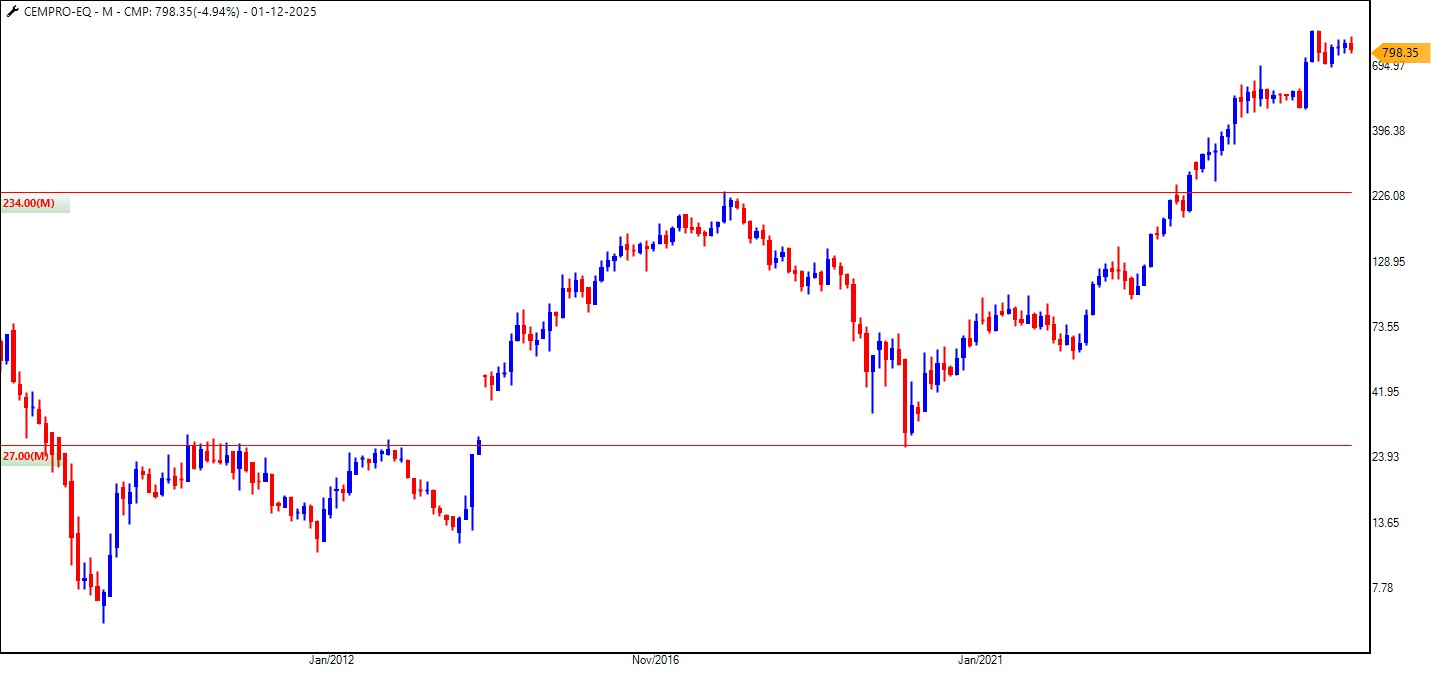

2. Cemindia Projects Ltd (CEMPRO)

CEMPRO Monthly Chart

In November 2023, the stock price of Cemindia broke out for the first time in years and stayed strong after that. The steady outperformance in 2025 shows that investors are willing to hold on and not rush to sell.

Dips towards the Rs.700 area look like places where buyers are coming in, at least in terms of technical analysis. The charts say that if the structure stays the same, the price may probably rally to Rs.1,300 and Rs.1,400 in 2026.

3. Sandur Manganese and Iron Ores Ltd. (SANDUMA)

The market didn’t really wake up to Sandur Manganese until it was listed on the NSE in 2023. The stock went up from Rs.80 to Rs.200 in just three months, and a lot of people thought the party was over. The stock did something better instead.

SADUMA Monthly Chart

It stayed in one place from February 2024 to October 2025, which is a classic “re-accumulation phase.” The trend wasn’t over when prices finally went over Rs.215; it was just on hold. This breakout makes it possible for strength to continue in 2026.

Are You Ready to Add these Stocks in 2026?

Markets don’t always go where we think they will, as we learnt in 2025. Microcaps aren’t about getting excited quickly. They are about finding strength early and giving it time to grow. These three stocks show us that even when gold is in the news, equity opportunities never really go away; they just wait quietly.

Sometimes, the best stories start when no one is talking about them.

Disclaimer:

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia is an Independent Research Analyst and is engaged in offering research and recommendation services with SEBI RA Number – INH000022075. He has two decades of experience in India’s financial markets as a trader and technical analyst.

Disclosure: The writer and his dependents do not hold the stocks discussed here.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.