The microfinance sector is designed to serve the lower-income segment of the population. This focus means that these companies often face higher risks when the economy slows, inflation rises, or unemployment spikes. Last fiscal year was a case in point, as slowing growth led to a sharp increase in bad loans, pushing many microfinance companies into significant losses.

However, that period now seems behind them. The sector has addressed the central challenges and is poised to rebound with greater agility. For investors willing to take a contrarian view, these three leading names can rebound.

CreditAccess: The Market Leader Weathering the Storm

With assets under management (AUM) of ₹260.5 billion, CreditAccess is India’s largest Microfinance institution. Its business is highly concentrated, and the top 5 states account for 66.3% of AUM. These states are: Karnataka (17.5%), Maharashtra (15%), Tamil Nadu (18.3%), Madhya Pradesh (8%), and Bihar (7.5%).

Slower growth but steady core

As of Q1FY26, the company’s AUM declined 0.9% year-on-year to ₹260.5 billion as the number of active borrowers fell 8.5% to 4.5 million. However, loan disbursements still grew 21.9% to ₹54.5 billion. With the slower growth in AUM, interest income declined 3.4% to ₹13.8 billion, while net interest income also fell 1.6% to ₹9.3 billion.

Net interest margin fell marginally by 20 basis points (bps) to 12.8%. The company’s pre-provision operating profit also declined marginally by 7.9% to ₹6.5 billion. This shows that despite the subdued growth, its core business remained stable.

Asset quality under stress

But its credit quality deteriorated. Gross non-performing assets (NPAs) tripled from 1.4% in Q1FY25 to 4.7% in Q1FY26, while net NPAs stood at 1.7%. To deal with rising stress, the company had to take an impairment of ₹5.7 billion, up 227.5% YoY. This, in turn, led to profit after tax (PAT) crashing 84.9% to ₹602 million.

However, the company is gradually recovering with the expectation of better H2FY26. The percentage of the gross loan portfolio held by borrowers with more than three lenders stood at 11.4%, compared to 25.3%.

The risky portfolio has stabilised. Recovery of bad loans is also taking shape. Capital-to-risk-weighted assets ratio (CRAR) is at 25% against the norm of 15%.

Recovery and outlook

Looking ahead, it aims to grow its AUM by 14-18% in FY26, driven by strong growth in retail finance. Net interest margin is expected to remain stable between 12.6-12.8%. Although management has stated that credit costs will remain high in the first half, they are expected to decrease in the second half. This may increase profitability.

With the increase in profitability, the company’s return on equity (RoE) is expected to increase from 7.7% to 11.8-13.3%. At the same time, the return on assets (RoA) is also expected to grow from 1.9% to 2.9-3.4%.

From a valuation perspective, it’s trading at a price-to-book multiple of 3.1x, below the 10-year median of 3.5x.

Spandana Sphoorty Financial: Struggling with Stress but Eyeing Recovery

Spandana is engaged in lending, providing small-value unsecured loans to low-income customers in semi-urban and rural areas. These loans usually carry a tenure of 1–2 years. The company also extends loans against property, business loans, and personal loans.

A sharp fall in growth

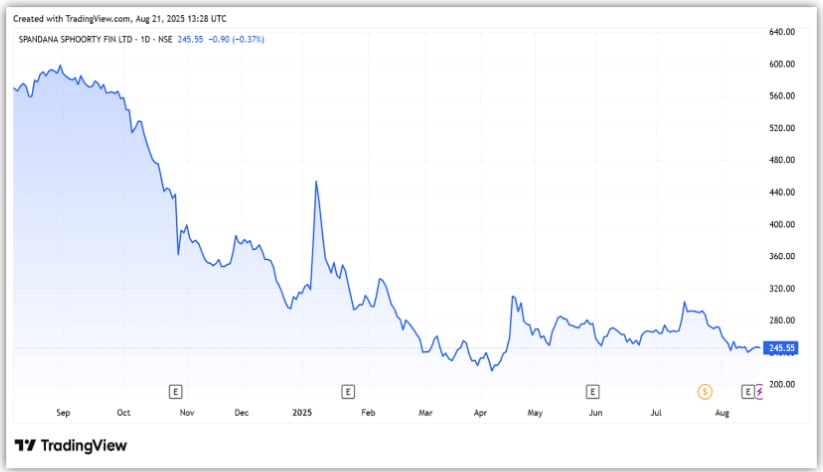

The company has successfully sailed through multiple business cycles, including the Andhra Pradesh crisis, demonetisation, and the pandemic. But this time, the impact has been severe, with its share price falling 78.5% over the last 18 months.

As of Q1FY26, Spandana’s AUM dropped 58% YoY to ₹49.5 billion, as disbursements plunged 88% to just ₹2.8 billion. Its customer base also contracted 40.2% to 2 million. The average disbursement per branch fell to only ₹29 million, compared with ₹77 million in Q1FY25.

Earnings under heavy pressure

The sharp decline in lending volumes hit its income hard. Total income fell 59% YoY to ₹3 billion in Q1FY26, while net interest income crashed 73% to ₹1.1 billion. With such a steep fall in revenues, the company swung to a pre-provision operating loss of ₹590 million, against a profit of ₹2.8 billion a year ago.

The strain was more evident in asset quality. Gross NPAs rose 290 bps to 5.5%, while net NPAs increased 62 bps to 1.1%. To clean up its balance sheet, Spandana booked impairment charges of ₹4.2 billion in Q1FY26, more than double the previous year.

With operating weakness and higher provisioning, the cost-to-income ratio surged to 139%. This led to a net loss of ₹3.6 billion, against a ₹560 million profit in Q1FY25.

