Foreign institutional investors (FIIs) are piling into a select group of small-cap stocks that have already rolled out triple-digit returns in 2025.

The latest shareholding data for the June quarter shows a huge jump in foreign ownership in companies that have seen strong momentum and price movement this year.

In several cases, stakes have climbed by over a percentage point in just three months, which is a remarkable move for companies of this size.

Traditionally, FII investments were heavily dominated by largecaps, but some smallcaps provide a much-needed diversification to FII portfolios. These companies operate in diverse sectors – specialty chemical, auto, engineering, services and logistics.

The buying patterns of FIIs in these stocks are now drawing close attention from domestic investors, eager to write the same wave.

Let’s take a look at 5 such stocks…

#1 Camlin Fine Sciences

First on the list is Camlin Fine Sciences.

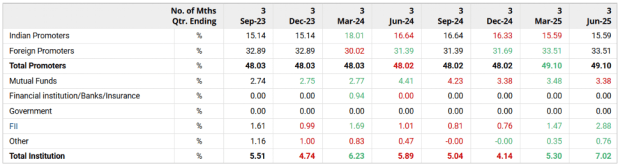

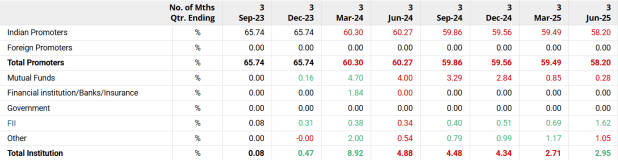

Shares of the speciality chemicals maker have gained over 100% in 2025, with FII shareholding increasing from 1.47% in March 2025 to 2.88% in June 2025.

Camlin Fine Sciences Shareholding Pattern

The company’s portfolio spans four verticals: shelf-life solutions, performance chemicals, aroma ingredients and a health and wellness segment launched in 2019 after its 80% stake in AlgaIR NutraPharms.

Camlin Fine Sciences serves more than 1,250 customers worldwide, including Shell, Cargil, Lockheed Martin, Clarity and Adani Wilmer, with about 85% of the rest of the rest with exports and exports for domestic sales.

Its network is spread over more than 80 countries across Asia, Europe and America, supported by nine manufacturing facilities, with more than 61,000 metric tonnes of combined capacity.

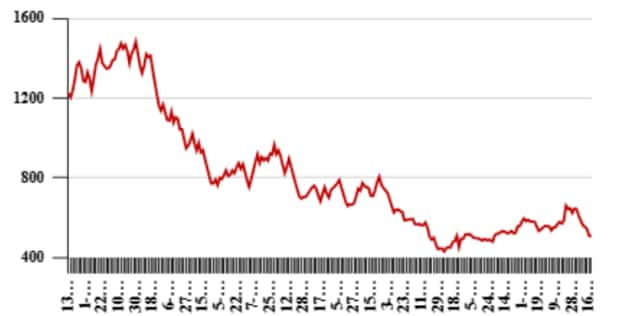

In FY25, Camlin’s consolidated revenue rose to Rs 16.7 bn from Rs 14.5 bn in FY24, with core business revenue up about 15% and EBITDA improving to Rs 2.08 bn from Rs 1.84 bn, maintaining margins near 12.5% despite softer product prices.

The company’s management expects continued growth in vanillin and blends while remaining alert to competitive and pricing pressures.

