Many investors turn to investment gurus for their valuable advice, expertise, and insights, which can help simplify the complexities of the investing world.

However, the best approach is to learn from their principles, and apply them thoughtfully to your financial goals, and maintain your own understanding and control over your investments.

An esteemed investor whose every investment garners attention is Ramesh Damani.

Who is Ramesh Damani?

Ramesh Damani is a member of the Bombay Stock Exchange and is a well-known face among the stock broking community in India.

He holds a bachelor’s degree in commerce from HR College in Mumbai and a master’s degree in business administration from California State University, Northridge, US. He was the well-known host of the TV show ‘Wizards of Dalal Street’ on CNBC TV18 and is frequently invited to comment on financial issues on business channels.

Damani follows the Warren Buffett model of investing, which favours companies with strong management credentials and financials.

Which Stock Did Ramesh Damani Buy and Why?

Ramesh Damani recently acquired a stake in John Cockerill India.

He acquired 27,500 shares of the small-cap firm John Cockerill India in a bulk deal on 26 December, amounting to Rs 130 million (m).

Meanwhile, the promoter company, John Cockerill SA, offloaded more than 191,000 shares worth Rs 910 m, including to other investors.

While the reasons for his buying a stake remain unclear, here are a few points that can explain the decision.

#1 Solid Order Book Intake

In the third quarter of the current calendar year, John Cockerill India’s order intake reached about Rs 5.86 billion (bn), nearly 10 times what the company recorded in the first quarter. The order backlog almost doubled to over Rs 11,000 m.

These figures give the company good visibility for 2026 and provides confidence to investors.

#2 Strategic Transformation Anchored in India

The group is advancing to ensure that John Cockerill’s global metals activities are anchored under a single, India-based listed entity. This initiative will create a more focused, transparent, and investible structure, enhancing both operational and financial agility.

The group was prompted to take this decision due to India’s strong economic fundamentals, favourable geopolitical environment, and proactive industrial policies including Make in India, the PLI schemes, and the National Green Hydrogen Mission make it the ideal hub for global metals consolidation.

All of these reasons may have led Ramesh Damani to pick a stake in the company.

What Next?

The company has done well on the financial front. Revenue growth accelerated from roughly 7.5% in the second quarter to over 18% in the third, supported by better project execution, improved coordination and stronger site readiness.

EBITDA rose sequentially by around 13%, reaching approximately Rs 120 m, while the cash position more than doubled from Rs 742 m in quarter one to over Rs 1,470 m in quarter three.

The company reported a net profit of Rs 87 m in the September 2025 against losses YoY.

The quarter saw major wins with leading steel producers such as JSW, Tata Steel, and Godawari Power & Ispat Ltd., driving the order backlog from Rs 6,388 m to Rs 11,291 m. This strong inflow ensures visibility well into 2026 and reinforces its expanding footprint across India and Asia.

With a robust order book, healthy liquidity, and the upcoming consolidation initiative, the company is well-positioned to lead John Cockerill Metals’ global expansion from India.

How Shares of John Cockerill India have Performed?

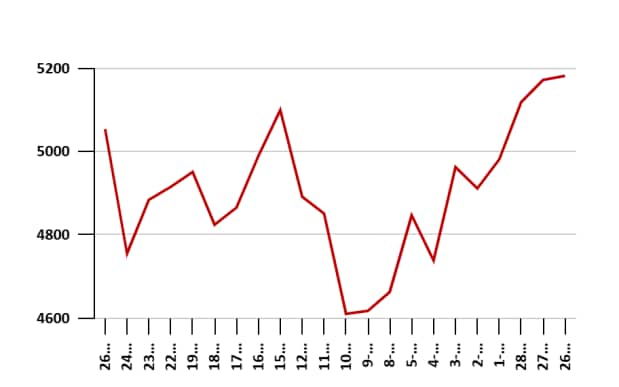

In the past five days, John Cockerill India shares have rallied to Rs 5,351.9 from Rs 4,900.5. In the last one month, the share price has gained about 8%. In the last one year the shares have gained 30%.

The stock touched its 52-week high of Rs 6,660 on 6 October 2025 and its 52-week low of Rs 2,383 on 17 February 2025.

John Cockerill India Share Price – 1-Year

Data Source: BSE

About John Cockerill India

John Cockerill India offers the entire product portfolio of John Cockerill Industry and is coordinating a range of activities including, but not limited to, local engineering, sourcing, and manufacturing.

It has developed a wide range of technologies in the field of processing lines, rolling mills, thermal and chemical processes. The company also supplies auxiliary steel treatment equipment.

To know what’s moving the Indian stock markets today, check out the most recent share market updates here.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary