Companies often resort to buybacks either to return cash to shareholders or because they believe the market is undervaluing their shares. Such moves usually send a positive signal, and more often than not, a stock tends to form a base around the buyback price, depending on market conditions.

Interestingly, while insider and promoter selling is a common feature during a bull market, buybacks are typically seen when valuations are depressed, either because the broader market or the stock has corrected, or due to company-specific challenges that have dragged down the share price.

Similarly, two companies that have recently repurchased their shares are still trading below the buy-back price. This comes at a time when promoters have sold shares worth $30 billion in H1FY26, pulling down their stake in listed companies to an eight-quarter low of 49.3% in Q1FY26.

So, what exactly prompted these buybacks? Let’s take a closer look at both.

#1 Dhampur Sugar

Dhampur Sugar is primarily engaged in the manufacturing and sale of sugar. The company has a unique position in the Indian sugar sector and considers sugarcane as the backbone of its organization, focusing on producing high-quality sugarcane.

Diversified Operations Beyond Sugar

Apart from sugar, the company also produces various value-added products and allied businesses, including ethanol, co-produced energy, chemicals, and portable spirits. The company has a production capacity of 24,000 tonnes of sugarcane per day in FY25.

The company has a distillery capacity of 350 kilolitre per day (KLPD). It also has a cogeneration capacity of 126.5 megawatt, and chemical capacity of 140 metric tonnes per day. The company also has a portable spirits capacity of 20,000 cases of spirits per day.

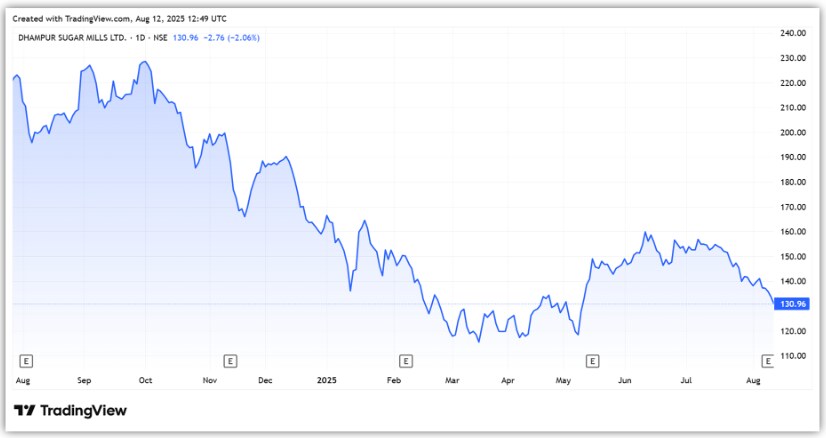

Current Price Lower than Buyback Price

Dhampur Sugar Mills buyback offer opened on May 29, 2025, and closed on June 4, 2025. The company repurchased about 1.1 million shares at ₹185 each, amounting to ₹200 million. This represents 1.6% of its equity. The current price of ₹130.9 is nearly 29% below the buyback level.

Financials Impacted by Sectoral Slowdown

Talking about the financial performance, revenue from operations remained stable year-on-year (YoY) at ₹26.5 billion in FY25. Revenue from the company’s core sugar business declined 1.7% to ₹14.1 billion, while EBIT margins expanded. EBIT stands for earnings before interest and tax.

Portable spirits revenue grew 44.9% to ₹7.8 billion in FY25, while margins expanded 60 bps to 1.8%. Revenue from the ethanol segment decreased 37.2% to ₹5.1 billion, while margins fell 1150 bps to 3.8%. The ethanol business performance was severely affected by the sectoral slowdown.

As a result, FY25 PAT declined 60.8% to ₹524 million, as EBITDA margin fell 400 bps to 7.1%. EBITDA stands for earnings before interest, tax, depreciation, and amortization.

Management Sees Recovery Ahead

Looking ahead, the management said the worst is over for the sugarcane sector. The company also forecasts an increase in sugarcane crushing in FY26 due to increased plantation area. As the worst is behind, the company aims to reach the ₹1.5 billion profit achieved in FY22 and FY23.

Ethanol production in FY26 is also expected to be higher than the previous year. It’s due to the availability of higher feedstock and the complete operation of the maize plant, which started last year. From a valuation perspective, it is trading at a P/E of 16.6x, well-above its 10-year median of 8.2x.

#2 SIS Limited

SIS is a leading security, facility management, and cash logistics solutions provider with a diversified presence in India and the Asia-Pacific region. Apart from India, SIS also serves markets in Australia, New Zealand, and Singapore.

SIS is the number one security solution provider in Australia, among the top three in New Zealand, and the top five in Singapore. It is also the second-largest cash management company in India. In India, its services span 293 branches across 36 states and over 630 districts.