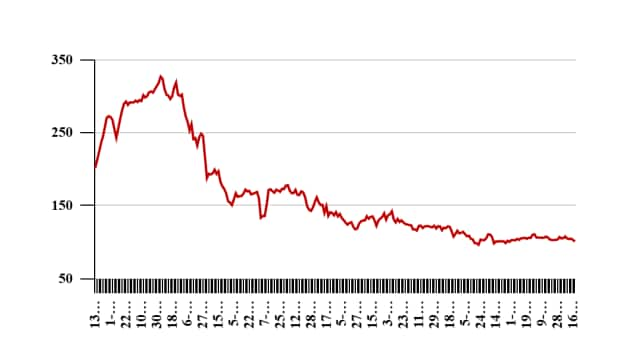

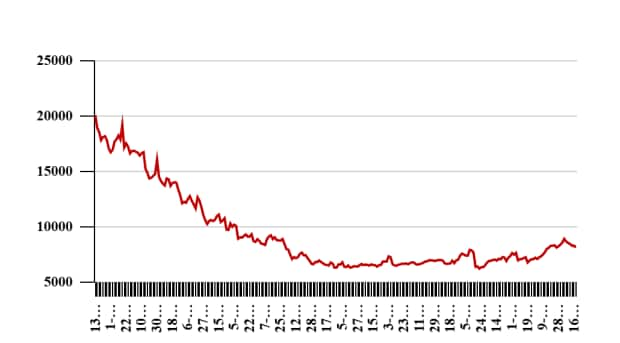

Camlin Share Price – 1 Year

#2 Gabriel India

Next up is Gabriel.

Shares of the auto components maker have surged over 107% in 2025. FII shareholding increased from 5.23% in March 2025 to 5.97% in June 2025.

Gabriel Shareholding Pattern

Part of the Anand Group, the company has a strong presence across OEM, aftermarket and export segments, manufacturing over 500 models of ride control products including shock absorbers, struts and front forks.

It’s among the top three players in two-wheelers, the leader in three-wheelers with an estimated 89% market share, and the first indigenous manufacturer to develop dampers for Rajdhani, Shatabdi, and Vande Bharat coaches.

Its client list spans Bajaj, Mahindra, Honda, Royal Enfield, Maruti Suzuki, Yamaha, Renault, Skoda, Volkswagen, Ashok Leyland, Isuzu, the Indian Railways, etc.

The management has plans to expand the company’s aftermarket reach to Latin America, Africa, and North America.

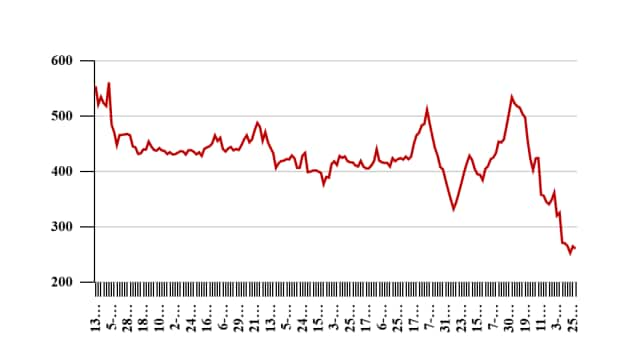

In FY25, Gabriel’s consolidated revenue grew 19.4% YoY to Rs 40.6 bn, with EBITDA at Rs 3.92 bn, and margins at 9.6%. The profit after tax came in at Rs 2.45 bn.

The sunroof subsidiary, Inalfa Gabriel Sunroof Systems, generated Rs 4.2 bn in revenue with an 8.1% margin and is set to double its capacity in FY26.

The company declared a final dividend of Rs 2.95 per share, an annual payout of 32% of its earnings.

The management is optimistic on growth, citing opportunities in solar dampers, e-bike forks, the expanding sunroof business, and overseas aftermarket opportunities.

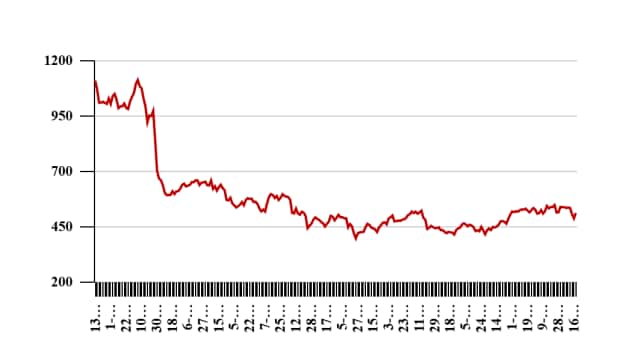

Gabriel Share Price – 1 Year

#3 Axiscades Technologies

Third on the list is Axiscades.

The stocks of the engineering and technology solutions provider have given a strong profit in 2025, with FII holdings increased from 0.69% in March 2025 to 1.62% in June 2025.

Axiscades Shareholding Pattern

The company offers product engineering services across embedded software and hardware, digitisation and automation, mechanical engineering, system integration, test solutions, manufacturing engineering, technical publications, and aftermarket solutions.

It operates in verticals including aerospace, defence, automotive, energy, semiconductors and heavy engineering, with aerospace contributing 30% of FY25 revenue. A notable recent win was an US$ 18 million (m) OEM deal in aerospace to be executed over five years.