Steps towards stabilisation

The management has begun focusing on recovery. In Q1FY26, the company recovered ₹410 million from defaulting customers, compared with ₹960 million in the entire FY25. It also brought down the share of borrowers with exposure to more than three lenders to 21%, from 23% in the previous quarter.

Alongside recoveries, Spandana has implemented tighter credit checks for new disbursements. The company is seeing improving trends in its top five states despite a difficult environment, aided by better rural economic conditions that may support further recoveries.

FY26 will be a year of rebuilding

For now, Spandana is not chasing new borrowers aggressively. Instead, it is targeting 50% of its existing and dormant customers who qualify for fresh loans under its stricter internal framework. Management has indicated that FY26 will be a year of rebuilding.

To support this phase, the company raised ₹4 billion through a rights issue, with participation from both promoters and institutional investors. The fresh capital will be used to fund future growth.

Promoter participation signals confidence, while Kedaara Capital has also marginally increased its stake from 48.1% in Q1FY25 to 48.2% as of August 13, 2025. Spandana remains well-capitalised, with a CRAR of 40.8%.

From a valuation perspective, it’s trading at a price-to-book multiple of 0.8x, well below the 5-year median of 1.7x.

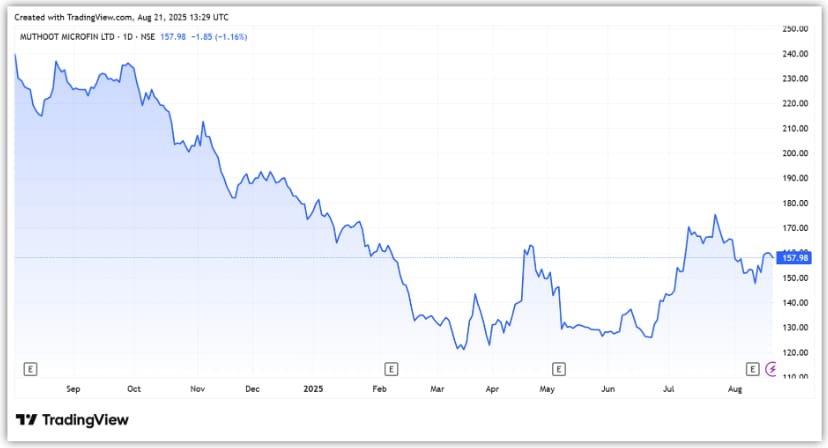

Muthoot Microfin: A Cautious Path to Recovery

Muthoot Microfin, a subsidiary of Muthoot Pappachan Group, provides microloans to female customers, mainly in rural regions of India. The company is the second-largest MFI in India by AUM at ₹122.5 billion in Q1FY26.

Diversified portfolio across regions

The company’s products include income-generating loans, life improvement solutions such as mobile phones and solar lighting products, as well as health & hygiene and secured loans.

Its loan book remains geographically diversified, with a dominant presence in the South (47%), followed by the North (24%), West (15%), and East (14%).

Weak growth and pressure on income

In Q1FY26, Muthoot’s AUM grew just 0.3% to ₹122.5 billion, as disbursements got impacted by tighter eligibility checks. Even so, the customer base inched up by 0.3% to 3.4 million. The share of existing customers stands at 62%, while the customer retention rate remains strong at 96%.

Total income fell 15.7% YoY to ₹5.6 billion, with net interest income down 16.8% to ₹3.4 billion. At the same time, asset quality worsened, with gross NPAs rising to 4.8% from 2.1%, and net NPAs to 1.5% from 0.7%. The provision coverage ratio, however, improved slightly to 68.5%, compared to 66.6% in Q1FY25.

Profitability under strain

To counter rising stress, the company increased impairment provisions by 77% to ₹1.2 billion. But higher provisioning, coupled with weaker income, pushed up the cost-to-income ratio sharply to 60.3%.

As a result, profitability fell sharply, with net profit crashing 94.5% to ₹61.8 million. Return ratios also took a hit, with RoE dropping to 0.9% from 15.8% in Q1FY25. Despite this, the company remains well-capitalised, with a CRAR of 27.9%.

Deleveraging efforts and cautious expansion

Muthoot has also been working on deleveraging and improving its client mix. The proportion of borrowers with exposure to Muthoot and four other lenders fell to 2.5%, from 4.8%, keeping it well below peers. Exposure to indebtedness above ₹0.2 million also reduced to 1.4% from 2.3%, lowering its overall risk profile.

As part of its controlled expansion strategy, the company has begun lending in the ₹0.1–0.2 million segment. It expects a gradual recovery in FY26, with AUM growth in the range of 5–10% and net interest margin steady at 12.4–12.7%.

Credit costs are expected to ease to 4-6% from 9.4% in FY25, which should support profitability. Accordingly, management projects RoA to improve to 0.5–2% and RoE to 2.5–10% in FY26.

From a valuation perspective, it’s trading at a price-to-book multiple of 1x. The company has a limited trading history, which makes it challenging to access using historical valuation.

Conclusion

The June quarter numbers show that while all three microfinance players, CreditAccess, Spandana, and Muthoot Microfin, are stabilising after a difficult FY25, the recovery is uneven. CreditAccess is holding ground with steady operating metrics but faces lingering asset quality pressures. Elevated NPAs continue to weigh down Spandana, despite capital support, while Muthoot Microfin is showing early signs of recovery, albeit at modest profitability. The sector’s near-term outlook hinges on how quickly asset quality normalises and credit costs taper.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.