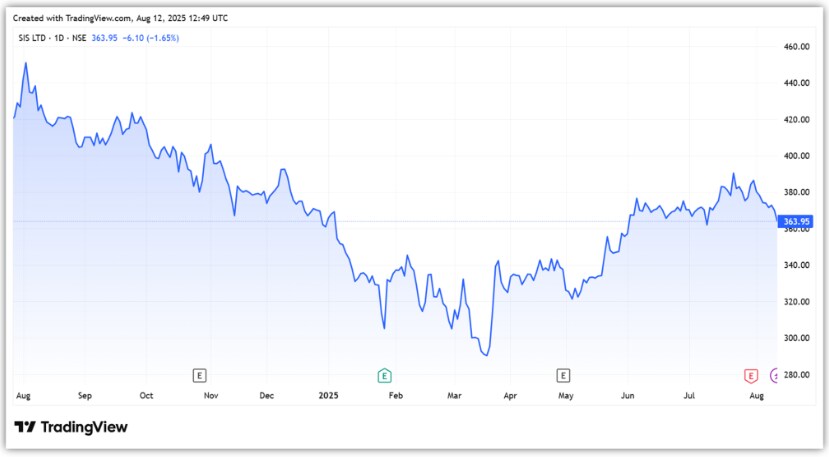

Fourth Buyback in Four Years Signals Confidence

SIS bought back 3.7 million shares at ₹404 per share, worth ₹1.5 billion. This is equivalent to 2.5% of the company’s equity capital. The tender offer opened on June 12, 2025, and closed on June 18. However, its share price is still trading 10.4% below its buyback price of ₹404 per share.

SIS aims to return excess cash and enhance shareholders’ returns by improving earnings per share (EPS) and return on equity (ROE). Notably, this is the fourth time SIS has repurchased shares, having previously bought back 1.2%, 0.9% and 1.1% of its equity capital in FY22, FY23, and FY24. This reflects its continued focus on maximising returns.

Segment-Wise Performance Remains Steady

The company has three business segments: security solutions (India and International), and facility management. Security Solutions India’s revenue grew 8.1% YoY to ₹55.7 billion in FY25. The segment now contributes 42.3% to the total revenue of ₹131.8 billion and 50.7% to the overall EBITDA.

Security Solutions International’s revenue rose 7.1% YoY to ₹54.3 billion in FY25. The segment contributes 41% to revenue and 32.8% to EBITDA. The facility management segment revenue rose 7.4% to ₹22.5 billion. This accounts for 17% of revenue and 16.5% of EBITDA.

SIS’ consolidated revenue grew by 7.6% to ₹131.9 billion in FY25, driven by stable performance across segments. India accounts for 59% of revenue, with the balance coming from international business.

Earnings Impacted by One-Off Costs, Valuations Attractive

However, PAT crashed 93.6% to ₹120 million, mainly due to goodwill impairment. Nonetheless, operating PAT grew 24.2% to ₹3.2 billion. Its valuation of 16.8x price-to-earnings multiple is also lower than the 10-year median of 24x.

Focus on Margins and Return Ratios Going Forward

Looking ahead, the company focuses on four key metrics, including revenue growth, margin improvement, better free cash generation, and higher return ratios. Although it has not provided specific guidance, its quarterly revenue and EBITDA growth have been approximately 15-16% over the last 7 years.

Margin improvement remains a continued focus for SIS. India security segment margins are expected to grow from the current around 5.5% to 6%. Facility management business margins are also expected to grow from 4.4% to 5%. International security margins are expected to grow from 3.7% to 4-4.5%.

The company’s return on capital employed has improved to 14.3%, and is expected to reach 15% with growth and margin improvement.

Conclusion

Both SIS Limited and Dhampur Sugar have turned to buybacks as a way to return cash to shareholders and signal confidence in their future prospects. While each faces its own set of challenges—SIS with one-off profit hits and Dhampur with sectoral headwinds—both are focusing on operational improvements. With current prices still below buyback levels, these stocks could be worth tracking for potential re-rating.

Disclaimer:

Note: Throughout this article, we have relied on data from http://www.Screener.in and the company’s investor presentation. Only in cases where the data was not available have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

About the Author: Madhvendra has been deeply immersed in the equity markets for over seven years, combining his passion for investing with his expertise in financial writing. With a knack for simplifying complex concepts, he enjoys sharing his honest perspectives on startups, listed Indian companies, and macroeconomic trends.

A dedicated reader and storyteller, Madhvendra thrives on uncovering insights that inspire his audience to deepen their understanding of the financial world.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources, and only after consulting such independent advisors as may be necessary.