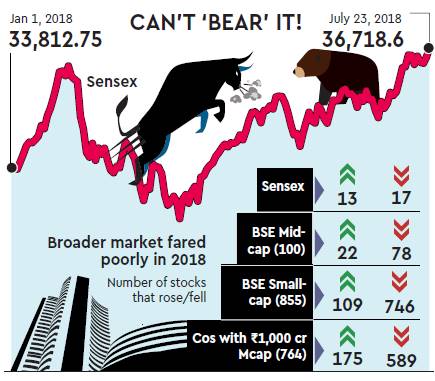

With close to 80% of the broader market in the red, very few investors are cheering the Sensex’s record high levels reached on Monday. At 36,718.60 points, the benchmark index has stayed flat in dollar terms since January while the Dow Jones is up 1.4%. While the Sensex has gained close to 8% in rupee terms, this is thanks to the outperformance of just a handful of stocks. The broader market has under-performed, with the BSE MidCap losing nearly 14% and the BSE SmallCap giving up 7.5% between January and now.

For perspective, 77% of all stocks with a market capitalisation of `1,000 crore and above are in the red. Moreover, over a third of the of these 764 stocks has lost more than a quarter of its value.

As Bank of America Merrill Lynch put, it India’s version of a “Fin-Tech” re-rating is supporting the index amid a correction. The stocks that have done spectacularly are Tata Consultancy Services (TCS), Kotak Mahindra Bank, HDFC, HDFC Bank, Infosys and Reliance Industries.

Another set of stocks, both in the Nifty 50, that have been stellar performers are Bajaj Finserv, which has gained 32.4% since January, and Bajaj Finance, which has put on nearly 57%. Among the large-caps, Bajaj Finance is the best performing stock in 2018 so far followed by TCS with 48.5% and Bajaj Finserv.

Of the Nifty 50 companies, 30 are trading in the red. At Monday’s closing of 11,084.75 points, the Nifty is now is just around 46 points away from its all-time high closing level of 11,130.40. However, the Nifty mid-cap index, at 18,255.20, is down 13.6% since January.

At 36,718.60, the benchmark Sensex trades at a price-earnings (PE) multiple of 18.15 times the estimated one- year forward earnings, a premium of 12.4% to the long-term average PE of 16.03 times. This compares with 8.6 times for South Korea’s Kospi and 14.1 for the Jakarta Composite. Brazil’s Bovespa and the Shanghai Composite are trading at a PE multiple of 10.8 and 10.6, respectively, data from Bloomberg show.

The poor breadth of the market has probably kept foreign portfolio investors (FPIs) away; since April, FPIs have sold stocks worth $3.03 billion, the bulk of it in May. However, domestic institutions have been buyers to the tune of $6.4 billion. Local buying since January has hit nearly $10.2 billion whereas foreign funds have sold shares worth $820 million.

UBS Securities, which has reiterated its underweight ratings on small- and mid-cap indices for 2018, cited rising interest rates and moderating flows as concerns. The brokerage noted that inflows into local equity mutual funds remain positive but have slowed in the first three months of 2018. “Despite the correction in small and mid-caps, their valuation premium to the Nifty is being sustained above the peaks of 2007-08,” UBS Securities wrote in a recent note.