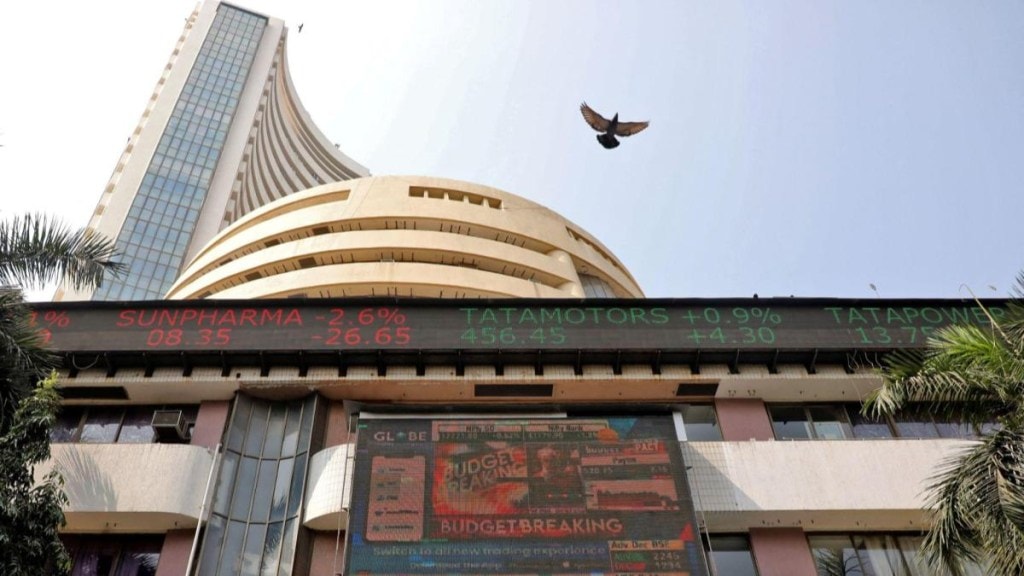

The Indian stock market wrapped up on a flat note today, February 25. The BSE Sensex added 147.71 points (0.20%) to settle at 74,602.12, maintaining a positive streak. Meanwhile, the NSE Nifty slipped 5.80 points (0.03%), ending at 22,547.55.

Among the Nifty stocks, Mahindra & Mahindra (M&M), Bharti Airtel, Bajaj Finance, Maruti Suzuki, and Nestle emerged as top gainers. On the flip side, Hindalco, Dr Reddy’s Labs, Sun Pharma, Hero MotoCorp, and Trent dragged the index down.

“The domestic market experienced a range-bound trading session in anticipation of key economic data releases this week, alongside the monthly expiry. Concerns over high valuations led to continued declines in small and mid-cap stocks,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Market sentiment is expected to remain cautious in the near term due to persistent pressure on the INR, ongoing FII outflows, and tariff-related developments. Key macroeconomic indicators, including the US Core PCE and GDP data for both the US and India, will be instrumental in shaping expectations for the central bank’s future monetary policy,” he added.

Sectoral Performance: IT and Metals slide, Auto and FMCG rise

Sectoral trends saw a mixed picture. IT, metal, oil & gas, energy, capital goods, and realty sectors declined between 0.5% and 1%. On the other side, auto, consumer durables, FMCG, and telecom sectors gained 0.5%.

Mid and Smallcap stocks struggle

Broader markets faced pressure as BSE Midcap and Smallcap indices ended in the red, down by 0.57% and 0.45%, respectively.

“We are of the view that, current market texture as non-directional, perhaps as traders are waiting for a breakout on either side. On the higher side, 22600/74800 would be the immediate breakout level for the bulls. Above this level, the market could move up to 22700-22800/75000-75350. Conversely, below 22500/74500, selling pressure is likely to accelerate. Below the same, the market could slip to 22400-22350/74200-74000. Given the non-directional texture of the current market, level-based trading would be the ideal strategy for day traders,” said Shrikant Chouhan, Head-Equity Research, Kotak Securities.

Market Holiday on February 26

Investors will have a break on February 26, as the stock market will remain closed for Mahashivratri. Trading will resume on February 27.