In FY25, Axiscades crossed Rs 10.3 bn in consolidated revenue for the first time, up 7.9% YoY in rupee terms, with EBITDA of Rs 1.42 bn, a 17% YoY rise after excluding one-off costs. The profit after tax jumped 2.25 times to Rs 752.6 m.

The management has outlined a target PAT of Rs 1.6–1.8 bn by FY26, backed by a strong order book, marquee clients, and an expanding solutions portfolio.

Axiscades Share Price – 1 Year

#4 Zinka Logistics Solutions (BlackBuck)

Next up is Zinka.

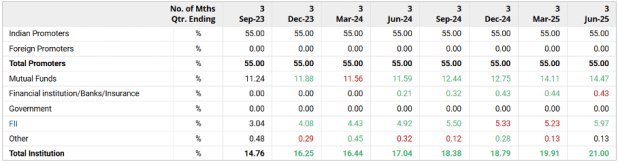

The company’s shares have delivered strong gains in 2025, rallying 114%. Its FII holdings jumped to over 20% in June 2025 from 11.6% in March 2025.

Zinka Shareholding Pattern Shareholding Pattern

It operates under the well-known BlackBuck brand. It offers a digital trucking platform covering tolling services, vehicle tracking, fuel management, payments, vehicle financing, and loads brokerage.

Operating on an asset-light, platform-led model, it has built high operating leverage and growing profitability, with tolling and tracking forming a stable recurring revenue base.

Its clientele includes large B2B names such as Hindustan Unilever, Reliance Petrochemicals, Asian Paints, and Colgate-Palmolive. Monthly transacting truck operators rose 20.8% YoY to 720,000 in FY25.

In Q1FY26, Zinka’s total income climbed 62–63% YoY to Rs 1.6 bn, with revenue from operations at Rs 1.44 bn. Reported EBITDA surged 4x to Rs 400 m, while margins expanded from 13% to 36% of net revenues.

The PAT came in at Rs 340 m, with operating cash flow at Rs 630 m, aided by upfront subscription collections.

The management is focusing on scaling payment services, aftermarket offerings, and expanding its financing network.

#5 Force Motors

Last on the list is Force Motors.

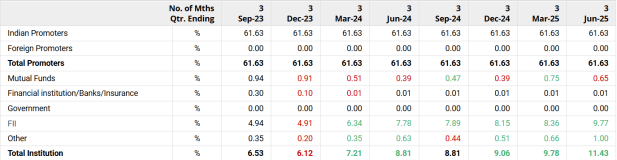

Shares of the company have delivered strong 145% gains in 2025, with FII holdings rising from 8.36% in March 2025 to 9.8% in June 2025.

Force Motors Pattern Shareholding Pattern

The flagship company of the Abhay Firodia group, Force Motors is in the business of manufacturing fully vertically integrated small and light CVs, multi-utility vehicles, and agricultural tractors.

It supplies these products to various countries in the Middle East, Asia, Latin America, and Africa. It was known as Bajaj Tempo till 2005.

The recent rally could be attributed to strong results posted by the 2-wheeler company.

In FY25, the company reported a net worth of Rs 24.02 bn. With better operating profitability, reduction in external debt, and prudent funding of capex, the debt metrics have improved.

In FY25, its profit more than doubled to Rs 8 bn, compared to Rs 3.9 bn reported in FY24.

As the company focusses on niche segments, it has maintained its market share. In fact, the company has increased its market share to over 16% in the electric 2-wheeler space.

As demand for LCV and MUVs has bounced back strongly with school openings and a pick up seen in travel, Force Motors has a chance to capture some more market share going forward.

Conclusion

Investing in multibaggers that attract substantial FII inflows can have a compelling rationale.

First, a prior record of outsized returns would point to a strong and scalable business model, good market positioning, and excellent execution strategy.

Fresh or increased FII participation could be a testament to global investors’ faith in the growth prospects of companies along with their operational resilience and governance standards.

This would also enhance market visibility and boost liquidity, factors that might potentially trigger a valuation re-rating.

However, they are not without risks. The valuations of such companies might be stretched while their performance can be volatile.

That is why thorough due diligence should be conducted, along with checks on corporate governance, to confirm if these are worthy of investment or not.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.